Why Copper Could Rise From Here

by Discount FountainSummary

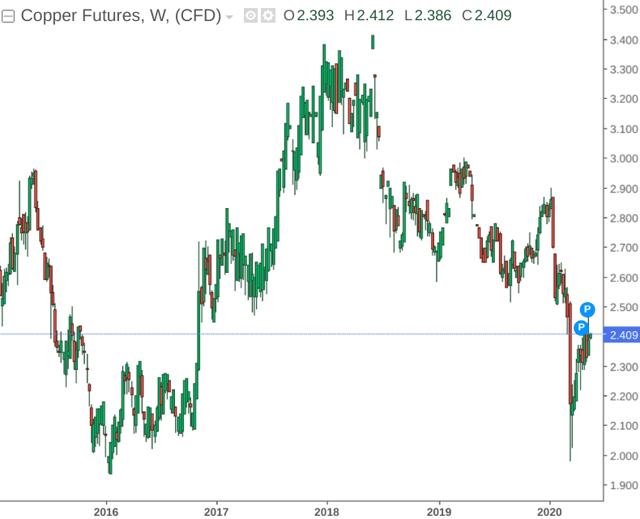

- Copper has taken a hit as a result of a sharp drop in economic activity due to COVID-19.

- However, the potential for rising inflation expectations along with rising imports of copper to China could push the metal higher.

- I take a bullish view on copper going forward.

With COVID-19 having introduced lockdown measures on the economy worldwide, copper prices have taken a significant hit in 2020.

Source: investing.com

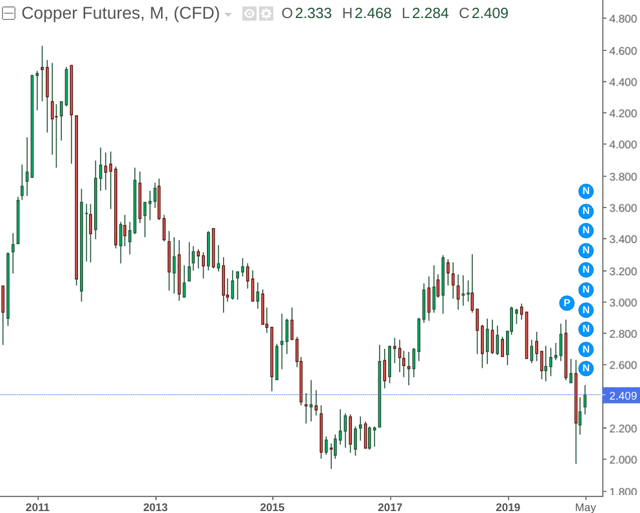

Taking a more long-term view, copper prices have been seeing an overall decline over the past decade:

Source: investing.com

The reason for this has primarily been a sustained period of low inflation – with a lower cost of production for copper producers, the resulting price competition between producers then places downward pressure on price.

With that being said, copper has traditionally been regarded as an inflation hedge. Given that copper production serves as a key barometer of economic activity – higher consumer spending in turn results in higher prices – which can then be hedged by the rising price of copper.

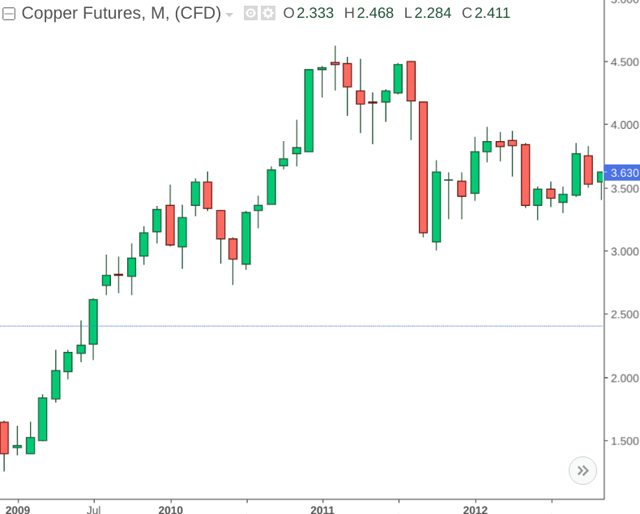

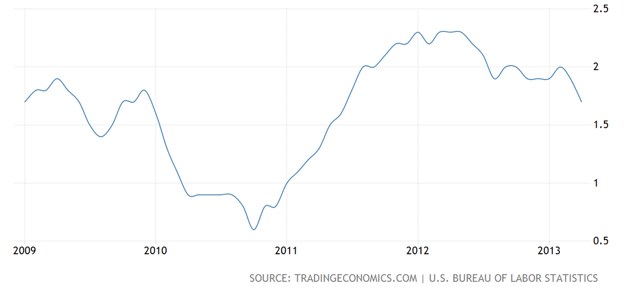

Interestingly, we see that copper prices started to rise from 2009 up until 2012 – even though U.S. inflation had not started to see a strong rise until 2011.

Source: investing.com

Source: tradingeconomics.com

It is possible that the rise in copper was due to rising inflation expectations on the part of investors, even though inflation itself did not kick in until 2011.

In some ways, there are similarities between 2009 and today in that the expected recession from COVID-19 is expected to be quite severe, with the World Bank predicting a 3% drop in economic output – the lowest growth rate on record since the Great Depression.

However, this does not mitigate the fact that the world economy can only absorb so much quantitative easing until prices eventually start rising again.

This is a particular risk if the economy recovers faster than expected – consumers will ultimately take advantage of lower rates and prices as a whole start rising.

In this regard, we may well see a situation where copper becomes more popular as an inflation hedge while price remains low.

In addition, China is the largest copper importer worldwide by far – accounting for 43% of all imports.

With China having dropped its official growth target for the first time in decades, the economic situation in that country is quite concerning, as it is elsewhere in the world.

That being said, China is stepping up infrastructure spending in an effort to restart economic growth – with a $600 billion budget being used for the purposes of upgrading major facilities such as airports, railways, and power stations.

Under such a plan, copper demand in China is set to increase very significantly going forward.

Ultimately, copper has taken a hit as the economy has come to a standstill. However, with inflation expectations having the potential to head higher as central banks continue with quantitative easing, coupled with an expected rise in copper imports into China – the metal could be set to rise from here. Assuming such circumstances, it is possible that we see copper prices rebound to the $2.90 level – where copper was originally trading before the onset of COVID-19.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.