Upwork: Must Grow Faster

by Tech and GrowthSummary

- After slowing down in the second half of 2019, Upwork reaccelerated its growth in Q1 2020. Marketplace revenue made up 90% of the business and grew by 24% YoY.

- Part of the growth plan is to invest more in brand awareness to bring in more higher-valued demand. So far, all the relevant metrics have been trending the right way.

- Currently led by its former CMO, it is likely the right timing to do so. Successful execution here can potentially upgrade Upwork from a 20% to 30% growth story.

Overview

There is upside potential on Upwork (UPWK). Since we wrote about the stock the first time last October, growth has accelerated while the take rate has improved. Furthermore, the increased investment in brand marketing will potentially result in higher growth beyond Q1 and 2020. However, shares price has also dropped by over 17% since then, primarily due to the concern on the COVID-19’s impact on the company’s significant SMB client base and the leadership change. Consequently, the current ~$12 price level offers an attractive entry point for investors.

Catalyst

Upon the stepping down of the CEO, Kasriel, Upwork is now led by Hayden Brown, who previously served as the company’s Chief of Marketing and Product. Considering Brown’s professional background in marketing, we view this appointment as positive news. Under his leadership, we expect Upwork to continue to invest in brand awareness, which will ease its penetration into the higher-valued segment and drive down future marketing expenses.

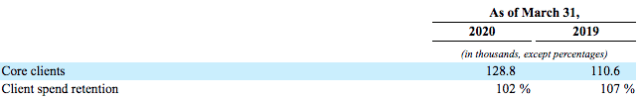

(source: upwork’s 10-Q)

With such an approach, we believe that Upwork is heading in the right direction to deliver the +20% long-term target revenue growth. While Upwork is very well-positioned to extract a lot of value out of the gig economy market, growth in the last few quarters could have been a lot better. In Q1 2020, we saw how growth accelerated as new initiatives were in place to drive the ~17% increase in core clients, which is the higher-spending segment of its client base. Despite dropping to 102%, client spend retention was still above the long-term target of 98% - 100%.

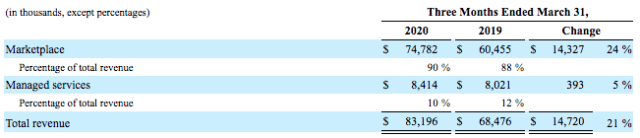

(source: company’s 10-Q)

Marketplace revenue, which consists of the company’s recurring and transactional fees, also now drives 90% of the business. Upwork’s Marketplace is a critical part of the business that drives the majority of the growth.

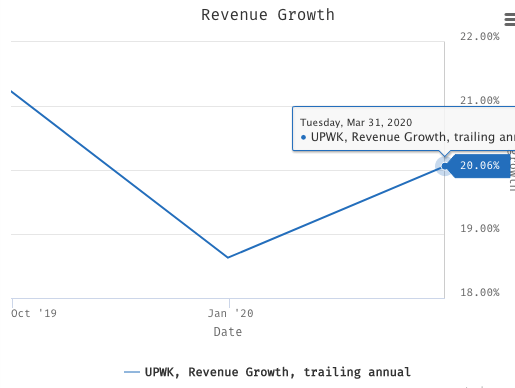

(source: stockrow)

In Q1, the solid 24% growth in Marketplace revenue drove the acceleration in the overall business. Considering the company’s continuing investments in brand awareness to drive new core client sign-ups, we see this number to go even higher in the next few quarters. Moreover, a consistent increase in take-rate, as we have seen happening, will also play an important role. Since three years ago, take-rate has increased by over 100 bps to 13.6% today. As Upwork consistently brings in more higher-valued services into its platform, it will benefit more from charging higher client fees. Though it is only a piece of the puzzle, the client fee increase to 3% in recent times was proven to drive take rate higher without a significant impact on growth.

Risk

In addition to the concern on the potential impact of COVID-19 on Upwork’s SMB client base, we will also expect the marketing spending to increase as the brand awareness campaign continues. As the management commented in Q1, this means delaying profitability in the near term.

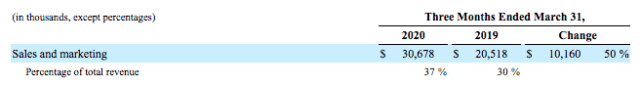

(source: company’s 10-Q)

In Q1, marketing expenses increased by 50% as its percentage of total revenue increased by 700 bps to 37%. This was a significant increase. When Marketplace revenue used to grow at +27% YoY a few years ago, marketing expenses were only between 26% to 29% of revenue. As such, we have got the impression that growth has become more expensive in recent times. In that sense, a competition from Fiverr (FVRR), which went IPO around a year after Upwork’s IPO, may also potentially be a key factor.

Valuation

With 4.5x P/S, the price is really attractive considering the growth potential and the strong results in Q1, where the business reentered a ~20% growth zone. The faster growth expectation in Fiverr, for instance, allows the stock to earn an 11x P/S. At the moment, Fiverr grows approximately twice as fast as Upwork and four times as small in terms of revenue. In our view, Upwork is well-positioned to take risks by investing more marketing dollars to accelerate its growth and maintain its leading position in the freelancing gig economy. The investments in brand awareness come at the right time considering it is now led by its former CMO. Upon the successful execution, the move will eventually reduce the marketing expenses in the long-term, while also potentially upgrading the business from being a +20% growth story to 30%.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.