Indian Banks may need $20-50 bn capital over next 1-2 years as bad loans set to rise

Fitch Ratings has pegged the total capital requirement for India's banking sector at $50 billion.

by Saloni Shukla, Joel Rebello

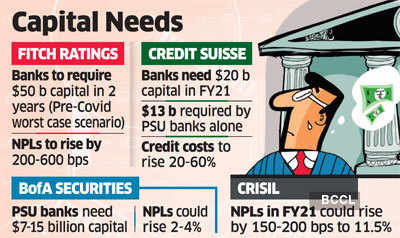

Indian banks may need to raise $20-50 billion capital in the next two years as bad loans and credit costs rise due to the Covid-19 induced slowdown in the economy, brokerages and rating agencies believe.

The problem is far worse for public sector banks (PSBs) with the government not budgeting any capital infusion this fiscal and hinting that they should rely on market for capital. Analysts say expecting PSBs to raise market funds is a tall ask considering they are trading at a discount of 0.2-0.6 times the book value.

“We had estimated a $50 billion capital requirement (over two years) in a pre-Covid worst case scenario. With growth set to contract and asset quality stress to increase, we expect this figure to remain elevated,” said Saswata Guha, director, financial institutions, Fitch Ratings. “We also see elevated levels of NPLs (non-performing loans) – an increase of 200-600 bps, depending on the exposure of each bank.”

Credit Suisse has pegged the total capital requirement for India's banking sector at $20 billion, of which $13 billion will be needed by public sector banks.

In a banking sector review, the brokerage said rising risk aversion and accelerating rating downgrades will add to asset quality woes of Indian banks in FY21. It has raised credit costs estimates by 20-60% due to the prolonged lockdown and moratorium extension.

PSBs’ RELIANCE ON GOVT FUND

Private banks can still manage, but the PSBs’ reliance on the government has increased, the brokerage said.

“Private banks’ Tier1 are healthy at 13% and, coupled with their strong pre-provision profitability, are adequate to absorb up to 4% additional credit cost. SBI’s stake sale in insurance subsidiary to 30% can cover 50% of its capital call, and for ICICI this is two times of capital needed. We expect PSU Banks to need a $13 billion recapitalisation from the government,” Credit Suisse said.

The central government is already walking a tightrope after a sharp fall in taxes pushed them into raising a full-year borrowing plan by nearly 50% to help meet spending. Experts have said the move could push the fiscal deficit to 5.5% of the GDP from the earlier target of 3.5%.

“The government has already indicated to PSBs to become self-reliant as far as funds are concerned as the finances are too stretched, though it will be very tough given the circumstances,” said a PSU bank official.

The government had not budgeted any capital infusion for PSU banks for fiscal 2021. However, that may change due to the current crisis.

“If the government wants PSU banks to push lending they will recapitalise them. How much it will be has to be worked out, but given the economic crisis we are facing it has to come because whatever little expectations PSU banks had of raising funds from the market has evaporated,” said Siddharth Purohit, analyst at SMC Global Securities.

Given the tough fiscal conditions faced by the government, most bankers and experts say the government is likely to use recapitalisation bonds to fund the banks. It had infused more than Rs 3 lakh crore in PSBs in the last five years, of which more than Rs 1 lakh crore came through recap bonds.

In a recent report, BofA Securities has estimated that state-owned banks’ NPLs could rise by 2-4%, which would result in a recapitalisation requirement of $7-15 billion, adding that the state could use recapitalisation bonds to fund PSU banks.

Earlier in May, Crisil had said banks’ gross NPAs will rise by 150-200 basis points from 9.5% in FY20 to 11-11.5% in FY21.

“Asking state banks to raise money from the market is a tall order given their market valuations,” said Guha. “If lenders don’t have enough capital they will not have the incentive to lend. The onus is on the government to do what is required to keep the banking system in good health.”