How Microsoft's Azure Is Helping In The Fight Against COVID-19

by David ZanoniSummary

- Microsoft's cloud business, Azure, along with artificial intelligence is being used by companies and the CDC to battle COVID-19.

- Microsoft is likely to be a high-growth outperforming stock over the long-term.

- However, it is probably not time to jump in just yet. It would probably be best to wait until the stock is near an oversold level.

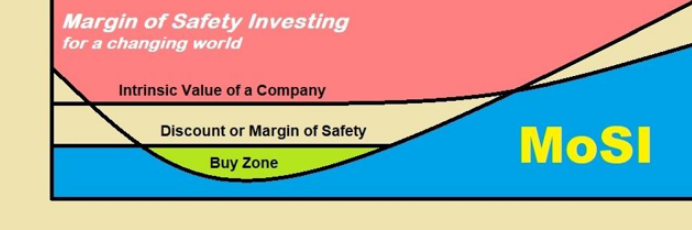

Microsoft (MSFT) is on the Margin of Safety Investing 'Must Own Large Cap Stock' lists. The company is a key dividend growth stock and a major component of all three of the major stock indexes, the Dow Jones Industrials (DIA), the Nasdaq (QQQ), and the S&P 500 (SPY).

This article is highlighting the use of Microsoft's Azure cloud technology for artificial intelligence [AI] applications to combat COVID-19. Multiple companies and the CDC are using Microsoft's technology to help find solutions for this pandemic.

Microsoft is currently the top cloud provider in today's market even over Amazon (AMZN) and Google (GOOG). The company also has the most data center regions than any other cloud provider. Spain, Mexico, and Italy were added recently as new regions. Microsoft is poised to build on its positive momentum as the global cloud market is expected to grow at an annual rate of 20% by 2025.

Cloud, AI, and COVID-19

The Intelligent Cloud segment comprised a little over one-third of Microsoft's total revenue in Q3. The Intelligent Cloud segment comprised 35% of Microsoft's total Q3 revenue and operating income. Intelligent Cloud segment revenue increased by 27% in Microsoft's Q3. This was higher than the 14.7% revenue increase for the Productivity & Business Processes segment and the 3% revenue increase for the More Personal Computing segment.

One recent important aspect of the cloud business is the use of AI. Various organizations have been using Microsoft's cloud, Azure and AI to help find solutions for COVID-19. Healthcare companies are using AI to speed up the development of testing, therapeutics, and vaccines.

Healthcare providers used Microsoft's Healthcare Bot service to create over 1,400 bots to help millions of people access healthcare information. The CDC used the Healthcare Bot to help people self-evaluate for COVID-19 symptoms.

ImmunityBio is using high computing power on Microsoft's cloud to help researchers speed up the process to build models in days vs. months. The Azure platform performs a detailed computational analysis of the COVID-19 protein structure by building a 3D model. Since the protein structure is the entryway for the virus to enter human cells, this is an area to focus on for a vaccine or antibody therapies.

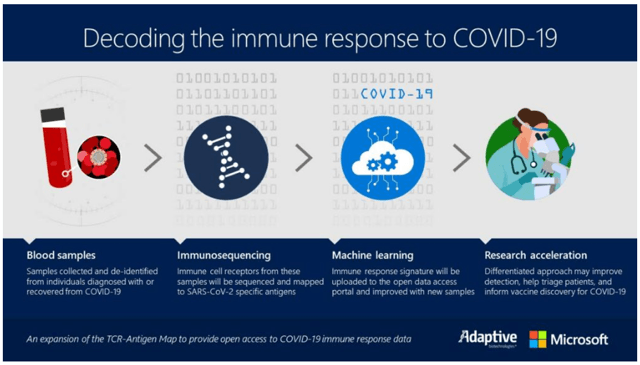

Adaptive Biotechnologies (ADPT) is using Microsoft's technology to decode the immune system's response to COVID-19. Adaptive is collecting blood samples from people who either have the virus or recovered from COVID-19 in conjunction with a few other companies. The data from this process will use Microsoft's machine learning capabilities and the Azure cloud, allowing the immune response signature to be improved and updated in real-time as more samples are sequenced from the study. This can help in the development of a vaccine.

These are some important uses for Microsoft's technology, some of which might be able to help save lives in a faster amount of time than without the technology. That's just a few examples of the use of Microsoft's cloud business. I thought it was important to highlight since the company's technology is being used to help in the fight against COVID-19.

Valuation on the High Side

Microsoft has an above-average high valuation with a forward PE of 32 and a PEG ratio of 2.45. This is higher than the company's 5-week average forward PE of 23 and PEG of 2.16. This is also higher than the S&P 500's (SPY) forward PE of 22 and PEG ratio of 2.2.

Microsoft does have strong above-average growth, so investors tend to award Microsoft with a premium valuation. Microsoft's revenue is expected to grow at about 12.7% in FY20 and 10.4% in FY21 (consensus). Earnings are expected to increase by 24% in FY20 and by about 9% in FY21. While this growth does justify an above-average valuation, the current valuation levels are higher than the preferable levels.

I could excuse the high PE ratio if the PEG was between one and two or at least closer to the 5-year average. However, the PEG of 2.45 seems stretched at this point and doesn't represent a compelling valuation for an entry point for the stock.

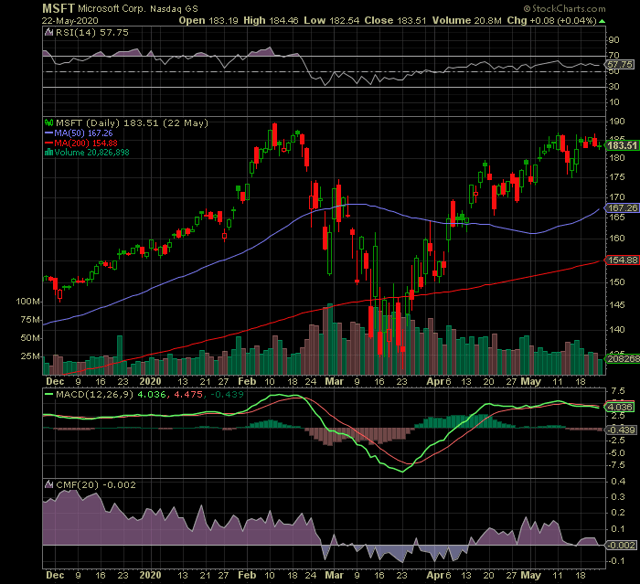

The RSI has been approaching an overbought level on the daily chart. The RSI is currently at about 58 with 70 being overbought. It might be better to wait for the RSI to drop closer to 30 (oversold condition). The MACD line (green) reached a high level and looks like it is crossing below the red signal line, indicating that momentum could be turning from positive to negative if the green line continues downward. The money flow [CMF] declined over the past two weeks, indicating that demand for the stock has waned. Therefore, it might be better for investors to wait for a pullback as the upside looks limited and the downside looks larger at this point.

Healthy Cash Flow

Over the past 12 months, operating cash flow increased 11% to $58 billion over FY19's figure of $52 billion. This strong cash flow gives Microsoft the ability to accomplish multiple things. The company spent $14.7 billion on CapEx, $1.1 billion on acquisitions, repaid $6.5 billion in debt, paid $14.8 billion in dividends, and repurchased $21.8 billion in stock.

The strong cash flow helps Microsoft to maintain sustainable long-term growth. This is accomplished by expanding the existing business and through add-on acquisitions. Microsoft's growing cash flow also makes the dividend sustainable and gives the company the ability for regular dividend payment increases.

On the surface, the dividend doesn't look highly attractive with a 1% yield. However, that is largely due to the stock's appreciation. For example, if the stock didn't appreciate over the past year, the dividend would have a 2% yield. The company is paying a $2 per share dividend. Investors also benefit from the stock's above-average price appreciation. So, if they don't like the yield, they could always sell some shares as the stock rises. Then, buy shares on price weakness.

Microsoft's Long-Term Investment Outlook

Microsoft's positive long-term investment thesis remains in-tact. The company is likely to achieve above-average revenue/earnings growth for multiple years. This will help the stock to outperform the S&P 500 which contains many companies that are not as strong.

There are many important uses for Microsoft's cloud business across multiple industries allowing for ongoing growth. Helping to research and fight COVID-19 is just one of them. The outlook for the cloud business looks strong as the global cloud market is expected to grow at an annual pace of 20% by 2025.

Microsoft's Productivity and More Personal Computing segments also have good growth potential, especially as more people are working from home, which could be a long-term trend. Of course, the company's products are used in office settings as well.

It is important to note that the recent rally from mid-March has the stock closer to an overbought condition. As a result, current stockholders may want to consider selling some shares into the price strength to lock-in profits and to raise cash. Investors who are interested in the stock would probably be better off waiting for a pullback and then enter with the stock rising off of an oversold condition.

The 2020s will see the transformation of the economy during the 4th Industrial Revolution. We are also running head first into a wave of demographic and debt driven problems that will need solving. A cautious, but forward looking approach, will be required to thrive in what could be a lost investing decade for many, much like 2000-2009.

Benefit from the insights of Kirk Spano, Dividend Sleuth and David Zanoni. Get exclusive investment ideas based upon in-depth and up close research that few others do.

Sign-up now for a free trial and 20% first year discount.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Business relationship disclosure: The article was written by David Zanoni for Kirk Spano's Margin of Safety Investing service [MoSI].

Additional disclosure: The article is for informational purposes only (not a solicitation to buy or sell stocks). David is not a registered investment adviser. Kirk Spano is an RIA. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.