Canacol Energy: 100% Gas Company Value As An Oil Company

by Investment Insights LatamSummary

- Canacol Energy's current market price is an attractive opportunity entry for three reasons: i) predictable top line, ii) proved track-record, and iii) attractive valuation.

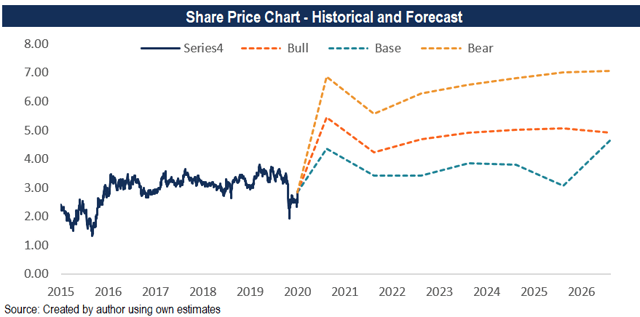

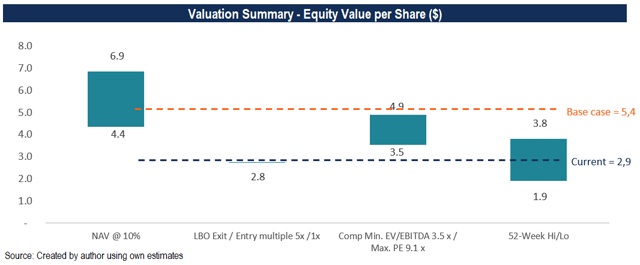

- Our base-case scenario is a target price per share of USD 5.4 or 91% upside, while bull and bear cases are USD 6.9 (+141%) and USD 4.4 (+53%), respectively.

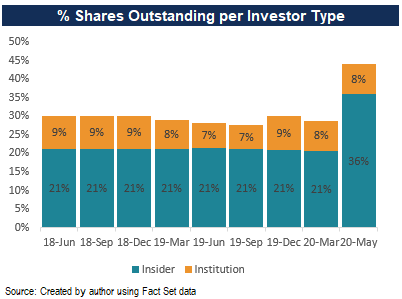

- The number of insiders as a percentage of share outstanding change from 21% to 36%, taking advantage of the attractive valuation.

Canacol Energy (OTCQX:CNNEF) stock price decreased by 14% year-to-day (YTD), while Latin American peers -40% YTD. In spite of having a better relative performance; we believe that the company deserves better, making the current market price an attractive opportunity entry. The main three reasons are: i) predictable top line, ii) proved track-record, and iii) attractive valuation.

Reason one:

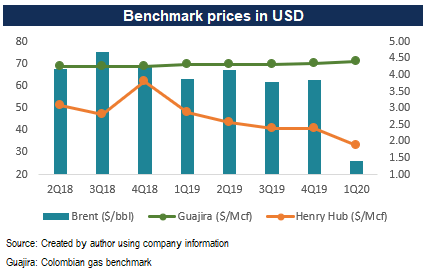

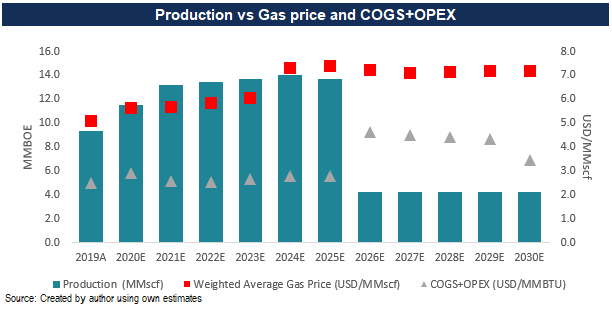

CNNEF has a predictable top line because of its stable selling prices and selling volumes. CNNEF only produces gas, and 80% of that production is under "take-or-pay" contracts (fixed volumes and prices) in USD, which offers protection against COP depreciation. Currently, these contracts have an average maturity of 6 years. The company sells the other 20% of production in the spot market, which highly depends on local drivers. Oil prices and international natural gas price volatility do not have a direct impact on the company. Management targets to maintain the 80/20 ratio and to sign more contracts as reserves increase. We don't believe the company will have problems to sign new contracts because new thermoelectrical plans in Colombia would work with natural gas, and old plants have been moving from coal to natural gas.

On the one hand, we do not expect an impact from the pandemic in "take-or-pay" contracts. Management mentioned that the buyer could only suspend contracts in force majeure events condition, and Colombia's current lockdown (from March 25th to May 31st) does not apply as a force majeure event. Nevertheless, CNNEF decided to help clients by allowing buyers to defer up to 20% of its 2Q20 purchases to 2H20. On the other hand, we believe that the pandemic will harm the company in the spot market sales because of a slowdown in consumption. Management mentioned that April 2020 consumption was ≈ 0, and they reduced its 2020 average production guidance from 205Mcfp/d to 197Mcfp/d (≈ 80% fixed contracts and 20% spot market).

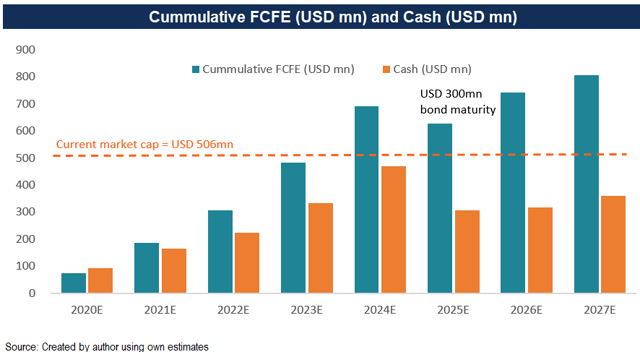

Our base case scenario assumes production of 179Mcfp/d or +25% YoY (157Mcfp/d fixed contracts and 22Mcfp/d spot market), which means a Free Cash Flow to the Equity (FCFE) of USD 75mn. Using guidance production, the FCFE will be USD 91mn. Nevertheless, we calculated that CNNEF in the next four years (2020-2023) could generate almost its entire market cap value (≈ USD 500mn) in FCFE.

Reason two:

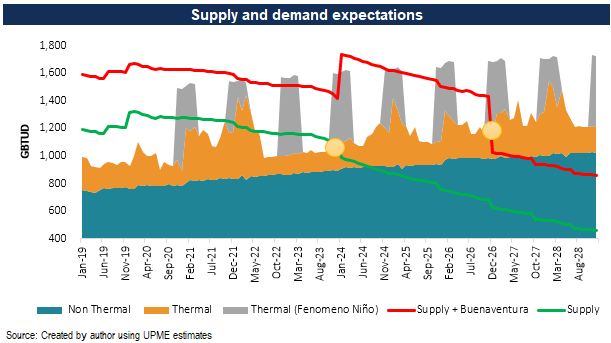

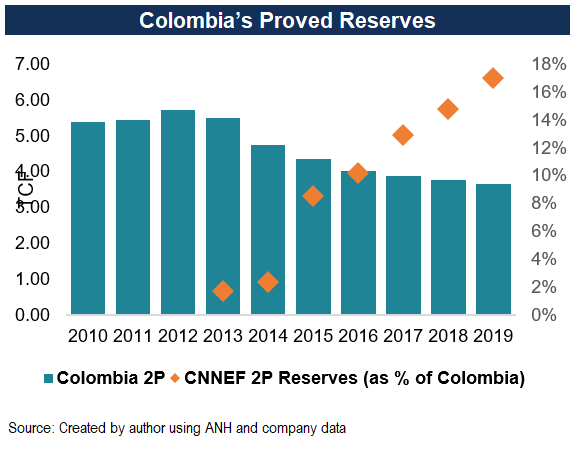

The company is in a privileged market. According to Colombia's Mining and Energy Planning Unit (UPME), an increase in consumption and a decrease in production will create a shortage in 2024. If the Buenaventura regasification plant is constructed, the deficit might be postponed to 2027. CNNEF is the biggest non-related government gas producer with a remarkable addition of reserves in the past years (CAGR13-19 +34%), demonstrating a robust track record (83% success rate in its exploration program over the past six years).

Reason three:

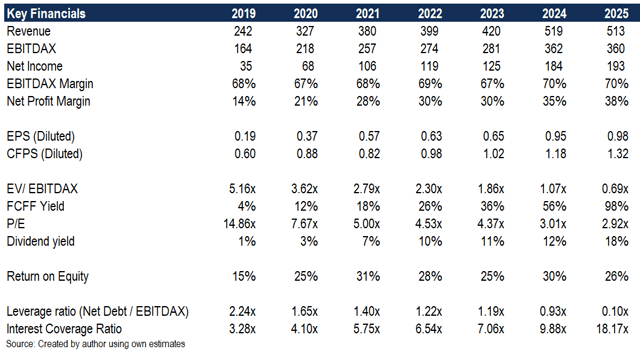

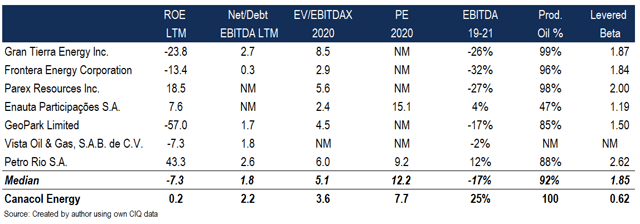

We expected a return over equity higher (ROE) than 25% since 2020, a deleveraging path from 2.2x Net Debt /EBITDAX in 2019 to 1.4x in 2021, and an EBITDA CAGR19-21 of +25%. CNNEF metrics are stronger than other O&G companies in the region (ROE -7.3%, Net Debt EBITDAX 1.8, and EBITDA CAGR19-21 -20%). Based on this, we believe that CNNEF deserves a premium, which is not happening.

CNNEF forward-looking multiples are 3.6x EV/EBITDAX 2020 and 7.6x PE 2020, while its peers are trading at 5.1x EV/EBITDAX 2020 and 12.2x PE 2020. Important to mention that besides CNNEF, there is not a 100% gas producer in the Latin American comparison universe (= more volatile cash flow).

Valuation

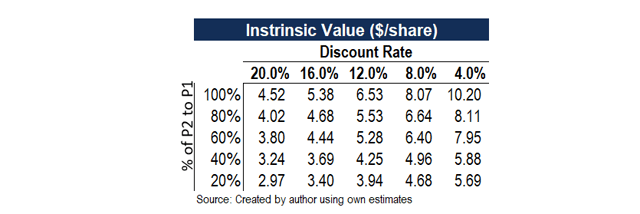

After analyzed the financial statements and defined our base case scenario, we get a target price per share of USD 5.4 or a 91% upside. The key valuation assumptions for the Net Asset Value are a discount rate of 10% (standard in a NAV valuation for an O&G company), a 50% reserve conversion from P2 to P1, a 53% success ratio, and a depletion of the entire P1 reserves by 2030. The key forecast assumptions are:

Besides, we included a sensitivity analysis for the base case valuation assumptions and scenario analysis. The bull case assumes a 100% reserve conversion ratio from P2 to P1 and an 83% success ratio. Both conversion ratio and success ratio are 0% in the bear case.

If we use a discount rate of 28%, instead of 10% in our base-case scenario, the target price will be equal to the market price (0% upside). We believe that a company with CNNEF characteristics (low leverage and predictable cash flows) deserves a much lower discount rate.

Based on company peers, CNNEF's target prices also offer an attractive upside. Also, we performed a Leveraged buyout analysis (≈ theoretical floor price) where we found a target price like our NAV bear case.

We attribute the mispricing to three reasons: low liquidity (≈ USD 1mn per day), association with high beta companies, and despite proven track record, lack of faith in the company to replace reserves. According to Fact Set, during the last three months, the number of insiders as a percentage of share outstanding change from 21% to 36%, taking advantage of the attractive valuation.

Market consensus

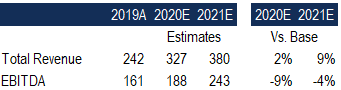

Based on Capital IQ consensus data, our higher realization price explains the higher revenues for the next two years. We believe analysts are not taking into consideration the prices from the 2019 reserves report, where the company provided their estimates based on gas contract pricing secured. Also, our EBITDA is lower because we assigned higher exploration expenses.

Risks

The investment recommendation has three main risks. Firstly, this crisis found Colombia with high public debt (≈50% of GDP) and on edge to lose investment-grade (S&P and Fitch have Colombia's sovereign rating at BBB- with a negative outlook). The government might need to increase taxes or royalties to fund its expenses. We estimated that an increase in 100bp in taxes or royalties would reduce FCFE by 4%. Secondly, a slowdown in the spot market recovery might impact the future cash flow. If that market does not recover for the next year, FCFE might be affected by USD 30mn or -25%. Lastly, the CNNEF has 6.2x years of reserves based on 2019 production. The company needs to continue to have an outstanding discovery and conversion track-record.

Conclusion

Canacol Energy is undervalued because it is associated with oil companies (higher beta). Also, it has low liquidity in the three stock exchange stock where trades (average 365 days trades in TSX: CNE was ≈USD 1.3mn, while in OTCQX: CNNEF was ≈USD 60k and in BVC: CNE was ≈USD 55k). Eventually, the market will pay attention to fundamentals: predictable top-line and proven track record.

Valuation Appendix

1) Free cash flow

2) NAV base case

Rolling value per share is Equity Value to Fully Diluted Shares Outstanding per each year. It is based on a 10% discount rate.

3) LBO

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.