PICK Is The Pick Of The Litter For Inflationary Times

by Andrew HechtSummary

- The ETF holds the cream of the crop.

- If 2008-2011 is a model, PICK will perform.

- Early 2016 through early 2018 shows the potential.

- Diversify risk with PICK.

- Inflation on the horizon.

Over the past week, Seeking Alpha published a series of articles about the leading raw material companies in the world. BHP Billiton (BHP), Rio Tinto (RIO), and Vale SA (VALE) are three of the biggest names in the business spanning three continents. From Australia to Europe and Africa to South America, the three companies supply commodities that are essential for consumers and individuals worldwide. While production is often a local affair, consumption is ubiquitous for the commodities market.

Commodities are cyclical, and their prices can be volatile. Raw material prices rise to levels where producers increase output, inventories rise, and demand tends to decline leading to market tops. On the other side of the pricing cycle, they fall to levels where production cost is above the market price when output declines; inventories begin to drop. Demand increases, leading to market bottoms. Commodities are highly sensitive to inflationary pressures. When currencies lose purchasing power, raw material prices can skyrocket. We could be on the verge of a period where the commodities asset class is on a launchpad for an unprecedented move to the upside. The iShares MSCI Global Metals & Mining Producers ETF product (PICK) holds shares in BHP, RIO, VALE, and the other leading commodity-producing companies in the world.

The ETF holds the cream of the crop

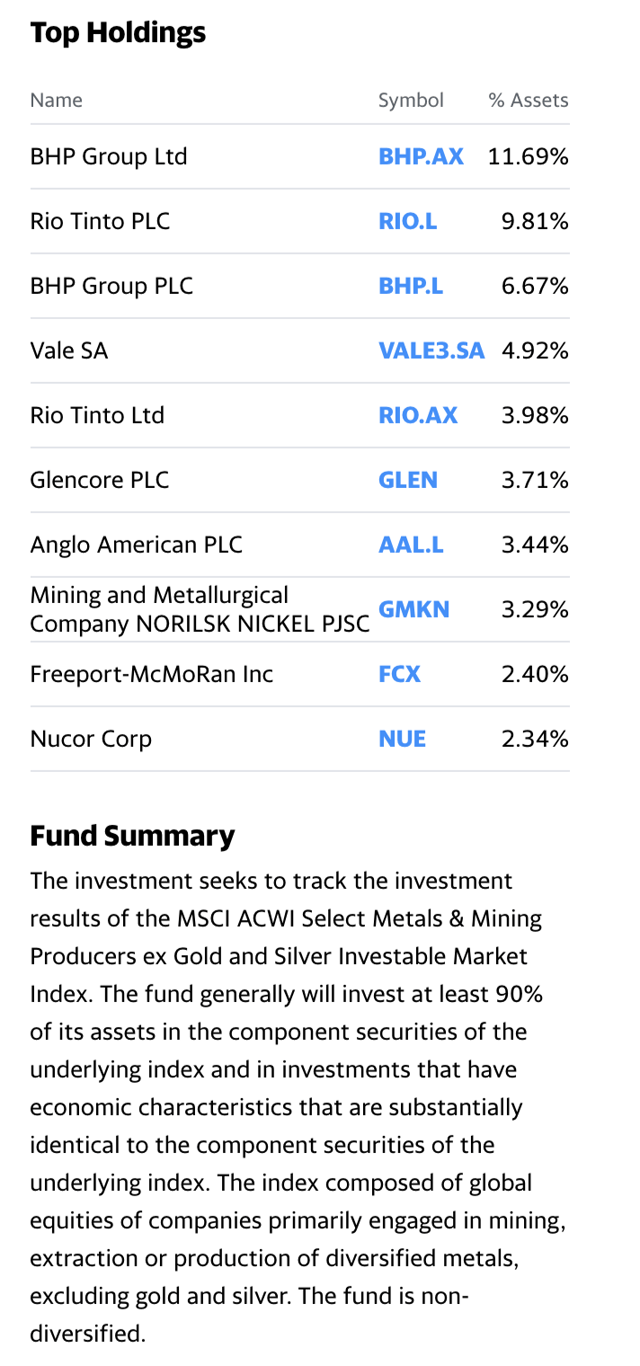

PICK has a 33.09% exposure to BHP, RIO, and VALE, but it also holds shares in other leading mining companies across the globe. The fund summary and most recent holdings of PICK include:

Source: Yahoo Finance

The ETF is a whos-who of commodity production. Glencore (OTCPK:GLNCY) is not only a commodity producer but also a leading trading and marketing commodity company. The company is the successor of Marc Rich AG, the Swiss giant in raw materials trading. Anglo American is the South African producer founded by Sir Ernest Oppenheimer, the diamond and gold mining entrepreneur who also controlled De Beers.

Freeport McMoRan (FCX) is one of the leading copper producers, with interests in North and South America, and Indonesia in the Grasberg region’s world-class copper mining property. Nucor (NUE) is a leader in the steel business.

The PICK ETF product is not only a metal and mining ETF but a barometer for inflationary pressures. PICK has $164.89 million in net assets, trades 100,420 shares on average each day, and charges a 0.39% expense ratio.

If 2008-2011 is a model, PICK will perform

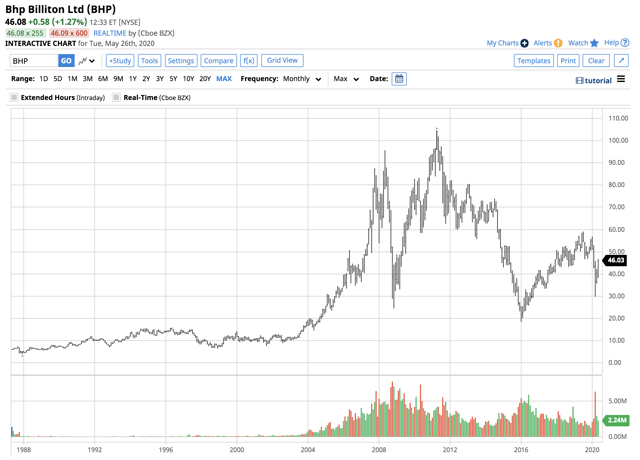

The PICK product has only been around since early 2012. In the articles on BHP, RIO, and VALE, I pointed out how the shares of the three companies together with most commodities prices tanked in 2008. They came screaming back in the years that followed, reaching peaks in 2011. Since PICK has an over 18% exposure to BHP, the price action in the company with a market cap of almost $115 billion is a barometer of what we can expect if 2008-2011 is a model for the coming years.

Source: Barchart

The chart illustrates that BHP fell from $95.61 in May 2008 to a low of $24.53 six months later in November, a decline of over 74%. In 2011, BHP shares peaked at $104.59, over four times the price at the 2008 low.

China is the world’s leading consumer of raw materials because of a combination of its 1.4 billion people and the second-largest GDP. When the Chinese economy slowed in late 2015 and early 2016, commodity prices fell to multiyear lows. BHP shares fell to a lower price than in 2008 when they reached $18.46 per share. In mid-2019, BHP moved to a high of $59.02 as the shares more than tripled in value.

Early 2016 through early 2018 shows the potential

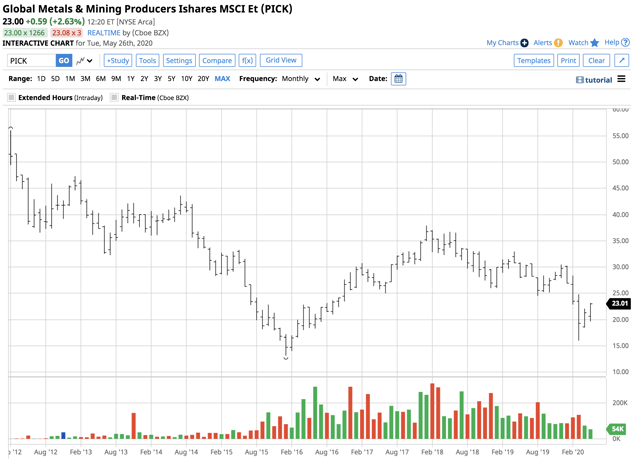

When it comes to the PICK ETF product, the price action from the early 2016 low to the early 2018 high as commodity prices recovered shows the product’s potential over the coming years.

Source: CQG

The chart shows that PICK was at a low of $13.14 in January 2016 and rose to a high of $37.91 per share two years later in January 2018. The ETF almost tripled in value over the period.

Diversify risk with PICK

All of the companies in PICK’s portfolio are world-class producers of a wide range of metals and minerals. I am bullish for the prospects of the leading companies, including BHP, RIO, and VALE. The benefit of PICK is that it removes some of the idiosyncratic risks of holding one or a few mining companies.

Risks in individual companies include management decisions, problems with specific mining properties, or in countries around the world that could change the rules, policies, or laws when it comes to allowing companies to extract the commodities from within their borders and export them around the globe. Diversification eliminates some of the risks and provides for exposure to the commodity prices without taking long positions in the specific raw materials.

Inflation on the horizon

The US Treasury borrowed a total of $530 billion from June through September 2008, which was a record. In May 2020, it borrowed $3 trillion, over five times the amount, and there is more borrowing on the horizon. The massive increase in the global money supply is inflationary as it weighs on the purchasing power of fiat currencies around the world. The bottom line is that more money in the system is inflationary, and inflation is the best friend of the commodity asset class. Over the coming years, the PICK ETF product has the potential to be the pick of the litter in the coming years. I am bullish for commodities over the coming years and believe we could see a move that takes prices far beyond the peaks in 2011.

If commodities are on a launchpad in late May 2020 because of inflationary prospects, PICK is an ETF that could hedge and enhance your portfolio.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.