Is Northern Oil And Gas Worth The Risk At This Price

by Brent HechtSummary

- We discuss Northern Oil and Gas's unique business model and how it may be a strategic advantage.

- We lay out the company's history of share dilution and will let you decide if it is something to be concerned about going forward.

- A brief look at the company's hedging strategy as well as its counterparty risk.

- Analysis of the company's balance sheet relative to peers and the steps the company is taking to shore up its balance sheet.

- A brief look at the company's management team and the incentive-based pay.

In this economic environment, it's fun to look around the market and try to find extreme bargains. I’m not talking about a large-cap stock that has traded down 30% and is now only 10% off the highs. I know some in the financial mainstream like to talk about those as an extreme bargain but they aren’t in my opinion. No, I’m talking about something with truly asymmetric risk. By asymmetric, I mean if the company survives, it could go up 30x over a 5 to 10-year time horizon, but if it doesn’t, then it could go down 90 to 100 percent.

Everyone knows oil was absolutely demolished in the Feb/Mar market crash and based on its performance since then, it's beginning to make me think we may have reached a low in the oil price for the long term. Does that mean that I think oil is going straight to $60/barrel? No, I don’t. I think it could rebound to $40 and trade in the 30 to 50 dollar range for the next 3 to 5 years.

Looking forward to a higher oil price, I think it’s important to begin to choose the horses you want to back now, in case oil continues going up. If you find a company you believe in, and oil prices go down again, you know you can step in and purchase more.

As I was looking around, I came across a company I’ve been familiar with for some time. That company was Northern Oil and Gas and it was trading at 80 cents a share. I knew I had to investigate. By investigating... I wanted to understand the risks that Northern Oil and Gas is facing over the coming years so I can make a projection on whether it survives this crisis.

Unique Business Model

Northern Oil and Gas’s business model is that of a “Non-Operator.” NOG allocates its capital toward non-operating interests in oil wells in the Williston Basin, which is situated in the Bakken Shale area of North Dakota.

The advantage of the non-operator model is that it keeps operating expenses especially low. The disadvantage is that you give up control of making decisions when drilling and operating the well. However, the Bakken is a mature oil play with turn-key drilling and fracking operations. Furthermore, Northern has relationships with all of the established players in the Bakken, so giving up operating control isn’t very much to sacrifice since business interests are perfectly aligned between the operator and the non-operator.

To date, Northern has varying interests in over 7,000 wells drilled in the Bakken.

Production Growth

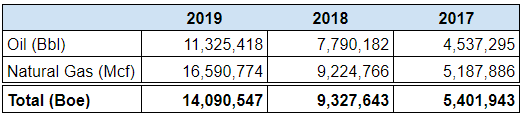

As of the end of 2019, Northern produced 45,000 barrels of oil equivalent/day. Eighty percent of their production was oil and 20 percent was natural gas in 2019. Here’s a chart that shows how much NOG has grown production since 2017.

Source: NOG’s 2019 10-K

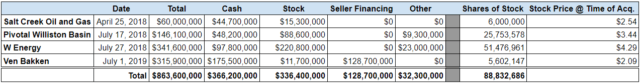

NOG has done this primarily by issuing new shares and going on acquisition sprees in 2018 and 2019. You can see in a chart below the acquisitions they made and how they paid for them.

Share Dilution Risk

Northern Oil and Gas has gone from 67 million shares outstanding on December 31, 2017 to 406 million shares at the year-end December 31, 2019. That’s about a 600 percent increase in the number of shares in just two years. These newly issued shares were primarily used to reduce debt levels and acquire new oil and gas production. The company is authorized to issue up to 675 million shares.

Here are the acquisitions they made in the past two years and how they were paid for which is compiled from their 2019 10-K report.

Source: NOG 2019 10-K

Given that Northern’s share price has decreased significantly after paying for these acquisitions, and that most of their production is hedged for the next two years, these acquisitions have potentially paid off handsomely for shareholders and are more likely to benefit shareholders going forward. This is assuming that NOG’s shares have decreased since then because of the oil price decline and the poor economic environment.

Rather than issuing new shares, the company began repurchasing shares in Q1 2020. They repurchased 5.6 million shares. Based on the information provided, they paid ~$2.90/share to repurchase these shares. Not exactly buying at the low, but we will see if they continue purchases in Q2 2020.

Preferred Stock

In a section below, we discuss NOG’s desire to retire its 8.5% second-lien notes. One of the primary ways that NOG is retiring its 8.5% notes is via issuing Preferred Stock. This begins to make NOG’s capital structure somewhat complicated. The important thing to know about this Preferred Stock, is that its par value is somewhere around $100/share and it has first rights to dividend payments in the amount of 6.5% per year which will accumulate if not paid. Furthermore, if the preferred stockholders wish to convert, they can convert at a ratio of 43 shares for each one share of preferred stock. This equates to about $2.29/common share. Don’t be surprised if there is some price resistance in the market at $2.29/share, should the price rise there.

Currently, there are 794,702 shares of preferred stock issued outstanding which means this has the potential to dilute common shareholders by about 34,172,186 shares. This equates to about 8.5% of the current shares outstanding. I don’t love the fact that there is inevitable dilution going forward, but it is a way to improve the balance sheet and ensure the company remains a going concern in the future.

The company is authorized to issue 5,000,000 shares of preferred stock if necessary.

Northern’s Hedging Counterparty Risk

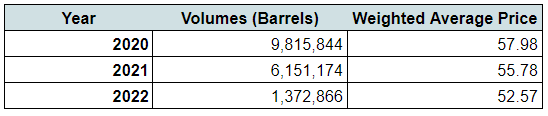

One of Northern’s main advantages is that it has hedged most of its 2020 and 2021 production at ~$58/barrel. Here’s their price hedges as of December 31, 2019 through 2022.

Source: NOG 2019 10-K

However, there is counterparty risk involved with hedging. I did some research to determine who NOG’s hedge counterparty was. Here’s a quick blurb about their counterparty agreement.

All of the Company’s outstanding derivative instruments are covered by International Swap Dealers Association Master Agreements (“ISDAs”). The Company’s obligations under the derivative instruments are secured pursuant to the Company’s Revolving Credit Facility, and no additional collateral had been posted by the Company as of December 31, 2019. The ISDAs may provide that as a result of certain circumstances, such as cross-defaults, a counterparty may require all outstanding derivative instruments under an ISDA to be settled immediately. Source: NOG 2019 10-K

This brings up the question, who is their Revolving Credit Facility through? Here’s the answer.

In November 2019, we entered into a revolving credit facility with Wells Fargo Bank, as administrative agent, and the lenders from time to time party thereto (the “Revolving Credit Facility”), which amended and restated our existing revolving credit facility that was entered into on October 5, 2018. The Revolving Credit Facility is subject to a borrowing base with maximum loan value to be assigned to the proved reserves attributable to our oil and gas properties. As of December 31, 2019, the Revolving Credit Facility had a borrowing base of $800.0 million and we had $580.0 million of borrowings outstanding under the facility, leaving $220.0 million in available borrowing capacity. Source: NOG 2019 10-K

Wells Fargo is the counterparty to their derivatives hedging program. If push comes to shove, will Wells Fargo be “too big to fail” again? I’d say it is more likely than not based on the Fed’s most recent actions.

Risk Of Insolvency

I personally believe that the risk of insolvency is small. My opinion is that the hedging program has protected Northern Oil and Gas for the next couple of years from becoming insolvent.

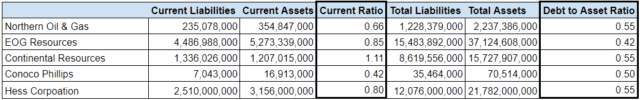

Here’s how NOG’s debt ratios compare to other oil and gas companies such as EOG Resources (EOG), Continental Resources (CLR), ConocoPhillips (COP), and Hess Corporation (HES).

Source: Yahoo Finance and NOG’s Q1 2020 10-Q

You’re probably thinking that Northern Oil and Gas shouldn’t be compared to companies like these because they don’t have the scale of operations that these companies have. As I see it, these are the types of companies that NOG is partnering with, and in addition, with the “Non-Op” business model, they scale much easier than a normal operating company. For example, see NOG’s G&A expense per barrel of oil relative to these companies. NOG’s will be lower.

With that said, I think NOG still has some work to do on its balance sheet. I’d like to see them get to at least EOG’s Debt to Asset ratio and probably lower around the .35 range. I think the economy has the potential to go through extraordinarily tough times in the next year to two years and it’s important that NOG continues to prepare.

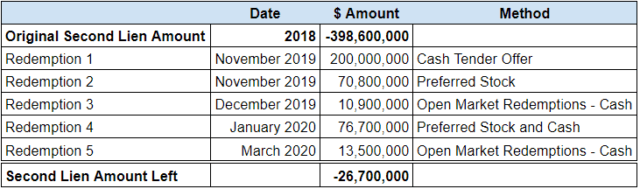

I’m hopeful based on the evidence that that is what NOG is trying to do. Management has made a commitment over the next two years to paying down debt. Specifically, they are focusing on the 8.5% second lien secured note that matures in 2023 first. The original total principal amount of that note was about $400 million. In the second half of 2019, they redeemed $280M of this note. In the first quarter of 2020, the company redeemed $90M of this note. The table below shows the progress that Northern has made since 2018. Only roughly $27 million left.

Source: NOG Q1 2020 10-Q

Management And Directors

When evaluating the risk to the company, it’s important to understand the management and the board. In my research, I’ve been impressed with the company’s top management and board of directors. I'm especially impressed by their percentage ownership in the company.

Currently, 30% of the NOG’s shares are owned by insiders. This is an unusually large amount. You can bet these insiders will be doing all they can to ensure NOG does not go into bankruptcy.

One of their chairmen of the board, Bahram Akradi, is the founder and owner of LifeTime Fitness. Although Lifetime has recently become bankrupt during the COVID-19 crisis for obvious reasons, Bahram brings a lot of valuable experience to the board.

There isn’t a conference call where the management isn’t bragging about Bahram’s leadership. They often bestow much of the credit to Bahram for the transformation that has taken place since 2017. One of the conference calls mentioned that Bahram owned 5% of the company by investing mostly his own money. It’s appropriate to say “he’s bought in.”

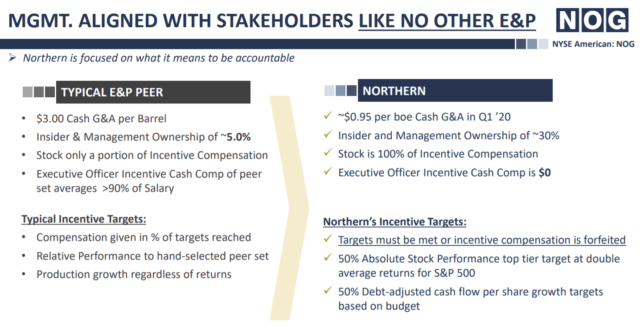

This slide demonstrates how NOG’s incentives are aligned with shareholders in a greater way than other E&P companies. Bahram Akradi is the director that heads up the area of compensation, so we have him to thank for this.

Source: NOG quarterly presentation

Privatization Risk

Because the Northern Oil and Gas team owns so much of the company, as the company becomes cheaper, there could potentially be a risk that they take the company private. This would potentially cause shareholders to be forced to sell their shares at the take-private price.

Why won’t they? The team at NOG seems like good people and I think they want the public shareholders who believe in the company to participate in the future upside with them. Furthermore, they have benefited greatly during the past few years from having access to public capital. I don’t think they will want to give that up.

Northern’s Stated COVID-19 Risk From Q1 2020 10-Q

Without limiting the generality of the foregoing, some impacts of the COVID-19 pandemic and recent oil market developments that could have an adverse effect on our business, financial condition, liquidity and results of operations, include: significantly reduced prices for our oil production, resulting from a world-wide decrease in demand for hydrocarbons and a resulting oversupply of existing production; further decreases in the demand for our oil production, resulting from significantly decreased levels of global, regional and local travel as a result of federal, state and local government-imposed quarantines, including shelter-in-place mandates, enacted to slow the spread of the coronavirus; significantly reduced development activity on our properties by operators in the Willison Basin; increased likelihood that the operators of our wells will curtail or shut-in production, either voluntarily or as a result of third-party and regulatory mandates, due to depressed oil prices, lack of storage, and/or other market, social, legal, or political forces; increased costs associated with, or actual unavailability of, facilities for the storage of oil, gas and NGL production, in the markets in which we operate; increased operational difficulties associated with, or an inability to, deliver oil and NGLs to end-markets, resulting from pipeline and storage constraints; the potential for loss of leasehold or asset value for failure to produce oil and gas in paying quantities; increased third-party credit risk resulting from adverse market conditions, a lack of access to capital and storage, and the failure of certain of our counterparties to continue as going concerns; Source: NOG Q1 2020 10-Q

Summary

Northern Oil and Gas is trading in the range of 80 cents to a dollar right now. This is near all-time lows reached in March 2020. If Northern Oil and Gas can make it through the next couple of years, the current share price will likely be viewed as a missed opportunity. When evaluating the risks and opportunities, Northern appears to be prepared to weather the storm. Here are the summarized opportunities and risks as I see them.

Risks

- The oil price at current levels creates challenges for E&P companies in general. Without higher oil prices, Northern will have production shut-ins dictated by their partner operating companies throughout the Williston Basin. If this lasts beyond 2021, then Northern will suffer significant lost opportunity when their production price hedges run out. In the worst case, the company could become insolvent and equity owners will be wiped out.

- Northern is going to continue to work on the balance sheet and in order to do so, they may need to issue more preferred stock which is convertible. This is the mechanism of choice they have used most recently. This presents the risk of share dilution in the future.

- Economic conditions could worsen due to COVID-19 or some other unforeseen event, primarily continuing to affect the oil price.

- Company insiders could decide to take the company private, forcing shareholders to sell at the negotiated price. I don’t view this as likely as it would cut-off NOG’s access to public equity capital markets which they need.

- Northern’s production is hedged through 2021. Hedges come with counterparty risk. The counterparty to their hedges is Wells Fargo.

Opportunity

- Experienced management team with an incentive plan aligned with shareholders and directors who are completely bought in with excellent experience and leadership skills. Very high insider ownership makes bankruptcy unlikely in my view.

- If Northern Oil & Gas can improve the balance sheet, this will likely open up opportunities to grow production via multiple non-op strategies in this oil price environment.

- Relative to peers, Northern Oil & Gas debt levels look reasonable but would like to see further improvement given the oil price volatility we have recently experienced to ensure solvency regardless of oil price.

- The current share price valuation is cheap both historically and relative to peers by most metrics.

- The non-op business model allows high levels of capital flexibility.

- NOG bond prices have been trading at significant discounts to par, allowing NOG to redeem bonds at extreme discounts on the open market.

- NOG’s 8.5% second lien bond, which is their highest interest rate bond, will likely be completely retired in Q2 of 2020.

- Most of their production is hedged between $50 and $55 per barrel from now until the end of 2021. This provides clarity for the future.

- Strong free cash flow projections with current hedging activity through 2021. This allows the company to plan strategically for the future.

Disclosure: I am/we are long NOG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.