Inflation Fears In A Deflationary World

by Topdown ChartsSummary

- Massive waves of quantitative easing stir fears of rising inflation and even hyperinflation, but is this fear well-placed?

- Indeed, some would say that the risk of deflation is higher.

- Our view is inflation will likely rise on the other side of the pandemic, but for now, a wave of cyclical deflation is spreading across the globe.

Central banks printing money leads to inflation. It sounds right... right? Not so fast.

For US investors, the 1970s era of elevated inflation and the early 1980s Fed-induced recession still eludes recency bias. We are conditioned to believe that massive amounts of quantitative easing and low interest rates should spark an imminent explosive period of higher prices. The data is rolling in, and it suggests we are moving toward deflation despite central banks buying $2.4 billion in financial assets each hour, according to Martin Baccardax of TheStreet.

I concede that base rates are important when analyzing this situation - i.e. what would inflation be like had central banks (namely the US Federal Reserve) done NOTHING? I imagine we would be experiencing even more deflation, but that's not to say inflation is suddenly on the horizon. But people seem to think it is.

We've written on our general bullish thesis within the energy & commodity space in the last two months, but we also acknowledge and respect the data showing weak growth and low policy rates. It's hard to see money moving around sharply again that would spur a major uptick in consumer prices. To really see inflation return, we need labor costs to increase and a general sharp move higher in money velocity.

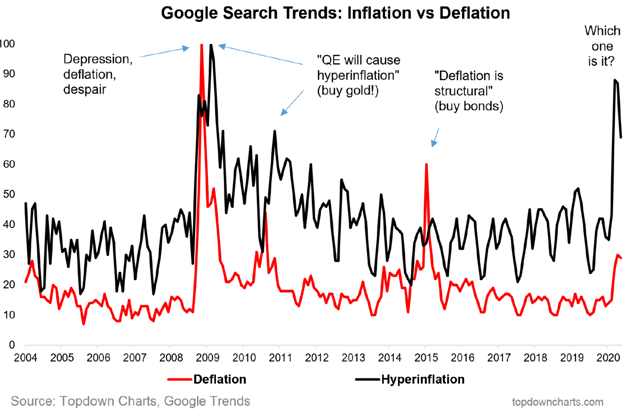

Enter Google Search Trends. We've all become Apple Mobility Trend data aficionados of late, but let's not forget the real OG - Google Search Trends. There has been a recent spike in both deflation and hyperinflation searches.

Our stance is deflation is likely in the near term for developed economies, and inflation may kick up somewhat in the intermediate to longer term, but persistent deflation and sudden hyperinflation are probably long tail risks.

The first chart dates back to 2004 and vividly displays the 'off-the-chart' nature of the Great Financial Crisis. Deflation was making headlines, so individuals were naturally curious about it. Then came massive QE and government intervention, leading to a rise in hyperinflation fears - recall how crude oil & gold performed quite well from very late 2008 to mid-2011 (that's what people think about when they hear 'inflation' - commodity price increases). The term 'reflation' was commonplace on financial television.

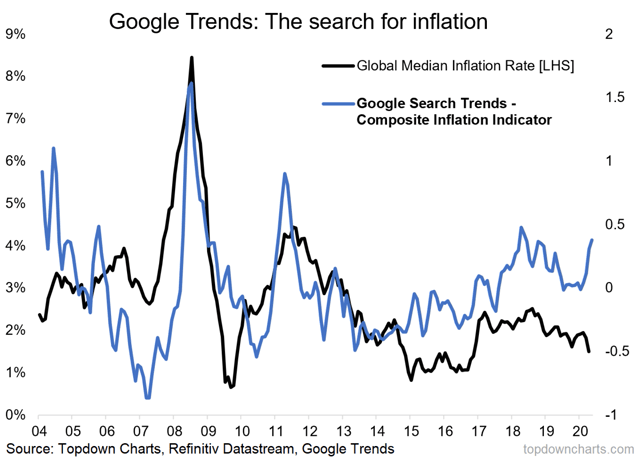

In the next chart, we compare Google Search Trends to actual inflation/deflation data. There has been a recent divergence. On a composite-basis, searches have been for inflation, and data has been disinflationary. 70% of countries have experienced negative Producer Price Index [PPI] figures this year and 30% featured negative Consumer Price Index [CPI] moves. Oil has played a role certainly, but so too has loosening capacity utilization.

What's the probable outcome? Persistent deflation is a risk due to COVID-19-induced economic weakness and a slow recovery. Call it U-shaped if you wish, but the bottom line is individual behavior will slowly transition back to normalcy - not a quick reversion. In the near term, a global economic recovery in late 2020 through 2021 may spur some transitory upward price pressure due to the bounce back.

In the near term, people may be feeling inflationary effects more than the traditional measure of consumer prices would suggest, according to Bloomberg. This could be driving some inflation concerns, too. It is reported that the typical basket of goods purchased during a lockdown is quite different from those bought during normal times. It makes sense in that people haven't purchased much gasoline and aren't booking airline tickets, but all of us were buying a ton of toilet paper. All of the spending dollars were chasing the same narrow scope of goods.

Here's the point - Deflation and hyperinflation get the clicks, but both of those scenarios are long-tail risks, in our view. A near-term period of deflationary pressure followed by higher inflation, but not hyper-inflation, is a more reasonable and likely outcome.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.