Chico's FAS: Too Early To Invest In This Turnaround

by Jesse CashSummary

- Chico's FAS's financials have been in bad shape for several years.

- The company has several foundational problems that make its future survival challenging.

- A new business direction is being attempted, and a turnaround is possible but likely difficult.

- Any investment in this company's turnaround should be delayed until management's efforts begin to show a track record of consistently positive and profitable results.

Chico's FAS Incorporated (CHS) is a women's clothing company that features three major retail store brands: Chico's, White House Black Market, and Soma. They also have one smaller online brand: TellTale. The combined company once enjoyed a good deal of consumer support, but their luck has faded in recent years. This has led to extremely inconsistent financials since 2013. Fading customer enthusiasm for their brands, has combined with poor financial choices, to leave the overall corporation in a difficult position. While the company does have some definite assets, and could be a good candidate for a turnaround, it is too early in the turnaround process to commit investment capital.

(Source: Chico's FAS 2019 Annual Report)

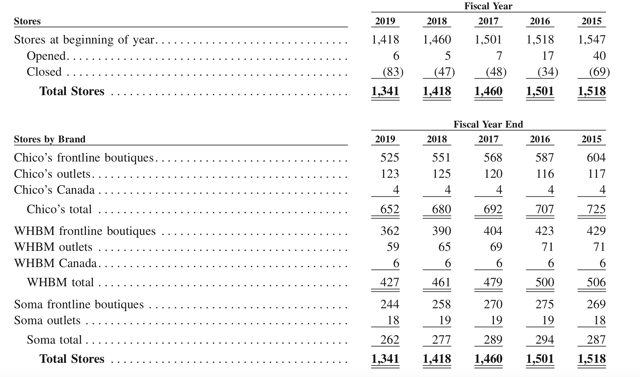

As of the 2019 Annual Report, the total retail footprint of Chico's FAS retail "boutiques", as they refer to them, was 1413 stores. This includes 1341 corporate-owned locations in 46 states, Puerto Rico, the US Virgin Islands, and Canada, and 72 Franchises, 70 in Mexico and 2 in domestic airport locations.

The corporate-owned stores break down as follows: Chico's totals 652 stores, White House Black Market totals 427, and Soma totals 262. Since 2013 all three brands have struggled. The 4th quarter of 2019 marked the first time since the 4th quarter of 2014 that all three brands showed favorable quarterly comparable sales growth. If Chico's FAS is going to make a turnaround and survive, much less thrive, they will need to continue making big changes.

Problem Areas

Financial

Chico's FAS's success appears to have begun to change with the 2013 accounting year. Sales, profits, and dividends per share all climbed, as the number of stores climbed, in the years immediately preceding.

| 2010 | 2011 | 2012 | |

| Sales ($Mill) | 1905.0 | 2196.4 | 2581.1 |

| Net Profit ($Mill) | 115.4 | 140.9 | 180.2 |

| Dividends Per Share | .16 | .20 | .21 |

| Store Count | 1151 | 1256 | 1357 |

| Common Shares Outstanding (Mill) | 177.9 | 165.74 | 162.77 |

| Return ON Equity (%) | 10.8 | 14.0 | 16.5 |

(Source: Valueline and Seeking Alpha)

However, something began to change in 2013. The profits fell dramatically and then became inconsistent, even while at first the total sales and store count kept growing. The problem is somewhat hidden in the Sales per share numbers, as the company continued to repurchase shares during this entire time, thus propping up the per share figures. However, even with this repurchasing, the per share earnings became inconsistent. In 2015 the company began to shrink their store count, but they continued to increase the dividend even as profits suffered, and fell into losses.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Sales ($Mill) | 2586.0 | 2675.2 | 2642.3 | 2476.4 | 2282.4 | 2131.1 | 2037.9 |

| Sales per share | $16.99 | $17.49 | $19.5 | $19.23 | $17.91 | $18.22 | $17.21 |

| Net Profits ($Mill) | 65.9 | 64.6 | 2.0 | 91.2 | 91.3 | 35.6 | -12.8 |

| Earnings Per share | $0.41 | $0.42 | $0.01 | $0.69 | $0.71 | $0.28 | $-0.11 |

| Dividends Per Share | $0.24 | $0.30 | $0.31 | $0.32 | $0.33 | $0.34 | $0.36 |

| Store Count | 1472 | 1547 | 1518 | 1501 | 1460 | 1418 | 1341 |

| Common Shares Outstanding (Mill) | 152.2 | 152.92 | 135.53 | 128.75 | 127.47 | 116.95 | 118.42 |

| Return on Equity (%) | 7.2 | 6.9 | 0.3 | 15.0 | 13.9 | 6.1 | -- |

Despite the company's continued expansion of retail locations in 2013 and 2014, the net profits plummeted. Management began to reduce their retail footprint (and thus overhead) in 2015, but the profits stayed down. Meanwhile management continued to raise the dividend. This may have been done with the hopes of keeping investors happy. However, whatever the reason, continuing to pay the dividend, much less raise it year after year, while profits were falling apart was a financial mistake. In 2015 and 2018, they paid out a raised dividend despite not having enough profits to cover it. In 2019, they again paid out a raised dividend, despite having a per share loss.

While it is conceivable that these moves were well intentioned, they were not fiscally prudent. As the company went from consistent profit and sales growth to declining and erratic earnings and losses, the dividend should have been reduced or eliminated. It certainly should not have been increased, especially while they were piling up debt. Between 2011 and 2019 Chico's FAS's total liabilities climbed from $351.1 million to $1.0126 billion.

In addition, beginning in 2013, the Return on Equity began to swing all over the place. This seems to confirm that management was no longer effectively reinvesting the company's assets to generate increased shareholder value.

Brand Popularity

Another major problem for Chico's FAS is in their retail brands. Two of the three retail names (Chico's and White House Black Market) have lost their shine, and one (Soma) is largely unknown. The TellTale online brand seems to have been largely abandoned in its crib with changes in management.

(Source: Chicos.com)

The Annual Report describes Chico's stores as being aimed at women 45 and older. They are vertically integrated and control everything from design and importation, to distribution. The brand that was begun in Florida in 1983, once had a following in their demographic. However, that seems to have faded. Twenty years ago, I knew many women (in my parent's generation) who shopped at Chico's. It was a go-to, if not the go-to, location for many women. However, the bloom seems to have come off the rose. I surveyed several hundred women (through social media) about which of the Chico's FAS brands they shopped at and how often. Out of these, I could find exactly 2 women who said they shopped at Chico's. One said, "Yes, when my mother drags me." So I guess that would technically be 3 if you also count her mother. I asked my former mother-in-law (who I remembered shopping there), and when asked if she shopped at Chico's, she said, "Twenty years ago!" I live in Southern California. There are 12 Chico's stores within 30 miles of me, and I could track down exactly 3 people who shopped there. I realize that this is not a scientific poll, but it is interesting. Other responses included, "I didn't know they were still in business," and "I've never heard of them." This is even more concerning when one considers that almost half of Chico's FAS's retail footprint is made up of the Chico's retail brand.

(Source: WhiteHouseBlackMarket.com)

White House Black Market was a little different. When I was still married, I would regularly accompany my wife there. I'm not a shopper, but they were pleasant stores, with fashionable clothes at a slightly premium price. They had a layout typical of more expensive stores, highlighted by plenty of space, and fewer items on sale. It always struck me as an aspirational brand, sort of what Williams Sonoma (NYSE:WSM) is to home goods. My wife would go there when she wanted a nice outfit for an evening out or a special occasion. It almost felt like she was treating herself when she went there.

White House Black Market is aimed at women 35 and older. Like Chico's it is vertically integrated, and all designs are in house. The clothes are private label, and everything is controlled by the corporate team.

In the same social media survey, several people said they still shopped there, some even regularly. However most, including the ones who still shopped there, said that the brand had changed. It was a more general store, with more normal clothing. Several women said, they didn't used to think they could afford it. However, they now know it's just another store. For this brand, I think that is a huge problem. The aspirational nature of the brand set it apart and made it special to women. Allowing that to disappear removes some of the shine from the brand. As an example: one of the reasons people drive a Bentley is they want others to know they can afford a $250,000 car. It's a status symbol. White House Black Market used to tap into that. Women seemed to be proud to wear it. However, if that is now gone, if it's just another store, with regular clothes that everyone can afford, then how is it unique or different from Chico's? In my opinion, it's not.

(Source: Soma.com)

Before researching this article, I had not heard of Soma. The women who knew of it, said that the brand has good quality undergarments and lounge wear. However, many had never heard of it. An increase in brand recognition could be a future source of profit and revenue growth that would support the company's turnaround efforts.

I looked to Yelp to further investigate brand popularity. Of the three major brands, the Chico's and White House Black Market Brand locations all scored in the 2 1/2 - 3 star quality rating range. Whereas Soma Intimates consistently scored 4 - 4 1/2 stars. This seems to confirm the thesis that with the exception of Soma, the brands are suffering in the eyes of the consumer.

(Source: MyTellTale.com)

Finally there is TellTale. TellTale was launched with a press release on April 10, 2019 featuring CEO and President, Shelley Broader talking about the need for the brand. Literally 14 days later, Ms. Broader stepped down and was replaced, and the brand seems to have been largely abandoned. TellTale is supposed to be a "digital only" intimates brand. They are aimed at marketing undergarments to millennials. However, other than a website, there appears to be no real support or marketing behind the brand. In the annual report, Chico's FAS describes themselves as a collection of 3 brands, and even features them on the cover.

(Source: 2019 Annual Report)

TellTale is barely in the report. They do not break out Telltale's sales results for its initial year. They are hardly described in the brand descriptions, versus lengthy descriptions of the other three. If you go to the corporate website, they do not even appear under the "Our Brands" drop down menus. It appears to me that this was a project pushed or supported by former CEO Broader, and after her departure, it was largely abandoned. If you combine this with the fact that the clothing sold under the TellTale brand seems to be exactly the same as the Soma items, it does not seem that this brand serves a purpose. It certainly does not appear to be a profit center.

Leadership

Another big problem I see is that the company has had huge leadership changes in the last year. Since April 2019 they have had 3 CEOs. After Ms. Broader stepped down, Bonnie Brooks replaced her as Interim CEO. She was formerly the CEO of Hudson's Bay (OTCPK:HBAYF). Three months later they hired Molly Langenstein (formerly of Macy's (NYSE:M)) to be the President of the Apparel Group (controlling Chico's and WHBM). In April of this year, Ms. Langenstein was named President and CEO. Ms. Brooks became the Executive Chair of the Board, and the existing Chairman of the Board became an Independent Director. That's right, Chico's FAS has had 3 CEOs in 13 months.

While it does seem that Ms. Brooks made good starts on reducing the retail footprint and controlling costs, that is a ton of change for any company. How can a corporate ship really turn, if the captain is continually changing? This is true even if the last two leaders believe they are on the same path. If this corporation is going to survive, much less make a turnaround, consistent leadership is needed.

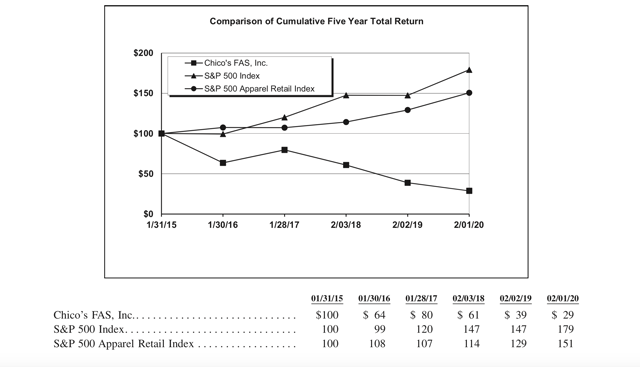

Total Return

The final issue to bring up is that an investment in Chico's FAS has been horrible for Total Return. Using a graph in their own Annual Report, this is incredibly clear.

(Source: 2019 Annual Report p.24)

That's right. Since January of 2015 a $100 investment in Chico's FAS would have dropped to $29 in February of 2020. That 71% loss is the total return, with dividends reinvested. Compared to the 79% Total return one would have earned investing in the S&P 500 index, it is clear that Chico's has not been a safe place for anyone's money.

Positives Supporting a Turnaround

So can the corporation be turned around? Well that is hard to say. However, they do have some things going for them. First, they do have name recognition for their two primary brands (Chico's and WHBM). This is a hard-won asset that many startups spend millions to achieve. Their two flagships stores are known. They could launch a rehabilitation campaign to revitalize their brands. This is far easier than building name recognition from scratch.

According to their Annual Report, they currently have "at least" than 21 Trademarks/Brands. It seems likely that not all of these are profiting the corporation. At least some are likely good candidates for licensing to other stores, or even selling to other retailers. Again, these trademarks all have some value.

They have established manufacturing throughout the world, and distribution channels at home. Since the COVID-19 situation began, they have begun to diversify the countries in which they produce garments, so they will not be entirely dependent on China. Having the manufacturers in place and the distribution functioning means design changes can quickly produce and distributed. This should give management the ability to adapt quickly to new trends and increases in demand for popular products.

They are making progress in digital sales.

Over the past six weeks, we have seen strong customer demand in our digital channels, including increased traffic and sales on our websites and increased engagement on our social media channels. Chico's FAS digital sales have experienced double digit growth in the six weeks since the company became a digital-only business on March 18, 2020. (Source: April 27 statement from CEO Bonnie Brooks)

This bodes well for the future success of all three major brands. As they begin to reopen boutiques, they are also rolling out an "order online, pick up in store" feature. This has been a crucial detail of success for many companies that are navigating the digital revolution.

They have finally cut the dividend. Sure, they did it under the cover of the COVID-19 shutdown and coming recession, but they did it. Now that it has been eliminated, those funds can be used to focus on building profits, paying down debt, and stabilizing the corporation.

Management has shut down over 406 retail boutiques from the peak in 2014 and they plan to close 60-70 more stores in 2020.

(Source: 2019 Annual Report)

This is being done in combination with the 2018 Retail Fleet Optimization Plan. This 3 year plan seeks to re-balance the mix of physical retail stores and digital sales. They are seeking to close under-performing stores throughout the chains. This is an excellent idea. Having too many stores is extremely expensive. Finding and closing poorly performing retail locations should help to grow the bottom line.

The company has also won numerous awards attesting to the fact that they do many things well. Among these awards are the following:

- Forbes: Best Employers For Diversity

- Newsweek Best Customer Service (Chico's & Soma)

- National Association of Female Executives: Top Companies for Executive Women

- Newsweek: Best Online Company:Chico's, White House Black Market, & Soma

Finally, the Soma brand seems to have some real possibilities. It has been around since 2003 and seems to be well-liked among people who have shopped there. This could be a potential source or real income if they maximize the asset and build for growth.

So, clearly a lot of good is happening in this corporation. Building on these positives could be the way forward.

Will The Turnaround Be Successful?

Looking at the company as it stands today, it is simply too early to say whether or not management will be successful in turning around this company. A lot of positives are happening. They are reducing their retail footprint, examining areas where they can improve their digital and retail synergies, and improving digital sales. They have eliminated the dividend and are looking to make serious cost cutting moves across the corporation.

These moves should eventually lead to increased and more predictable profits. However, retail is an extremely challenging and competitive realm. A turnaround is difficult under good circumstances, and the COVID-19 era makes the business environment even more challenging. While there have been recent improvements in the numbers, they are far from good. The fact that the 4th quarter of 2019 marked the first time that the major brands all showed comparable growth in 5 years shows how early in this process they are, and how difficult turning this company around will be.

The frequent changes in leadership are another source of concern. While it is likely that Ms. Brooks did help to stabilize the corporate direction and finances, the newest CEO Ms. Langenstein is just taking the helm. How will she fare? It's simply too early to say. If the company is going to survive, hopefully the current leadership stays for several years, and is successful.

Is This A Wise Investment?

So yes, a turnaround is possible. However, I do not know if it is likely. Will they make the difficult choices? They may. In my opinion it is just too early to say. While the stock is currently trading at just $1.40 per share, that only represents a good price if management successfully stabilizes the company and returns it to growth. If the company continues to spiral downward, then an investment at that level is just wasted money.

Two important things to keep in mind. First, if Chico's FAS Inc. files for bankruptcy, the shareholder equity will almost certainly be wiped out. Any money invested in the stock would be lost. The bondholders would be first in line in bankruptcy court. Second, the board of directors recently adopted a Shareholders' Rights Amendment that will expire next April. It is designed to be a type of poison pill to prevent a hostile takeover by another company, a private equity firm, or activist investor. So this makes an acquisition far less likely. A turnaround will have to be homegrown, at least for the next year. Don't invest thinking that a buyout will insure a profit. It is not likely to happen anytime soon.

I do think a turnaround is possible for Chico's FAS. However, I do not believe that the financial changes have had enough time to leave a track record. Investing now would be gambling on a change. While the moves are beginning to show success, they are just beginning. One positive comparable quarter for the three main brands does not equal success.

If the turnaround is going to be successful in the longer term, it will take time, and it will leave evidence of the successful moves being made. If the one positive comparable quarter becomes several, and the bottom line begins to consistently show a profit that is improving, then it may be time to invest in the turnaround.

Purchasing these shares now would be attempting to catch a falling knife. Waiting and watching is the better move. If the turnaround is working, the numbers will begin to consistently show it. Then an investment can be made, albeit a speculative one.

At this point, Chico's FAS is just not a safe investment vehicle for your money.

Good Luck and Good Investing

Price Targets

Unknown on this one. I just can't predict at this time.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.