Alteryx: Expect Continued Strong Performance For The Long Term

by Steve AugerSummary

- A high-growth "Big Data" company with end-to-end data analytics solutions.

- Positive free cash flow margin and ample cash-on-hand make Alteryx a good investment candidate.

- My opinion is that the stock price is fairly valued relative to its peers.

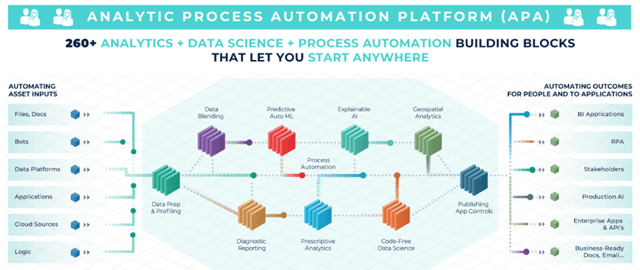

Alteryx, Inc. (AYX) is a market leader in analytics, data science, and process automation, three pillars of digital transformation that are seeing signs of maturation and bumping elbows as vendors start to expand into adjacent niches.

Alteryx has a vision of being the front-runner of a market category that it calls Analytic Process Automation (APA).

(Source: Alteryx)

I'm not sure whether Alteryx has created a new market platform or this is simply a marketing ploy. From what I have been able to tell, this announcement has not spawned any revolutionary technology but simply expresses where the company is in terms of product offering.

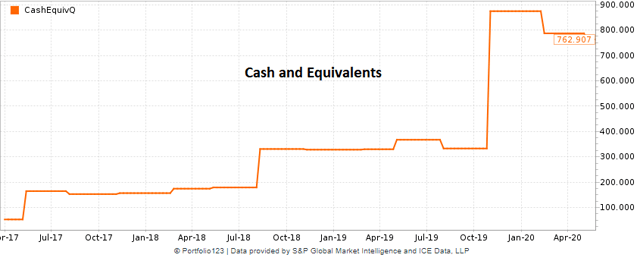

But in any case, I am impressed with Alteryx's strong revenue growth of 60+% that it has maintained over the years. Between the revenue growth, positive cash flow, and $760 million in cash and equivalents, Alteryx should survive the pandemic and recession quite nicely.

(Source: Portfolio123)

I should note that Alteryx management has withdrawn guidance for FY 2020 and provided very conservative guidance for the next quarter with YoY revenue growth of 10%-15%. I am not going to read too much into the low level of guidance as management got burned on Q1 earnings with a miss on analysts' estimates, something that is not well-tolerated by investors in SaaS companies.

It is impossible to predict how Alteryx will perform for the remainder of 2020, but the company has a strong balance sheet, steady free cash flow, and exceptional revenue growth prior to the pandemic. Alteryx should be in good shape once the pandemic scare subsides and global growth restarts. Given the stock's reasonable valuation, I am maintaining my very bullish rating for Alteryx. This company is one of my favorites.

The Rule Of 40

One industry metric that is often used for software companies is the Rule of 40. The rule provides a single metric for evaluating both high-growth companies that aren't profitable and mature companies that have lower growth but are profitable. Revenue growth and profitability (expressed as a margin) must add up to at least 40% in order to fulfill the rule. Analysts use various figures for profitability. I use the free cash flow margin.

The rationale for the Rule of 40 is as follows. If a company grows by more than 40% annually, then you can tolerate some level of negative free cash flow. But if a company grows by less than 40%, then it should have a positive free cash flow to make up for the less-than-ideal growth. This rule accommodates both young, high-growth companies as well as mature, moderate-growth companies. The 40% threshold is somewhat arbitrary but typically divides the digital transformation stock universe in half, separating the best stocks from the so-so ones.

For a further description of the rule and calculation, please refer to a previous article I have written.

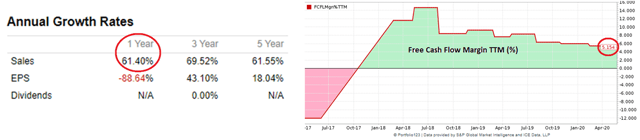

The two factors required for calculating the Rule of 40 are revenue growth and free cash flow margin. Alteryx's annual revenue growth is 61%. The company's TTM free cash flow margin is a steady 5%.

(Source: Portfolio123/MS Paint)

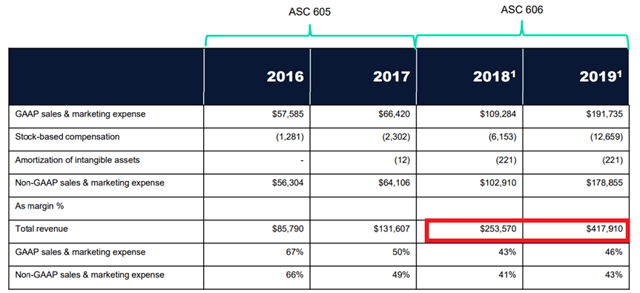

I would like to make a point here. Every time I write an article on Alteryx, a commenter complains that I am not accounting for the effects of ASC 606 in the calculation of revenue growth. Accounting for the ASC 606 effect, revenue growth would be lower than I claim.

Instead of waiting for the comment to show up this time around, I am going to address the issue head-on by bringing to the reader's attention to the Alteryx 2019 Q4 earnings call presentation. The snippet below is from this presentation.

(Source: Alteryx)

The financials for both 2018 and 2019 are provided according to ASC 606 accounting rules. The change in revenue from 2018 to 2019 was 100 * (417,900 / 253,700 -1) = 65%.

While the switch to ASC 606 may have affected the revenue accounting in previous years, this is no longer an issue. Therefore, I will use the 61% revenue growth provided in the Portfolio123 database.

The Rule of 40 calculation for Alteryx is as follows:

Revenue Growth + FCF margin = 61% + 5% = 66%

The score is much higher than the necessary 40% needed to fulfill the rule of thumb, suggesting that Alteryx is strong and healthy, ideal for survival in the current market conditions.

Stock Valuation

There are numerous techniques for valuing stocks. Some analysts use fundamental ratios such as P/E, P/S, EV/P, or EV/S. I believe that one should not employ a simple ratio, and the reason is simple. Higher-growth stocks are valued more than lower-growth stocks, and rightly so. Growth is a significant parameter in discounted cash flow valuation.

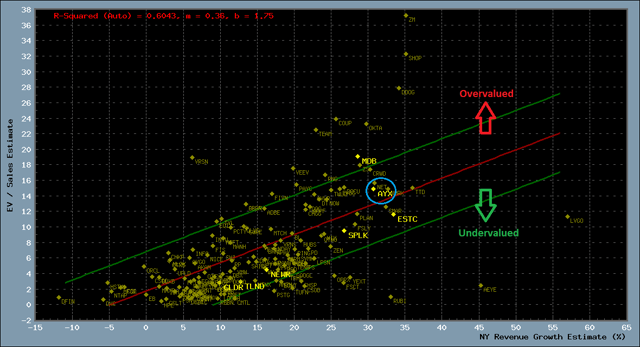

Therefore, I employ a technique that uses a scatter plot to determine relative valuation for the stock of interest versus the remaining 150+ stocks in my digital transformation stock universe. The Y-axis represents the enterprise value/forward sales, while the X-axis is the estimated forward Y-o-Y sales growth.

The plot below illustrates how Alteryx stacks up against the other stocks on a relative basis based on forward sales multiple.

(Source: Portfolio123/private software)

A best-fit line is drawn in red and represents an average valuation based on next year's sales growth. The higher the anticipated revenue growth, the higher the valuation. In this instance, Alteryx is positioned above the best-fit line, suggesting that the company is modestly overvalued on a relative basis relative to its peers.

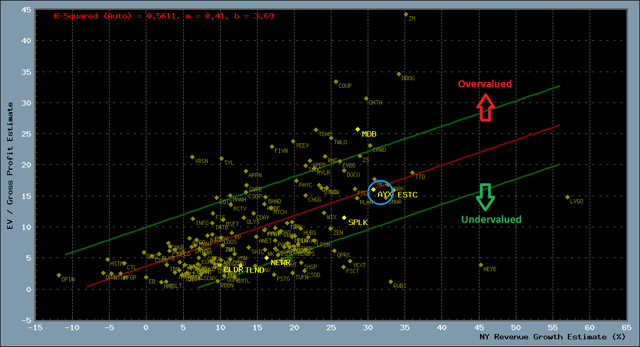

Another perspective is to use the estimated forward profit multiple instead of using the forward sales multiple for the Y-Axis of the scatter plot. When I make this adjustment Alteryx sits on top of the best-fit line, giving this company a fair valuation.

(Source: Portfolio123/private software)

I have highlighted several other "Big Data" stocks. You can see that Big Data is not in high demand at present. Cloudera (CLDR), Talend (TLND), New Relic (NEWR), Splunk (SPLK), and Elastic (ESTC) are all undervalued according to my relative valuation technique. Only MongoDB (MDB) is overvalued and in fact is quite overvalued.

Investment Risks

There are several risks that investors should consider before investing in Alteryx. First of all, I view the current stock market action to be reminiscent of the Dot.com era, immediately prior to the crash starting in 2000. Back then, I quadrupled my investments in a few months. Technology stocks were hopping. But it wasn't long before the market turned into a disaster.

While Alteryx is not overvalued some of its software peers are. Companies such as Zoom (ZM), Shopify (SHOP), Atlassian (TEAM), and Coupa (COUP), are extremely overvalued. A market crash led by these software stocks could cause Alteryx to get swept along with the crowd.

The biggest risk to Alteryx's business is if customers are unable to continue making payments according to subscription schedules. 25% of Alteryx's customers are in sectors most affected by the pandemic.

Summary and Conclusions

Alteryx is a Big Data company offering end-to-end data analytics starting with raw data into actionable insights. The company management would like to believe it is inventing a new platform called APA along the lines of customer relationship management (CRM), IT service management (ITSM), and human capital management (HCM). This may or may not be the case. It is too soon to make any kind of judgment. But I do know that Alteryx is putting up some very strong revenue growth figures, above 60% growth, a feat that few companies achieve for any length of time.

Given that the company's fundamentals are strong, and, in my opinion, the stock price is fairly valued, I expect that Alteryx will emerge from the pandemic in terrific shape and continue to perform well thereafter. The stock price hasn't kept up with other digital transformation stocks, many of which are breaking out to all-time highs. I expect that Alteryx stock will soon follow suit in a very bullish manner. For these reasons, I am giving Alteryx a very bullish rating.

And now I would like to leave readers with a quote from the 2020 Q1 Alteryx earnings call regarding the paradigm shift due involving digital transformation:

... in times like this while, lots of people are impacted we believe that winners and losers are made in times like this. We see the focus on digital transformation being right in front of us. As I said earlier, if this is not a wake-up call to executives around the world, nothing will wake them up.

Digital Transformation is a once-in-a-lifetime investment opportunity fueled by the need for businesses to convert to the new digital era or risk being left behind. You can take advantage of this opportunity by subscribing to the Digital Transformation marketplace service.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.