Tesla: China Trade War Risk

by Bill MaurerSummary

- President Trump will use "China virus" in his re-election campaign.

- Chinese government and consumers may push back on US companies.

- Stronger US Dollar will impact China based revenues.

Perhaps the biggest part of the bull case for electric vehicle maker Tesla (TSLA) this year is the ramp of the Shanghai gigafactory. With production in high gear currently, current expectations are for the new facility to produce well over 100,000 Model 3 units this year. One of the biggest risks here, however, may be the re-escalation of the US/China trade war during this key election year. Today, I'll discuss why this is something to watch for in the coming months, and what the short term impact is on Tesla.

(Shanghai gigafactory. Source: electrek article, seen here)

The United States is about to pass 100,000 deaths from the coronavirus. President Trump continues to blame China for this, calling it the "China Virus" in a number of speaking engagements. It is not too far fetched to think he will continue to use this rhetoric during his re-election campaign as a way to shift blame any potential blame away from his administration. However, I am not here today to turn this into a heated political argument.

In recent days, there has been a lot of discussion regarding raised tensions between the two nations. Some have gone as far as saying this could be the new Cold War. The US has been involved in a major crackdown against China's Huawei Technologies, and recent China aggression in Hong Kong has not helped the overall situation. In fact, there was a report recently that large US companies, perhaps major technology names like Apple (AAPL), could even be retaliated against if things get bad enough.

In the past year and a half, Apple itself has had to issue two revenue warnings because of issues in or around China. The first was the original US/China trade war, which caused a lot of Chinese consumers to push back on purchases of Apple devices. The second was the coronavirus forcing Apple to again lose sales in China, but also see some of its production facilities close for a time. Tesla's Shanghai gigafactory was also closed for a time due to the virus.

Should there be a major push back from Chinese consumers against US names, Tesla could be easily hit. Even though Tesla is now producing Model 3 units in the country, consumers might choose to favor local brands with new vehicles like the BYD Han or Xpeng P7. There are plenty of new Chinese EVs being launched this year, and many are lower priced vehicles that also are eligible for local subsidies. Tesla recently lowered the price of its cheapest Model 3 variant in China to get under the subsidy threshold, but after the grace period ends, more expensive variants and the future Model Y are not likely to be eligible.

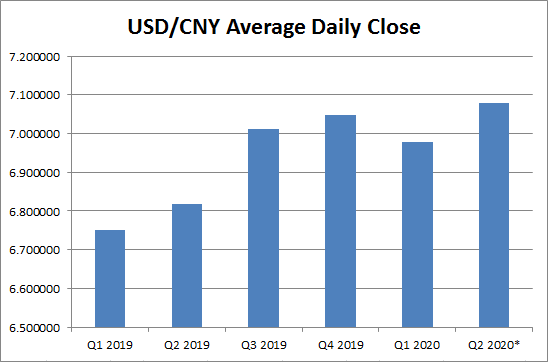

The other issue involved with a trade war between these nations is the impact is has on currencies. Generally speaking, rising tensions between these two superpowers has resulted in a stronger US Dollar. After the greenback declined to a 2020 low under 6.84 Yuan in the second half of January, we've seen a nice rally to more than 7.13 Yuan recently. As a result, the average daily close of the currency pair could approach or even top 7.10 Yuan in Q2, its highest level since Model 3 sales began in China last year (first vehicles were imported from the US until the Shanghai factory hit production mode in Q4 2019).

(*Quarter to date as of May 25th. Data sourced from Yahoo! Finance)

Now Tesla bulls might say what's a percent or two here and there. Normally, I would agree, but you also have to consider the price cut that went into effect recently. For instance, the Shanghai built Standard Range Model 3 was previously priced at a pre-subsidy base price of 323,800 Yuan. At the Q1 average daily close exchange rate, that would turn into about $46,400 when converted to US dollars for revenue purposes. At the new lowered base price of 291,800 Yuan and an exchange rate of 7.10, that equals about $41,100. Tesla will recoup some of that from lower costs when translated to dollars, but that's a sizable revenue hit to overcome. Every little bit matters when Tesla is trying to produce a quarterly profit to become eligible for the S&P 500 index.

Some may wonder about the Chinese government's role in all of this. So far, Tesla has gotten very preferential treatment, which may give that country's leaders a bit of leverage moving forward. I don't think that China will take over the Shanghai factory or make some drastic move in the short run if trade tensions ramp up. However, pain could still be felt financially if local leaders do things like charge Tesla a higher interest rate on future loans or even remove Tesla's vehicles from being eligible for EV subsidies.

In the end, investors will have to be careful with Tesla throughout this year if trade tensions between the US and China grow during this election cycle. President Trump seems willing to blame the Asian nation for the coronavirus as part of his campaign, which could result in some retaliation against US firms from the Chinese government or consumer. A renewed trade war also would seem to benefit the US dollar against the Yuan, pressuring Tesla's revenues when translated for quarterly results. While this issue isn't going to tank Tesla shares overnight, it's one potential risk that could become a major problem rather quickly.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.