Hidden Stock Market Gems: Fuchs Petrolub

by Daniel SchönbergerSummary

- Fuchs Petrolub is the world's largest supplier among the independent lubricant manufacturers from Mannheim, Germany.

- With no debt, a wide economic moat around the business, and stable management team, Fuchs Petrolub is in a great position.

- With an intrinsic value of €30.70, Fuchs Petrolub seems fairly valued, but the stock could drop lower (considering an almost 70% decline during the Financial Crisis).

In 2018, I started my series called "Preparing for the end of the cycle" in which I was analyzing several companies, which had to fulfill one basic characteristic: high-quality companies with a wide economic moat built around the business to ensure stable long-term performance. And like many other stocks in the last few years, most of these companies were more or less overvalued but could become a great investment at lower prices.

(Source: Pixabay)

In the coming weeks, I will start another series and look at several high-quality companies again. Some will be the same as in the last series, and some other companies I will cover for the first time. And while not all companies will be small companies (I will also include some large-cap companies), all companies are more or less undercovered on Seeking Alpha, although these companies outperformed the major indices over the long run in an impressive manner. I will start today with the German company Fuchs Petrolub (OTCPK:FUPEF) - a multinational manufacturer of lubricants.

Business Description

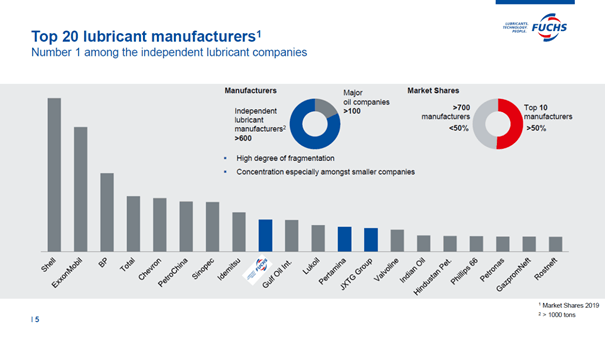

Fuchs Petrolub is a German company that was founded 1931 in Mannheim. As the preferred shares of the company are only listed in the MDAX (which is listing the 60 biggest German companies, excluding those 30 companies listed in the DAX), it is probably not well-known outside Germany. But the company is the world's largest supplier among the independent lubricant manufacturers and among the top 10 lubricant manufacturers - including names like Royal Dutch Shell (RDS.A), Exxon Mobile (XOM) or PetroChina Company (PTR).

(Source: Fuchs Petrolub Investor Presentation)

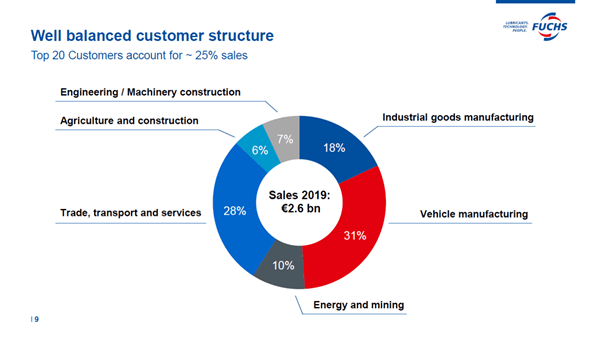

Fuchs Petrolub develops, produces, and sells a full portfolio of lubricants and related specialties for virtually all industries and areas of application and has a portfolio of 10,000 products which are all designed to reduce friction. The more than 100,000 customers in more than 150 countries include automotive suppliers, companies in the engineering, metalworking, mining and exploration, aerospace, power generation, construction or transportation sector and many others.

(Source: Fuchs Petrolub Investor Presentation)

Strong Position…

Fuchs Petrolub is also in a very strong position due to its healthy balance sheet, its leading position in the industry, the wide economic moat resulting from switching costs and because of its stable and consistent management team.

…from a financial point of view

Especially right now, in times of turmoil and huge fluctuations of asset prices, the financial health of a company is more important than ever. High debt levels can be a huge problem when revenue and cash flow are contracting, and banks probably won't grant credits to companies in distress. But, in case of Fuchs Petrolub, we don't really have to worry. Not only has Fuchs Petrolub basically no debt at all on its balance sheet (nor in the past years), it also had €219 million in cash and cash equivalents on December 31, 2019. This might be a strong statement, but I can't find any problem with the company's balance sheet, and from that point of view, it is definitely a company we can own during a phase of credit and liquidity contraction.

…in its industry

But not only the balance sheet and financial health are important. The competitive position within the industry also plays an important role. Fuchs Petrolub is the 9th largest lubricant company worldwide, but excluding the major oil companies, the company from Mannheim is the largest among the 570 independent manufacturers. The two closest competitors are Valvoline (VVV) and Gulf Oil International. With about 700 competitors all over the world (major oil companies as well as independent manufacturers), the industry is rather fragmented. But, on the one hand, the industry consolidated during the last two decades. In the mid-90s, Fuchs Petrolub competed with about 1,700 other companies and right now about 700 remained. On the other hand, Fuchs Petrolub is number one in its market and has a relative high market share and is profiting from being the industry leader.

(Source: Fuchs Petrolub Investor Presentation)

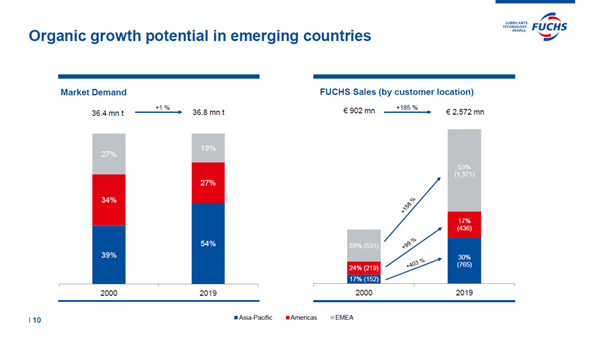

And a leading position in the industry is especially important, when considering that the overall market could not grow in the last two decades. With a total market demand of 36.8 million tons in 2019, it is almost the same as in 2000 (36.4 million tons). After the financial crisis in 2009, demand declined to 31.9 million tons and then increased again over the following years. For 2020 and the years to come, we can assume a similar scenario. We also see a constantly declining demand from Americas and the EMEA region, while more than half of the global demand for lubricants is coming from the Asia-Pacific region now (for more details see the first slides of this presentation). Considering the stagnating market demand, Fuchs Petrolub can only grow by price increases, by acquisitions or by gaining market shares (from competitors).

(Source: Fuchs Petrolub Investor Presentation)

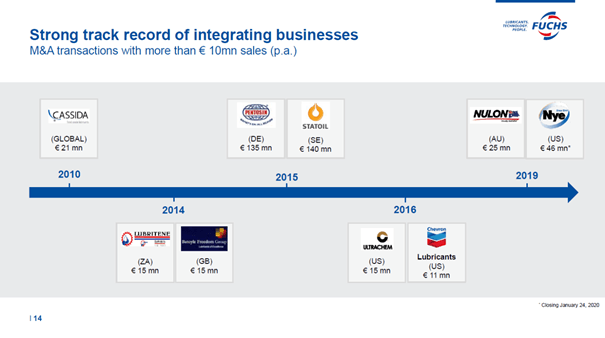

And acquisitions were always a part of Fuchs Petrolub's growth strategy with the focus lying on smaller acquisitions (Statoil being the biggest acquisition in the last decade for €140 million).

…due to a wide economic moat

And while being among the industry leaders is important, the competitive advantage Fuchs Petrolub has, as it is profiting from switching costs, is even more important. Basically, Fuchs Petrolub is producing a product that is cheap compared to the total costs of a good, but has a huge effect on the end product. Lubricants in a car, for example, are responsible for only a very small fraction of the overall costs but are extremely important for the quality and durability of the product. We have a product with a high benefit/cost ratio when we have a mismatch between the costs (which are very low) and the effect on the end product (very high). In this case, switching costs are extremely effective. When a car manufacturer is using Fuchs Petrolub because of its quality and can save a few dollars (or euros) by using the lubricant of another producer, management won't take the risk of producing a low-quality car that is failing after a few thousand miles because of using the wrong lubricant for saving a few dollars in the production process. These are high economic risk costs for the company, because car manufacturers like Daimler (OTCPK:DDAIF) or BMW (OTCPK:BMWYY) probably would see sales decline if the cars are suddenly not as good as before because of using the wrong lubricant. And as the lubricants are only responsible for a small fraction of the overall costs, Fuchs Petrolub can easily increase its prices in the low single digits without losing any customers (resulting in pricing power for Fuchs Petrolub). The company is also producing an indispensable product that can be found in every machine and in every place with friction, but the product (lubricants) is rather invisible, and customers of Fuchs Petrolub might not even think about it when talking about cost reduction.

Aside from switching costs, Fuchs Petrolub is also in a great position as it is fully focused on lubricants and has an advantage over the major oil companies as Fuchs has gained massive knowledge in lubricants and special applications. And being number one among the independent companies and also being a full-line supplier with a global presence gives Fuchs Petrolub an advantage over the other independent companies. Fuchs Petrolub combines the strengths of full-liners with the individuality of niche specialists. As long as Fuchs Petrolub uses its financial power to keep on investing in R&D and staying ahead, we can be pretty confident about the future. Fuchs Petrolub spends about 2% of its revenue for research and development and increased the absolute as well as the relative amount (in 2012, only 1.61% of revenue was spent; in 2018, the company spent 2.03% on R&D). And about 10% of the company's staff is focused on R&D projects.

And to take away the 100,000 sticky customers would take a lot of work by a new competitor: it does not only need similar good or even better products and probably cheaper prices, but also a lot of persuasiveness. Complicating for new competitors is also the fact that Fuchs tailors its products to the very specific needs of the customers. A new competitor would first have to invest in research and development to offer substitutes, and after higher upfront costs, it is especially difficult to offer the product at cheaper prices than Fuchs Petrolub.

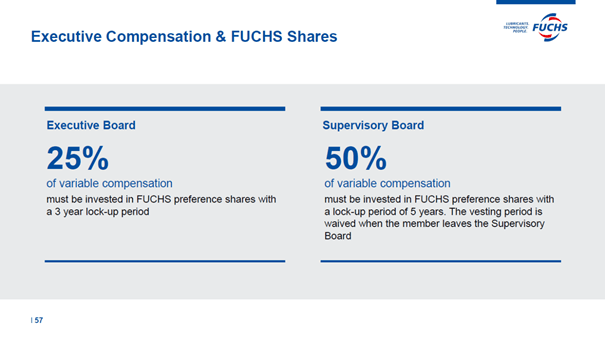

…due to stable management

Despite having more than 5,500 employees and being listed on the stock exchange for more than 30 years, Fuchs Petrolub can still be called a "family business". The company is still in the hands of the Fuchs family as they hold 55% of the ordinary shares and run the company. Right now, the third generation is running the company, and Stefan Fuchs is only the third CEO the company had. After the death of the founder Rudolf Fuchs in 1959, his son Manfred Fuchs became CEO and led the company until 2004. In almost 90 years, the company was led by only three people, which is providing extreme consistency and stability. And the fact that 25% or 50% of variable compensation of executives must be invested in Fuchs Petrolub preference shares with a lock-up period of 3 or even 5 years is also a good sign for investors.

(Source: Fuchs Petrolub Investor Presentation)

Risks

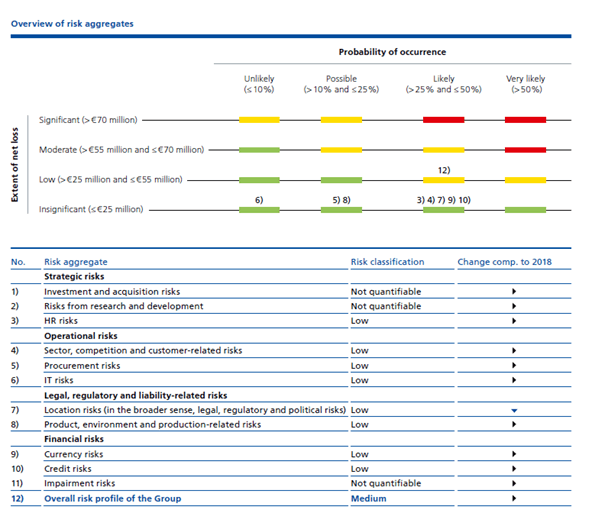

But despite all the positive aspects, Fuchs Petrolub is also facing risks like any other company, and we need to take that into account. In its annual report, Fuchs Petrolub has a "risk map" with different risks management sees for the company as well as the likelihood of occurrence and the extent of net loss. The risk classification of management is low in almost all categories, but management might be biased a little to see its own company better as it is.

(Source: Annual Report 2019)

While the above-mentioned risks might be no threat to Fuchs Petrolub, the risk assessment doesn't include the threat of a pandemic and global recession. And there are also other aspects which are important when talking about risks and threats to the business model. As already mentioned, a big user of lubricants is the automotive sector, and the companies operating in the automotive sector are important customers. In 2019, vehicle manufacturing was responsible for 31% of total sales, and declining sales in that segment are not an existential threat to Fuchs Petrolub, but one-third of revenue is nothing management can ignore.

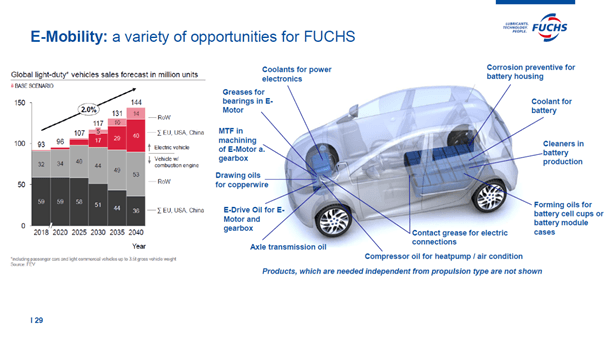

Fuchs Petrolub will definitely be affected by the ongoing trend towards E-Mobility and cleaner environment as well as attempts to get away from internal combustion engines. To understand, what impact this major trend and shift towards E-Mobility might have for the business model, we have to look at a few aspects:

- While we can expect a decline of engine oil- and gear oil-usage, E-Mobility will also create new requirements for lubricants - for example, to control temperature and new necessary materials. There will be demand for battery cooling and other cooling lubricants. Fuchs Petrolub also expects an increase in grease demand as new applications come up. The chart below shows where new products might still be necessary.

- North America and especially Europe are trying to shift towards E-Mobility, but we are talking rather about decades than just a few years before this shift will really happen (and the pandemic and its consequences might slow down the efforts towards E-Mobility). Management has to invest in research and development, and the company is already addressing the issue and has still enough time to respond before this major shift will happen. But Fuchs Petrolub is a very international company, and while the Western world might shift towards E-Mobility, in other parts of the world, the internal combustion engine is still important. And management is also trying to make Fuchs Petrolub a more international company and expanding in these regions. Until 2040, we can expect the number of cars with ICE to stay more or less stable (with the number of cars in Africa and Asia increasing). The overall number however will continue to increase about 2% due to the increase of electric vehicles.

(Source: Fuchs Petrolub Investor Presentation)

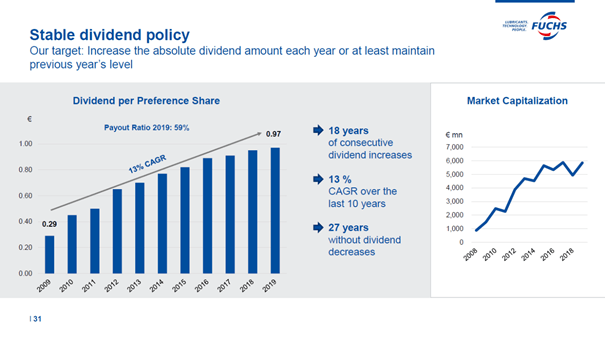

Dividend

Fuchs Petrolub is also interesting for its dividend. Not only could Fuchs Petrolub keep the dividend stable for 27 years, it could also increase its dividend for 18 consecutive years, and it is therefore one of the very few companies in Germany coming close to achieve the dividend aristocrat status. In 2020 (for the business year 2019), Fuchs Petrolub paid €0.96 per ordinary share (and I would prefer the ordinary share), resulting in a dividend yield of about 3.2% right now.

(Source: Fuchs Petrolub Investor Presentation)

Comparing the dividend to €1.63 earnings per ordinary share in 2019, this is resulting in a payout ratio of about 59%, which is a rather high payout ratio. But with about €130 million in paid dividends and €162 million in free cash flow and €175 million in free cash flow before acquisitions, the dividend is still covered.

Intrinsic Value Calculation

For 2020, it is quite difficult to provide any meaningful guidance, which is the reason why management offers no statement for 2020. In a previous guidance, management estimated free cash flow before acquisitions to be around €130 million. That estimate does not include the negative effects from the pandemic and the worst recession in the last decades. And many of the customers - like automobile, construction or transportation companies - will be hit hard reducing the demand for the products of Fuchs Petrolub. Although it might seem extreme to you, I will assume €0 free cash flow in 2020 to be on the safe side.

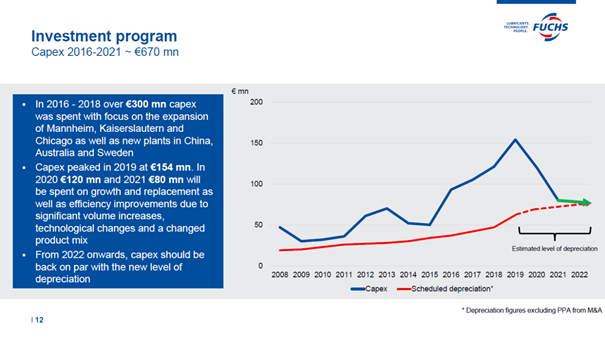

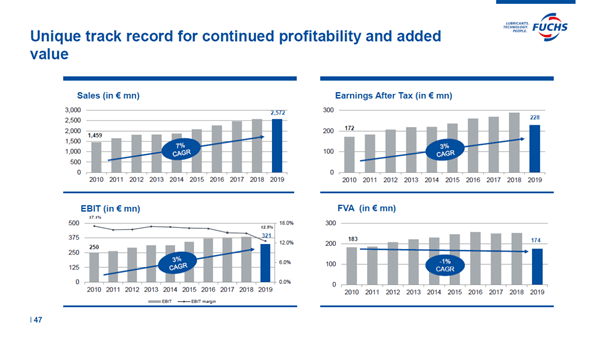

(Source: Fuchs Petrolub Investor Presentation)

For 2021, I will still assume that cash from operations will be 20% lower than in 2019 (for comparison, in 2019, the company saw a 15% decline in revenue), but as capital expenditures will be much lower from 2021 going forward (about €80 million), the free cash flow will be €183 million in our calculation. For 2022, I will assume cash from operations to be the same as in 2019 again (€329 million), and with the low capital expenditures of €80 million, this leads to free cash flow of €249 million. From 2023 going forward, I will assume 5% growth annually. When looking at the bigger picture (last three decades), revenue increased with a CAGR of 6.24% between 1989 and 2019, and net income increased with a CAGR of 13.93% (and we have to take into account that net income already declined pretty steep in 2019; until 2018, the CAGR was even 15.37%). But looking at the last few years (since 2010) is making me a little more cautious.

(Source: Fuchs Petrolub Investor Presentation)

Using these assumptions, we get an intrinsic value of €30.70 for Fuchs Petrolub. When taking into account that the free cash flow in 2020 might be higher than €0 and the long-term growth rate might also be higher than 5%, the intrinsic value could be much higher. But as we are rather cautious right now (and we should be), we also include a margin of safety of 20% leading to a preferred entry point of €24.56.

Technical View

Aside from an intrinsic value calculation, technical analysis can also help us to determine potential entry and turnaround points for the stock. When looking at the technical picture, the level between €24.50 and €25.50 is a strong support with the lows of 2013, 2014 and 2020 as well as the 50% Fibonacci retracement. This would basically be our preferred entry point from the intrinsic value calculation above. If that support level should not hold, the next support level would be between €20.50 and €21.00 with the 38% Fibonacci retracement and 200-month simple moving average in that range. And finally, there are also support levels at €14 (where we find 2011 lows and the 23% Fibonacci retracement) and at about €12 (with the highs of 2006 and 2007).

(Source: Own work created with Traderfox)

A decline to €14 or €12 might seem extreme with Fuchs Petrolub trading at €30 right now, but when looking at the last bear market during the Financial Crisis 2008/2009, the stock declined 68% (which is pretty steep for a wide-moat company), and when taking the highs of 2018 as the starting point, a 68% decline would lead the stock to €15. And from that point of view, €14 or €12 doesn't seem so unlikely.

Conclusion

Although Fuchs Petrolub will be facing some challenges in the next few years with the shift to E-Mobility, the company has not only a successful history but also a very stable business model. The company might also be fairly valued right now. Nevertheless, I consider another decline likely and assume we will reach at least the March 2020 lows again (with the possibility of dropping even lower). And no matter if you buy now or wait for lower prices, the wide moat, the strong balance sheet and the high level of consistency in management should make the company and stock a great long-term investment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.