Red Electrica: Too Exposed To The CNMC

by Mare Evidence LabSummary

- Regulated utility assets make it a guaranteed cash flow generator even under COVID-19.

- They have an ESG mandate, whereby they are developing energy storage systems to implement in the grid and power the electrification movement in Europe.

- Despite the fact that they are part of integrating renewable energy into the grid, the CNMC declare Spanish regulated utilities "over-compensated".

- Along with the Hispasat acquisition, which wasn't even at a particularly low multiple, we are not big fans of Red Electrica given so many other regulated utilities to choose from.

Red Eléctrica (OTCPK:RDEIY) (OTC:RDEIF) is the sole transmission agent and operator (TSO) of the Spanish electricity system. In their mandate, they are naturally required to supply electricity to Spanish households through the electricity grid, but they are also being required to spend a lot in CAPEX in order to meet an ESG mandate, particularly with energy storage technology to make electrification more viable. However, despite the fact that Red Eléctrica needs cash to reinvest on somewhat risky projects, as electrification is by no means a foregone conclusion, remuneration reductions of a substantial nature are being proposed by the CNMC. This is a highly unfriendly move towards investors. With the evident need for Red Eléctrica to diversify its income, having made a mediocre acquisition in 90% of Hispasat, Red Eléctrica's situation is not optimal. So, even though they have regulated assets that produce predictable income under COVID-19, there are many other excellent regulated utilities like Snam (OTCPK:SNMRF) and Iberdrola (OTCPK:IBDSF) that would be much better picks. Hence, we do not think that Red Eléctrica is attractive.

Q1 Results

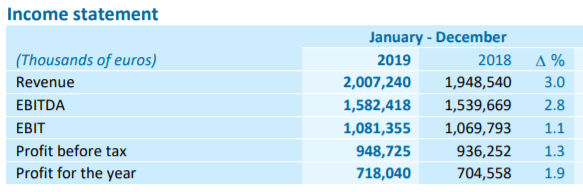

Although the CNMC is implementing its remuneration cuts, there is no question that Red Eléctrica's income is very predictable, as seen in the 2018-2019 FY results:

- Revenue grew by a modest 3.0%

- EBITDA increased by 2.8% compared to 2018

- EBIT stood at €1,081.4 million, up 1.1% from 2018. Without including Hispasat, this result would have grown at a rate of 0.8% compared to 2018

- Profit for the year amounted to €718.0 million, a rise of 1.9% year-on-year

(Source: FY 2019 results)

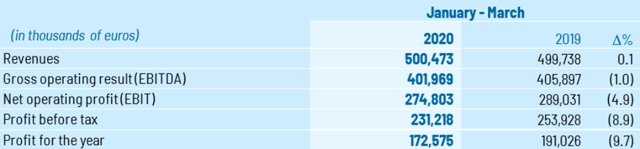

The Q1 2020 results reflect for the first time the recent CNMC changes as well as the consolidation of Hispasat's finances. "The remuneration rate for transmission assets has dropped from 6.5% to 5.5% in 2020". Despite the latest Hispasat acquisition, EBITDA amounted to €402 million, 1% less than in the previous year and profit for the first quarter stood at €172.6 million, 9.7% less compared to the same period last year. Without Hispasat, the revenue decline as a result of reduced remuneration would have been more substantial, causing a 7% decline.

(Source: Q1 2020 results)

For a company that typically generates very predictable revenues, a drop in remuneration rates of 1 percentage point from 6.5% to 5.5% is dramatic, especially over time where the difference will compound. These remuneration decreases were a result of the perceived overcompensation of regulated utilities according to the CNMC, which as of January 2019 became responsible for regulating utility income. These policies which are now in force will reduce the remuneration substantially over the 2020-2026 regulatory period by over 20%. This will eventually result in the current dividend, which pays out at an 81% rate, to become unsustainable. Considering that Enagas (OTCPK:ENGGF), which is a Spanish regulated utility for gas transmission, is subject to less intense remuneration reductions below 20% and is also already somewhat diversified into high-quality affiliates, the fact that Red Eléctrica trades at almost a 10% premium to Enagas in terms of EV/EBITDA is a source of concern and indicates that Red Eléctrica is not attractive despite its income proposition.

Hispasat Acquisition

Another aspect that we have not liked is the Hispasat acquisition, which was Red Eléctrica's first attempt to diversify away from regulatory revenues which are clearly under attack by the newly appointed CNMC. Geo-orbital satellite operators are somewhat of a dying business as TV broadcast continues to become displaced by streaming over the internet. Moreover, plans to launch low-orbit satellite constellations as a way to supply satellite internet, which geo-orbital satellites provide only at very high latency, makes it another market in which a company like Hispasat will not be able to compete. Nonetheless, this was the business that Red Eléctrica chose to acquire. They acquired it at a 13x EV/EBIT multiple, while a company like Eutelsat (OTCPK:EUTLF) now trades at a multiple of 10.6x EV/EBIT which although depressed by COVID-19's impact on markets, is much more sensible for a multiple of business in structural decline. Indeed, the sale of Hispasat to Red Eléctrica came right after Eutelsat sold its stake in the very same Hispasat to Abertis. Abertis flipped the company within a year at what was likely a lower multiple, but definitely at a lower valuation than when Eutelsat gave up its stake. So, it seems Red Eléctrica bought a structurally ailing company on a down-round, which is very alarming and seems to be a desperate move to diversify income.

Conclusion

The conclusion is very simple: the Spanish CNMC has hurt both gas and electricity transmission networks because these networks were being "over-compensated". Other governments are not doing this, as they see the importance of these networks for EU sustainable development goals. Since there are a wealth of excellent regulated utilities to choose from, all appropriate income propositions in the COVID-19 environment, there is no reason to choose a company whose regulated assets are concentrated in Spain and are attempting to diversify through very poor acquisitions in arguably terminal industries. We would suggest avoiding Red Eléctrica, as it trades at a modest but nonetheless unjustifiable premium to other regulated Spanish utilities and isn't managing the contracting situation particularly well.

Disclosure: I am/we are long SNMRF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.