Samsung Unveils 'Samsung Money' Cash Management Account and Mastercard Debit Card

by iClarifiedSamsung has introduced 'Samsung Money by SoFi', a new mobile-first money management experience that offers a cash management account, Mastercard debit card, and exclusive Samsung Pay benefits.

The account is secure, with no account fees and rewards users for saving—earning higher interest relative to the national average of transactional accounts. At a time when people are turning to their technology to take care of essential tasks without leaving home, Samsung Money by SoFi makes it easier for them to manage more of their financial life in the Samsung Pay app.

“Samsung’s goal is to make everyday life better by putting powerful tools in the hands of Galaxy users,” said Sang Ahn, Vice President and GM of Samsung Pay, North America Service Business, Samsung Electronics. “Samsung Money by SoFi is our biggest move yet to help users do more with their money. Samsung Pay is already the most rewarding shopping and payments experience driven by numerous innovations over the years. Now, users can access mobile-first financial services and earn exclusive Samsung benefits. We’re excited to help our users reach their financial dreams by allowing them to spend, save and grow their money and access it easily and securely.”

Highlights:

Users can choose between opening an individual or joint cash management account. What’s more, users enjoy in-network ATM fee reimbursement at more than 55,000 locations in the United States.

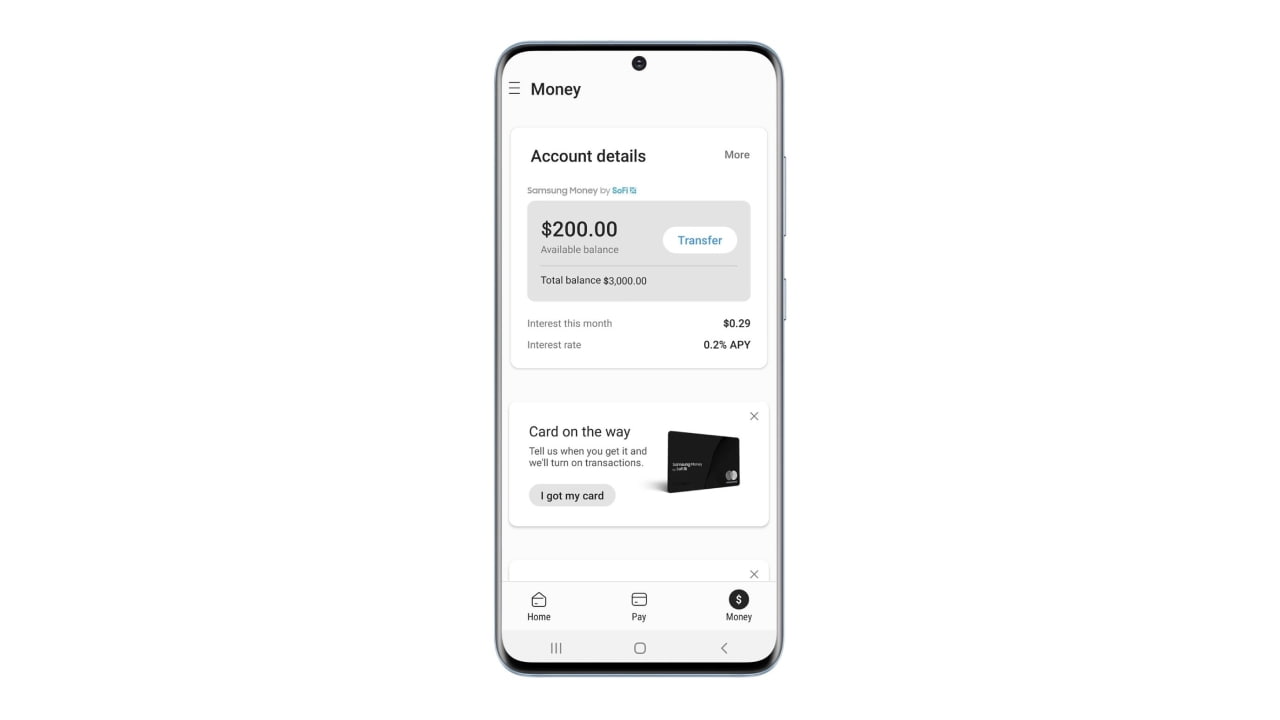

Setting up an account in the Samsung Pay app will take almost no time at all. The virtual card will appear instantly within Samsung Pay upon approval. And as soon as users receive their physical debit card in the mail, there’s no need to call a 1-800 number; the card is ready to use in a snap—just open Samsung Pay and activate the card with a tap.

To help people manage their finances from anywhere, Samsung Money by SoFi will put essential financial tools at users’ fingertips. With just a tap in the Samsung Pay app, users can check their balance, review past statements, and search transactions. They can flag suspicious activity, pause or restart spending, freeze or unfreeze their card, change their pin, and assign their trusted contact—all without ever having to leave home or call a representative.

Benefits:

Users can enroll in the Samsung Rewards program to earn points for every purchase they make using Samsung Pay. As an added bonus, loyal Samsung Pay users with 1,000 or more Samsung Rewards Points will be able to redeem their points for cash that will be deposited directly into their Samsung Money by SoFi account.

A Samsung Money by SoFi account is FDIC insured for up to $1.5 million (six times that of a normal bank account)5. Samsung Money by SoFi account holders get the benefit of defense-grade security from Samsung Knox. The physical debit card will not display the card number, expiration date, or CVV. Should users need that information, they can easily find it within the “Money” tab of the Samsung Pay app, which is further protected by biometric or PIN authentication. Users assume zero liability should an unauthorized transaction occur.

Availability:

Samsung Money by SoFi will start to be available to U.S. consumers later this summer. You can sign-up for the wait list at the link below.

Read More