Switch: Overvalued For Such Low Growth Prospects

by Gary AlexanderSummary

- Investors have piled into Switch this year, whose shares are up ~28% year-to-date despite a ~10% decline in the markets.

- Churn has increased in the wake of the coronavirus.

- Shares are trading at ~21x forward EBITDA, despite expectations for only 11% y/y revenue and adjusted EBITDA growth in FY20.

- Net debt levels remain elevated at ~3x adjusted EBITDA.

I've never understood the rewards of holding Switch (SWCH), the colocation company that essentially rents out server rack space in low-cost areas like Nevada and Georgia to clients for a recurring rental fee. So far year to date, investors have treated Switch as a safety stock in the tech sector. In sharp contrast to a ~10% decline in the broader S&P 500, Switch is trading an inch away from all-time highs and is up nearly 30% year-to-date. Shares have risen ~10% in May alone after the company released Q1 results and offered relatively lackluster guidance for 2020.

There are a number of reasons why I think investors should avoid Switch - but chief among them is that the stock's year-to-date rally has left the company painfully overvalued.

Valuation is rich when considering low growth prospects in 2020

There are two principal reasons why I, or anyone, would want to buy a stock - either because it represents good value and/or I earn yield for holding the asset (at current share prices, Switch is yielding well under 1% annually), or because I believe in the company's future growth prospects. To me, Switch seems neither.

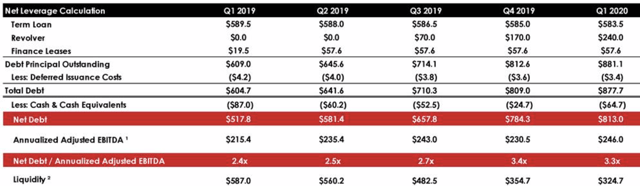

At current prices near $19, Switch carries a market cap of $4.60 billion. After we add on the $813 million of net debt on the company's most recent (Q1) balance sheet, we're left with an enterprise value of $5.41 billion.

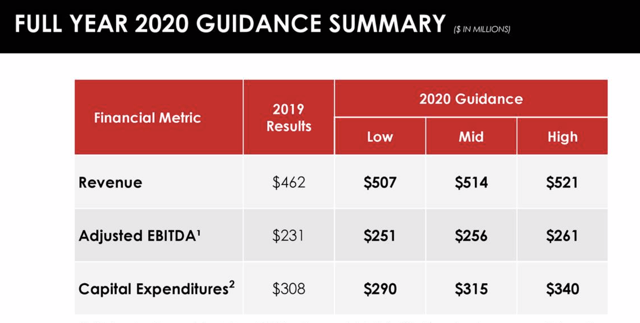

Alongside its recent Q1 earnings release, Switch also refreshed its guidance expectations for 2020. We can't say we're overly impressed with its revenue forecast of $514 million (+11% y/y) and adjusted EBITDA of $256 million (+11% y/y).

Figure 1. Switch FY20 guidanceSource: Switch Q4 earnings deck

If we take Switch's guidance at face value, it implies that the stock is currently trading at 10.5x EV/FY20 revenues and 21.1x EV/FY20 EBITDA - which is painfully expensive for a company projected to only grow at ~11% y/y. This is especially true when we consider the fact that Switch also plans to spend $315 million on capex this year - essentially meaning that Switch will spend the entirety of its profit on capex. In fact, as we can see in Switch's most recent 10-K, the company has generated negative free cash flow in FY19, FY18, and FY17.

Switch is a stock in no-man's land - it's neither a value stock trading at double-digit multiples of EBITDA and even revenue, and its ~11% y/y growth guidance hardly justifies calling it a growth stock either.

Churn, adjusted EBITDA margins showing negative trends

Fundamental trends aren't looking especially great for Switch either. The company has prided itself in recent quarters of maintaining low churn - that once customers are installed in one of Switch's "Primes" (which is what it calls its data center facilities", that they would be long-term customers.

Churn ticked up in Q1, however, potentially brought on by the coronavirus - up to 0.4%, a substantial increase from just 0.1% churn in the year-ago quarter. This is also up from 0.2% as of the end of 4Q19.

Figure 2. Switch churnSource: Switch Q4 earnings deck

The good news is that so far, Switch doesn't estimate that the coronavirus pandemic has done much to dent its new deals pipeline. Thomas Morton, the company's CEO, noted as follows on the most recent earnings call:

We have seen no change in our pipeline as a result of COVID-19. We continue to see a large number of customers that are looking to do substantial deployments with us. As you can see, we sold a number of 22 new logos this quarter including five more in Atlanta. So we continue to see a lot of sales activity despite the COVID-19 pandemic. That has most largely affected smaller companies versus the larger companies that we tend to do most of our business with. So Gabe, if you have any additional comments I'd love to hear them. But the most part, we are very confident in our pipeline for the balance of 2020."

We do worry, however, about elevated churn being retained as apart of a longer-term trend.

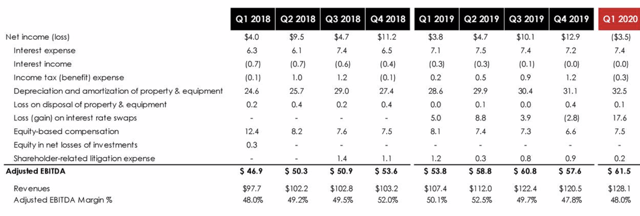

There's also a negative trend developing in terms of Switch's adjusted EBITDA margins. As can be seen in the chart below, Switch's adjusted EBITDA margin clocked in at just 48.0% in the first quarter, down 210bps on a y/y basis:

Figure 3. Switch adjusted EBITDA trendsSource: Switch Q4 earnings deck

Switch's management believes this margin headwind is temporary, noting that "elevated SG&A costs in Q1 [are] related to professional services as a result of our transition to a large accelerated filer," and that adjusted EBITDA should normalize in the ~50% range for the remainder of the year. However, Switch's guidance for FY20 - implying 11% y/y revenue and adjusted EBITDA growth, and flat margins - would require Switch to show adjusted EBITDA margin expansion in Q2-Q4 to make up for the two-point headwind in Q1. Considering the cloudy performance in Q1, that seems like an aggressive target.

Switch's meager growth is financed by capex and debt

We note as well that Switch continues to maintain a heavy debt load. Net debt levels continued to rise in Q1 to $813 million, while its leverage ratio remained relatively flat to Q4 at ~3.3x.

Figure 4. Switch debt trendsSource: Switch Q4 earnings deck

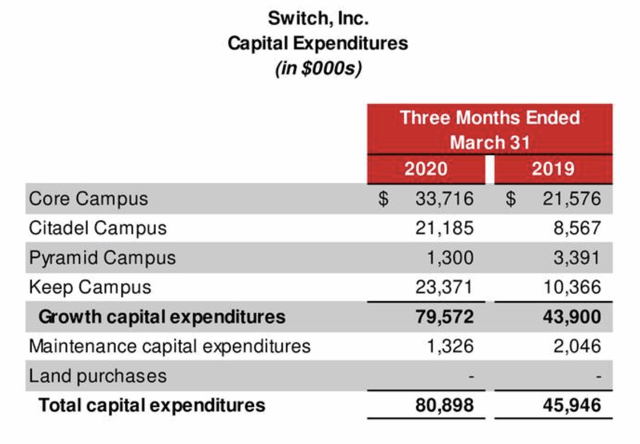

Perhaps even more concerning is that Switch - which is already capex-heavy - grew capital expenditures by nearly 2x in the first quarter to $80.9 million, despite its full-year capex guidance calling for flattish capex spend (the company notes that 1Q19 presents a difficult comp due to rainfall delaying last-year construction).

Source: Switch Q4 earnings deck

Rising debt levels and continually high capex (capex is expected to be 61% of revenues this year!) continues to enforce the thesis that Switch's meager growth is financed by ever-mounting debt levels and persistently high capex. Even if Switch is able to show net profit/adjusted EBITDA growth, it's still far from hitting positive free cash flows (-$100 million FCF in FY19).

Key takeaways

Switch trades at growth stock multiples that would be more appropriate to a bona fide technology company, but in reality Switch's meager ~11% growth and heavy capital expenditures make it far more comparable to something like a REIT (and indeed, with the company's primary business being leases of server space, its business model is far closer to a REIT than to any other cloud company). With the possibility of elevated churn, EBITDA margin disappointments, and elevated capex, Switch's fundamental performance doesn't justify its premium multiple either. Continue to stay on the sidelines here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.