Micron: Big Bets Are Being Placed

by Business QuantSummary

- Institutional investors collectively bought about 3.5% (net buying) of Micron's total shares outstanding in the last 13F cycle.

- Moreover, 11 of Micron's 15 largest institutional investors increased their exposure to the chipmaker.

- Investors should ignore the FUD and remain long on the name.

Investing forums are rife with debates about Micron's (MU) prospects of late. While some believe the stock is on the verge of beginning its next memory super-cycle, others feel the coronavirus outbreak will cripple its sales going forward. But amidst this heightened market uncertainty and indecisiveness, institutional investors saw an opportunity and accumulated the chipmaker's shares in significant quantities during the last 13F cycle. This should come across as an encouraging sign for Micron's long-side investors.

(Image source, Image labeled for reuse)

The Buying Frenzy

Institutional investors generally have resources that most of the average retail investors don't - such as access to company managements, supply chain connections, research services etc. So, tracking the trading activity of these sophisticated investors can sometimes provide us with leading insights about where a particular company and its shares may be headed next.

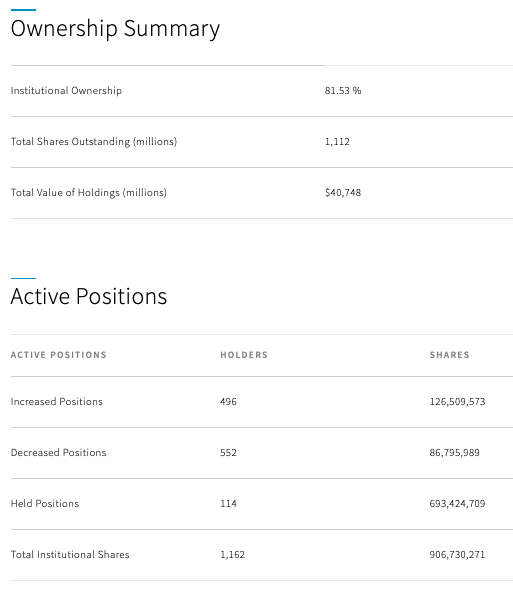

As per Nasdaq's records, institutions collectively bought about 126.5 million shares of Micron against collective sales of about 86.7 million shares in the last 13F cycle. This effectively created a net buying differential of approximately 40 million shares. The chipmaker has about 1.12 billion shares outstanding which means that the net buying represented about 3.5% of its total share count.

(Source: Nasdaq)

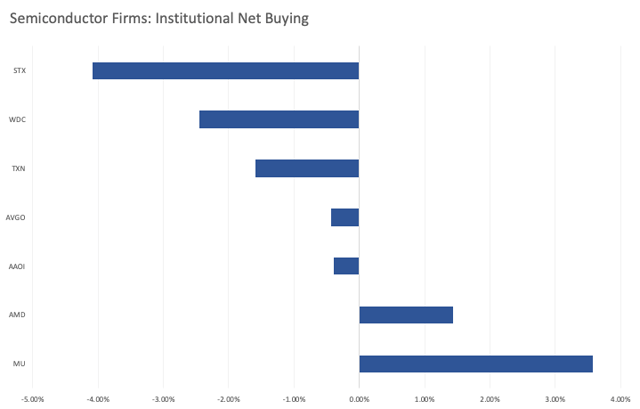

This calculated percentage figure may seem minuscule at the first glance but it isn't. I looked at some of the industry comparables and found the net institutional buying in Micron to be quite significant. This class of investors collectively reduced positions in other popular semiconductor firms in my brief study, whereas Micron saw a net accumulation of 3.5%.

(Data from Nasdaq for individual ticker pages, such as here for MU, chart compiled by author)

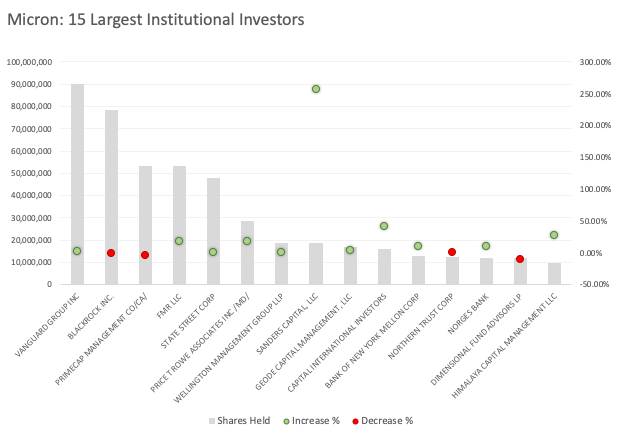

I dug further in Micron's institutional holding pattern to rule out any anomalies and an interesting trend came to light. As it turns out, 11 of Micron's 15 largest institutional investors increased their positions in the chipmaker while only 4 trimmed their positions. This suggests that a broad swath of Micron's largest institutional holders grew bullish on the name in the last 13F cycle.

(Data from Nasdaq, chart compiled by author)

This is a noteworthy development especially since global markets were in a state of turmoil in the last 13F cycle, which, by the way, spanned from January through March. Micron's shares fell from $61 to about $31 in a matter of a few weeks within this cycle. But it's now evident that these institutions saw an opportunity and accumulated Micron's shares at discounted prices, than following the herd and contributing to an already severe selloff.

While all this establishes the fact that institutional investors grew bullish on Micron in the last 13F cycle, we're yet to fully understand as to why these investors grew bullish on the chipmaker in the first place.

Reasons for Optimism

The general premise from January through March was that global lockdowns - complete or partial -- due to the coronavirus outbreak, would bring the global supply chain and logistics to a grinding halt. But while that was a popular opinion at the time, it wasn't necessarily true.

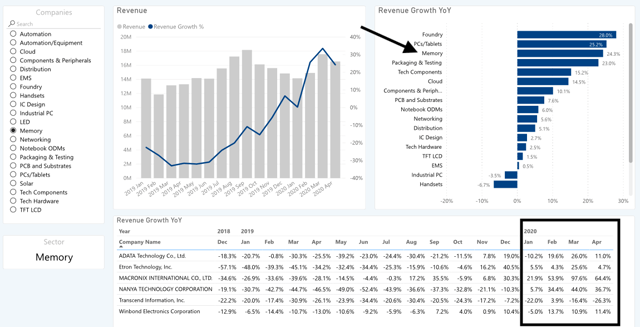

Our monthly revenue tracker covering over 1300 firms, reveals that prominent global memory firms - such as ADATA and Nanya - posted robust sales growth in January, February and March. If a crippling slowdown was truly unfolding in Q1 CY20, these monthly sales numbers would have dropped proportionally.

(Source: Business Quant)

But these firms instead posted a significant sales growth during the period, defying the popular bear thesis at the time and suggesting that the ground reality wasn't as dire as the bears would lead us to believe. Micron's Q1 revenue beat in late March also suggested that the Street was overly bearish. Although the investment thesis of these institutional investors are not always published in the public domain, this disparity between reality and facts might have been a contributing factor for their active net buying in Micron of late.

Looking forward into Q2 CY20, or Micron's Q3 FY20, the data points are looking consistent with the trends seen in Q1. As it turns out, 5 out of the 6 Taiwanese memory firms shown in the chart above, posted positive sales growth during April.

It remains to be seen whether these trends are sustainable or not, and I'll keep you posted on that, but for now, the positive revenue growth in April suggests that there was no crippling slowdown for memory firms till last month at least.

TrendForce corroborates our findings. They said in a recent research note that growth in ASPs and bit shipments are bound to push DRAM revenues higher in the second quarter. Here's the relevant excerpt:

TrendForce indicates that the backlog of orders in 1Q20 will be deferred to 2Q20. In 2Q20, as the magnitude of QoQ increase in DRAM ASP expands, and bit shipment rebounds, TrendForce forecasts a QoQ increase of more than 20% in overall DRAM revenue. DRAM suppliers are projected to continue improving their revenue and profitability.

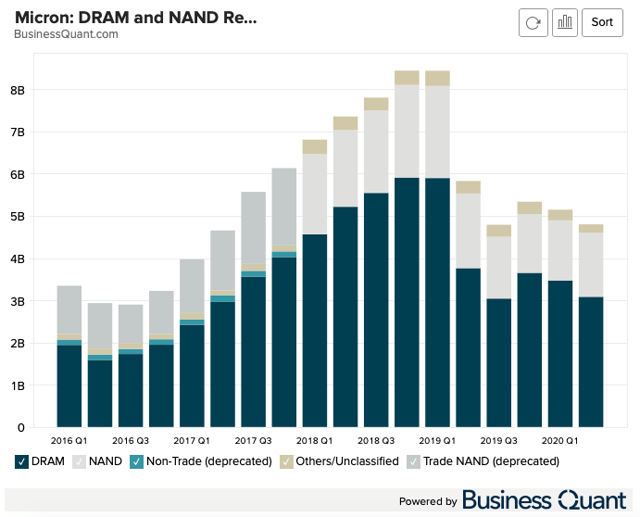

For the uninitiated, Micron generates most of its revenues from selling DRAM modules. I think it's needless to say but an improved market forecast on that front automatically improves the outlook for Micron as well. So, I believe investors shouldn't be unnecessarily fearful about Micron's prospects for the near future.

(Source: Business Quant)

Final Thoughts

I'd like to point to readers that the institutional buying data is based on trades that have already taken place in the past and, so, it does not guarantee how Micron's shares are going to perform in the near future. Also, the monthly sales growth figures for various memory manufacturers referred earlier in the article, should, at best, be used as industry comparables. These firms may or may not have a direct financial relationship with Micron, which means that their sales growth may not be fully correlated with Micron's.

Having discussed the risk factors of this thesis, there aren't any data points to suggest that a global slowdown is on its way to cripple Micron's sales in the ongoing quarter, as many bears would lead us to believe. On the contrary, the different bits of data points available to us - whether that's analyst commentary, monthly sales growth of other memory firms or aggressive institutional buying - suggest that Micron's prospects are looking bright. So, I believe investors should ignore conjecture, focus on the facts and remain long on the chipmaker for the time being at least.

Author's Note: I'll be writing another article on Micron in the next week, you can stay updated by clicking the "Follow" button at the top. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.