3 Gold Stocks to Buy on the Dip

The opportunity to buy low has finally arrived.

If you’ve been watching the gold rally from afar, wishing for a second chance to snatch up gold stocks at lower prices, then wait no longer. Equities linked to precious metal find themselves on a four-day losing streak. It’s the first bona fide buy the dip setup we’ve seen in a while.

Economically-sensitive equities took flight on Tuesday amid continued vaccine hopes and optimism surrounding the economy’s reopening. This, by the way, is the new evergreen headline, sure to be trotted out on big up days. It’s also the likely culprit for the register ringing in gold stocks and other recent winners. Peloton (NASDAQ:PTON), video game stocks, Zoom Video Communications (NASDAQ:ZM), and Netflix (NASDAQ:NFLX) all joined metals among the day’s biggest losers. At the same time, the largest gainers counted airlines, cruise lines, and retailers among their ranks.

I don’t think that the uptrend in gold stocks is going to rapidly unwind, though. That’s why I’m viewing this dip as a potential buying opportunity. Here are three of my favorite tickers for getting exposure.

- Vaneck Vectors Gold Miners ETF (NYSEARCA:GDX)

- Newmont Corporation (NYSE:NEM)

- Wheaton Precious Metals (NYSE:WPM)

Let’s take a closer look at their charts and share how to use high probability options trades to profit.

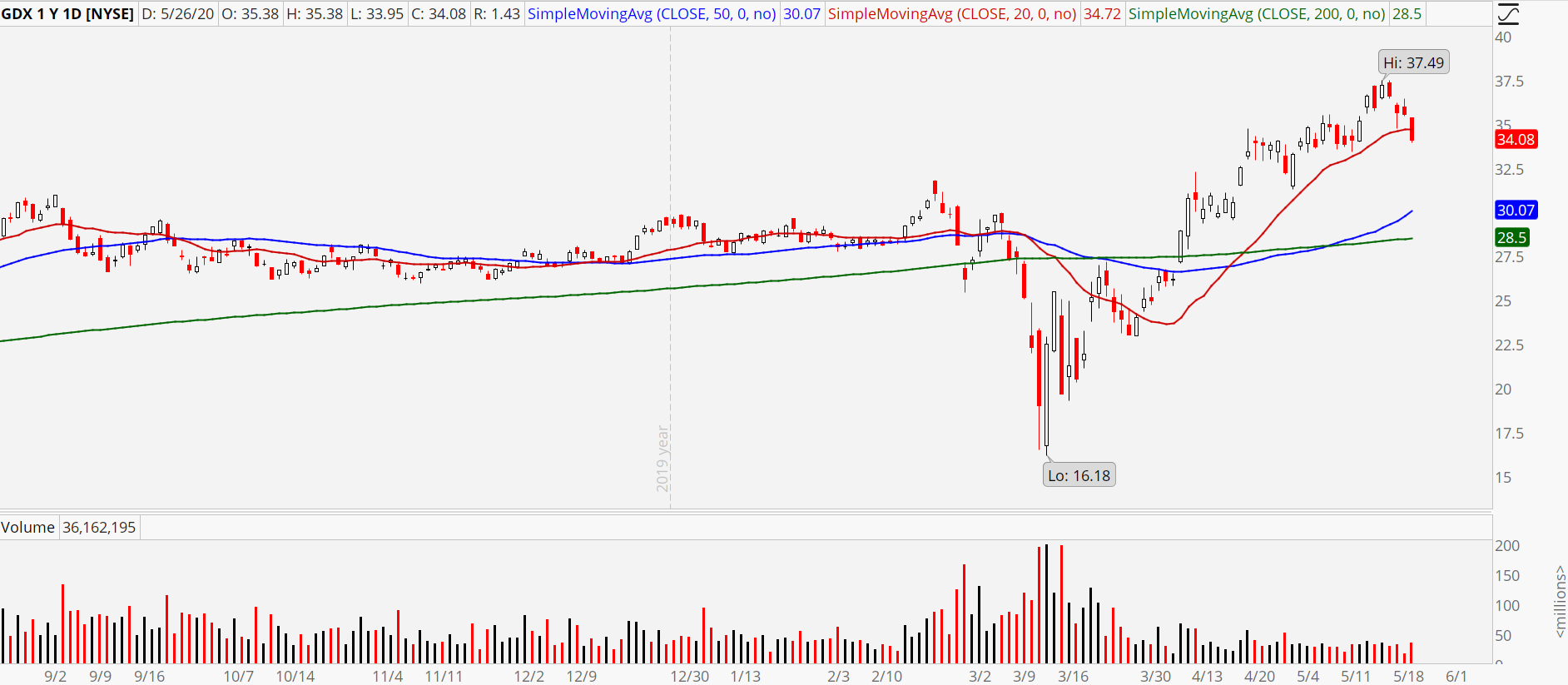

Gold Miners ETF (GDX)

The first and easiest vehicle to use when playing a sector trend like gold stocks is an ETF that tracks that particular area. In this case, we’re talking about the Gold Miners ETF, GDX. It allows you to sidestep stock-picking altogether, and instead bet on the entire industry. Because you own a diversified basket of companies, the threat of an earnings report upsetting your entire trade is minimal.

Last week, GDX notched a new seven-year high, confirming its trend strength and the willingness of buyers to push prices to levels not seen in, well, years. Since then, we’ve seen a four-day retreat that has cracked the 20-day moving average for the first time since mid-March. It’s a short-term sign of weakness, to be sure, but I think the pullback in gold stocks is ultimately a buy.

To stack the odds in our favor and give GDX room to chop around if profit-taking persists, let’s sell naked puts.

The Trade: Sell the July $31 puts for around $1.00.

By selling the put, you obligate yourself to purchase shares at a cost basis of $30, if the stock sits below $31 at expiration. If GDX remains above $31, then the put will expire worthless, and you’ll pocket the $1 premium.

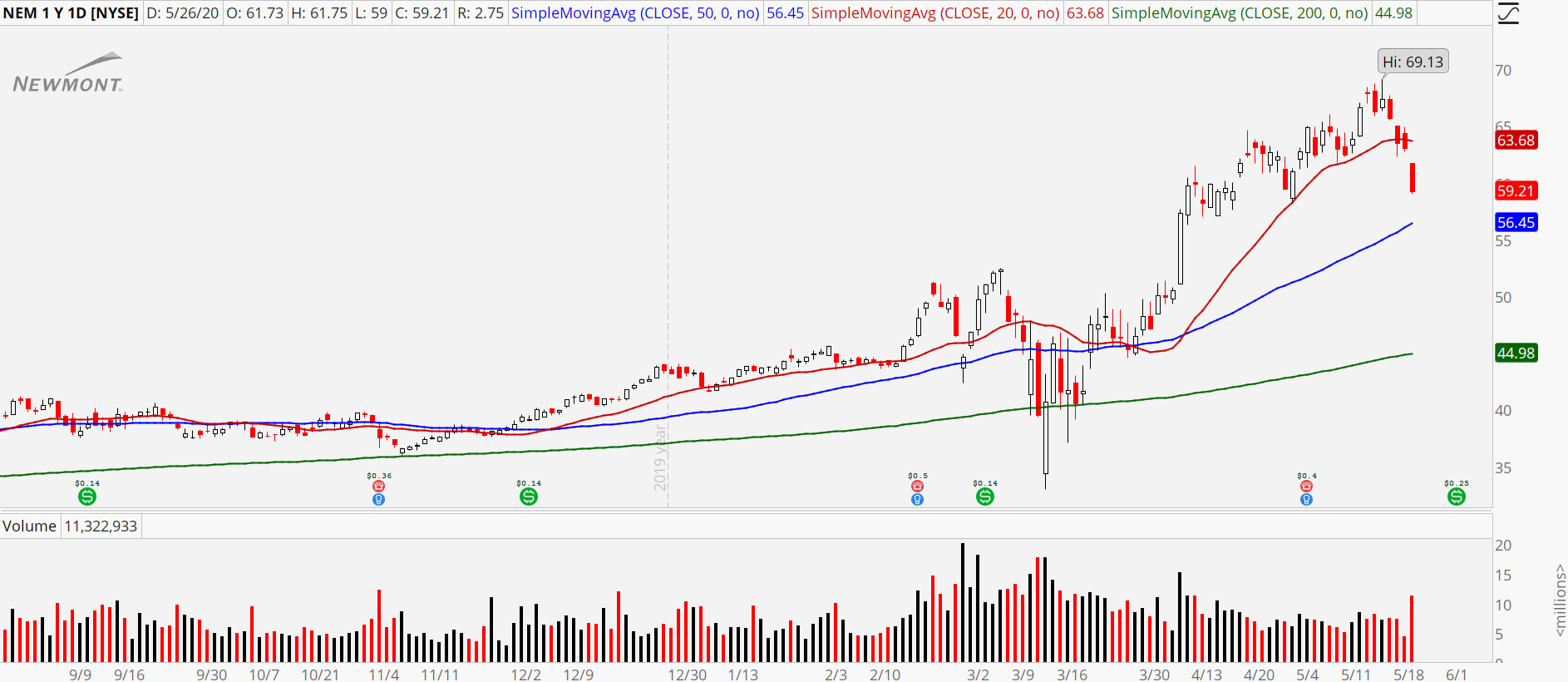

Newmont Corporation (NEM)

As one of the top holdings in GDX, Newmont boasts a similar-looking chart, but with one big difference. While GDX remains a far cry from its record high, NEM stock has already fully recovered. That makes it an indisputable leader in the space and one that is mighty attractive for traders seeking relative strength. Tuesday’s 6% slide pushed NEM stock well below the 20-day moving average and has it $10 or 14% off the highs.

While we could see more downside pressure in the short run, the impressive long-term uptrend makes this a definite buying opportunity. Once again, I like using short puts on gold stocks to increase our odds. To limit the risk, we’re going to use a bull put spread.

The Trade: Sell the July $55/$50 bull put spread for $1.13.

Wheaton Precious Metals (WPM)

WPM is another leader in gold stocks worth trading. Like Newmont, WPM stock has already raced to its old record highs, far outpacing the rebound in its industry ETF, GDX. It’s moving averages are all stacked atop each other, and unlike NEM, WPM still remains above its 20-day. I like the resiliency and think it makes Wheaton one of the most attractive stocks in the space.

Its options are less liquid than NEM and GDX, so limit orders are a must. If you think it remains north of $38, then this bull put spread offers a nice 25% return on investment.

The Trade: Sell the July $38/$35 bull put spread for around 60 cents.

For a free trial to the best trading community on the planet and Tyler’s current home, click here! As of this writing, Tyler didn’t hold positions in any of the aforementioned securities.