Venus Concept Inc.: A COVID-19 Casualty That Makes A Case For Recovery

by Edmund InghamSummary

- Venus Concept develops, commercializes, and delivers minimally invasive and non-invasive medical aesthetic and hair restoration technologies and related aesthetic surgery practice enhancement services.

- The company was formed via a merger between Nasdaq-listed hair transplant specialist Restoration Robotics and privately held Venus Concept Ltd. in November 2019. The new entity is headquartered in Toronto.

- Post-merger the company raised $28m via a private placement of shares to numerous healthcare venture capital backers. In March, Venus raised a further $22.25m via the same method.

- The company has developed an innovative subscription payment model which accounted for 66% of all revenues earned in Q120. Venus earns the majority of its revenues by leasing or selling its systems.

- Venus' Q120 results were disappointing with revenues down 41% year-on-year to $24m. EPS of -$1.68 missed by $0.97. Venus ascribes the poor performance to COVID-19 lockdown restrictions. The company ought to bounce back as headwinds ease.

Investment Thesis

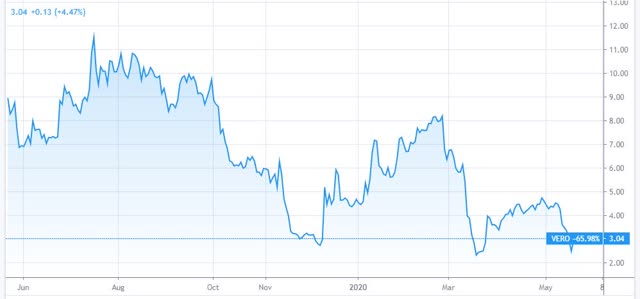

Venus Concept (NASDAQ:VERO) 1-year share price performance. Source: TradingView.

The November 2019 merger between Restoration Robotics - a Nasdaq listed hair transplantation company with a proprietary physician assisted robotics system, ARTAS, that increases the speed and accuracy of hair transplantation surgery - and Venus Concept - a subscription-based provider of non-invasive aesthetic surgery systems to health and beauty practitioners - seemed to get off to a good start.

Although analysis of the share price is complicated by the fact that the two firms performed a reverse merger - with Venus (the much larger company) shareholders each receiving 8.7 shares of Restoration in exchange for each share of Venus held, followed by a 1-for-15 reverse stock split of Venus' common stock, followed by a $28m equity fundraising - the newly formed entity's stock rose from a price of $3 in November 2019, to >$8 by mid-Feb '20.

Subsequently, however, Venus stock has declined to a price of just $3.04 at the time of writing this update, largely due to a poor set of Q120 financials which the company has - with some justification - blamed on the COVID-19 pandemic. Domenic Serafino, Venus Concept's CEO, commented on the results in a press release:

"Approximately 30% of our 2019 sales came from the APAC and European regions which were impacted by the pandemic throughout the first quarter. We also saw a pronounced decline in system sales, product sales and service revenues in North America and Latin America beginning in March 2020, primarily as a result of mandated government lockdowns or 'shelter-in-place' requirements in these regions. We expect COVID-19 will continue to significantly negatively affect customer demand in the second quarter of fiscal 2020 and into the second half of the year."

The company made a Q120 operating loss of $46.3m (compared to a loss of $1.9m in Q119) which included a $27.5m goodwill impairment charge related to the adverse market conditions created by COVID-19 and the global lockdown measures. Total revenues decreased by 41% year-on-year to $10.1m, whilst operating expenses increased by $32.9m, or 165%, to $52.9m - mainly due to the impairment charge.

Alongside these results, which appear to be somewhat catastrophic on the surface, the company announced that it was withdrawing its 2020 guidance - issued on January 13th - which anticipated top line growth of 9% - 13% - which translated to full year revenues in the range of $134 - $140m - and expects to provide revised guidance in August during its second quarter earnings call.

Venus' share price has fallen 63% since the results were announced, but the company's CEO sounded a more positive note in his concluding comments during the Q120 earnings call:

We continue to believe the long-term opportunity for Venus Concept remains extremely compelling for us as a leading player in both the global minimally invasive and noninvasive medical aesthetic market and the minimally invasive surgical hair restoration market.

The investment opportunity here is based on several factors.

Firstly, given that the coronavirus pandemic did not truly begin to take hold in many of Venus' core markets e.g. the US, Europe, South America and Japan, it might be expected that Venus' Q220 will be even worse than Q120, but this may not prove to be the case. As a supplier of non-invasive surgical machinery, I suspect that Venus will have taken its largest hit in Q1, with its client-base cancelling orders in anticipation of lockdown. Management has indicated that sales have already begun to pick up, as clients begin to plan for the end of the lockdown period.

Secondly, management has begun to implement a new restructuring program and expects to realize savings of ~$20m in full-year 2020, with the trend continuing into 2021. Coupled with the previously announced ~$18m of synergies and cost cuts relating to the merger, Venus hopes to achieve close to $40m of cost savings overall.

And thirdly, although it has a stringent loan arrangement in place with Madryn Health Partners, Venus remains well-funded, with $20.6m of cash and near-term assets of $100m at the end of Q120, having completed a second equity fundraising in March, raising $22.25m via a private placement to a group of investors that included Saudi asset management firm SEDCO Capital, plus New York based healthcare investment fund EW Healthcare Partners and California based VC HealthQuest - with the latter two having been involved in the previous, $28m post-merger fundraise.

As such, I believe Venus can surprise the market by delivering a more-positive-than-expected set of Q2 results. Since its merger, Venus has been badly buffeted by events completely outside of its control, and has not had an opportunity to test out its newly-integrated business model. The pandemic setback has hit the share price and although the short-to-medium term period will require careful negotiating, if the "new-normal" proves to be a fair-weather period for the company, I believe the stock, at current price, will start to look heavily discounted.

In the rest of this article I will examine the company's business model in more detail, look at some of the upcoming tailwinds and headwinds, and provide some forecasting and fair value price analysis. To my mind, there is a reasonable argument for acquiring some Venus' stock at this time. A return to the pre-pandemic share price high of $8, for example, would represent a gain of 171%.

Company overview: innovative subscription model addresses a growing market

Venus Concept has developed and commercialized twelve technologies relating to a range of non-invasive aesthetic applications. These include Venus Legacy, designed for dermatological and general surgical procedures including moderate to severe facial wrinkles, Venus Versa, designed for treatment of lesions and hair removal, Venus Freeze (wrinkle treatment), Venus Velocity (hair removal), Venus Bliss (lipolysis), and of course, ARTAS and ARTAS iX, for the harvesting and implantation of hair, and another acquisition, NeoGraft, for cutting of hard tissue or bone.

Nearly all of these products are FDA approved and based around proprietary technologies which leverage techniques such as multi-polar magnetic pulsed technology ("MP"). I am by no means an expert on aesthetic surgery, but to all intents and purposes it does seem that Venus has a core suite of products, ameliorated by the inclusion of Restoration Robotics' ARTAS technologies, that is more than adequate to support the company's desired business model.

This is also borne out by the fact that, in FY19, the company earned revenues of $24m and only narrowly missed on delivering an annual profit, posting an overall loss of just $1.8m.

Venus Concept sells its products to a broad network of clients across 29 international markets, utilizing its 245-strong direct sales and marketing force, and has office branches in 24 countries including the US, Canada, Mexico, United Kingdom, Germany, France, Singapore and Israel.

In 2018 and 2019, Venus generated 51% and 55% of its revenues on a subscription basis. The company's products are not cheap - Venus says that a typical device may require a financial commitment of up to $190,000 - and given that the devices are often replaced by new and improved models every 24 months, the subscription model suits both Venus and its clients.

Clients pay a smaller up-front fee and typically sign-up to a 36-month installment period, with 40% of the total contract payment collected within the first year. All of Venus' products are re-activated each month using an access code provided by Venus, which is withheld if clients fail to meet their payment for that month, meaning the product cannot be used. Venus says the flexibility afforded by its subscription model enables it to offer better deals and upgrades to long-standing clients. At present, only the ARTAS technologies are not available to purchase via subscription.

In terms of its addressable market, in the company's latest 10K submission it quotes data from The International Society of Aesthetic Plastic Surgery ("ISAPS") that ~23m cosmetic procedures were carried out globally in 2018, with 10.6m being surgical, and 12.7m non-surgical. Venus estimates that the global energy-based aesthetic device market was worth ~$3.4bn in 2018, and that it will increase at a CAGR of 9.7% to >$5.3bn by 2023. In terms of the Hair Restoration market, Venus quotes data from the International Society of Hair Restoration Surgery ("ISHRS") that "an estimated 597,181 patients worldwide had a surgical hair restoration procedure in 2016, compared to an estimated 216,547 patients in 2006, representing a 10.6% CAGR over the period."

To summarize, other than the coronavirus crisis, there is scant evidence to suggest that the company's business model is flawed in any obvious way, or that, provided the aesthetic surgical market returns to a business-as-usual state of affairs, the company will not see a strong uplift in client-orders and subsequently a return to, or even surpassing of its 2019-levels of revenue.

Addressing the level of competition Venus faces, again, although the company describes the medical technology and aesthetic product markets as "highly competitive", there is little evidence that Venus is not sufficiently differentiated or does not enjoy a reputation sufficient to strongly compete for market share in this space. As I have already mentioned, the company has a large global sales force, and is heavily backed by healthcare investment funds and VC firms.

Shoots of recovery?

The last several months must have been a frustrating period for Venus management which has experienced the worst of all possible false starts to its new life as a publicly traded company. The question is, how soon can the company return to business-as-usual, and start generating the kinds of revenues and bottom line growth that will satisfy investors?

CEO Domenic Serafino and CFO Domenic Della Penna provided some early indications on the recent earnings call.

First of all, Serafino revealed that, in the first 2 months of 2020, sales increased 7% on a year-over-year basis, fueled by new product launches such as the commercialization of the Bliss technology. In March, however, device sales reportedly declined by 95% on a year-over-year basis during the last 2 weeks of the month, with large numbers of cancelled or delayed orders.

In April, the CEO estimated that 95% of Venus' clients remained closed, but also said that April sales performance was better-than-expected, with US sales, for example, falling by 55% "only". The company's sales team continues to be active, hosting a series of well-attended webinars throughout the lockdown, for example, whilst leveraging virtual selling and services strategies. The CEO said he "couldn't be happier" with the sales strategy and results during the lockdown period, but also described management as "very cautious" about whether the worst of the crisis was now behind the company.

Of course, these comments may be dismissed by many as so much management flannel, who might instead point to the disastrous Q1 numbers as evidence that the company is in dire straits. It is interesting to note, for example, that the Hair Restoration technology part of the new business apparently performed quite well during the period, generating $1.9m (a year-over-year increase), which hints at a possible issue on the Venus Concept side of the business.

I cannot claim to have any privileged insight into potential issues at the company, but I do not believe there is any overwhelming evidence to suggest that a company that made $24m of sales in 2019 and was nearly profitable could suddenly have started to fall apart at the seams. The more likely scenario, it seems to me, is the one presented by management, which makes a case for the current stock price undervaluing the company somewhat.

What To Expect Going Forward

Looking ahead, we can certainly forecast a year-on-year sales decline. Assuming quarters 1 and 2 are the worst affected, we can project Q1 revenues into Q2, and then let's assume the company matches Q119 revenues in quarters 3 and 4.

That gives us a revenue figure for 2020 of ~$78m - a 29% year-on-year decline. If we keep the OPEX margin steady at ~97% of total 2019 sales OPEX would be ~$79m, which would reasonably accurately reflect the expected cost savings generated in 2020. In 2021 my model assumes the company also makes cost savings so that OPEX accounts for ~81% of total sales, which I have kept steady going forward, whilst increasing sales at an annual rate of 8% - slightly less than the company had originally forecast for 2020.

Venus financial forecast 2020-25. Source: my table using my assumptions and company historical financial data.

If we do this (always bearing in mind that these are ballpark figures) the picture begins to look quite rosy for Venus. Using a WACC of 10.8% (expected market return = 10%), I arrive at a market cap for Venus of $175m (premium of 86% to current market cap of $94m) and fair value share price of $7 using DCF analysis.

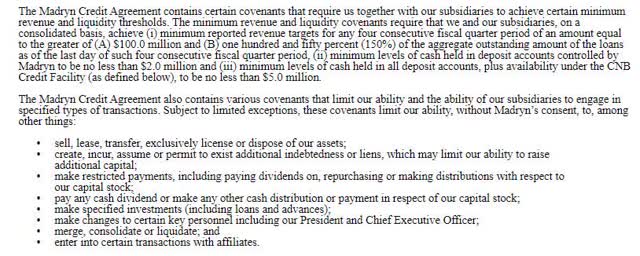

The WACC figure includes a cost of debt of 11.4% which relates to a loan the company has taken out with Madryn Health Partners that charges 9% interest currently, but will soon switch to 12% interest, and looks like an all-round ugly deal for Venus. There are all sorts of stipulations to this loan secured against the company's assets according to the company 2019 10K:

Madryn debt arrangement detail from company Q120 10Q

Additionally, it goes on to say that:

In connection with the Madryn Credit Agreement, Venus Concept Ltd. issued three types of 10-year warrants ("Madryn Warrants"). As of March 31, 2020, Madryn Warrants exercisable for 179,932 shares of common stock were outstanding.

To what extent this arrangement is likely to restrict the company's growth is open to question, but in fairness, the deal has been in place since October 2016 and has not proved to be a significant impediment to further fundraisings - it would also be interesting to know whether there is any COVID-19 wiggle-room around performance obligations, which might help Venus with its short-term recovery and ought to be in the interests of both parties.

Conclusion

In this article, I have tried to provide a balanced appraisal of the state of play at Venus based on publicly available information. I will confess to not having a great deal of insight into the company prior to identifying it as a significantly undervalued stock based on the recent collapse in its share price hitting monthly price lows.

Whilst there is a persuasive case that, having been battered by its obvious exposure to coronavirus, there is nothing stopping the company from gaining significant momentum going forward with its innovative subscription model and with the added sales impact from Hair Restoration, and with the support of its institutional backers, there is also present and clear risk.

Was the Q1 under-performance down to more than the disruption of BAU? Is the company too heavily indebted? Has the merger created issues within the company?

If I tried to answer these questions in detail, I would merely be speculating. Of course, investing in any company that has just hit a share price low of $3 will be risky and there will never be a risk-free investment of this type. It is all about weighing the pros and cons. As described above, I have explored a scenario where the company makes a more-or-less full recovery from the COVID-19 pandemic, whilst making heavy losses in quarters 1 and 2 2020, offset by cost synergies, and it results in a large (>140%) gain for shareholders.

Whilst this may be too optimistic, we do know that pre-coronavirus, the stock traded at a price of $8. There are very few analysts setting price targets for Venus, but the one I found predicts the stock will reach a price of $8. The stock is volatile enough to make me believe it can recover on short-term price catalysts. A good strategy may be to watch developments unfold closely and look out for news ahead of Q2 results and the new set of 2020 forecasts. For the more risk-on investor, there is an argument that the stock will make its move upwards sooner rather than later.

More bad news, however, and a price of sub-$1 is not impossible either. This really is a judgement call. On balance, I believe that a company the size of Venus can, and most likely will, recover. Specialty aesthetic service providers are under intense pressure at this time but may benefit from a surge in retail spending when the lockdown period finally concludes.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in VERO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.