PhosAgro: Resilient In Any Environment

by Danil KolyakoSummary

- PhosAgro published Q1 production and financial results recently.

- In the meantime, the stock has suffered a short-term drawdown but now trades at pre-corona levels.

- The company demonstrates enviable resilience, so I maintain my long-term Bullish view on the stock.

Photo by Paul Mocan on Unsplash; image made by Author

PhosAgro (OTC:PHOJY) feels relatively well amid the economic chaos all around the world. Despite operating in the cyclical fertilizer industry, the company proved to be one of very few virtually unaffected by the initial phase of the coronavirus crisis. PhosAgro's performance is unquestionable during these turbulent times, though low fertilizer prices are still a concern to keep in mind.

Recent Results Highlights

Source: Company data, Author's spreadsheet

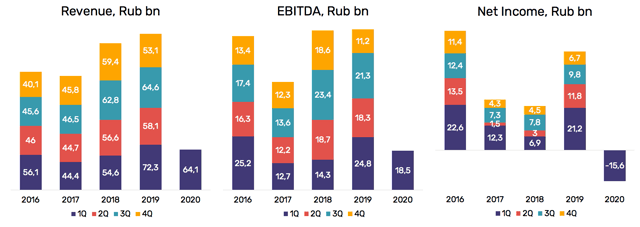

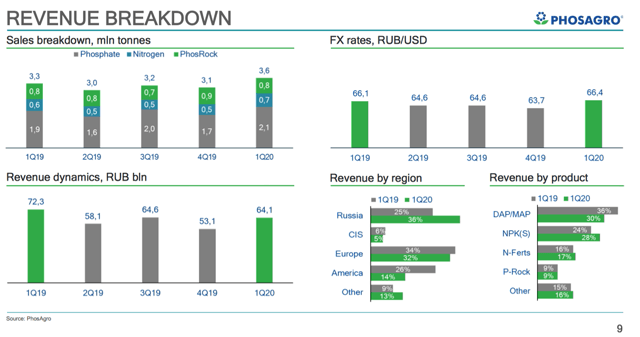

Revenue for the first quarter decreased by 11.4% year-on-year to 64.1 billion roubles ($965 mn) due to a decline in fertilizer prices during the previous year. Revenue grew by 20.5% compared to Q4 2019, mainly due to higher sales volumes and price recovery at the beginning of the year against the background of seasonal demand.

Source: Company presentation

Net income declined by 15.6 billion roubles against a net profit of 21.1 billion a year earlier. Net profit, adjusted for the effect of foreign exchange differences, amounted to 14.4 billion roubles ($216 mn), which is 6% higher than in Q1 2019 and 68.8% higher than in Q4 2019.

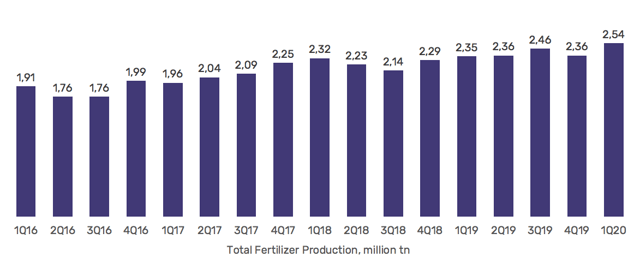

Fertilizer production over the past quarter amounted to 2,546.6 thousand tons, an increase of 8.6% compared to the first quarter of 2019 as a result of modernization of production capacities and growth in production efficiency over the past year. Compared to the fourth quarter of 2019, the growth was 8%.

Source: Company data, Author's spreadsheet

Phosphorus-containing fertilizer sales increased by 8.2% compared to Q1 2019 and amounted to 2,087.2 thousand tons.

Nitrogen fertilizer sales increased by 13.8% compared to the 1st quarter of 2019 and amounted to 702.8 thousand tons. Compared to the fourth quarter of last year, the growth was 30.9%.

The share of fertilizer sales on the domestic market in Q1 2020 amounted to 33%, compared with 17% in the fourth quarter of 2019, and 24% in the first quarter of 2019, which is due to the company's focus on the Russian market and rapid recovery of the domestic demand.

As of 31 March 2020, the net debt/EBITDA ratio was 2.2x. The increase during the first three months of the year was due to the devaluation of the rouble against the dollar in March, as a large part of the PhosAgro's loan portfolio is denominated in US dollars. Net debt as of 31 March 2020 amounted to 152.1 billion roubles ($2 bn).

The Outlook

PhosAgro expects volatility to persist amid currency fluctuations in key markets and supply chain disruptions due to the COVID-19 pandemic. The off-season period in Europe, Latin America, the US, and Russia will be a negative factor for fertilizer prices, and the recovering production of fertilizers in China will further pressurize the prices. However, an increase in seasonal demand in India and Brazil will help to stabilize fertilizer both demand and prices in the short term.

PhosAgro expects with autumn to be uneasy because of the second wave of the coronavirus outbreak. In the most recent interview to Vedomosti newspaper, PhosAgro CEO Andrey Guryev said:

Mineral fertilizers are a seasonal business. There is a spring sowing season, and there is an autumn sowing season. In other words, 90% of mineral fertilizers are applied twice a year. Between them, stockpiles of fertilizers are formed, and warehouses are filled. For PhosAgro, the second quarter is almost fully contracted. So far, I do not see any problems with demand. But they may appear when the world faces the second wave of the pandemic, which is forecasted to happen in October and November.

Healthy Lobbyism

In the meantime, the European Commission has announced its "Farm to Fork" strategy. In this strategy, the European Commission aims to reduce nutrient losses by at least 50 percent, while avoiding a reduction in soil fertility as a result of reduced fertilizer use by at least 20 percent by 2030.

PhosAgro is concerned that as a result of the chosen strategy, which involves reducing fertilizer use without specifying possible environmental risks, the approach to fertilizer application will not be differentiated in terms of environmental friendliness. Therefore, fertilizers that fully meet the required environmental standards will also fall into the scope of the reduction targets. In this regard, the company proposes that the European Commission should apply measures to restrict the use of fertilizers based on clearly defined and scientifically sound criteria of possible harm to the environment.

I find the cooperation of PhosAgro with the European authorities a clear win-win situation as the company can offer a unique combo of both eco-friendly and relatively cheap fertilizers to its European customers. It's obviously more reasonable to use such fertilizers rather than just limit the usage of all fertilizers regardless of ecological properties. Let's hope that the EU will stick to common sense and make the right decisions on fertilizer regulation.

What's Wrong With Record-High Dividends

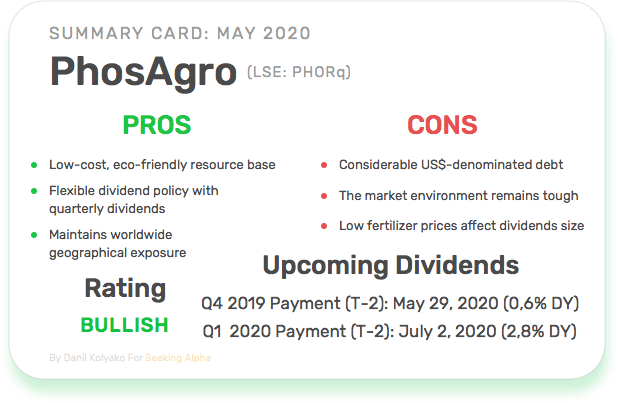

PhosAgro recently approved dividends for Q4 2020 and Q1 2020. The company has a little bit confusing schedule of payments, and the latest payment was actually for the Q3, not for Q4, as I mistakenly stated in my last article on PhosAgro. The next two payments will have a time lag of just one month: Q4 dividends are to be paid on June 2, 2020, and Q1 dividends on July 6, 2020. Dividends for Q4 amount to 18 roubles per share or 6 roubles per GDR; dividends for Q1 are the highest in the company's history - 78 roubles per share, which at current stock prices promises a quarterly dividend yield of 2.8%.

On the one hand, investors may be glad to receive the highest quarterly dividends in the history of the company. On the other hand, let me explain what I find worrisome about these dividends:

- Payments will be made from the company's undistributed net profit as of March 31, 2020. In fact, the company is spending its cash reserves when the world is in the midst of a full-scale economic crisis.

- A bigger concern I have is that PhosAgro has a considerable debt load (which is tied with the dividend policy), and instead of deleveraging, the company spends almost all its FCF on dividends. In my opinion, a "deleveraging first" approach would be much better for the company's long-term sustainability and investment attractiveness.

Anyway, for your convenience, I decided to show T-2 dividend dates in my summary cards so you could know when is the last day to buy the stock with dividends.

On The Stock

Source: TradingView

PhosAgro is my second Bullish pick that held pretty well during market volatility. My previous article about the company was called "A Great Buying Opportunity Is Coming Soon", and, as you can see, this opportunity actually came. The problem, though, is that I completely missed on timing: I expected a drawdown in Q2-Q3, and the actual decline occurred just a few weeks later after the publication of the article. The window of opportunity was rather narrow - the stock went down to its local lows only for a few days of March.

It seems investors began to appreciate more operationally stable companies, so now even disappointing Q1 earnings didn't discourage investors from holding PhosAgro. A risk of exclusion from the MSCI Russia Index I mentioned in my previous article also didn't materialize - the company even gained more weight in the index.

Nonetheless, the following factors will continue to affect the performance of PhosAgro, as well as the stock, in the medium term:

- Fertilizer prices are likely to remain under pressure amid the coronavirus crisis. India, one of the key markets for PhosAgro, has become one of the epicenters of the infection in Asia.

- PhosAgro's debt is mostly dollar-denominated, which revaluates together with the company's mostly dollar-denominated earnings.

- The company operates in a highly competitive market where it has pretty limited pricing power. Chinese producers, in turn, got a noticeable advantage in terms of operational costs because of low commodity prices (natural gas, for example, which is used in nitrogen fertilizers)

Final Thoughts

Overall, both the company and the stock remain steadfast even in such a worldwide mess. The quick rebound in the stock price can be justified by consistently robust growth in operational metrics. At the same time, it's hard to recommend buying the stock at the moment as there's still too much uncertainty around the coronacrisis. I'll monitor prices more closely and publish a bullish call when I see really attractive levels.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.