Epizyme, Inc. Is Doing Everything Right But Its Shares Appear Fairly Priced

by Boston Biotech InvestorSummary

- Tazverik's current FDA approval for an "ultra-rare" disease that, per our analysis, afflicts less than 200 patients/US/year (yes two-hundred, not a typo) & therefore offers minimal revenue opportunity near term.

- While Tazverik will likely receive 3rd line follicular lymphoma approval (PDUFA 6/18/2020), our analysis concludes, with new competing therapies imminent, prescription volumes won't generate enough revenues to justify Epizyme's valuation.

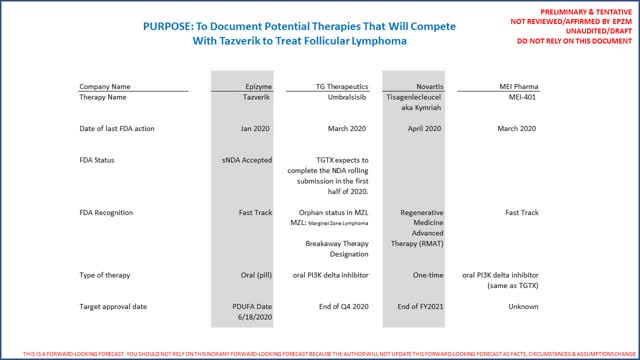

- Imminent competitors in Follicular Lymphoma include TG Therapeutics' Umbralisib (granted orphan status by FDA), MEI Pharma's inhibitor just "fast-tracked" by FDA & Novartis' Kymriah/Tisagenlecleucel (recent RMAT designation from the FDA).

- Tazverik as 2nd line Follicular Lymphoma therapy appears likely but it's years before approval. The remaining pipeline is impressive but any commercialization of EPZM's remaining pipeline appears ~5 years away.

- Epizyme's enterprise valuation as a multiple of 5-year consensus revenue estimates (per Seeking Alpha) are, at best, consistent with rare disease peers and, at worst, higher than oncology peers.

It should first be noted we did not consult with Epizyme, Inc. in the preparation of this article.

Our analysis concludes Epizyme, Inc.'s (NASDAQ:EPZM) is an incredible company and EPZM's product Tazverik could have a bright future treating those who suffer from Follicular Lymphoma. EPZM's Tazverik has a sNDA awaiting approval (PDUFA date of 6/18/2020) for 3rd line Follicular Lymphoma ("FL") label which, if approved, should generate meaningful revenues. The author would remind readers that the s in sNDA mean supplemental because the underlying product has already been approved by the FDA.

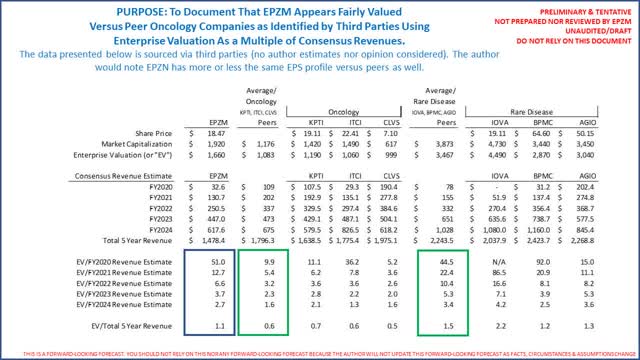

However, using peer rare disease and peer oncology companies per Seeking Alpha and Yahoo Finance and 5 year consensus revenue estimates per Seeking Alpha, it is apparent that EPZM's valuation as a multiple of 5 year consensus multiples are on the high end. These data points suggest limited near term upside unless EPZM revenue guidance is materially increased which, our analysis concludes, is unlikely as at least 3 competing therapies all with impressive clinical attributes, and all 3 just granted some positive attribute by the FDA, just like EPZM, will be commercialized shortly after Tazverik's sNDA is approved (assuming approved). The following is a summary of EPZM valuation versus consensus revenue estimates:

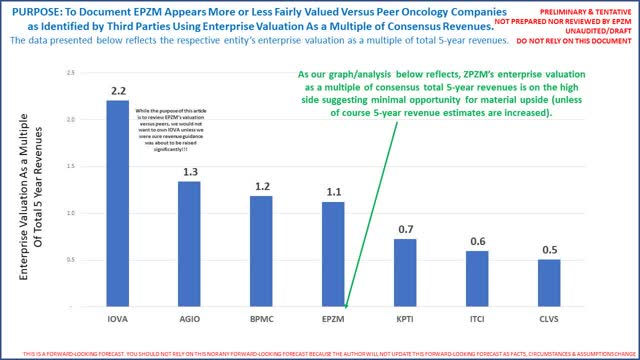

To be crystal clear, if Tazverik's sNDA is not approved EPZM's valuation will likely fall dramatically. Again our analysis concludes rejection is unlikely. Assuming approved, you will note EPZM's multiples above are still almost twice that KPTI (which expects to be indicated to treat 2 cancers that afflict more than 8,000 people in the US per year versus EPZM's 1). These data points by themselves suggests limited upside because as noted above and below EPZM already trades on the high end of forward looking revenues. It is also possible KPTI and oncology peers are undervalued). The following graph provides a simple visual documenting EPZM's enterprise valuation as a multiple of total 5 year consensus revenues:

EPZM's enterprise valuation as a multiple of total 5 year revenues is clearly on the high end. Furthermore, TG Therapeutics (ticker symbol TGTX) also has an interesting product called Umbralsisib in a Phase 3 trial that also shows impressive efficacy in treating Follicular Lymphoma and was just granted "orphan" status by the FDA in March 2020 as an inhibitor. MEI Pharma's (ticker symbol "MEIP") inhibitor (still in Phase 2 trials) was granted "fast-track" designation by the FDA in FL also in March 2020. Then in April 2020, the FDA granted Novartis' Kymriah (aka Tisagenlecleucel) "Regenerative Medicine Advanced Therapy" (or "RMAT) designation for Follicular Lymphoma. To be transparent the author is not familiar with the "RMAT" designation. Novartis' expects to launch Tisagenlecleucel in 2021 as a "one-time" therapy. The following is a summary of all the therapies which the FDA took some kind of action on since 1/1/2020 (this may or may not include other therapies to treat FL in development):

The author did not do a comprehensive clinical review of these 3 competing therapies versus Tazverik. The primary reason we note them is because it is important all will compete to treat the same ~10,000 of the ~14,000 patients/US/year who fail 1st line chemotherapy and will likely be indicated for Tazverik in FL. To summarize, it is these 2 primary reasons our analysis concludes there is limited upside in EPZM:

1. EPZM trades on the higher end of consensus revenue estimates versus peers and:

2. 3 competitors are close (within 18 months) to commercializing products with the exact same indication as EPZM's anticipated indication (3rd line Follicular Lymphoma) even if a different formulation.

Below our analysis below will show that EPZM's future over the next 5 years is tied to Follucular Lymphoma ("FL") because Tazverik's current approval is for an "ultra rare" disease and hence offers very limited peak revenue potential. EPZM has a great opportunity to treat/cure FL but it appears there are no opportunities for EPZM beyond FL for years. While EPZM's future for now looks OK in FL because there is no standard of care and there appears enough room for multiple therapies. However, these are impressive competitors, 2 of which have valuations in the billions. Investors should understand this is generally a shared risk to any oncology therapy.

We should reiterate the valuation and revenue data points above are from third parties and not the estimates nor opinions of the author. We would also point out EPZM's share price as a multiple of consensus EPS paints a similar profile. The oncology related peers noted may not be perfect (and perhaps CLVS should be ignored entirely), as there's enormous variance in multiples, but it does suggest EPZM upside is limited unless EPZM revenue estimates are materially increased in the near future which, again our analysis concludes is unlikely. Longer term the future is more uncertain as these new therapies are introduced to the FL community. Revenues and cash flow are what is most important when assessing the valuation of a stock. The good news is, after analysis of EPZM's product and anticipated approval of a NDA expected 6/18/2020, our analysis concludes the EPZM revenue estimates above appear more or less reasonable. We will demonstrate below in detail.

By way of background, EPZM is a biopharmaceutical company that discovers, develops, and commercializes novel epigenetic medicines for patients with cancer and other diseases primarily in the United States. EPZM was founded in 2007, has approximately 200 employees (as of December 31, 2020) and is located in Cambridge, MA. EPZM's lead product is called Tazverik (aka tazemetostat) which was first approved by the FDA for epitheleoid sarcoma ("ES") in January 2020. EPZM then filed a second NDA for Tazverik in December 2019 for Follicular Lymphoma ("FL"). The FDA accepted EPZM's NDA for FL and set a PDUFA date of June 18, 2020. EPZM set a list of price of $15,500 for Tazverik and, per EPZM's CFO on the Q1 2020 earnings conference call (22 minutes 20 seconds into the call) said gross to nets have been roughly 10% but guided to 10 - 15%. This suggests a net price to estimate revenues at approximately $13,175 on the low end (at 15%). We will therefore use a conservative $13,175 throughout the rest of this analysis except when assessing Q1 2020 revenues for which we will assume a 10% gross to net.

To calculate the potential annual revenue estimate of Tazverik for ES it is of course first most important to get an estimate of the prevalence of ES in the United States. Per a review of EPZM's May 2020 investor presentation, EPZM does not provide an estimate of the ES population in the United States like it does for FL. During the Q1 2020 earnings conference call (exactly 26 minutes into the call), EPZM's CEO notes ES is an "ultra rare type of tumor." We Googled "number of epitheleoid sarcoma patients in the United States." Per cancer.org there were 13,130 new soft tissue sarcomas identified in the United States in the year 2020. Per wikipedia epitheleoid sarcoma accounts for less than 1% of soft tissue sarcomas. This suggests there are literally only ~130 or so cases of epitheleoid sarcoma in the United States (1% of 13,130). Per a 2005 NIH study, the prevalence of ES is .041 per 100,000 people, or .4 people for every 1,000,000 people. With a population of 320 million in the United States, this suggests a patient population of ~128 people (consistent with cancer.org). Hence we have 2 data points suggesting Tazverik is only currently indicated in ES for literally ~130 people in the United States. While this may appear absurdly low, EPZM's CEO acknowledged that Tazverik was prescribed for 38 patients in Q1 2020 (after it was approved in January 2020). It is reasonable to conclude there was "pent up" demand when approved suggesting ~130 patients eligible in the US is close. Q1 2020 Tazverik revenues were $1.35MM which is roughly 38 patients at 2.5 prescriptions/patient at ~$14,000 per prescription (we'll use 10% gross to net at launch). The best case Tazverik revenues from these 130 patients even if they all received 12 refills per year would be roughly ~$20 million. This is important because the author has read estimates on social media that the ES indication is worth $100 million/year for EPZM. We are unable to recalculate such an estimate (or come remotely close). If the market expects $100 million in Tazverik revenues from ES, our analysis concludes the market will be disappointed.

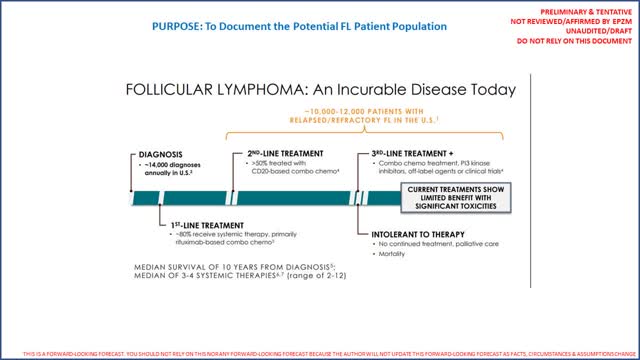

While the Tazverik revenue opportunity may appear very small in ES, the revenue opportunity in FL, if approved by the FDA on 6/18/2020, appears considerably more compelling. As noted EPZM filed an NDA for Tazverik as a 3rd line therapy for FL. While we do not have exact patient counts for FL, EPZM does include the following worksheet in their investor presentation (page 12 of 26):

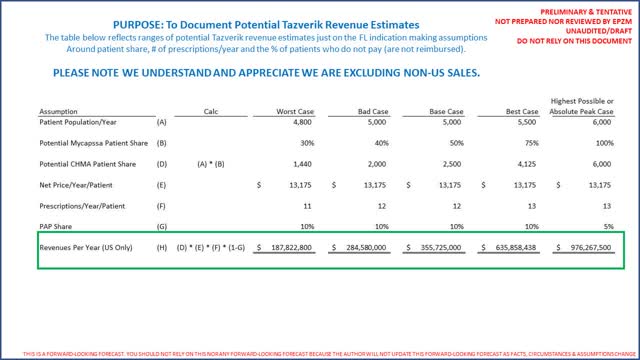

While again we do not have exact counts, based on the worksheet provided above it appears reasonable to conclude that the specific patient population for a 3rd line therapy is roughly one-half of the 10,000 to 12,000 total FL patients per year identified by EPZM. We did review TGTX's investor presentation (page 10) and noted FL patient estimates consistent with EPZM. On EPZM's Q1 2020 conference call (31 minutes and 40 seconds), EPZM's CEO noted there is no standard of care in FL. For this analysis we will assume there are between 5,000 and 6,000 patients for which Tazverik will be indicated (as a 3rd line therapy). Per ClinicalTrials.gov we know patients were dosed for 12 (twelve) 28 day cycles. Hence to estimate revenues we come up with a worst case to best possible case (assuming Tazverik was prescribed to all 6,000 patients assumed indicated as 3rd line), we need to estimate a share of eligible patients, how many prescriptions they will be provided a year (could be 13 as prescriptions are for 28 days), the net price/prescription using the low end of the gross to net guidance and an estimate of how many prescriptions will be filled at no cost (under a PAP like program for those who simply cannot afford treatment). The following table provides a very broad range of potential revenue estimates in just the United States:

Remember the word refractory means stubborn and more specifically in cancer difficult to manage. Furthermore EPZM's CEO said there was no standard of care in FL. Hence it is possible we are underestimating the patient population in the table below by a factor of 2 as it is possible there will be considerable off label use if there is truly no standard of care as EPZM's CEO suggests and Tazverik is able to take material patient share. However, the ultimate purpose of providing the revenue forecast in the table above it to see if EPZM's 5 year consensus revenue forecasts are more or less in the ballpark, which it appears they are (compare for yourself to the 5 year estimates above in the valuation exercise). To reiterate our primary theses is that EPZM appears overvalued only when assessing its valuation as multiples of forward looking revenues versus peer companies. Our analysis does not consider how well Tazverik may compete clinically with the 3 imminent FL products noted.

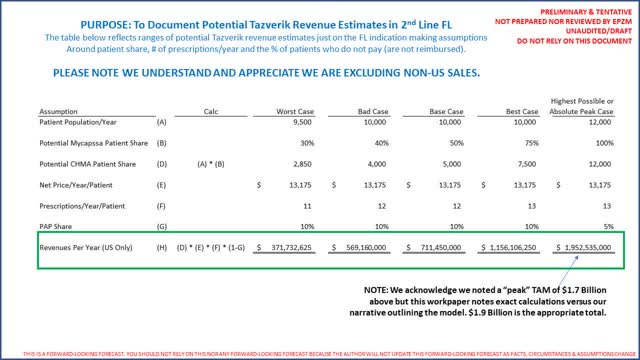

Leaving the 3 competing products completely aside, the author should note, while not a physician nor an expert in EPZM's science, should there be considerable "off-label" use of Tazverik in 2nd line FL due to its compelling clinical profile and successes, EPZM's revenue opportunity could be materially understated at least while the other 3 products are not approved. Remember per EPZM there are between 10,000 & 12,000 FL patients eligible as 2nd line (half that in 3rd line). With a cost of Tazverik/patient/treatment cycle of $13,175 and a 10% PAP factor (those that simply cannot pay) suggests the highest possible revenues/year if all 12,000 patients are only treated with Tazverik would be (or 12,000 x ~$140,000/year/patient) would be $1.7 Billion. This is obviously unrealistic as EPZM revenue potential but does provide the total addressable market for Tazverik in FL.

We would also note Tazverik's clinical profile in FL is strong. Per EPZM's investor presentation (page 8) Tazverik showed a 15% ORR with a 16 month DOR (duration of response) in ES (NOT FL) in a 19 person trial (incidentally another data point suggesting ES is truly an ultra rare disease). In FL, EPZM's clinical trial showed significant complete and partial responses noting independent review committee said Tazverik demonstrated tumor reduction in 98% (44 of 45 patients) trial participants. This is an incredible clinical data point. The author notes that the clinical data appears so overwhelming it may explain why EPZM is priced higher than peers. However, such compelling data would also translate into a higher revenue forecast especially if it can out-treat these 3 new therapies. It is unfortunate EPZM does not retain traditional investor presentations given at oncology conferences on its website.

EPZM's intermediate to long term revenue estimates appear reasonable if it can maintain a material share of the FL market. Again our analysis more or less concludes intermediate term (3 - 5 years) success is already baked into EPZM's share price. EPZM's primary development plan for Tazverik is to get it approved as a 2nd line therapy in FL which would double the number of patients indicated for Tazverik. Going back to our revenue analysis for Tazverik above we simply double the number of patients as follows:

Just to be clear, it appears approval for Tazverik by the FDA as a 2nd line indication is years away as patient enrollment in a confirmatory trial is still ongoing. While approval appears years away, the clinical data results in the clinical trial for the 3rd line indication was overwhelming. With compelling clinical data for Tazverik as presented by EPZM, our analysis concludes Tazverik could possibly become the standard of care in FL until at least the 3 new products are launched. However, it only appears that the risk/reward benefit has already been priced into EPZM's share price (or EPZM peers are undervalued which is just as possible). Finally, the fact that 3 well respected competitors (perhaps 2 are "very well" respected) pose a material risk we recommend avoiding EPZM's at its current valuation.

Epizyme Balance Sheet & P&L Outlook

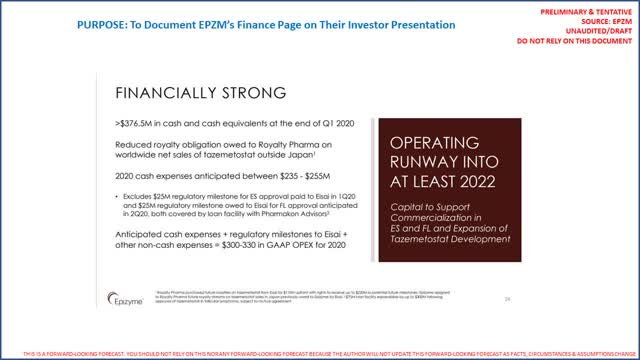

EPZM is very well capitalized with $378 million in cash (including ~$2 million in restricted cash) and ~$60 million in immaterial debt and notes a cash runway into FY2022. At the moment liquidity is not an issue of concern for shareholders. The following is an excerpt from EPZM's investor presentation (page 24):

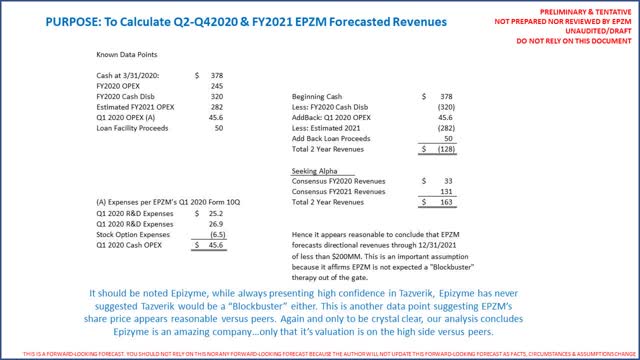

From this page we can ascertain how, directionally, EPZM forecasts revenues through FY2022 because we know cash on hand at 3/31/2020, operating expenses for 2020 (which we can use as a basis for 2021) and the fact that EPZM believes cash lasts until at least 12/31/2021. It is by no means perfect but directional as follows:

SOURCE: EPZM Q1 2020 Form 10Q

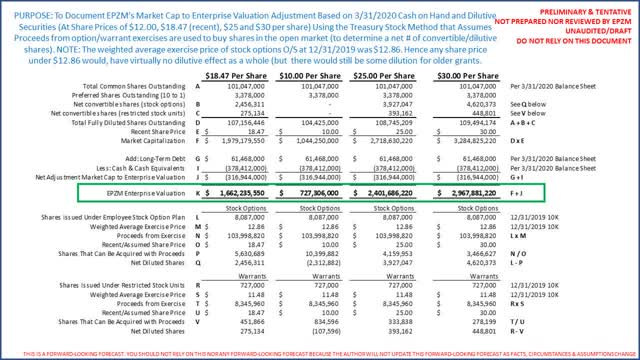

To determine EPZM's market capitalization to enterprise valuation adjustment and number of fully diluted shares outstanding our analysis concludes:

Investors should consider these reconciliations have not been reviewed nor approved by EPZM nor any third party. Investors are encouraged to review these reconciliations. Broadly speaking the more Epizyme's share price increases the more dilution from stock options and the like (consistent with any high growth company). Most important, for every $1 increase in EPZM's share price the enterprise valuation increases about $110 million which is a data point supporting our thesis that, versus peer oncology companies, EPZM's share price appears on the high side. Furthermore, at $25/share EPZM would have an enterprise valuation of $2.4 Billion which would mean its valuation as a multiple of forward looking revenues also increases. Last, as EPZM burns cash over the next 2 years the less the difference between its market capitalization and enterprise valuation. This would be at a time new products hit the market.

CONCLUSION

To conclude, we are very bullish on EPZM's future and outlook. However, because EPZM's Tazverik is approved only for an "ultra-rare" cancer, EPZM's material revenue opportunity comes from an approval for Follicular Lymphoma (PDUFA 6/18/2020). If EPZM's sNDA is not approved, EPZM's shares will decline materially. However, since Tazverik is already approved and because the FL trial data is so compelling we believe this unlikely.

That being said, because EPZM's valuation as a multiple of forward-looking consensus revenues is on the higher end versus peers, coupled with the imminent introduction of 3 new therapies with compelling clinical value propositions, we would recommend waiting to invest in EPZM until its price is more in line with peers. We were thinking $13/share would be a reasonable entry point. Alternatively, we would recommend avoiding EPZM until it is known which of the 4 imminent therapies being launched over the next 18 months is considered best.

Should EPZM's Tazverik be approved as a 3rd line treatment for FL on or around June 18, 2020, investors should keep an eye on revenue forecasts, Tazverik's progress towards a 2nd line Follicular Lymphoma indication and the introduction of the 3 competing therapies. Finally, should professional analysts raise revenue forecasts, we would recommend reconsidering our analysis.

To reiterate, we did not consult with EPZM in the preparation of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Should EPZM's shares record any further gain in valuation, we may initiate a short position (meaning it would be preferable for us if EPZM's stock went lower).