AMD: 100X P/E Ratio Is Not Supported By 2020 Revenue Projections

by Bill ZettlerSummary

- No stock can maintain a 100x PE ratio without booming revenue.

- A recession/depression will depress overall demand.

- Competitor Intel is projecting a weak quarter 2.

- Competitive ARM processors are being used by Amazon and Microsoft.

AMD (AMD) is a great company that I have done well with in the past. In fact, it was the most profitable stock investment I have ever made. It is also the stock I have written the most about with 35 published articles on Seeking Alpha.

In 2018 I recommended that AMD's CEO Lisa Su be named Executive of the Year for the outstanding job she did in turning AMD around.

And I predicted, correctly it turned out, that the huge short position in 2018 was doomed to failure in my last AMD article "AMD: 5 Reasons The Shorts Will Be Changing Their Shorts Shortly".

I still like AMD as a company and I think it has great products and great management. What I don't like is the market multiple given to it by buyers. It is almost the exact opposite of my last article when I felt the market was underrating the stock's potential. Now they are overrating it.

Here are 4 reasons I think AMD's P/E (price to earnings) ratio is much too high.

1. No stock can maintain a 100x P/E ratio without booming revenue.

AMD's price is about $50 and its trailing 12-month earnings is $.43. That comes out to be a big-boy P/E ratio of 116.

But looking at the current Q1 numbers and projected Q2 numbers make one wonder what the market is thinking.

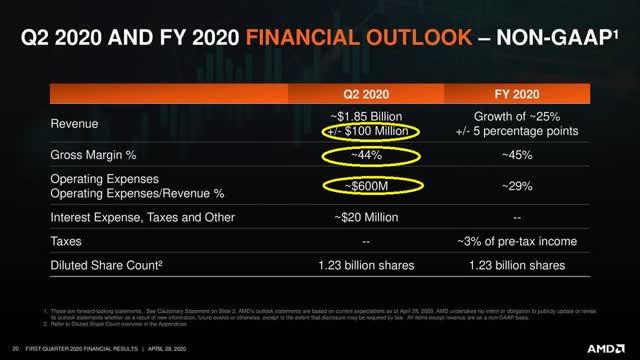

If you look closely at the slide of 2020 Q2 revenue you will see this.

Revenue may actually fall in Q2 from Q1 and best case it will be up about 8%.

That's because of the little item beneath the Revenue estimate (+/- $100 million). If its the minus $100 million then Q2 revenue will be $1.75 billion less than Q1 $1.79 billion. That's not what 116 P/E companies do quarter over quarter.

Then note Gross margin will drop from 46% in Q1 to 44% in Q2. Not good.

But that's not all because Operating Expenses are estimated at $600 million in Q2 up from $584 million in Q1.

None of these items by themselves or even together means AMD is not a good company with potential. But it is a stretch, in my opinion, to slap a 116 P/E on such results.

2. Who's going to buy all the new Graphic cards and CPU's?

Not the laid-off, formally well-paid oilfield workers. Not the laid-off, formally well-paid airline workers. Not the laid-off, formally less well-paid restaurant workers. And the auto workers. And the fisherman. And the farmers.

In fact, I would think few of the 20% unemployed (on its way to 25%) will be willing to stretch their newly limited budgets to buy a new graphics card let alone a new PC. When you are out of work 8-cores and a 5MH processor versus 4 cores and a 3MH processor doesn't matter much anymore.

The old one works pretty well when you think about it.

And big corporate accounts are thinking twice too. Here's from Instinet:

1. In a semiannual Instinet survey of 50 CIOs, 46% expect a coronavirus-related decline in IT spending this year.

2. The majority of CIOs expected PC cuts, while slightly less than half see declines in AI and servers.

3. Intel (NASDAQ:INTC) and AMD (NASDAQ:AMD) could take hits in the decreased PC spending.

Source: Seeking Alpha

3. And how is competitor Intel thinking about quarter 2?

Intel (INTC) is, of course, the Big Kahuna in the CPU market and it looks like they may be hunkering down too expecting a tough year comparison wise.

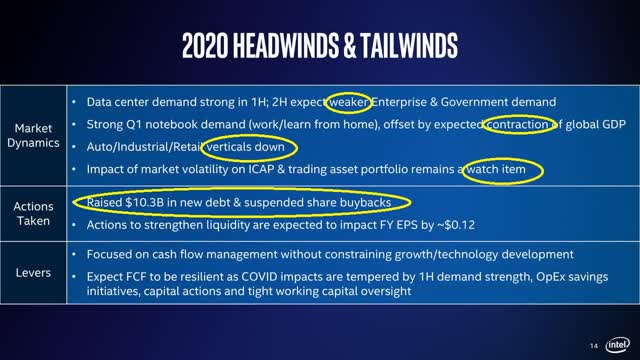

We see that Intel is also looking a little weak in their Q1 to Q2 comparisons.

Revenue down: Q1 $19.2 billion to Q2 $18.5 billion.

Operating margin down: Q1 38% to Q2 30%

Earnings down Q1 $1.45 to Q2 $1.10.

That's down, down and down.

And in Intel's summary (below), you see such words as "weaker", "contraction", "down", "watch".

Also, Intel raised $10.3 billion in cash and suspended share buybacks. That is not a sign that Intel is expecting a robust market for the rest of this year or longer.

And by the way, Intel is selling at a P/E of about 11.

4. The ARM-y is coming.

With the short and medium-term problems AMD is facing there is also on the horizon a longer-term issue. That is the ascent of ARM processors both in the server market and the PC/laptop market.

Amazon (AMZN) is using ARM processors in their servers because they are cheaper and run cooler.

" AWS Graviton processors are custom-built by Amazon Web Services using 64-bit Arm Neoverse cores to deliver the best price performance for your cloud workloads running in Amazon EC2. "

Source: Amazon

And Apple (NASDAQ:AAPL) uses ARM processors in their phones and iPads and next year they will be using them in MacBooks as outlined here "Apple to launch multiple Macs with ARM processors next year".

And Microsoft runs Windows 10 on ARM and has shown a new Surface Pro X running an ARM processor (see here).

When the three largest and arguably most successful tech companies in history begin a new trend watch for others to follow soon thereafter.

Conclusion.

A good company that is overvalued is not a good investment. Right now AMD, at a P/E of 116, is vastly overpriced based upon short, medium and longterm issues.

And it is not just me that is saying that, it's the management of both AMD and Intel too. Sometimes you should listen to management. This is one of those times.

I will not buy AMD here but if you feel it is necessary to invest in AMD then buy Puts. May I suggest Jan 2021 LEAPS for the brave of heart.

Risks, alarm bells and red flags

Extraordinary caution is required for all investments including this one.

And remember, there is nothing wrong with being in cash at this point in time until the market shows less volatility and more firm direction. Cash is a viable alternative.

In addition, there could be a recession coming or even a depression according to several economists.

“Economic data in the near future will be not just bad, but unrecognizable,” Credit Suisse economists led by James Sweeney wrote last week. “Anomalies will be ubiquitous and old statistical relationships within economic data or between market and macro data might not always hold... There is no blueprint for the current shock, and uncertainty about the extent of contagion and the economic consequences is overwhelming.”

Caution is the investment word of the day.

If you found this article to be of value, please scroll up and click the "Follow" button next to my name.

Note: members of my "Turnaround Stock Advisory" service receive my articles prior to publication, plus real-time updates.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.