Netflix: Behind The Account Culling

by Dan StringerSummary

- On May 21, 2020, Netflix announced they would be culling accounts dormant for over a year.

- The company indicated they didn't want people to pay for a service they aren't using.

- The action is not totally supported by underlying consumer trends and economic realities.

- A regulatory investigation may tie into this action as it appears to focus on subscriber numbers.

Netflix (NFLX) announced on May 21, 2020 that they were going to begin culling inactive accounts. In the company post, they indicated this effort would focus on accounts that had not been used in over 12 months. Customers in this category would be required to confirm their accounts. Netflix indicated in the release that a key reason for the action was they did not want people paying for a service they did not use. The company indicated the revenue at risk was not a large amount with just a few hundred thousand accounts affected, comprising less than ½ of 1% of the company’s subscriber base.

Reaction by investors and fans of the company have been generally positive to this action; the comments in the Seeking Alpha posting provide a pretty good composite of sentiment. With many people struggling economically during COVID-19, this move is a good public relations move by the company for those that may be continuing to pay for the service unknowingly.

I find several things odd about this disclosure. Firstly, for a company still struggling to generate cash flow, returning money voluntarily seems to be an odd choice. “Dead” accounts are like free money for companies; with no cost to service the customers, they can be very profitable accounts for businesses. The most common instance of this situation are gym memberships where people sign up for a fixed term and then never go. Netflix accounts can be cancelled very easily with little notice so there is much less resistance to quitting than the gym scenario. The revenues affected are only in the $100m+ range on an annual basis, so it is relatively immaterial to the business. This makes the disclosure a little strange.

Secondly, I find it unlikely that any customer with financial difficulties would not have already taken the time to cancel their account already, especially if they not using it the service. The cancellation process is not particularly difficult:

Source: Netflix.com

These dormant accounts are more likely to be with those who can afford it but have lost track of the cost for one reason or another. Netflix’s comments in the press release may be valid in some cases, but I am skeptical that this is the primary reason due to this lack of barrier to cancellation.

This factor makes me ask what else would cause the company to be reviewing their subscriber lists, especially in a revenue reducing way. One potential reason could be a regulatory action. The company does not disclose any direct investigation in their 10-K or 10-Q documentation, but subscriber additions is a key performance indicator in their quarterly reporting.

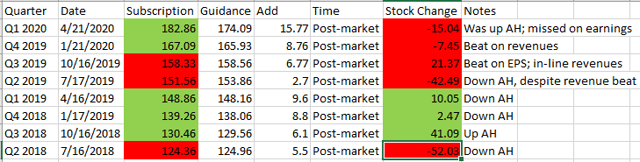

Netflix has historically seen its share price heavily driven by its quarterly subscriber additions as well as its installed base. This has largely been born out over its recent operating history, with share price moves being driven by how the subscriber additions compared to guidance. I compiled a summary of the company quarterly subscriber levels, guidance and net additions compared to its stock performance below:

Source: Netflix Quarterly Disclosures, Market Performance

There has generally been a positive correlation between immediate stock performance and subscriber growth compared to guidance. This has somewhat broken down over the last two quarters, though this could be because of the heightened volatility in the markets in general.

The Takeaway

There has been no indication from the company of a regulatory investigation. The company’s 10-K disclosure in the risk factors is pretty boiler plate when discussing regulatory investigations while the amendment in their Q1 10-Q risk factors only covers COVID-19.

The nature of its “account culling” press release is curious as well. It does not appear to be material to the companies results and the spin the company noted in its press release seems like a marginal explanation at best on further examination.

One potential reason could be that some issues were found with Netflix’s subscriber numbers. In some cases, a company will sometimes take steps to mitigate the effects of a disclosure issue in advance of a regulatory investigation or ruling. This can manifest itself in the form of fines, but there are many instances where companies take even more serious actions, instead of having them imposed.

It is not clear why the company is going through this culling of its accounts, but it does not make sense from a financial perspective as it would be giving way free revenue. It is also unlikely that the sole reason for this release was for good press, especially considering that people most affected by COVID-19 are likely to have cancelled their accounts already. The company’s focus has been on subscriber growth, justifiably from a business perspective. The pressure the market puts on its growth to drive its share price could have put pressure on its subscriber numbers. At this point, it is all circumstantial, but the timing and nature of the press release struck me as odd.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.