Diamondback Energy: Hunkering Down For A Brutal Second Quarter

by Long PlayerSummary

- Cash production costs are among the lowest in the industry for oil producers.

- The well profitablity occurs at unexpectedly low WTI prices.

- This company probably will be one of the first to recover from the current oil price downturn.

- The prior emphasis on financial strength (the achievement of an investment grade rating before the latest downturn) gives this company considerable staying power.

- This Permian producer also has lower acreage costs due to being among the first to produce in the Permian before acreage costs rose.

Diamondback Energy (FANG) is one of the faster growing medium sized oil and gas producers in the Permian. Overall costs are low enough to keep the breakeven below many in the industry. That means this producer will be among the first to resume production growth.

But first this company and the industry have to get past the second quarter. The unprecedented speed of demand destruction caused by the "shelter in place" strategy has many companies scrambling to plan for a future without precedent. Many do not know if this recovery can happen in months or years. Therefore there are all kinds of strategies to deal with the uncertainty.

At the core of many strategies is to hang onto as much as cash as possible to minimize or eliminate any borrowing needs until there is a "clear sight" or pathway to more normal times. Sometimes the dividend has been reduced to facilitate the conservative cash management strategy. In the case of Diamondback, the dividend is such a minimal part of cash flow that this dividend will be maintained.

An unconventional future income strategy would include this stock for consideration at the current price in the hopes that the dividend will continue to grow rapidly in the future. This company has an excellent Permian location and can therefore grow at least 20% a year in more normal times. That growth rate implies some excellent prospects for the dividend.

First Quarter Results

There has been a steady string of positive surprises throughout the industry as the first quarter remained remarkably unaffected by the coronavirus challenges. That will not be the case for the second quarter as more and more companies withdraw guidance and announce conservative cash policies. No one really knows how long the effects of the coronavirus will last. Therefore just about any of the strategies announced publicly to deal with an uncertain future could be correct.

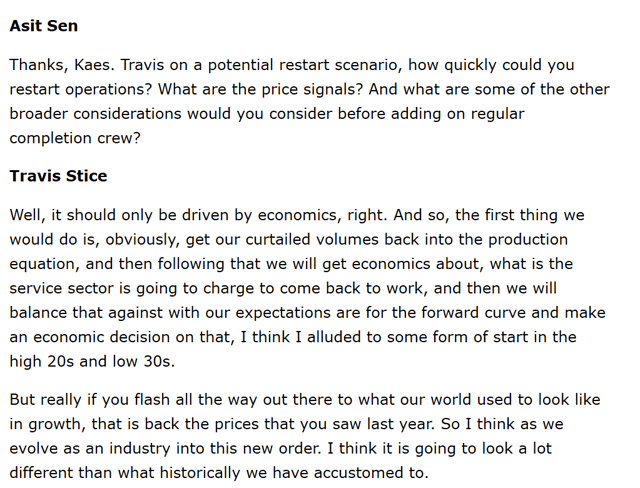

The following question and answer was a huge surprise:

Source: Diamondback Energy First Quarter 2020, Conference Call

Probably the biggest thing to come out of the first quarter was the admission that this company's wells would be reasonably profitable in the WTI $30 range. That very much does not fit the common thought that the unconventional business is high cost. The best acreage in the business is becoming very profitable to operate. Should the technology improvements that sweep the industry continue, we could be in for at least a decade of relatively low oil prices.

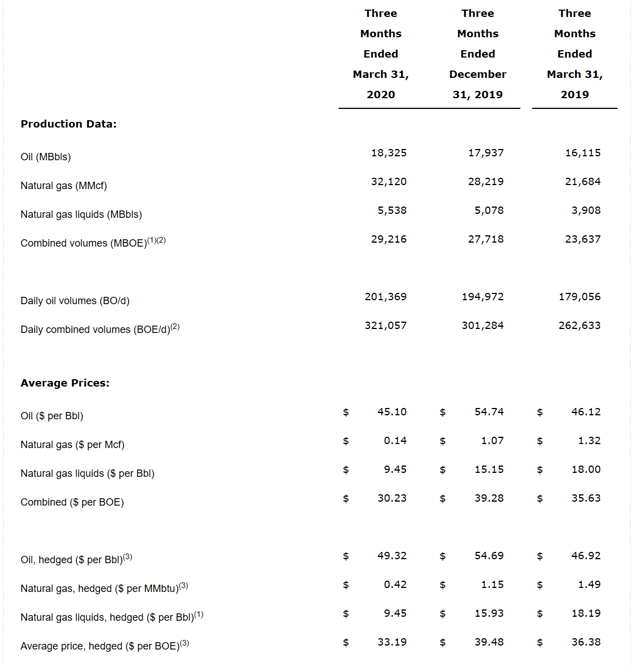

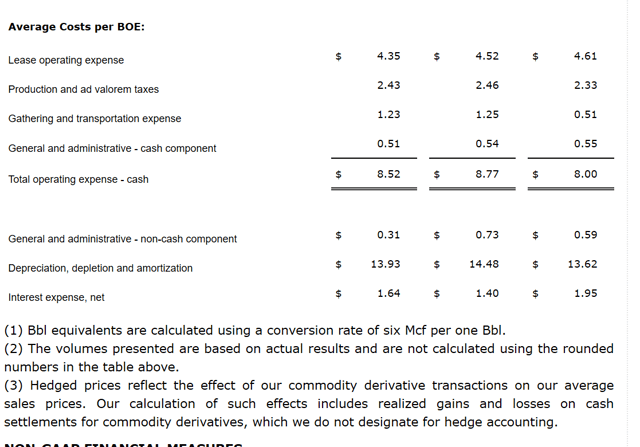

Source: Diamondback Energy First Quarter 2020, Earnings Press Release.

The management statement appears to be backed up by the figures calculated in the first quarter press release. The company shows $8.52 BOE of cash operating costs. When that is combined with the non-cash charges and the interest expense, the total cost is less than $25 BOE. This means that the unconventional business has come a long way since the high cost days of the 1990's. Management's necessary minimum profitability gets the needed price to the WTI high $20's to $30's.

This company does need to be more aggressive in marketing the gas byproduct of the oil produced. Currently oil is such a large part of production that management has usually focused on that production. However, the gas can and should be sold for higher prices than currently received. Management has been uncharacteristically lax about the natural gas sales. That needs to change in the future.

The debt ratios will expand some this year. But the hedging should still allow for cash flow that is adequate to service the debt load. So far management has maintained the dividend. But the future is not real clear-cut at the current time. Guidance could probably be revised a few times this year as the year progresses.

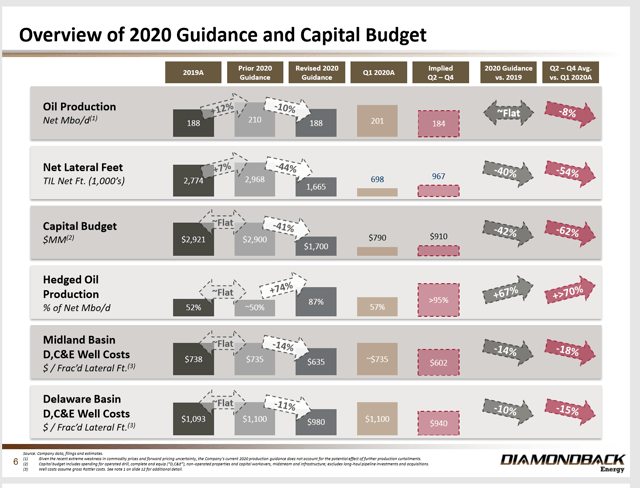

Source: Diamondback Energy First Quarter 2020, Conference Call Slides.

Now the strategy switch given the materially different market conditions should be apparent to the casual observer. The oil production decline is surprisingly tame given the known first year decline of unconventional wells. This is happening because there are a lot of older wells with far less annual declines that are producing. The decline rate shown above is an average decline rate for all producing wells.

One thing that may happen is a decision to unexpectedly rework wells to increase production. Reworks are often at least partially oil price sensitive (probably including the hedges). Reworks are often surprisingly profitable even at current prices. In fact the hedging program may (in effect) "guarantee" that reworks are profitable. Any rework program would slow declines of production.

To finish out rig contracts, management has made a decision to drill wells but not complete those wells until prices are better. If and when oil prices rally to sufficient levels, the company will get a temporary production boost on less than expected capital expenditures.

That kind of boost does create a cycle though because there is an unusually large amount of new wells that will decline in production quickly in their first year. That would mean a higher rate of capital would be needed to maintain production. The relationship that production maintenance capital is related to the growth rate of production is one that is not always highlighted in the market. Of course there are other factors that weigh into maintaining production as well.

The Future

The conference call highlighted the difference between the breakeven cost for wells and corporate breakevens. Anytime that wells contribute to lower corporate breakeven points, they should probably be drilled. Sometimes the company still reports a loss because many older wells still contribute cash flow even if they are not profitable. That "muddies the water" when investors try to figure out if drilling wells is the correct management decision.

Low oil prices cited by management to resume well completions should mean that this company will be one of the first to recover from the recent coronavirus challenges. Management is basically stating that they can resume something approaching normal activities at lower levels than this market expects.

In the past, this company was one of the fastest growing (and profitable) companies in the industry. Those characteristics should again assert themselves in the future. The unconventional industry is very young. As a country we appear to have far more unconventional reserves than we ever had conventional. If that remains the case, then the unconventional industry could be in for a very long period of cyclical growth cycles.

The fast growing dividend was recently maintained. This stock offers both appreciation and continuing fast dividend growth potential in the future. For those that do not need the income right away. More importantly the low debt and the achievement of the investment grade ranking before the latest challenges does assure some financial staying power when that staying power is clearly needed.

This is one of the premier Permian operators that was in the basin "first" or close enough to being first. Therefore acreage cost is really not as much an issue for this producer as it is for those that came later. Moreover, this company has a history of acquisitions by using stock. That conservative expansion strategy has kept the balance sheet in good shape for a crisis like the current.

The company could make offers "at the right price" for additional acreage or competitors in the current environment. The stock price may be low. But the acquisition prices are also low. Therefore any acquisitions made now could work out very well for investors. What is clear is that no matter what path management chooses, this company will be one of the more profitable survivors.

I analyze oil and gas companies like Diamondback Energy and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

Disclosure: I am/we are long FANG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.