Applied Materials Could Be The First U.S. Victim China Sanctions

by Robert CastellanoSummary

- Applied Materials' acquisition of Hitachi Kokusai Electric is being held up awaiting regulatory approval from China.

- Hitachi Kokusai holds a strong position in tube/non-tube LPCVD and oxidation/diffusion semiconductor equipment.

- The latest sanctions by the U.S. Commerce Dept. should delay if not permanently block China's approval of the acquisition.

Applied Materials (AMAT) in mid-2019 announced that it had agreed to acquire Japanese semiconductor equipment maker Hitachi Kokusai Electric from an investment firm, namely KKR & Co Inc. for $2.2 billion. It requires regulatory approval in China, Ireland, Israel, Japan, and Korea but not in the U.S.

To date, Ireland, Israel, Japan, and Korea have given regulatory approval, but not China. That's despite AMAT's CFO Durn how stated during company's 4Q earnings call of February 12, 2020:

“we expect to close the Kokusai transaction in the middle of this year…during the quarter, we received regulatory approvals from Japan and Korea.”

The middle of this year is one month away. The February 12 comment by Durn was before an escalation of tension between the U.S. and China. Subsequently, the United States government slapped sanctions on 33 Chinese companies and institutions, putting them on two so-called entity lists as it dials up the hostility during the lowest point in US-China relations in decades.

The latest sanctions add to the litany of grievances between the two largest economies on earth, as the jostling from almost two years of the US-China trade war extended into disputes in technology and cybersecurity, access to Wall Street’s capital market and even to the origin of the current coronavirus pandemic.

Why is AMAT interested in Kokusai?

On December 09, 2017 global investment firm KKR and Hitachi Kokusai Electric Inc. announced the completion of a tender offer for the common shares of Hitachi Kokusai (excluding the 51.67% of its shares that are owned by Hitachi, Ltd).

Kokusai Electric, originally a subsidiary of Hitachi, sells LPCVD equipment and oxidation/diffusion, and epitaxy systems. KKR acquired the semiconductor equipment business of Hitachi Kokusai Electric from Hitachi.

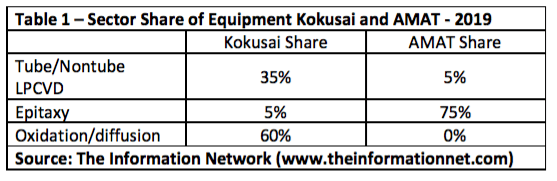

Table 1 shows the sector share of the three product lines from Kokusai, compared with that of Applied Materials. The focal point of AMAT’s interest is Kokusai’s 35% share of the $3.5 billion tube/non-tube LPCVD market, compared to just 5% for AMAT. Kokusai led the tube LPCVD sector as it did the $400 million oxidation/diffusion sector in 2019, according to The Information Network's report entitled "Global Semiconductor Equipment: Markets, Market Share, Market Forecasts."

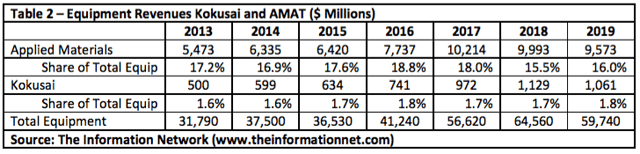

Another essential reason for the acquisition that AMAT's organic growth (without any acquisitions) has been relatively flat between 2013 and 2019, as its percentage of total semiconductor equipment reached its peak back in 2016 at 18.8%, as shown in Table 2. Also note that AMAT's revenues for for 2018 have been adjusted to reduce $331 million in revenues the company deducted and added to 2019, which I discussed in several of my articles, which they say is due to new accounting practices, calling it "reprofiling." AMAT has never officially reported in SEC documents this reprofiling. Otherwise, 2019 revenues and share of the overall market would have been higher in 2018 and lower in 2019 pointing to an erosion in overall market share for the past three years.

Hitachi Hokusai's revenue share has been consistent between 1.6% and 1.8% between 2013 and 2019.

Investor Takeaway

AMAT still needs to get regulatory approval from the China before the acquisition of Kokusai can be completed. The acquisition was expected to be completed in mid-2020 according to AMAT’s CFO Durn. Eleven months has passed since the announcement of the acquisition, yet China has not yet agreed to regulatory approval.

The latest sanctions add to the litany of grievances between the two countries, which followed almost two years of the US-China trade war that morphed into a technology and cybersecurity war. A political game of one-upmanship and retaliation could be the death knoll for Applied Materials acquisition of Hitachi Kokusai Electric.

It would also be detrimental to AMAT's growth in 2020. I already discussed in a May 15, 2020 Seeking Alpha article entitled "ASML And Applied Materials: Worst Growth Among WFE Peers In Q1" that Applied Materials' semiconductor revenues decreased 8.8% in Q2 FY2020, its most recently ended quarter, which follows the company losing the #1 position in semiconductor equipment to ASML (ASML) in 2019.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.