HEICO Beats Again, But Caution Is Warranted

by Harrison SchwartzSummary

- HEICO has beat EPS and revenue estimates for the 10th consecutive quarter despite a slowdown in commercial aircraft orders.

- This is good news, but Q3 and Q4 will likely be more difficult as demand for commercial aircraft has fallen to essentially zero.

- Analysts currently do not see any growth in HEICO over the next two years.

- Given a poor growth outlook and a possible peak in Aerospace's secular growth, it is difficult to justify HEICO's valuation.

- Irrational exuberance among investors is often a long-term bearish indicator.

HEICO Corporation (HEI) is an aerospace company that creates products for aircraft, spacecraft, defense equipment, medical equipment, and telecommunication systems. It has been one of the best performing aerospace companies over the past decade and risen from $9 in 2010 to $107 today.

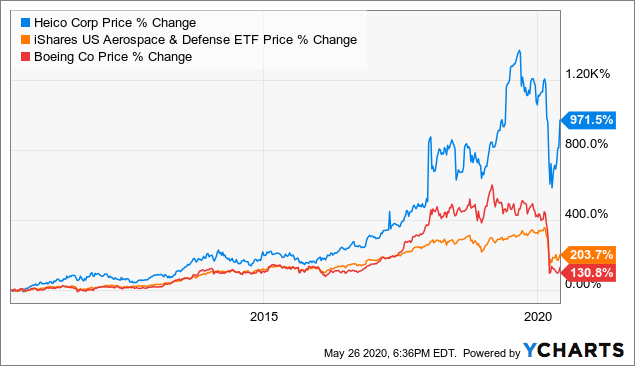

The company announced earnings on Tuesday and beat EPS by $0.16 and revenue by $30M. This is despite its revenue being 10% lower YoY due to COVID. This caused the stock to jump 7% after-hours and is its 10th consecutive quarterly EPS beat. HEICO appears to be an unstoppable company. This is particularly true when looking at its stock performance compared to the iShares U.S. Aerospace & Defense ETF (ITA) and Boeing (BA):

Data by YCharts

While HEICO's performance is great, there are a few risks investors must consider now that its Q2 earnings report is released. Most notably is its exposure to companies like Boeing which are in an extremely difficult position. HEICO is a very expensive company with strong historical growth, but if that growth slows, it carries significant downside risk. Quite frankly, it is difficult to find a reason for the stock to be headed higher given its current price.

Trouble in the Air

Importantly, around 60% of HEICO's sales usually comes from its Flight Support Group. This group designs and manufactures jet engines and aircraft parts, usually at a lower sales price than those manufactured by OEMs (see 10-K Pg.1).

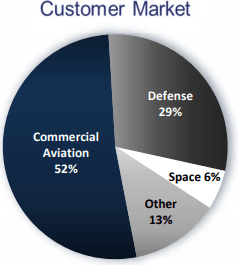

HEICO's customer market is shown below:

This means the company's revenue is highly dependent on demand for commercial aircraft. Demand for aircraft was alright before the crisis, but Boeing has seen a total of 540 cancellations this year and has seen essentially no orders over the past few months and only 6 deliveries.

Of course, airlines have been hit the hardest and have seen an extreme decline in revenue with many at a very high probability of bankruptcy. As such, very few airlines have the financial wherewithal to purchase planes and likely not for months or even years to come. Slowly but surely, this has resulted in essentially no demand for commercial aircraft. Aircraft parts are purchased in advance, so this has yet to fully impact HEICO, but it will over the coming quarters.

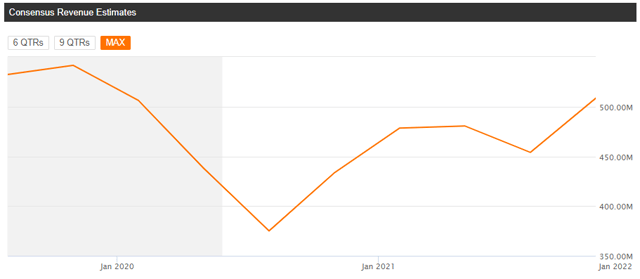

HEICO's Flight Support Group only saw sales decrease by 7% in the first six months of the year and 18% YoY this quarter. Importantly, the worst has yet to come as the slowdown in commercial aircraft orders today will result in a slowdown in part orders in the quarters ahead. This is why HEICO's consensus revenue estimates for Q3 are 20% below Q2's sales. This, and the expected recovery, is shown in consensus revenue estimates below:

(Seeking Alpha - HEICO Consensus Revenue Estimates)

As you can see, most analysts expect a relatively rapid recovery for HEICO's sales. Q3 2020 is expected to be the worst quarter and full recovery is not expected until 2022. This implies demand for air travel will recover or HEICO's sales will be offset by higher non-commercial sales. In general, I do not disagree with a 2022 recovery, but see Q3 and Q4 as perhaps worse than expected. Demand for commercial aircraft is down over 90% and will likely remain low until airlines are recapitalized (which could take until 2021-2022). This will bring a similar drop in aircraft component sales.

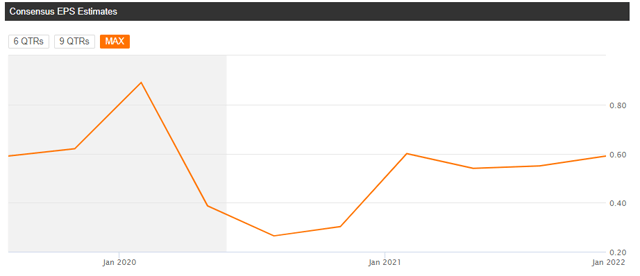

HEICO also had $0.55 EPS in Q2. Consensus EPS estimates signal that it will likely remain around this level until at least 2022:

(Seeking Alpha - HEICO Consensus Earnings Estimates)

I generally agree with this estimate but expect slightly lower earnings in Q3 and perhaps Q4. The company has relied on high demand to increase its gross margins over the past few years, with this demand now absent, it will likely be forced to sell at lower prices.

Fortunately, HEICO's Electronic Technologies Group, which usually accounts for half of its income, has not been impacted by COVID. The majority of this section is products sold to the U.S. government as well as foreign military agencies. This has been a major area of growth for the company as militaries have been in a race to improve their technological edge. With many governments being forced to divert money to domestic welfare, growth in this segment may dry up too, but it will be some time before we know that with certainty.

HEICO's Valuation is Difficult to Justify

No doubt HEICO has been a stellar growth company that has likely created significant long-term gains for many investors. That said, given it has no growth expectations through 2022, it is very difficult to justify its meteoric valuation.

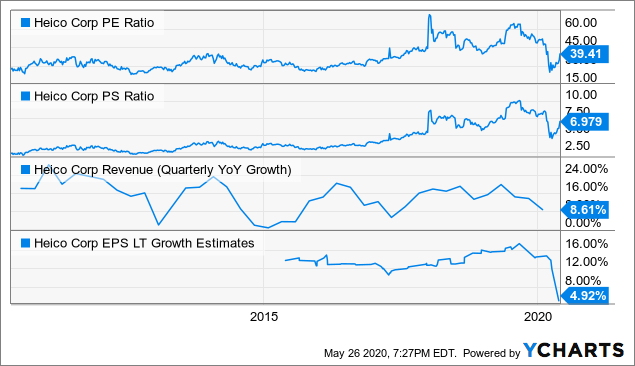

It is currently trading at a TTM P/E ratio of 39.4X and at a price-to-sales that is among its highest level ever. The company's forward EPS expectation is $1.85, so its forward P/E is 57X. Additionally, the company's revenue growth has been slowly declining over the past few years and its long-term growth estimate has recently collapsed:

Data by YCharts

Again, a "V-shaped" recovery is very unlikely. Airlines are in an abysmal state today and were not even strong before the crisis. The same is true for Boeing which has struggled with its 737 MAX drama. HEICO is making an effort to grow in a shrinking market which will likely exacerbate competition and put increased pressure on margins.

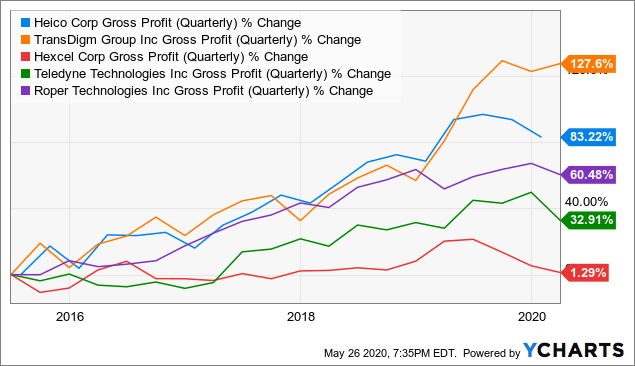

Obviously, those betting on HEICO missing earnings have been proven wrong time and time again, but growth stories almost always result in a lasting period of stagnation. Remember, HEICO's growth is not entirely attributable to its management. In fact, its growth is only slightly above that of its peers TransDigm (TDG), Hexcel (HXL), Teledyne (TDY), and Roper (ROP) as you can see below:

Data by YCharts

Quite frankly, the financial distress of Boeing and airlines as well as exacerbation of global government deficits may mark the end of Aerospace's current secular growth phase. As airlines, governments, and other firms look to cut budgets, producers of expensive technological capital will be hit the hardest.

To make matters worse, HEICO is heavily reliant on a global supply chain that is under immense pressure not only due to COVID but also the growing geopolitical divide.

The Bottom Line

Overall, I am bearish on HEICO. It is a solid business that has been run well, but extreme investor bullishness does not seem to be in line with the bearish fundamental reality of the airline industry. Demand for planes is absent and will likely remain so until most airlines are restructured. Even Boeing's CEO believes a rapid recovery is unlikely, particularly without immense government support.

Additionally, the Aerospace industry has seen years of secular growth that has brought many of these companies' valuations to extreme highs. Unsustainable levels that seem to be reflected in irrationally exuberant investor sentiment across the industry. This view is likely contrary to popular opinion, but the evidence suggests Aerospace firms like HEICO are trying to grow into a now shrinking/plateauing market. Inevitably, this will put pressure on the firm's margins.

Interested In More Alternative Insights?

If you're looking for (much) more research, I run the Core-Satellite Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios as well as weekly commodity and economic research reports. Additionally, we provide actionable investment and trade ideas designed to give you an edge on the crowd.

As an added benefit, we're allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they'd like. You can learn about what we can do for you here.

Disclosure: I am/we are short HEI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.