Etsy: Downgrading On Valuation And Competition

by Gary AlexanderSummary

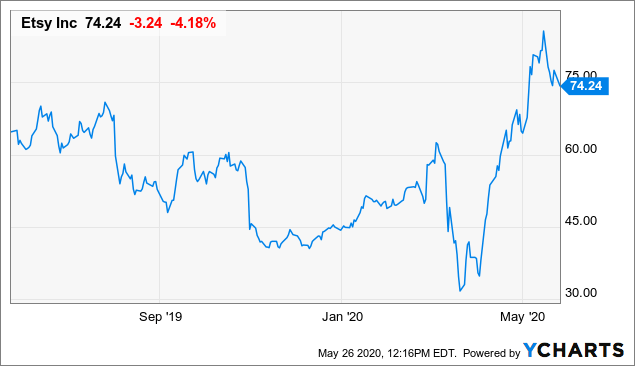

- Shares of Etsy have been a major outperformed this year, rising 64% year-to-date despite a ~10% decline in the broader markets.

- The company has continued strong >30% y/y growth trends in Q1.

- However, the recent introduction of Facebook Shops may divert some sellers away from Etsy.

- Shares look fully valued at ~9x forward revenues.

Being bullish on Etsy (ETSY) this year has paid off. While the rest of the market has cratered on recession fears, investors have piled into Etsy as a sort of safety stock in the tech sector, reasoning that the stay-at-home orders would boost e-commerce platforms like Etsy. Year-to-date, Etsy has shown impressive >30% y/y growth in both revenues and GMS, while shares have jumped more than 60% since the start of the year:

Data by YCharts

I've been a big Etsy bull since the beginning of the year, but when a stock climbs this hot relative to the broader market, however, it's always prudent to put on a more skeptical lens. Etsy's large outperformance has put its valuation way out of line with historical levels and competitors, while big risks remain on the horizon - namely, the May rollout of Facebook Shops (FB), a nascent and serious competitor to Etsy.

I'm downgrading Etsy based on its recent outperformance/stretched valuation, rising competition, and the possibility of growth deceleration that will put a dent in Etsy's multiples. Steer clear of this stock until valuation multiples come down.

Q1 download: GMS holds up, but April acceleration is boosted by masks

Before we get into the risks plaguing Etsy, let's quickly dive into Etsy's latest quarterly results, which show no major cause for concern.

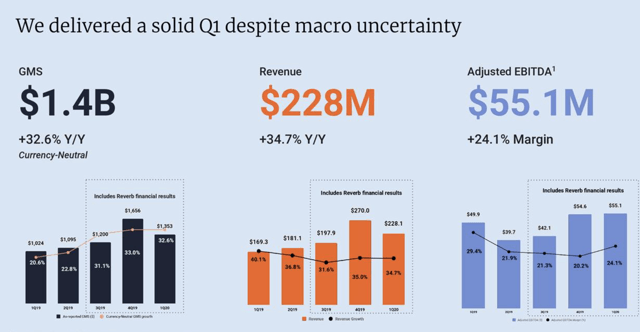

As shown in the chart below, Etsy's GMS rose 33% y/y and revenue grew 35% y/y to $1.4 billion and $228 million respectively, the exact same pace at which Etsy grew in Q4. Etsy's revenue also beat Wall Street's expectations of $220.0 million (+30% y/y) by a five-point margin.

Figure 1. Etsy Q1 key resultsSource: Etsy 1Q20 earnings release

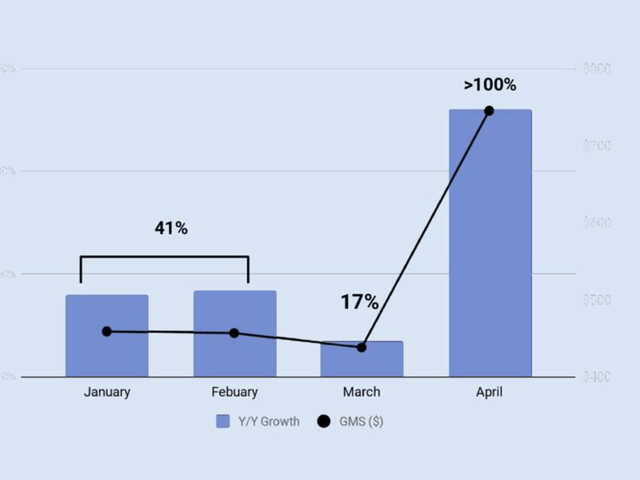

The linearity of Etsy's recent growth is interesting. We can see in the chart below that Etsy's "baseline" GMS growth trend in January/February was really around 41% y/y (which actually accelerated over Q4 GMS growth of 35% y/y) - though we do have to remember that Etsy's acquisition of Reverb only completed in August of last year, so its comps will be felt beginning Q3 of the year (Reverb generated $168.3 million, or roughly 15%, of Etsy's Q1 GMS).

Then in March and April followed serious volatility. Growth rates more than halved to just 17% y/y in March, and then soared to >100% y/y in April - proving correct most investors' thesis that the lockdown orders would cause a surge in e-commerce traffic.

Figure 2. Etsy GMS monthly linearity

Source: Etsy 1Q20 earnings release

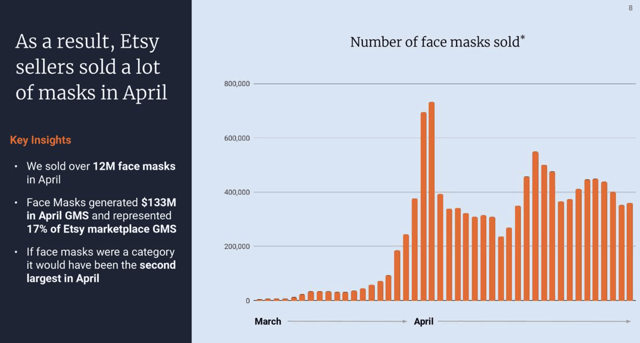

We do have to be careful of the fact, however, that a large portion of Etsy's April sales owed to masks - a category that, once the coronavirus is in the rearview mirror, is perishable. Etsy reported that masks made up $133 million/17% of Etsy's GMV in April (as well as contributing a portion to March sales), and that masks were actually Etsy's second-largest category in April.

Figure 3. Etsy mask contributionSource: Etsy 1Q20 earnings release

Etsy has provided incentives for mask sellers on its platform in the form of listing credits, while offering more direct coronavirus support in the form of hospital mask donations and providing ad credits to sellers in coronavirus-impacted categories. The company has reported incurring $11-$13 million of coronavirus-support charges, most of which will hit the books in Q2 ($12 million is roughly 20% of Etsy's quarterly adjusted EBITDA).

Facebook Shops - better integration into social media, lower fees

Having now established that Etsy's growth so far looks strong - perhaps aided by masks and other coronavirus-related sales in April - let's discuss the biggest risk to Etsy at the moment. Facebook and Instagram rolled out their Shops offering in mid-May, which allows existing Facebook/Instagram Business pages turn instantly into storefronts. An Instagram VP, according to TechCrunch, noted that more than 1 million businesses had signed up at the start of the launch.

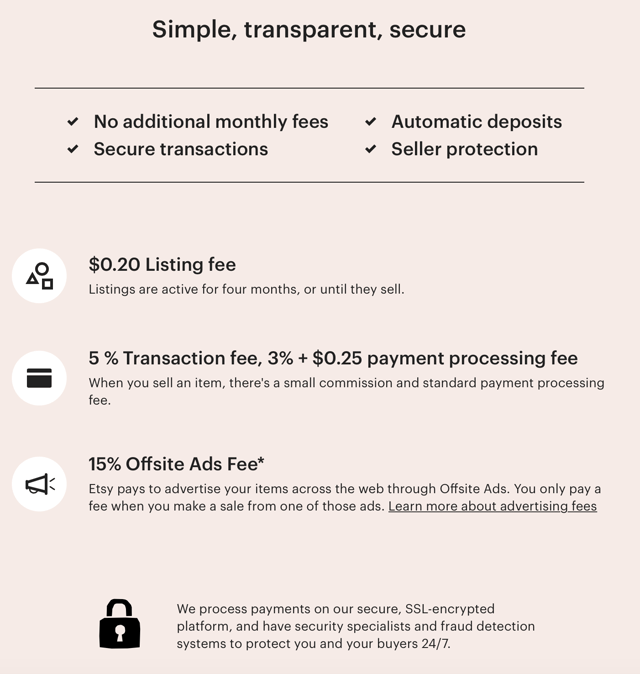

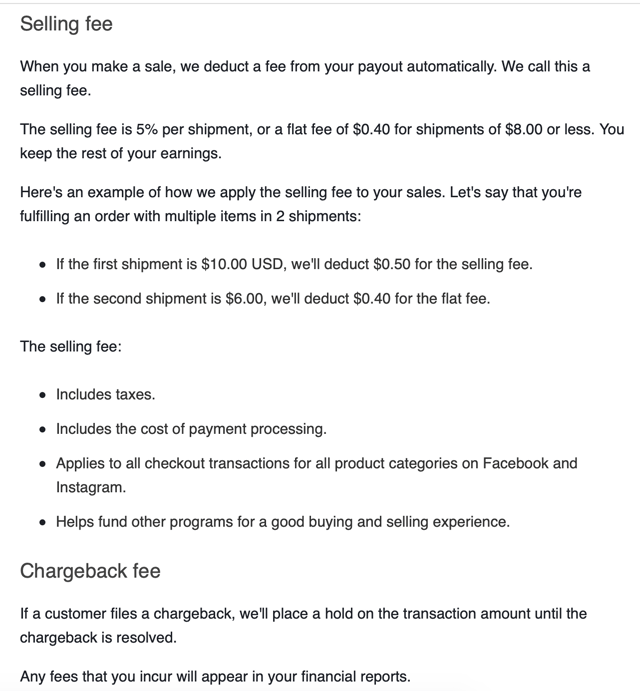

Facebook shops is positioned as a direct competitor to Etsy. The fee structure is very similar to Etsy. Take a look at the two fee tables below:

Figure 4. Etsy fee structureSource: etsy.com

Figure 5. Facebook Shops feesSource: Facebook Business help center

Each marketplace platform takes a 5% cut of sales. However, Facebook wins in two ways:

- Etsy charges an additional 3.0% + $0.25 for credit card/payment processing if the seller elects to use Etsy Payments (competing offerings like Stripe are similarly priced), while Facebook's payment processing charge is already included in the 5% fee for using Facebook Checkout

- There's no listing fee on Facebook, versus a $0.20 listing fee on Etsy, so "barriers to entry" for sellers who want to casually list a few items are much lower on Facebook

Many Etsy sellers have griped about high fees on the platform, especially since the fee hikes that Etsy implemented last year (which took transaction fees from 3.5% to 5.0%). The lower fees on the Facebook platform may be the final straw for some fed-up Etsy sellers, similar to what Amazon.com (AMZN) did to eBay (EBAY) in the 2010s.

Marketing items on Facebook/Instagram may also just make more sense than on Etsy. Many indie brands use Instagram as a favored marketing channel anyway, and having the storefront directly integrated onto a Facebook or Instagram page may be the better way of retaining shoppers and sales rather than farming out links to a third-party website. Then there's the greater control over marketing that Facebook/Instagram offers. Etsy requires sellers that generate more than $10,000 in annual revenues from their shop to participate in the "Offsite Ads" program, whereas shop sellers on Facebook and Instagram have the flexibility to determine their own marketing budgets and have no forced advertising mandates.

Even throughout the pandemic, Etsy has enjoyed stable GMS growth, with growth rates (helped by mask sales) even jumping above 100% y/y in April. As Facebook Shops becomes more prominent, however, I'd be wary of Etsy's GMS growth rates beginning to decay.

Valuation and key takeaways

In my view, Etsy's valuation hasn't fully priced in the Facebook risk and is still priced for relative perfection. At current share prices near $74, Etsy trades at a market cap of $8.75 billion. After we net off the $898.1 million of cash and $794.1 million of debt on Etsy's balance sheet, its enterprise value is $8.65 billion.

Prior to the onset of the pandemic, Etsy issued a revenue outlook for FY20 of $1.04-$1.06 billion, representing a 27-30% y/y growth range. Wall Street analysts now have a consensus target of $982.9 million for the year, representing 20% y/y growth (per Yahoo Finance). Against this consensus view, Etsy trades at 8.8x EV/FY20 revenues.

Now, that's not terribly expensive for a company expected to grow revenues in the mid-20s (similarly-growing software companies like Salesforce.com (CRM) and Workday (WDAY) trade at similar high single-digit valuation multiples) - but neither does it leave much head room for expansion. There's a massive uncertainty in the impact of Facebook Shops' rollout on Etsy's ability to retain sellers and GMS, and I'd argue that Etsy's current ~9x revenue multiple doesn't factor in this uncertainty.

I'd become interested in Etsy again at 7x EV/FY20 revenues, representing a $59 price target (20% downside from current levels), but would recommend staying on the sidelines until then.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.