A Simple Retirement Portfolio - 5 Funds, Lower Risk, Market-Beating Performance

by Juan de la HozSummary

- Vanguard provides investors with a suite of target retirement funds that can fulfill the investment needs of retirees of any age.

- These funds are cheap, safe, and provide competitive returns.

- There are a few simple and time-proven ways to boost the returns and lower the volatility of these funds.

- Here are a few, and the resultant portfolio.

Vanguard's target retirement funds, including the Vanguard Target Retirement 2020 Fund (VTWNX), are some of the easiest, cheapest, and all-around strongest ways for investors to save for, and during their retirements.

These funds will always be great investment choices, but I believe that investors could always do better.

In light of the above, I decided to create and analyze a simple retirement portfolio meant to provide investors with a similar, but all-round stronger, performance and product as VTWNX.

This isn't a high-yield high-risk high-conviction portfolio that might make you rich but will likely leave you a pauper, but a conservative portfolio of high-quality lower-risk funds with a strong track record of small, but consistent, outperformance combined with a slight, but always beneficial, reduction in risk and volatility.

Lower-risk higher-reward investment opportunities are few and far between, but I do believe that this portfolio is one.

Overall asset allocation was taken from VTWNX, while the funds themselves were selected for their combination of market-beating performance and comparatively low level of risk. Selected funds have all significantly outperformed their respective benchmarks since inception, and since I first covered them.

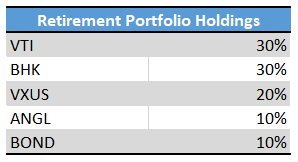

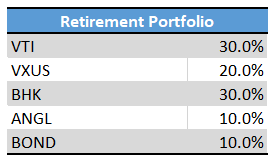

A brief overview of the portfolio and its performance:

If lower-risk higher-reward retirement portfolios are of interest, keep reading.

Vanguard Target Retirement Fund Overview

I started the process of constructing the retirement portfolio by selecting a benchmark. I needed a benchmark to, well, benchmark the portfolio's performance, but also to serve as a starting point for the portfolio's holdings and asset allocations. No need to start from scratch with all the great funds out there.

I settled on VTWNX, which offers investors a diversified portfolio of low-cost index funds, and is specifically constructed and targeted towards investors who aim to retire in 2020. The fund seemed like a good fit, and Vanguard is always my top choice for simple, cheap, and lower-risk funds.

VTWNX:

- Invests in both equity and fixed-income assets, which boosts diversification, reduces risk, and ultimately increases risk-adjusted returns.

- Decreases the fund's equity exposures while boosting its fixed-income exposure as investors age, to protect shareholder capital as retirement nears.

- Fixed-income exposure means the fund should underperform broader equity indexes, including the S&P 500, during bull markets and in the long term, but outperform during downturns, which is of special importance for retirees.

- Invests in both local and international securities, which boosts diversification, reduces risk, and ultimately increases risk-adjusted returns. On the other hand, as international equities have underperformed for years, said diversification has moderately reduced returns during the same.

VTWNX's holdings and overall investment strategy seem perfect for retirees, and are a natural benchmark and starting point for my portfolio, which would naturally end up sharing most of the same characteristics as VTWNX.

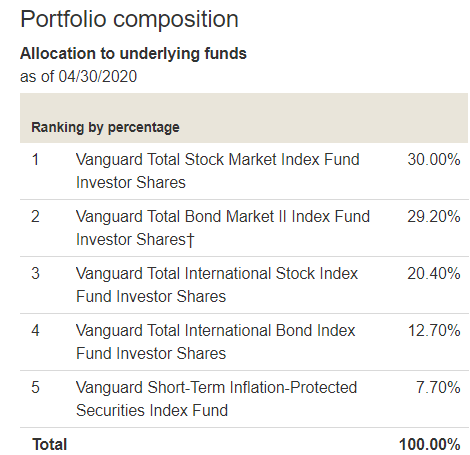

With the above in mind, let's take a look at the fund's specific holdings:

(Source: Vanguard Corporate Website)

VTWNX's holdings are basically evenly split between equities and fixed-income, with a small tilt towards U.S. equities, and a much larger tilt towards U.S. fixed-income securities. I'll be copying Vanguard's asset allocation percentages for the time being.

With the above in mind, I then decided which, if any, of the above funds would I be replacing.

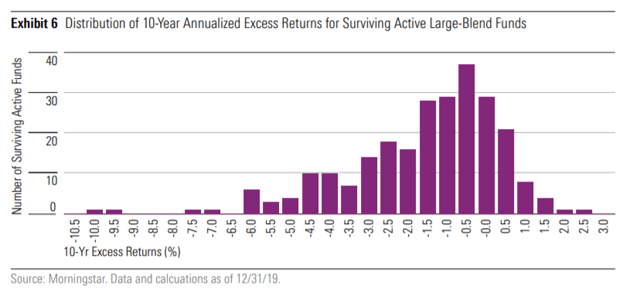

I decided to keep both equity funds, the Vanguard Total Stock Market ETF (VTI) and the Vanguard Total International Stock ETF (VXUS), for the very simple reason that most actively-managed equity funds moderately underperform their benchmark. This is especially true for large cap U.S. equity funds, most of which underperform their benchmark by between 1.5% and 0.5% per year. There are a couple of equity funds that I really like, but not at these prices, or at these levels of market volatility.

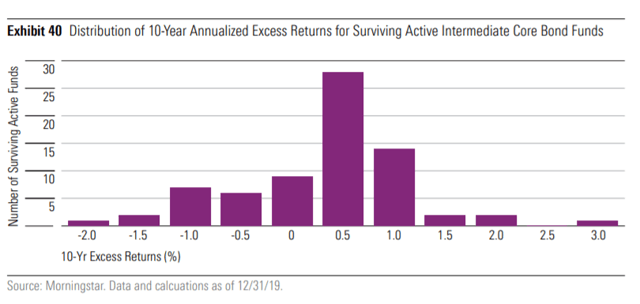

(Source: Morningstar)

I decided to swap all three fixed-income funds, the Vanguard Total Bond Market ETF (BND), the Vanguard Total International Bond ETF (BNDX), and the Vanguard Inflation-Protected Securities Fund (VIPSX), for basically the opposite reason. Most actively-managed fixed-income funds moderately outperform their benchmark. Most intermediate core bond funds, basically actively-managed versions of BND or BNDX, do so by between 0.5% and 1.0%, reasonably strong results:

(Source: Morningstar)

A combination of equity index funds and actively-managed fixed-income funds seems likely to outperform, so my portfolio focuses on these.

With the above in mind, I selected three fixed-income funds which I had previously written about, and whose risk-return profile seemed particularly attractive. Let's take a quick look at each.

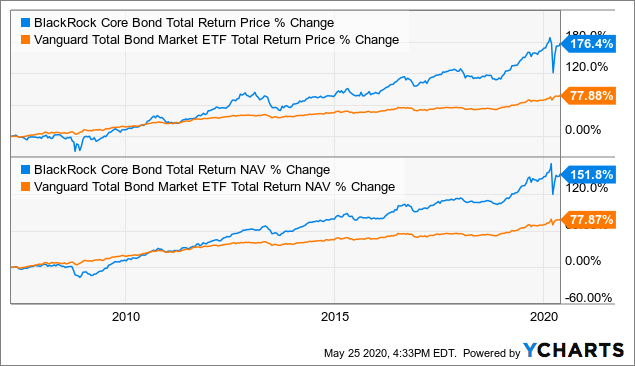

The BlackRock Core Bond Trust (BHK) is a leveraged fixed-income CEF focusing on investment grade corporate bonds, mortgage-backed securities, and treasuries. BHK would comprise 30% of the retirement portfolio, due to the fund's diversified holdings, and comparatively strong 5.28% yield. I last covered the fund here.

BHK has significantly outperformed its benchmark and most of its peers for decades:

Data by YCharts

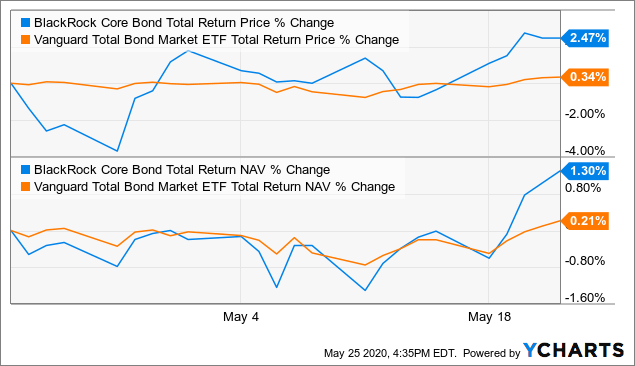

BHK has also outperformed its benchmark since I first wrote about the fund in the CEF/ETF Income Laboratory marketplace on April 21st:

Data by YCharts

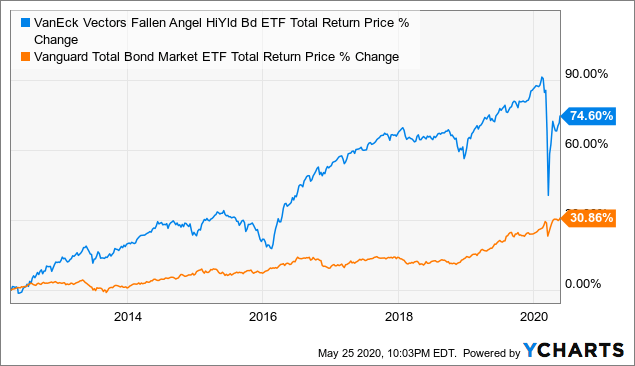

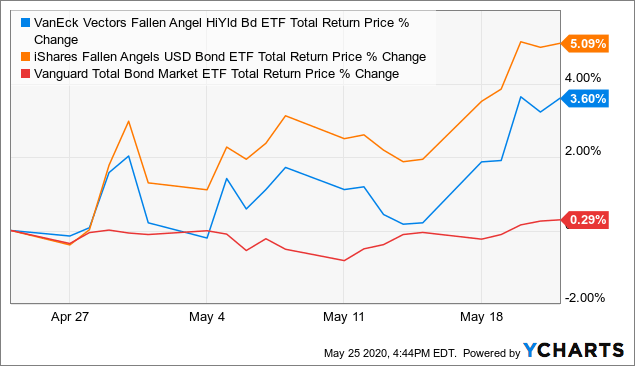

The VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL) and the iShares Fallen Angels USD Bond ETF (FALN) are both ETFs investing in "Fallen Angels," which are downgraded corporate bonds, a niche security with market-beating returns. FALN is the stronger choice, due to the fund's lower expense ratio and higher dividend yield, but I'll be focusing on the longer-lived ANGL in this article. ANGL would comprise 10% of the portfolio's holdings, and currently yields 5.51%. I previously covered the fund here.

ANGL has outperformed its benchmark for years:

Data by YCharts

Both funds have also outperformed their benchmark since I first wrote about them in the CEF/ETF Income Laboratory marketplace on April 24th:

Data by YCharts

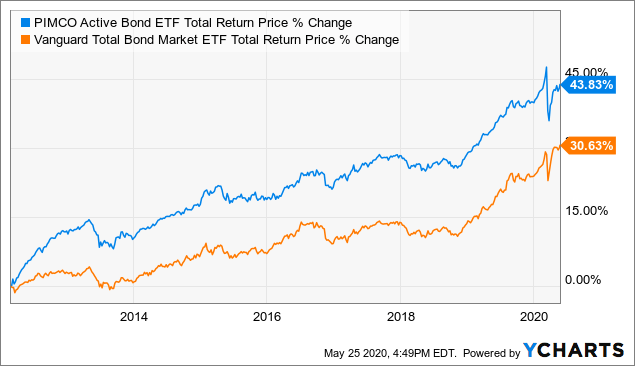

Finally, the PIMCO Active Bond Exchange-Traded Fund (BOND) is a fixed-income CEF focusing on lower risk lower yield investment grade corporate securities. BOND would comprise 10% of the fund's holdings, and currently yields 3.20%.

BOND has outperformed its benchmark since inception:

Data by YCharts

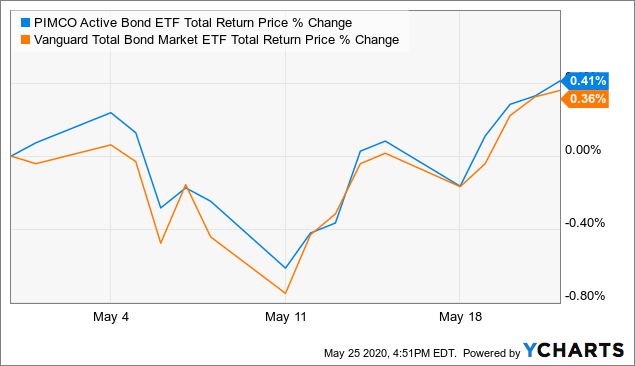

BOND has also outperformed its benchmark since I first wrote about it in the CEF/ETF Income Laboratory marketplace on April 30th:

Data by YCharts

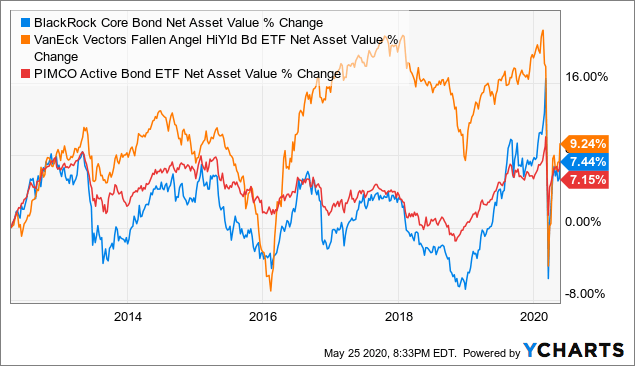

These same funds have all managed to slightly grow their NAVs since inception, strong evidence of their generally conservative holdings, overall investment strategy, and distribution policy. Capital preservation is paramount for retirees, so this is great news for these investors.

Data by YCharts

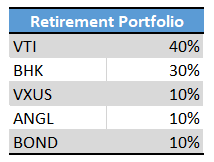

The resultant portfolio is as follows:

In my opinion, the portfolio's combination of index equity funds and actively-managed fixed-income funds should result in strong, safe, and market-beating shareholder returns, combined with a low level of risk and volatility. The portfolio's strong focus on fixed-income funds make it a natural choice for retirees.

With the above in mind, let's take a look at the portfolio's past performance.

Performance Analysis

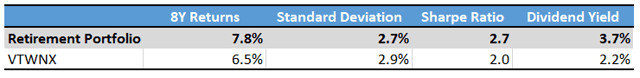

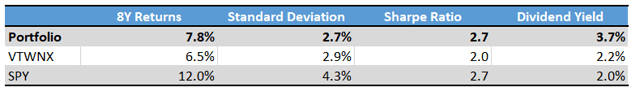

The portfolio compares favorably to VTWNX on most relevant metrics. Returns are moderately greater, due to the portfolio's focus on fixed-income funds with market-beating performance, while volatility is very slightly lower, due to the portfolio's diversified asset classes, and due to its investments in BOND. Risk-adjusted returns are understandably greater as well. Finally, the portfolio boasts a greater dividend yield.

The portfolio also compares somewhat favorably to the S&P 500, but less so. Returns are moderately lower, due to the portfolio's focus on fixed-income securities and international equities, while volatility is moderately lower, due to the same. Risk-adjusted returns are roughly comparable, very slightly greater for the portfolio. The portfolio's dividend yield is also greater.

The following table summarizes the above:

(Source: AlphaVantage - chart and calculations by author)

Sharpe ratios are quite high as the past eight years have been.

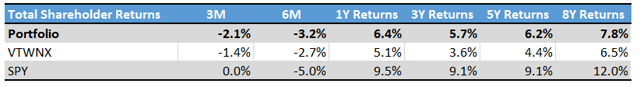

Detailed performance information is as follows: (Source: AlphaVantage - chart and calculations by author)

In my opinion, and taking into consideration the above, the portfolio constructed above would fulfill the investment needs of many retirees, and would likely outperform its benchmark and comparable peers in the coming years.

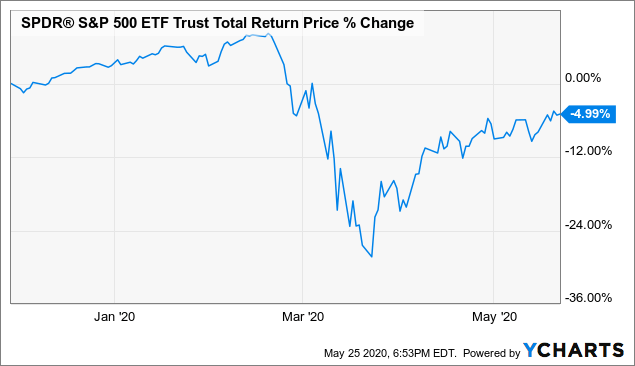

Finally, I just want to note that the performance information above assumes, for lack of a better word, that March has already ended. So, for example, six-month returns are the returns from November 30th 2019 to March 25th, when I finished the article. This isn't actually a six-month time period, but close enough. SPY's returns, as an example:

Data by YCharts

Excessive International Equities Exposure

A small point concerning VTWNX and the portfolio's equity holdings.

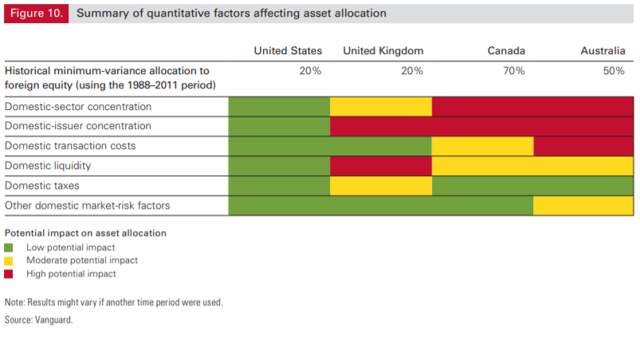

VTWNX's holdings are, according to Vanguard's own research, excessively focuses on international securities. According to the firm, U.S. investors’ foreign equity holdings should comprise about 20% of their equity portfolio, lower for fixed-income:

(Source: Vanguard)

Excessive international equities exposure has been a key factor behind VTWNX's lackluster performance in prior years. Investors wishing to reduce their international equities exposure to minimum-variance levels could consider the following portfolio:

Shifting towards U.S. equities would have improved the portfolio's past performance, although it is less clear if it will have the same effect in the future. U.S. equities are famously overvalued, at least relative to international equities, which should lead to underperformance, although analysts have been wrong about this for years. Including me.

I considered analyzing the performance of the portfolio with the above change, but decided against it, as changing asset allocations so strongly makes the performance comparisons less informative.

Conclusion - Strong Retirement Portfolio - Market-Beating Performance

Investors looking for lower-risk higher-reward retirement portfolios should consider investing in the above model retirement portfolio. Said portfolio has achieved market-beating performance at a lower level of risk in the past and will, I believe, continue to do so in the future.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive future updates.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.