'Obvious' Shorts: The Highest Borrowing Fee Stocks In The U.S. Market Of May 2020

by Robbert MandersSummary

- High borrowing fees are a red flag for a stock.

- I compiled a list of stocks that have 50%+ fees to borrow (for shorting).

- Canadian cannabis and corona-related stocks again take a prominent place in this field.

- Some stocks in this edition have a surprisingly high market cap.

This article was highlighted for PRO subscribers, Seeking Alpha's service for professional investors. Find out how you can get the best content on Seeking Alpha here.

In February, I published an article about obvious shorts. This included the most expensive stocks to short in the US market with fees that exceed 50% annually. The logic behind looking at these stocks is well explained in my previous article which doesn’t require a Premium subscription to read.

This list was never intended as a source for shorts, but it can serve as a warning for potential investors. Also, investors who still want to own these stocks despite the obvious red flags are advised that they are probably best off by making their shares available for lending to increase their total return.

Now that we have seen some very tumultuous months, it is time to take a fresh look at the current expensive stocks to short.

Methodology & data

As for my methodology, I have taken the complete list of shortable stocks in the US from Interactive Brokers (IBKR) and sorted them from highest to lowest fees. In the next step, ADRs, funds, bankrupt companies, and preferred shares were filtered out. I also excluded stocks with a low share availability, also because those were most likely to be penny stocks with a low market cap. The remaining top of the list still contains many penny stocks and micro caps that have a market cap of less than $50m. The table below shows all stocks that fit the filter above and have a short fee in excess of 50%. Next to the fee rate column, I added a column showing the fee rate in February as a reference point.

Most of the stocks on the list are microcaps without serious operating activities and this is a good reason to ignore them. The high short fees can be easily explained by a combination of a low supply and the obvious upside if the stock finally reaches zero. The stocks that are going to be discussed in this article are shown in bold print.

| # | Ticker | Company name | Fee rate | Fee rate in Feb. | Market cap (USD mln) |

| 1 | CTIB | YUNHONG CTI LTD | 264% | 356% | 6 |

| 2 | RBZHF | REEBONZ HOLDING LTD | 237% | N/A | 1 |

| 3 | CPSH | CPS TECHNOLOGIES CORP | 190% | 75% | 19 |

| 4 | AWSM | COOL HOLDINGS INC | 181% | 197% | 3 |

| 5 | CAPR | CAPRICOR THERAPEUTICS INC | 163% | 53% | 77 |

| 6 | DTSS | DATASEA INC | 162% | N/A | 41 |

| 7 | MITT | AG MORTGAGE INVESTMENT TRUST | 149% | 0.3% | 93 |

| 8 | BKYI | BIO-KEY INTERNATIONAL INC | 147% | 2% | 15 |

| 9 | (VVNT) | VIVINT SMART HOME INC | 145% | N/A | 2030 |

| 10 | (CODX) | CO-DIAGNOSTICS INC | 144% | 135% | 509 |

| 11 | SAEX | SAEXPLORATION HOLDINGS INC | 144% | N/A | 7 |

| 12 | RVLT | REVOLUTION LIGHTING TECHNOLO | 141% | 143% | 1 |

| 13 | (SDC) | SMILEDIRECTCLUB INC | 137% | 38% | 825 |

| 14 | CREX | CREATIVE REALITIES INC | 136% | 8% | 25 |

| 15 | GNPX | GENPREX INC | 129% | 188% | 90 |

| 16 | TGIC | TRIAD GUARANTY INC | 124% | 125% | 1 |

| 17 | YAYO | YAYYO INC | 121% | 111% | 6 |

| 18 | WLL | WHITING PETROLEUM CORP | 120% | 0.5% | 84 |

| 19 | TTPH | TETRAPHASE PHARMACEUTICALS I | 119% | 3% | 19 |

| 20 | BBI | BRICKELL BIOTECH INC | 118% | 2% | n/a |

| 21 | APDN | APPLIED DNA SCIENCES INC | 117% | 93% | 52 |

| 22 | PEI | PENN REAL ESTATE INVEST TST | 116% | 7% | 95 |

| 23 | CRC | CALIFORNIA RESOURCES CORP | 112% | 10% | 71 |

| 24 | EFLVF | ELECTROVAYA INC | 112% | 120% | 23 |

| 25 | TGHI | TOUCHPOINT GROUP HOLDINGS | 111% | 116% | 2 |

| 26 | LLIT | LIANLUO SMART LTD-A | 110% | 121% | 12 |

| 27 | (BROG) | BROOGE ENERGY LTD | 107% | N/A | 1200 |

| 28 | (ACB) | AURORA CANNABIS INC | 106% | 103% | 1630 |

| 29 | PLAG | PLANET GREEN HOLDINGS CORP | 104% | 156% | 30 |

| 30 | DMPI | DELMAR PHARMACEUTICALS INC | 103% | 108% | 11 |

| 31 | BUDZ | WEED INC | 99% | 100% | 53 |

| 32 | YOGA | YOGAWORKS INC | 99% | 99% | 2 |

| 33 | DGLY | DIGITAL ALLY INC | 98% | 147% | 13 |

| 34 | ABILF | ABILITY INC | 97% | 93% | 2 |

| 35 | SIF | SIFCO INDUSTRIES | 96% | 1% | 24 |

| 36 | AIKI | AIKIDO PHARMA INC | 96% | N/A | 25 |

| 37 | GNC | GNC HOLDINGS INC-CL A | 96% | 1% | 47 |

| 38 | AIHS | SENMIAO TECHNOLOGY LTD | 96% | 84% | 11 |

| 39 | AKER | AKERS BIOSCIENCES INC | 96% | 66% | 20 |

| 40 | XELB | XCEL BRANDS INC | 95% | 5% | 17 |

| 41 | EDNT | EDISON NATION INC | 93% | 110% | 14 |

| 42 | SOLO | ELECTRAMECCANICA VEHICLES CO | 93% | 84% | 40 |

| 43 | TRNX | TARONIS TECHNOLOGIES INC | 93% | 98% | 14 |

| 44 | EYEG | EYEGATE PHARMACEUTICALS | 91% | 113% | 25 |

| 45 | JAGX | JAGUAR HEALTH INC | 91% | 100% | 8 |

| 46 | ASTC | ASTROTECH CORP | 90% | 44% | 21 |

| 47 | TMBR | TIMBER PHARMACEUTICALS INC | 90% | N/A | ? |

| 48 | DRIO | DARIOHEALTH CORP | 90% | 111% | 26 |

| 49 | OXBR | OXBRIDGE RE HOLDINGS LTD | 88% | 104% | 5 |

| 50 | SNCA | SENECA BIOPHARMA INC | 88% | 116% | 9 |

| 51 | MARA | MARATHON PATENT GROUP INC | 87% | 69% | 13 |

| 52 | CYCC | CYCLACEL PHARMACEUTICALS INC | 86% | 34% | 26 |

| 53 | NAKD | NAKED BRAND GROUP LTD | 85% | 12% | 5 |

| 54 | GLG | TD HOLDINGS INC | 84% | 87% | 46 |

| 55 | EMMA | EMMAUS LIFE SCIENCES INC | 83% | 88% | n/a |

| 56 | MTC | MMTEC INC | 83% | 90% | 22 |

| 57 | DOGZ | DOGNESS INTERNATIONAL CORP-A | 83% | 78% | 28 |

| 58 | INPX | INPIXON | 82% | N/A | 25 |

| 59 | SPI | SPI ENERGY CO LTD | 79% | 168% | 14 |

| 60 | FTFT | FUTURE FINTECH GROUP INC | 79% | 82% | 39 |

| 61 | KIRK | KIRKLAND'S INC | 78% | 3% | 14 |

| 62 | VUZI | VUZIX CORP | 78% | N/A | 112 |

| 63 | VIVE | VIVEVE MEDICAL INC | 78% | 80% | 10 |

| 64 | TEAR | TEARLAB CORP | 76% | 77% | 1 |

| 65 | SNES | SENESTECH INC | 76% | 0.3% | 5 |

| 66 | MYOS | MYOS RENS TECHNOLOGY INC | 76% | 63% | 11 |

| 67 | ANY | SPHERE 3D CORP | 75% | 78% | 11 |

| 68 | TRNF | TARONIS FUELS INC | 75% | N/A | 18 |

| 69 | CTRM | CASTOR MARITIME INC | 75% | 84% | 15 |

| 70 | OPGN | OPGEN INC | 74% | 71% | 31 |

| 71 | MYT | URBAN TEA INC | 74% | 90% | 12 |

| 72 | AEMD | AETHLON MEDICAL INC | 74% | 164% | 12 |

| 73 | ERDCF | ERDENE RESOURCE DEVELOPMENT | 73% | 78% | 31 |

| 74 | ALT | ALTIMMUNE INC | 73% | 25% | 106 |

| 75 | DPW | DPW HOLDINGS INC | 72% | 81% | 6 |

| 76 | (SPCE) | VIRGIN GALACTIC HOLDINGS INC | 72% | 12% | 3310 |

| 77 | MBRX | MOLECULIN BIOTECH INC | 71% | 14% | 65 |

| 78 | CLSK | CLEANSPARK INC | 70% | 2% | 21 |

| 79 | GRNF | GRN HOLDING CORPORATION | 70% | 100% | n/a |

| 80 | THMO | THERMOGENESIS HOLDINGS INC | 68% | 2% | 41 |

| 81 | FAMI | FARMMI INC | 67% | N/A | 6 |

| 82 | CBLI | CLEVELAND BIOLABS INC | 67% | 68% | 23 |

| 83 | (CAN) | CANAAN INC. | 67% | 14% | 599 |

| 84 | EYES | SECOND SIGHT MEDICAL PRODUCT | 67% | 9% | 22 |

| 85 | IFMK | IFRESH INC | 66% | 58% | 22 |

| 86 | CHKR | CHESAPEAKE GRANITE WASH TRUS | 66% | 70% | 19 |

| 87 | BEBE | BEBE STORES INC | 65% | 72% | 45 |

| 88 | TENX | TENAX THERAPEUTICS INC | 65% | 68% | 11 |

| 89 | BGI | BIRKS GROUP INC | 64% | 109% | 10 |

| 90 | YTEN | YIELD10 BIOSCIENCE INC | 64% | 16% | 11 |

| 91 | UAVS | AGEAGLE AERIAL SYSTEMS INC | 64% | 64% | n/a |

| 92 | BLPH | BELLEROPHON THERAPEUTICS INC | 62% | 14% | 137 |

| 93 | SGLB | SIGMA LABS INC | 62% | 60% | 8 |

| 94 | MGAFF | MEGA URANIUM LTD | 61% | 61% | 25 |

| 95 | (APHA) | APHRIA INC | 61% | 49% | 1130 |

| 96 | MARK | REMARK HOLDINGS INC | 60% | 3% | 111 |

| 97 | MDRPF | MIDAS GOLD CORP | 59% | 72% | 124 |

| 98 | COCP | COCRYSTAL PHARMA INC | 58% | 3% | 50 |

| 99 | LLEX | LILIS ENERGY INC | 58% | 119% | 17 |

| 100 | PTOTF | PATRIOT ONE TECHNOLOGIES INC | 57% | 39% | 88 |

| 101 | PME | PINGTAN MARINE ENTERPRISE LT | 56% | 58% | 90 |

| 102 | KBSF | KBS FASHION GROUP LTD | 56% | 57% | 4 |

| 103 | (AXU) | ALEXCO RESOURCE CORP | 56% | 10% | 273 |

| 104 | USAU | US GOLD CORP | 56% | 62% | 15 |

| 105 | DARE | DARE BIOSCIENCE INC | 56% | 87% | 28 |

| 106 | SNDL | SUNDIAL GROWERS INC | 56% | 43% | 91 |

| 107 | ETHOF | ETHOS GOLD CORP | 56% | 61% | 6 |

| 108 | MYO | MYOMO INC | 56% | N/A | 11 |

| 109 | NEWA | NEWATER TECHNOLOGY INC | 55% | 57% | 28 |

| 110 | (GMDA) | GAMIDA CELL LTD | 55% | 10% | 251 |

| 111 | PHIO | PHIO PHARMACEUTICALS CORP | 55% | N/A | 11 |

| 112 | PULM | PULMATRIX INC | 55% | 58% | 48 |

| 113 | WRTC | WRAP TECHNOLOGIES INC | 54% | N/A | 139 |

| 114 | IBIO | IBIO INC | 53% | 52% | 179 |

| 115 | OBLN | OBALON THERAPEUTICS INC | 53% | N/A | 6 |

| 116 | CDTI | CDTI ADVANCED MATERIALS INC | 52% | 50% | 0 |

| 117 | ONCY | ONCOLYTICS BIOTECH INC | 52% | 55% | 101 |

| 118 | TNXP | TONIX PHARMACEUTICALS HOLDIN | 52% | N/A | 36 |

| 119 | MYSZ | MY SIZE INC | 52% | 110% | 7 |

| 120 | (BSGM) | BIOSIG TECHNOLOGIES INC | 52% | 9% | 285 |

| 121 | CYDY | CYTODYN INC | 52% | 76% | 1580 |

| 122 | ADOM | ADOMANI INC | 52% | 1% | 7 |

| 123 | SXTC | CHINA SXT PHARMACEUTICALS IN | 52% | 250% | 12 |

| 124 | (MNK) | MALLINCKRODT PLC | 51% | 8% | 285 |

| 125 | SONM | SONIM TECHNOLOGIES INC | 51% | 1% | 21 |

| 126 | FGPR | FERRELLGAS PARTNERS-LP | 51% | 60% | 57 |

| 127 | TLGT | TELIGENT INC | 51% | 30% | 22 |

| 128 | (NEPT) | NEPTUNE WELLNESS SOLUTIONS | 51% | 21% | 289 |

| 129 | EARS | AURIS MEDICAL HOLDING LTD | 51% | 51% | 5 |

| 130 | RCON | RECON TECHNOLOGY LTD | 50% | 63% | 10 |

| 131 | BOXL | BOXLIGHT CORP - CLASS A | 50% | 60% | 15 |

| 132 | MITO | STEALTH BIOTHERAPEUTICS CORP | 50% | 99% | 109 |

| 133 | (HEXO) | HEXO CORP | 50% | 51% | 319 |

Fee rate source: Interactive Brokers May 25, 2020. Market cap values in the table are rounded to the nearest million. Stocks that have a market cap of less than $500k are listed as zero.

A difference compared to my previous article is the list has grown and that there are more companies with a market cap above $100m. In February there were 80 names, including ten with a market cap of at least $100m versus 133 and 24, respectively for May. Due to that sharp increase, I’m focusing on stocks with a market cap above USD 250 million this time, which still leaves 15 tickers to explore. Like 3 months ago, some stocks can be grouped together quite easily, like the coronavirus stocks for example.

Coronavirus stocks

Let’s start with a look in the rear-view mirror. Last time, I mentioned Novavax (NVAX), a struggling micro cap that saw its market cap double in a matter of weeks, settling at $164m before publication of my article. At the time, the company communicated that it was working on a vaccine and I was quite skeptical of this struggling company to be the first one to produce a working vaccine. Apparently, the market sees more potential in the company and now values it at $2.37bn. Aside from sentiment, two elements help: one is the announcement of a clinical trial, the other one is that the company used its new valuation to issue shares for $250m in cash, increasing its tangible book value per share and cash to spend on R&D.

Some of Novavax’ shorts have clearly thrown in the towel as its short fee rate has gone down to single digits in late May from ~70% in early February. This also serves as a lesson about what can go wrong when shorting a hot microcap. Even if your thesis is correct and the stock is fundamentally worth nothing because it will never produce a working vaccine, you can be easily wiped out before that time if bullish sentiment persists like in this case. A loss of 870% on one position (equal to NVAX’ price increase from $7 February valuation to $61 May peak) is enough to trigger a margin call in most brokerage accounts if the position was of any significance to the portfolio.

While Novavax has burned short-sellers, they have moved on to new coronavirus-related stocks to short. One of which is Co-Diagnostics, a company that developed a diagnostic test for the coronavirus. There is one contributor on Seeking Alpha who sees evidence that its test is not working. This is perhaps also the reason why it is a relatively crowded short at a fee rate of 144%. A fun fact is that the fee was almost as high in February, but that its market cap has gone up almost 6-fold since that time. Time will tell who will make money.

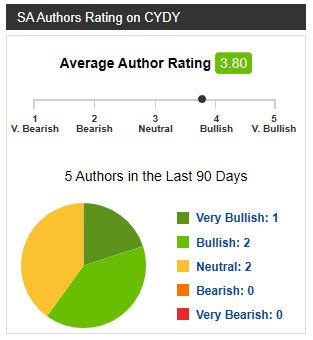

A less obscure COVID-19-related pharma small cap is CytoDyn, a company that owns leronlimab (after trying to pronounce it several times, it still sounds funny). This medicine that is approved by the FDA as an emergency investigational new drug “eIND” to treat COVID-19. The company enjoys coverage from 5 authors on Seeking Alpha and none of them are bearish.

Source: Seeking Alpha.

This seems like a very speculative stock with potential, so why is it targeted by shorts? First of all, its main product was a HIV medicine in development, and it seems like a long-shot as for effectiveness for COVID-19. Second, balance sheet equity is nothing while CYDY’s market cap is $1.6bn. Third, the company raised around $200m by issuing shares from 2015 to 2019, spent every last penny of that cash, all while achieving zero sales since its foundation in 2002. According to Seeking Alpha data, the company has 10 employees and assets of $38.8m. A bad omen is that few institutional investors own the shares, so I’m curious where this will go, but I think that buying this stock is not a very smart decision given the signals that shorts give us.

Last among the coronavirus stocks, BioSig Technologies, has also profited greatly from the market trend over the past weeks, quadrupling its stock price. It also owns a drug that it has repurposed for the coronavirus. Apart from that, there are more similarities with CYDY, except that BioSig doesn’t have recent bulls on Seeking Alpha.

Cannabis stocks

Canadian pot stocks are retail investor favorites and usual suspects when it comes to expensive shorts. These retail darlings have been overhyped for some time and the bubble is deflating bit by bit. The king of overvaluation in this space is Aurora Cannabis, about which I wrote in the past and have nothing to add to, except that its fundamentals have not improved in my opinion. Other producers include Aphria, which I also wrote about before and HEXO. Both of them are in a slightly better shape than Aurora, given that there is a less severe immediate cash crunch, but Aphria is able to repurchase its debt at a sizeable discount. HEXO also attracted more bears on Seeking Alpha.

All three cannabis producers are particularly popular with retail investors. Evidence of this is the number of Robinhood accounts that hold ACB, HEXO and APHA. As I write this, ACB is held by 484 thousand accounts making it #6 on Robinhood, HEXO is at place 26, and APHA is number 37. This is quite special as there number of stocks tracked is over 8000 and other top names in the list include well-known blue chips such as Ford (F), Disney (DIS) and Microsoft (MSFT).

A last cannabis related stock is Neptune Wellness Solutions. The company claims to be among Canada’s largest cannabis processors, and extracts different substances from cannabis. Products include industrial hemp, cannabis oils, and food ingredients made from cannabis. Because NEPT is not a producer (grower), but primarily a processor, I wouldn’t necessarily group it together with ACB and the likes, but it is possible that the company is also a bit overhyped. Though the stock lost about 30% of its value versus a year ago, it trades at triple its 52-week low.

The midcaps

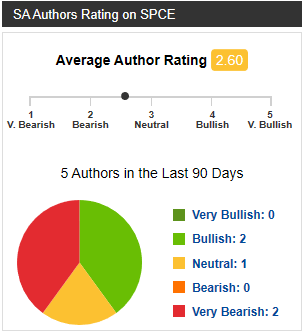

There also a few midcaps ($2bn+ market cap) that attracted the attention of short sellers. At a market cap of $3.3bn, Virgin Galactic is the most valuable company among the 50%+ fee group. The company intends to develop commercial spaceflight primarily for individuals who want to visit space. Like other Virgin-branded companies, it was founded by Richard Branson. It appears as if the stock reflects potential, as its 2019 revenue was just $3.8m, a fraction of its $231m operating loss. Authors on Seeking Alpha seem to be split about the company.

Source: Seeking Alpha.

It’s clear that SPCE is a theme or concept stock and that its value can’t be captured by just looking at revenue or profits. However, it seems like short sellers have made up their mind and are prepared to pay up to 72% in annualized fees to borrow shares to short the stock.

Vivint Smart Home has a $2bn market cap and is also the most expensive stock to short among the $250m+ group. Vivint is somewhat of an oddity on this list as it is an established company that sells home security devices and also has a decent Wikipedia page. The company has business relationships with many established companies and had a Softbank SPAC taking it to the market 5 months ago, both increasing and reducing the obscurity one would presume because of the aggressive shorts it attracts.

There are several problems with the company, however. One is that, though it generates solid revenue (growth), it has not turned an operating profit over the past 4 years. Another issue is that its equity is negative by $1.5bn on a balance sheet with $2.7bn of assets. There is also an interesting arbitrage play involving the company’s warrants, pointed out by different authors on SA, which probably caused a large part of the high short interest.

Other stocks

There are also several other stocks in the top shorts table that don’t let themselves be grouped that easily. Overall it is a diverse bunch that still shares a couple of characteristics such as poor profitability.

SmileDirectClub has a market cap of $825m and saw its short fees soar from 38% in February to 137% nowadays. The company operates a teledentistry platform that provides aligners for customers’ teeth. It is supposed to be a cheaper alternative to braces. However, NBC has written a rather negative report about the services that the company provides. And, like many other stocks on this list, the company is unprofitable. This is a classic case of ‘highly speculative’ at best.

Brooge Energy is another special purpose acquisition vehicle. It appears to own a stake in a midstream oil storage player in the United Arab Emirates called Brooge Petroleum. Finding information about this company is less easy than it should be and its investor website can be found here. In a presentation filed with the SEC, the company says it targets a dividend of $1 per share. To me, it seems like oil storage is not a poorly timed investment at this moment because oil is in contango, making storage of oil profitable. In my best guess, the concerns of investors must be of the non-operating kind.

A business that I would fully expect to appear in this peergroup is Canaan. This company sells equipment to mine bitcoin. Unfortunately, bitcoin mining has become less profitable because the number of BTC earned for mining has been halved. There is a recent article about the CAN that nicely explains the short-thesis, including why its product is inferior to those of its competitors.

Alexo Resource Corp is a precious mineral exploration and mining company that is active in the Yukon Territory in Canada. The company primarily mines silver. As we could expect from the company being an expensive one to short, it is loss-making, has been for a couple of years and its market cap exceeds its assets by at least a factor of 2. It appears as if the company is developing a new mine and that this risky operation is the reason for bulls to be hopeful. For some, it could also be a macro play on silver as the company says it has ‘a high beta’ to silver. Any investors who believe in the company becoming profitable are best off by also taking some additional yield from lending the shares in my opinion. The shorts have grown more skeptical over the past year while its short fees went from 10% to 55% and its market cap doubled.

The last two names on the list are pharma companies. Gamida Cell generates no revenue but is developing a medicine and is therefore highly speculative. My best guess is that shorts were attracted to this stock because they did their due diligence on the drug under development and found that it has poor commercial prospects.

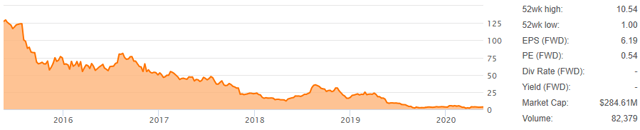

Mallinckrodt is similar to GMDA to the extent that it is pharma, but it does generate revenue and income. The company has a different problem than GMDA, which is its high debt load. Its junk bonds issued in March already trades at ~80 cents on the dollar according to a recent SA news article. The company has a net debt of $4.6bn, and considering the market cap of $285m, it looks like the market is pessimistic about the prospects of the company being able to avoid restructuring or bankruptcy.

On the bright side, the company has had a positive operating income in each of the past 10 years. The problem remains that the debt load is 18 times 2019 operating profit and I also don’t see a straight forward way for MNK to get out of this. The company has significant negative momentum; 5 years ago, the stock traded close to $130 per share and it has since been on a gradual slide to $3.

Source: Seeking Alpha.

Conclusion

By far, most of the companies I came across in this high fee group are very small but there are several surprisingly large companies of which the stocks face borrowing fees of 50% or more. Still, for most stocks on the list, the short thesis seems quite strong. Yet, I am not sure if it will be profitable to short these stocks after factoring in borrowing fees. But neither am I convinced that harvesting the lending yield will make up for the expected losses on these stocks. A lot depends on timing as the market can stay irrational longer than you can stay solvent. Short squeezes like the one we saw at Novavax are always a distinct probability.

However, it is telling for most of these stocks that institutional investors have come to a consensus that the downside makes the extremely high borrowing fees palatable. For that reason I would like to tell retail investors to be extremely cautious when dealing in these stocks and preferably stay away from them.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.