SL Green: Buy Manhattan's Largest Office Landlord At A Steep Discount

by Timothy D GallagherSummary

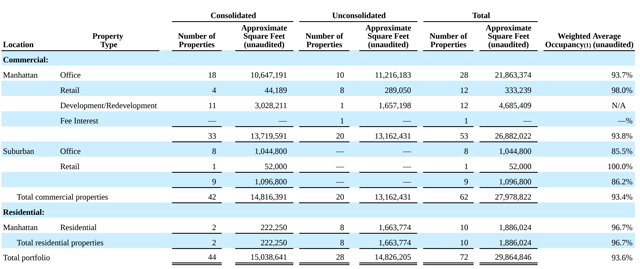

- SL Green Realty is the largest office landlord in Manhattan and managed by a crew who has worked together through several previous crises.

- A 9% yield looks to be sustainable through the current crisis, and continued action on its development projects could contribute to growth in the future.

- No shortage of risks, but at its current steep discount, I believe investors will earn handsome rewards if they are able to hold through some short-term uncertainty.

Investment Thesis

SL Green Realty (NYSE:SLG) is the premier player in the valuable Manhattan office market. The stock has cratered in response to excess office supply in NYC as well as doomsayers' predictions of an end to office work, but I believe it is now well oversold. The company possesses high-quality assets in an extremely valuable market, can speak to exciting development projects, and has taken decisive steps to shore up its liquidity heading into the downturn. The above-9% yield looks to be sustainable through a number of situations this year, and over a long-term holding period, SLG appears to be a very promising stock.

Brief Company/Leadership Description

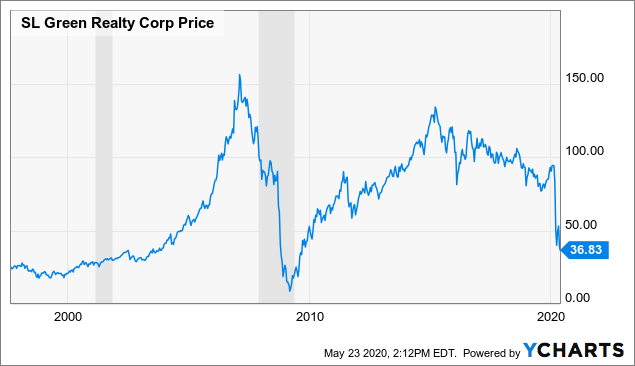

SLG has a dedicated and extremely experienced management team. The core leadership consists of Marc Holliday as Chairman and CEO, Andrew Mathias as President, Ed Piccinich as COO, and Matthew DiLiberto as CFO. The group has worked together for over a dozen years, and all of them experienced the trials of the 2008 Financial Crisis at SLG. I believe this will be a differentiating factor moving forward as the current team has shown it can succeed through unprecedented crisis. In the years after 2008, the company rebounded strongly and provided solid returns for shareholders. Now, the company is trading at levels not seen since 2009 and seems poised for another rebound in the years to come.

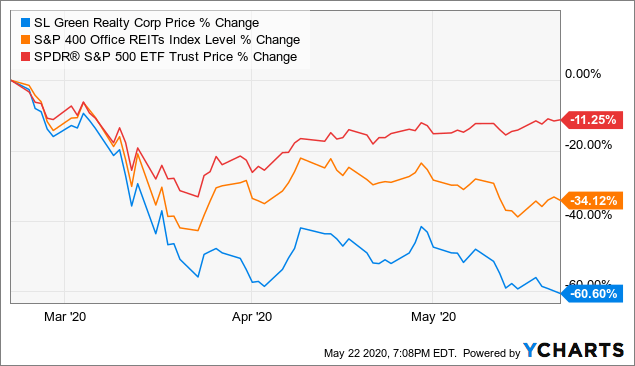

Data by YCharts

Q1 Takeaways

The leadership team's crisis management experience served the company well in the first quarter and will likely continue to do so as the city begins its phased reopening. COO Ed Piccinich outlined detailed plans for every single aspect of reopening, including testing new elevator algorithms intended to minimize traffic, providing sanitizing products in every lobby, and potentially using thermal scanners to detect high temperatures. The quick contingency plans enacted for reopening reinforce my faith in management and likely ease many of the tenant's worries as well.

On the tenant front, results for April were not bad at all, and forward expectations seem to be in a similar to better region. Per the 10-Q, 87.8% of April rents were collected from all tenants (93.4% from office; 63.4% from retail). From those who did not or could not pay, management has engaged in tenant-specific talks to figure out a deferred rent plan or another solution. In terms of the company's debt/preferred equity (DPE) portfolio, 98% of interest payments were received, and any non-payments that arise in the future are likely to be short-lived as it is heavily weighted towards higher-quality office and residential assets.

In terms of tenants' thoughts on WFH following the lockdown, CEO Marc Holliday noted:

What we are hearing from our tenants is that employees definitely will want to return once the restrictions are lifted. Work from home is proven serviceable at best. However, businesses are currently operating far below total capacity and capability and there is simply no substitute for working in purpose-built environments, free of home life distractions in a collaborative setting, which nurtures creativity, comradery and collaboration.

SLG's tenants wanting to return to their offices bodes well for the future despite many people foreseeing an end to office culture.

Liquidity and Financial Situation

In response to the overall uncertainty in the market, SLG has decided to raise $1 billion in cash. Its cash balance at the end of Q1 added to its recent $150 million credit facility drawdown means the company now has $730 million in cash on hand. Additionally, management intends to sell $100-$150 million of its DPE securities, which, combined with ~$100 million in repayments of existing positions, should add $200-$250 million in liquidity and bring the grand total to above $900 million.

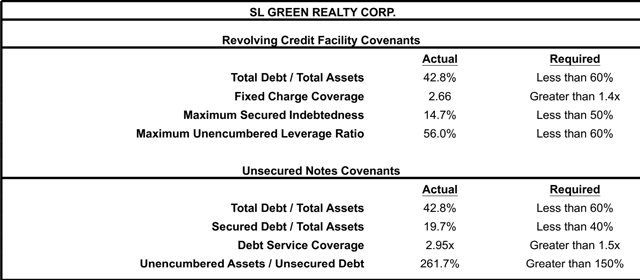

Despite total debt (including Joint Ventures) exceeding $10 billion, SLG remains in a strong financial place. Net debt to EBITDA stands at 9.7, which is high, but unworrying as the company covers all fixed costs and debt easily. Also, once OVA begins to contribute, leverage should head lower.

The table below summarizes SLG's debt covenants compared to its current situation. With plenty of wiggle room on almost all fronts, I do not foresee any issues here either.

Source: Q1 Supplemental

SLG has no material debt maturities this year, has paused all share buybacks, and holds in-place financing for all of its ongoing development projects. With a high cash position, SLG will obtain short-term flexibility and likely be able to snap up potential bargains in a weak market, similar to what the company did in 2008. The decisive moves taken to shore up liquidity place the company in an excellent position to weather the impending downturn and emerge as a stronger company.

Dividend

SLG currently yields over 9%, which is immediately deserving of further investigation. At its current level of $3.54 per share, the dividend costs SLG around $271 million annually; add in the preferred distributions and the grand total comes to just under $320 million. Per the Q1 call, the company -- after discussions with tenants and including expected rent losses -- expects $400 million in FAD (Funds Available for Distribution) for FY 2020. This makes for a payout ratio around 80% -- given management's projections are correct, which is no guarantee given their slightly optimistic assumptions. For Q1, FAD was about $106 million, and common/preferred dividends totaled $79.6 million. To be on the conservative side, let's assume that FY 2020 FAD comes in 20% under expectations to $320 million, exactly what the dividend would cost. In this situation, two things lead me to believe SLG will retain the dividend:

- Management is very shareholder-focused, and I expect they will want to preserve SLG's recent history of consistent dividend growth in order to continue building an established record.

- Likely only a small portion of cash on hand will be necessary to make up any potential shortfall, and the message to shareholders will be a strong positive.

On the other hand, even in the event of a dividend cut, I remain optimistic on the payout in the long run due to the company's aggressive efforts at growing the dividend in the wake of the Financial Crisis. Since 2011, the company has increased the dividend at a 30% CAGR. If SLG cuts or suspends the dividend this year, the company will likely increase its payout during the recovery just as aggressively as it has done previously.

Development

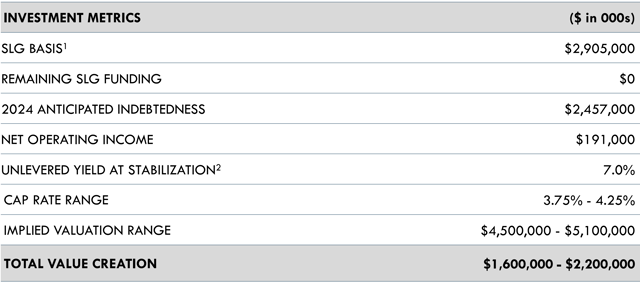

In the interest of brevity, I will highlight only the largest and most promising project SLG is developing: One Vanderbilt Avenue (OVA). OVA, located above Grand Central Terminal, is the fourth-tallest skyscraper in Manhattan and will become a highlight of the skyline upon completion. Before COVID-driven construction delays, the project was three months ahead of schedule, and despite delays, SLG still expects an August/September opening. Highlighting the quality of the asset, the building is already 67% pre-leased, and leasing discussions do not seem to have meaningfully slowed. By the end of 2020, management hopes the building will be 82% leased. Even if this turns out to be overly optimistic, over time the building should almost definitely stabilize due to its aesthetic appeal, strategic location, and SLG's strong management.

In addition, for long-term investors, the Observation Deck at OVA will be fully operational by 2022 and will likely become a key Manhattan attraction. The Summit, as it will be known, will be the fourth highest observation deck in the city and become only the second with an outdoor area. By 2024-2025, the Summit be a significant contributor to revenue and is expected to add ~$47 million to the top line by that time.

Below are the projected financials for the OVA project.

Source: Company Presentation

Valuation

At current prices, the company is shockingly cheap based on a number of valuation methods. The lowest analyst forecast for 2020 FFO is $6.35 per share while the highest is $6.89. For the sake of ultra-conservatism, I will chop 20% off the lowest estimate to get 2020 FFO of $5.08. Using a P/FFO multiplier of only 10 -- whereas the Office REIT sector average is around 15 -- SLG is calculated to be worth $50.80 per share. That implies, with very conservative inputs, greater than 37% upside from its current valuation.

On a book basis, the company is incredibly cheap as well. REIT peers, such as Vornado Realty (VNO), Boston Properties (BXP), and Empire State Realty (ESRT), all trade at their respective book values, and more often at a premium, yet SLG is valued closer to half its net assets.

SLG is trading at a steep discount in relation to both its peers and assets. Perhaps this is driven by its concentration in Manhattan and the excess supply on the island, yet I am unconvinced considering ESRT is also focused exclusively on NYC and, in fact, is more exposed to COVID due to its higher retail exposure.

What Are the Risks?

Although I sincerely believe the risk of work-from-home replacing traditional office culture is overblown, it must remain a consideration for any investment in SLG. With that said, my thoughts on the matter are as follows. While many employers will almost certainly allow for greater flexibility in WFH policies, I do not think this translates directly into a significantly decreased demand for office space. Yes, companies may follow Facebook and Shopify in the shift to complete WFH, but in most cases, WFH is not necessarily a binary option to offices. I think the true result of the current forced WFH will be an increase in the option to work from home. But this new ability to work from home likely will not replace office use; it will augment it. Office naysayers may be correct in that WFH will become much more widespread, but this does not directly imply a significantly adverse result for office landlords like SLG.

Additionally, as employers become more spatially aware due to social distancing and other measures, I believe the overall trend of de-densification in office space will accelerate. This means more square footage per employee, and it likely could benefit SLG, particularly with its focus on the ultra-dense Manhattan.

The other risk stemming from COVID lies in the reopening of NYC. If a significant increase in coronavirus cases occurs as the city begins its phased return to activity, NYC may be forcibly shut down once again, which would likely be detrimental to SLG's tenants, and in turn, SLG itself. However, at SLG's currently depressed valuation, I believe an extended lockdown is fully priced in already. While there may be some further downward pressure on the stock driven by emotion, any short-term challenges should be smoothed out by a rapid recovery upon return to even just a semi-normal environment.

Similarly, the shutdown will inevitably, if it has not already, cause a recession, which will impact companies in virtually every industry. This could result in downward rent pressure, lower occupancy levels, increased tenant delinquency, or a combination of all three. Although this would have an adverse effect on SLG's business, as I said above, almost all of this has been priced in. The more than 60% drop in SLG's price -- greater than both the overall market and its REIT peers -- has more than accounted for investors' worst fears.

Data by YCharts

In general, the excess of office space in Manhattan is threatening to SLG's prospects, yet supply has outpaced demand for several years now, and SLG has managed to succeed in spite of it. Real estate pundits have been predicting the demise of the Manhattan office market since 9/11, yet the city has always managed to recover. Manhattan leasing activity in Q1 was poor, as expected, yet SLG's numbers remained strong with 426,000 square feet closed 100,000 square feet in April) and a leasing pipeline (excluding tenant delays due to COVID) of 815,000 square feet remaining. I believe SLG's success in the face of overall market weakness stems mainly from its high-quality assets -- e.g. One Vanderbilt Ave, which has continued to post growing pre-leasing numbers -- and strong management.

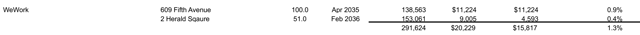

Lastly, SLG has exposure to co-working tenants, notably WeWork, which is likely to fail and/or default on its rent.

Source: Q1 Supplemental

However, with WeWork representing only 1.3% of annualized cash rent, any impact will be marginal, and again, the >60% drop in the price more than compensates for this exposure. Additionally, if WeWork is forced to vacate, I believe SLG will be able to re-lease WeWork's space quite easily given the excellent locations. The Herald Square property is located within a block of transit hub Penn Station, and the Fifth Ave property is only several blocks from Grand Central and directly across from Rockefeller Center.

Conclusion

Despite the long list of risks presented, SLG yields above 9%, and the steep price drop has more than accounted for future struggles. With its extensive list of high-quality Manhattan properties and a very strong management team steering the company, I believe the long-term prospects for an investment in SLG are promising. If investors can buy and hold while disregarding the headlines through an extended market downturn, I think the eventual reward will more than compensate for any interim struggles.

Disclosure: I am/we are long SLG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.