International Flavors & Fragrances: Growth On Pause Due To Pandemic

by Vasily ZyryanovSummary

- In Q1, IFF delivered low-single-digit revenue growth despite the double-digit contraction in a few product categories.

- The company's cash from operations and FCF were negatively impacted by seasonality effects.

- Net debt/EBITDA ratio remains high; however, IFF has no issues with debt servicing.

- The momentous merger with DuPont Nutrition & Biosciences is progressing on schedule.

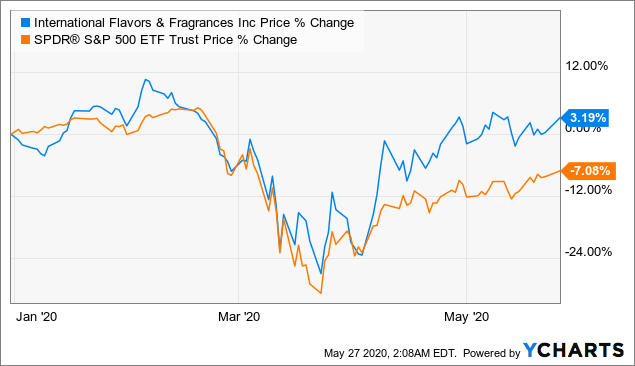

The late-March and April rally proved I was too skeptical on International Flavors & Fragrances Inc. (IFF) in my previous coverage. The stock has easily rebounded from the bottom and almost touched its February price zenith, easily trouncing the S&P 500 (SPY) price return. The stock has gained over 3% since the beginning of the year, while the U.S market benchmark is down by more than 7%.

Data by YCharts

The market was barely concerned with the company's high debt load, inflated valuation, and a few litigation matters (see page 22 of the Form 10-Q for details) and shrugged off all the risks, as the stock is considered to be a defensive play due to its exposure to the food industry and the consumer staples sector, which are, in turn, relatively immune to the ripple effects of the economic downswing and secure low volatility in earnings and revenue. Investors typically abandon cyclical names and bet on defensive stocks with more stable and predictable revenue trends when harbingers of the impending recession emerge. So, there is no coincidence that IFF attracted their attention. Among other things, I believe the ongoing integration with DuPont Nutrition & Biosciences, which inspires confidence that its market position will become even stronger in 2021, also contributed to the bullish sentiment.

IFF's Q1 earnings were presented on May 11. Inside, there were a few surprises that positively impressed investors like better-than-anticipated adjusted EPS and much stronger revenue. However, there also were some disappointing issues and dangerous trends that should not be overlooked. Now, as we have a plethora of data to analyze, I suppose the stock deserves reassessment.

The top line

While IFF delivered net sales growth of 3.8%, the performance of a few product categories was mediocre or even lackluster. More specifically, Nutrition & specialty ingredients (e.g., natural food protection), Flavor ingredients (e.g., specialty botanical extracts and essential oils), and Fine fragrances (perfumes and colognes) were laggards.

Among the above-mentioned categories, NSI was the strongest, as it posted only a 0.6% sales decline. Meanwhile, FI and FF were severely battered, as their sales dropped by 15% and 11% respectively (please, take notice that I used the GAAP revenue figures unadjusted for the FX effect). In the earnings presentation, IFF explained that the decline in FF revenue was caused by the COVID-19 pandemic which prompted "a sharp deceleration late in the quarter." As in April and May, the pandemic has taken a toll on consumer sentiment and supply chains, it is highly likely the sales of Fine fragrances will continue to decline. During the earnings call, answering an analyst's question, the CFO said that:

...based on our largest - what our largest fine fragrance customers are saying publicly, the category is declining double digits. So I'd expect the same for IFF and our competitors.

The silver lining is that the lackluster performance of some categories was largely offset by impressive results of IFF's bulwarks: Flavor compounds and Consumer fragrance. After all, Scent and Taste both delivered single-digit sales growth rates. Scent reached a 3% GAAP revenue growth; adjusted for the FX effect, the growth rate was 7%. Taste managed to achieve a 5% adjusted sales improvement, while the segment's GAAP revenue rose by 3.2%. Importantly, Taste now includes the results of the Frutarom businesses, which were previously reported under the Legacy Frutarom segment.

Consumer Fragrance category, the second-largest regarding the contribution to the top line, fared especially well during the quarter, primarily because of Fabric, Home, and Hair Care sub-categories. Its almost 11% growth was mostly achieved due to double-digit improvement in Latin America. Answering to an analyst's question, the CFO Mr. Jilla shared his thoughts on the category's performance this year:

Sustainability of Consumer Fragrance, we do believe this will continue to be robust, where consumer demand remains high in hygiene and disinfection.

Next, for a broader context, I should briefly touch upon the results of IFF's principal competitors Swiss Symrise AG (OTCPK:SYIEF) (see the trading update) and Givaudan SA (OTCPK:GVDBF). Both are the SIX Swiss Exchange-listed; the country's stock market regulations do not require filing an analog of Form 10-Q with a detailed performance analysis every quarter, so, now, we have only limited data. Unfortunately, we cannot compare IFF with another heavyweight rival, also Switzerland-based Firmenich SA, as the company is privately owned, and thus does not publish financial reports.

On a side note, to understand the industry a bit deeper, I recommend taking a look at the April investor presentation of Givaudan, where the data from IHS and Leffingwell were visualized.

Now, let's turn to Symrise. The company's Scent & Care segment delivered 1.2% organic revenue growth; the Flavor division's organic sales rose by 1.6%. Despite the uncertainty spawned by the pandemic, the company remained confident it would "grow faster than the relevant market, supported by the very diversified competencies, in the course of the year." IFF does not share its optimism, as it had withdrawn the FY 2020 guidance blaming uncertainty regarding the pandemic's ultimate impact.

Finally, the results of Givaudan were far more robust. Adjusted for the FX effect and acquisitions, its total sales were up 5.4%. Revenues of Flavours rose 4.6%, while the Fragrances segment has done especially well, reaching a 6.3% top-line growth. It is worth noting that Givaudan also noticed prodigious demand in the Latin American region, where its adjusted revenues surged by 17.4% (see slide 11 of the presentation).

Profitability

The Q1 gross margin of International Flavors & Fragrances increased by 1% thanks to the slightly lower cost of goods sold despite more expensive raw materials. IFF uses around 23,000 raw materials, so, it is tough to say precisely which categories were impacted by price inflation.

Among the factors that positively impacted the operating margin, which rose to 14.6%, were lower R&D expenses. In the Form 10-Q, the company did not bring much color why R&D expenses were lower than a year ago. It did not clarify if some initiatives were suspended or deferred. I would not say lower quarterly R&D should be interpreted as a dangerous sign; as the CEO said during the call, commenting on the merger with DuPont Nutrition & Biosciences,

We have a great R&D pipeline with combined spend upon around about $550 million, more than 9,000 patents granted.

Among other things, in the first quarter, the company benefited from the repayments on the Term Loan and Tangible Equity Units. That helped to decrease interest expense to 2.9% vs. 3.2% a year ago.

Cash flow

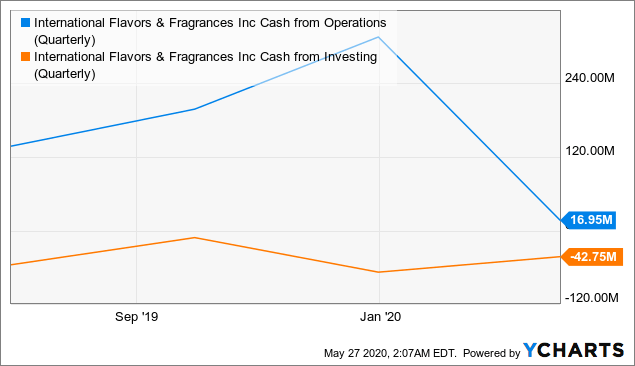

In Q1, IFF posted a bleak net cash flow because of the seasonal increase in working capital. Lower capital intensity did little to buttress FCF, as outlays related to core working capital required around $166 million. Net CFFO dropped to $16.95 million, while FCF dived to $(31) million.

Data by YCharts

One of the performance indicators I frequently use is Cash Return on Total Capital. Because of burdensome debt on the balance sheet, we cannot substitute total capital with shareholder equity or use ROE as a reliable indicator. It would be much better to have a grasp of how much cash the company generates per every dollar provided by equity and debt investors. So, LTM CROTC of IFF stands at 6.4%, which is low.

High debt load and a few maturities ahead

As I have already outlined in the previous article, higher debt was a direct consequence of the Frutarom acquisition. IFF's total debt is now above $4.3 billion, while Net debt/EBITDA equals to 3.3x. Its debt covenants are 4x ND/EBITDA and 3.5x ND/EBITDA as of March 31, 2020, and March 31, 2021, respectively (see slide 17 of the presentation). Also, $941 million in debt mature in 2020 and 2021. As of March 31, the company had only $433.2 million in cash.

Though the Frutarom deal led to an increase in debt, I should acknowledge that IFF's decision to acquire the firm was entirely reasonable. Flavors and fragrances industry is consolidated and competitive; to cement market position and outmaneuver and outthink rivals, IFF made an excellent step and acquired a prodigious business with bright prospects.

On a side note, reading a plethora of earnings presentation this May, I have noticed that companies across different sectors and industries mentioned their debt covenants, while in the past, it was quite rare. It's an interesting sign of the crisis times, as when the recession hits, investors begin to pay much more attention to liquidity and solvency.

Final thoughts

This year, because of the ripple effects of the pandemic, IFF's growth story will likely remain on pause. At the moment, analysts are not expecting the 2020 revenue to improve substantially; the average revenue forecast is standing at $5.15 billion (+0.14% YoY).

Nevertheless, the company is in the middle of the transformative merger with DuPont Nutrition & Biosciences that will cement its market position. Upon closure, a new industry titan will emerge in 2021 when the deal is scheduled to be closed (see Integration planning on slide 21 of the presentation). I should briefly mention that N&B, temporarily the segment of DuPont de Nemours, Inc. (DD), performed generally well in the first quarter. Its Health & Biosciences products category was especially strong, up 6.1% YoY (see page 16 of the Form 10-Q).

To sum up, though IFF is an attractive defensive play, I suppose it is worth waiting until the next price correction before accumulating the stock for long-term holding.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.