Chewy: Reaping The Benefit Of Stay-At-Home Measures

by Cornerstone InvestmentsSummary

- Chewy is the largest pure-play pet e-commerce player and it was approaching break-even EBITDA as of Q4 2019.

- The pandemic and WFH measures have resulted in more consumers trying Chewy's subscription service - many of them will stay.

- We believe the secular tailwind was accelerated by COVID-19 and Chewy is poised to take market share from brick-and-mortar pet retailers.

Chewy (CHWY) is one of the online merchants that have benefited immensely from the consumer behavior changes brought by COVID-19. As people stay home and spend more time with their pets, pet foods and accessories are in demand. Meanwhile, the social distancing measures have positioned Chewy as the go-to designation for many pet owners. We think some of the surges in demand will likely stay post-COVID as Chewy's subscription service provides convenience, flexibility, and reliability.

Pet E-Commerce

The pet industry was long thought to be recession-proof as the industry saw healthy growth during the last economic recession in 08-09. Since that time, e-commerce has emerged to disrupt several retail sectors including the pet industry with Chewy being the front runner in the space. As traditional brick-and-mortar pet stores lose sales to online merchants, Chewy is the largest pure-play player and it has built up a wide moat against potential new entrants through economies of scale and subscription-based model.

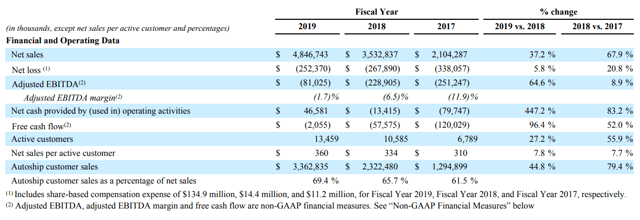

Chewy carries more than 2,000 brands and 60,000 products and is the largest pet online retailer in the U.S. It has built a network of distribution centers that can ship to ~80% of the U.S. population overnight and almost 100% within two days, according to the company. The result of these investments is impressive growth including more than doubling net sales in two years while cutting free cash flow deficit by $120 million to almost break-even in 2019. We think the company was solidly on its path to positive EBITDA and free cash flow in 2019 which would only be accelerated by the pandemic.

(Source: 10-k)

Chewy is a high-growth company that has low capital expenditures of ~$40 million per year. Its biggest costs are product and shipping which enjoys economics of scale due to the fixed nature of its infrastructure investments and high shipping costs of small parcels. Its gross margin of 24% in 2019 is low compared to other retailers. Chewy is a business that is built on scale and operating leverage and the company is reaching a tipping point where relentless growth has eventually lifted its key earnings metrics to approach positive territories. We believe COVIG-19 will push the company to grab substantial market share from traditional brick-and-mortar pet retailers on a permanent basis which is hugely beneficial to its profitability, barring any short-term expenses related to the pandemic.

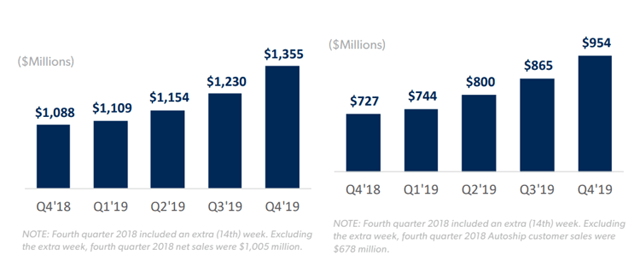

(Source: Company Filings)

Going forward, the outlook for Chewy is bright because it will likely continue reporting expanding margin and free cash flow as it gains scale. The e-commerce business model has high fixed costs associated with technology and logistics infrastructure, which means that unit economics will keep improving along with higher volume. The company has also focused on margin expansion opportunities with its private brands and pet healthcare offerings.

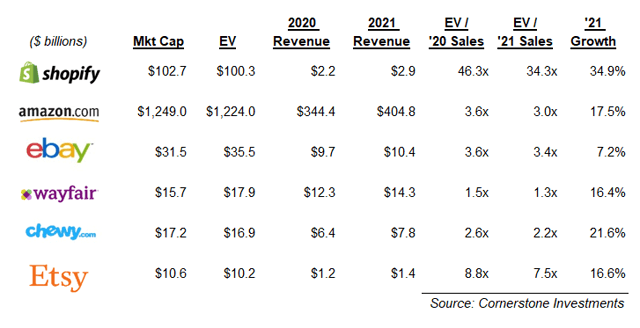

Valuation and Performance

Chewy has a market cap of $17 billion and is trading at the lower end of its e-commerce peers. With the stock valued at 2.2x 2021 sales, valuation appears full based on its historical trading pattern. Chewy has lower gross margins due to some structural differences: its basket size is smaller which increases shipping expenses; its private-label penetration remains low; a competitive pricing environment with little pricing power.

(Source: Public Filings and Bloomberg)

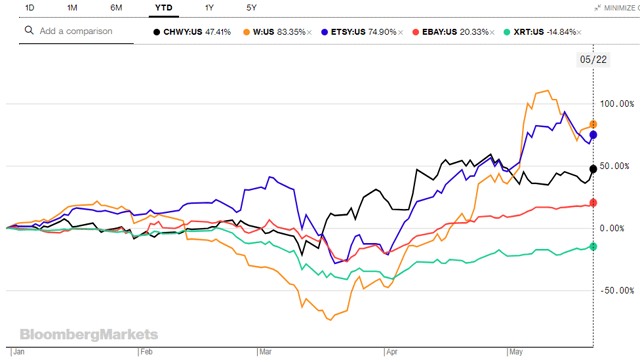

Chewy has performed strongly in 2020 as investors appreciate the tailwinds resulted from consumer behavior changes. While it remains early days to tell whether and how much of the increase in online business is sticky, it is safe to say that the pandemic has facilitated a large number of new consumers to try Chewy and some of them will stay afterward. Chewy has a sticky business model with ~70% of its customers subscribing to its Autoship service. While the SPDR S&P Retail Retail (XRT) is down 15% this year so far, Chewy is one of the rare bright spots in the retail market.

(Source: Bloomberg)

It would be remiss of us not to mention PetSmart's relationship with Chewy. In fact, PetSmart still owns more than 50% of Chewy as both companies were effectively controlled by BC Partners. The controlling shareholder means at some point the shares will be sold into the market. Given the recent momentum of Chewy, secondary share sales should have minimal effect on its share price. Notwithstanding the ownership, there are also business and operational overlap between PetSmart and Chewy that could become hairy if the two firms are no longer related. Potential dis-synergies include procurement and private label.

Looking Ahead

Chewy is benefiting from the pandemic-induced lockdown measures and changes in consumer behaviors. Its leading brand and market position in pet e-commerce should enable the company to take share from brick-and-mortar channels on a permanent basis. Given that more than two-thirds of Chewy's customers are on subscriptions and over 70% of its revenue from consumables, it is highly likely that many of the newly acquired customers will stay with Chewy even after the pandemic eases. Chewy has historically spent a lot on customer acquisitions and the COVID situation just brought in lots of new potential customers at minimal costs. We think this is a long-term tailwind for Chewy and has only accelerated the secular trend towards pet e-commerce. As a result, we think long-term investors should remain confident about Chewy's position in the marketplace.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.