Southwest Airlines: $41 Is Too Low

by Stone Fox CapitalSummary

- UBS slapped a $41 price target on Southwest Airlines for 28% upside.

- The airline has plenty of liquidity, and the recent jump in traffic should greatly reduce daily burn rates.

- The stock has normalized EPS potential near $5.50 in '22 based on a pre-virus $6.50 estimate.

- A $41 price target is only the start for a stock still holding the potential to top 52-week highs near $60.

The market has become slightly more positive on the airlines as traffic starts to rebound, but the market is far too negative on the long-term prospects of Southwest Airlines (NYSE:LUV). The airline has a 52-week high of nearly $60, and my investment thesis was bullish on the safety net concept. The market spent Monday celebrating a $41 price target, while even the previous high is logically too low.

Image Source: Southwest Airlines website

$41 Basis

Just last week, Southwest Airlines confirmed that bookings are now topping cancellations. Some airlines such as American Airlines Group (AAL) forecasted June still having large refunds with limited revenues by next month.

Anybody looking at the daily TSA traffic trends can see a huge bump in traffic while destinations such as Las Vegas, Orlando and Hawaii aren't even open for travel yet. Unlike back in April, one can now make the case for traffic rebounding to levels at 20%, 30% or even 50% of 2019 levels over the summer months.

UBS picked Southwest Airlines based on a full recovery in air travel not taking place until '23/'24. Analyst Myles Walton hiked his price target to $41, up from $37. The target was a 41% gain from where the airline stock closed on Friday. Due to a general market rally, Southwest Airlines opened up at $32, providing upside of only 28% now.

The analyst forecasts the $41 target based on 12x EPS targets amounting to $3.42. The airline earned $4.45 in 2019, and dilution will reduce the EPS of similar net income levels in the future.

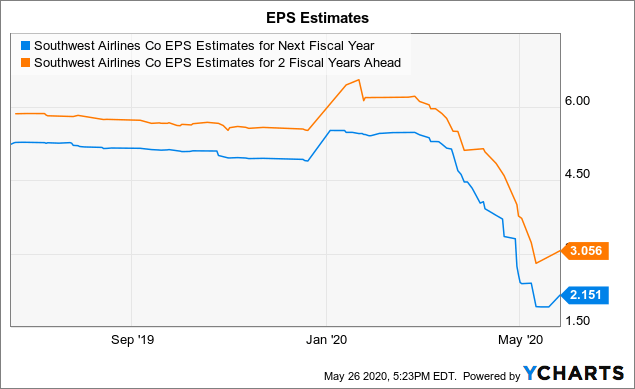

Analysts only have the airline earning $2.15 next year and $3.06 in 2022. The numbers are rising, but still far below pre-coronavirus estimates by a long shot.

Data by YCharts

New Highs Basis

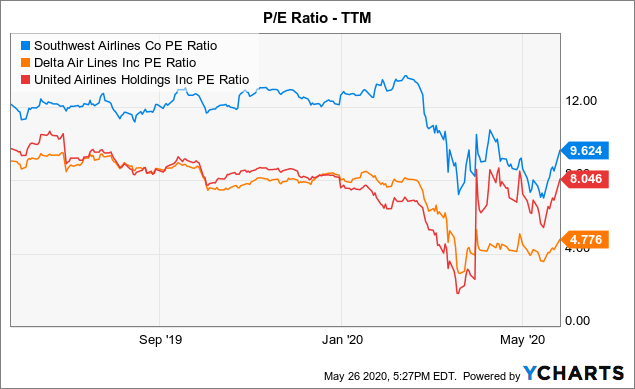

My basis that Southwest Airlines and other airlines should trade at new highs are due to the stocks previously trading at discounts due to recession fears and irrational concepts that the airlines couldn't survive the next recession. As the UBS analyst mentioned, Southwest Airlines typically traded around 12x trailing earnings. Both Delta Air Lines (DAL) and United Airlines (UAL) traded closer to 8-9x trailing EPS.

Data by YCharts

The case exists for airline stocks to trade at higher P/E targets. Other transportation stocks such as railroads and delivery services traded above 15x forward EPS estimates.

In more normalized times, Southwest Airlines was forecast to earn over $6 in 2022. The case for air travel not returning to normal levels by 2022 when a vaccine should exist for COVID-19 is very low.

The airline entered the crisis with a net cash balance starting 2020. Following a $3 billion equity and convertible debt offering on April 28, Southwest Airlines had a liquidity balance of $13.9 billion even before accessing the Loan Program of the CARES Act. The company was burning up to $22 million per day after the PSP funds, so one could envision the airline burning less than the equity raise before reaching cash flow profitable.

Without much damage to the Southwest Airlines balance sheet, the only issue for shareholders is the 63 million share dilution equating to 12% share dilution. The hope is the airline can repay the $1.15 billion in convertible debt without dilution and won't need to access the Loan Program, which comes with dilutive warrants.

By the time May 2021 rolls around and normal trends are forecast to return in 2022, the market will slap a 12x multiple on a '22 EPS of $5.50 after dilution. Under this scenario, the stock obtains a $66 price target. At some point, the stronger airlines should trade at more normal transportation multiples of 15x forward EPS estimates, which would push Southwest Airlines up to an $82 price target.

So, while the $41 price target sounds great when the stock was trading below $30 prior to the UBS call, the target doesn't represent the "normal" opportunity in Southwest Airlines or any of the other airlines.

Takeaway

The key investor takeaway is that a $41 price target is a great start for Southwest Airlines, but the stock has much more upside in the next year. The market will start coming around to the upside potential for airline stocks as traffic reaches levels in June unthought of just a month ago. The airlines will see daily cash burn levels decline, and the dire outcomes will disappear. The big gains for Southwest Airlines on Monday were just the start.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Disclosure: I am/we are long AAL, UAL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.