51job: Despite Short-Term Pain, Long-Run Perspectives Look Bright

by Money ArtistSummary

- Several structural big-picture drivers are in place to give material tailwinds to recruitment services market in China.

- 51job and Zhaopin are the top dogs in terms of operational KPIs in the Chinese job classifieds vertical.

- The current crisis will lead to market consolidation which will benefit the market leaders, as Seek's case in Australia/New Zealand suggests.

- Current valuation is at historical levels and offers an interesting entry point against the background of long-term material growth opportunities.

Investment thesis

Despite short-term pain ahead due to economic contraction, I am bullish long term on 51job (NASDAQ:JOBS), considering (i) its market leading position, (ii) its strong balance sheet in combination with the ability to generate significant cash flows and (iii) market consolidation tendencies in online jobs classifieds in periods of economic turmoil as the case of Australia-based Seek (OTCPK:SKLTY) suggests.

51job is the leading nationwide one-stop solution provider in China when it comes to recruitment and HR linked services to employers. The company provides both online and offline recruitment services addressing different target groups. However, currently, Chinese (and world) economy are facing unprecedented economic challenges triggered by the coronavirus pandemic.

Massive pressure on Chinese job market

According to the CIER Index, China's job market might recover in the second quarter of 2020 from a severe hit in the first three months when job vacancies declined by up to 23% and the CIER Index itself dropped to 1.02 on a quarterly basis (1Q19: 2.47). The index, published by the China Institute for Employment Research (CIER), keeps track of labor supply and demand. It divides the number of vacancies by the amount of job seekers. Thus, the higher the ratio, the more competitive the job market from an employer’s point of view. Nevertheless, the authors of the report state that "employment still faces very big uncertainty and the prospect of jobs could be worse than the prediction". The importance of labor market stabilization is indeed one of the Chinese government's main priorities. The CCP, for the first time in history, felt unable to hand out an official GDP growth target due to lacking visibility in the current macro environment.

There is no doubt that the impact caused by the coronavirus pandemic will particularly hit the recruitment sector. Companies simply stopped hiring against the background of suspended production/operations in the first place and, further down the road, because of demand shortage from overseas as the virus outbreak turned global.

Positive long-term labor market drivers

Despite all these short-term headwinds, the Chinese labor market is characterized by several structural drivers which will provide mid- to long-term tailwinds for recruitment businesses. These drivers will (in)directly increase the number of vacancies and, thus, hirers' demand for talent will see an uptick while workforce is not available in abundance. Therefore, recruiters are willing to pay for features/products to make their hiring process more likely to be successful.

According to data from Liepin, an online job board focusing on mid-to-high-end talents (defined as candidates aspiring at an annual salary of RMB 100k+), the overall HR services market will account for more than RMB 1 trillion by 2022 (approx. USD 146 billion). This implies an average annual growth rate of 22% as of 2019. In the light of the coronavirus crisis, this data most likely will not be applicable anymore, however, it allows us to get a grasp on the market potential.

One of the most noteworthy driving forces is the still relatively low internet penetration rate in China as a whole. In 2020, overall internet user penetration stands at 66% and will, according to eMarketer estimates, rise to 73% by 2024. In the most recent years, this ongoing digitization contributed significantly to moving recruitment processes from the offline to the online world.

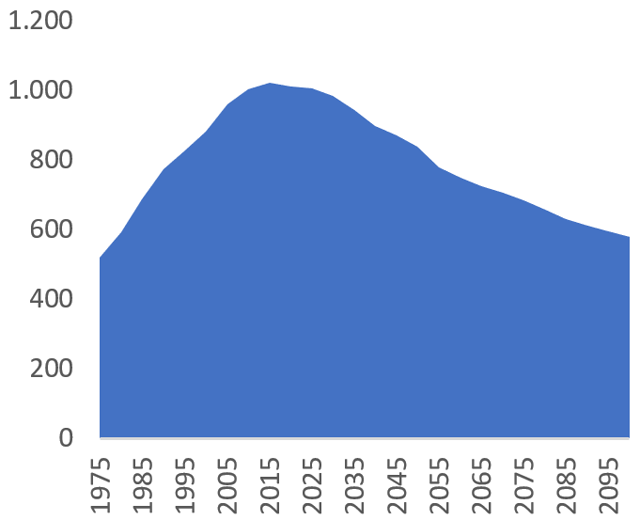

Then, secondly, Chinese economy will suffer a continuous decline in working-age population. The number of people aged between 15 and 64 peaked in 2015 amounting to 1,022 million. The United Nations (UN) forecast a decline to 986 million by 2030 and to 838 million by 2050. This development is mainly a result of the one-child policy, which was introduced in 1979/80.

Thirdly, within this age cohort the percentage of early-retirees increases due to improved retirement benefits. According to the National Bureau of Statistics, the economically active population will shrink over-proportionately to 580 million by 2026 (2018: 806 million).

Fourthly, Zeng Xiangquan, director of the CIER, states that migrant workers, who play an important role in Chinese economy, are often limited in terms of their educational background. Therefore, they are less/not suitable for a variety of jobs which leads to additional shortage in labor supply.

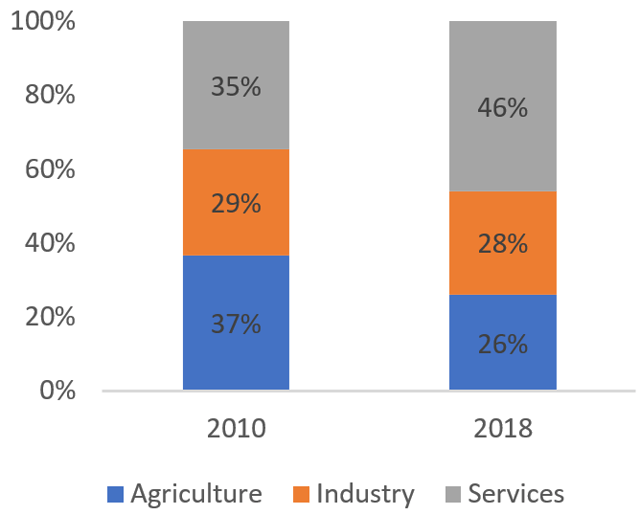

And, fifthly, China is set to further transform its economy more and more towards services to the detriment of the agricultural sector. According to Statista, in 2010, roughly 35% of Chinese workforce was employed in the service sector. In 2018, this percentage amounted to 46%. This change will go along with a pronounced urbanization. The UN estimates that around 80% of the country’s population will be living in urban areas by 2050, while this number today stands at 61%.

| China: working-age population (15-64 years old) forecast in millions | China: distribution of workforce across sectors |

| Source: own illustration based on data of the United Nations. | Source: own illustration based on data of Statista. |

Competitive landscape led by incumbents 51job and Zhaopin

The top dogs of the Chinese online recruitment market are 51job (founded in 1998) and Zhaopin (1994). Both cannibalized their print business over time. In recent years, new contenders such as Liepin have appeared on the scene. Additionally, generalist portals such as 58.com (NYSE:WUBA) entered the jobs vertical. Most lately, a new generation of competitors such as Boss Zhipin have made their appearance fighting for market share.

The USP of purely digital players such as Boss Zhipin, compared to the more traditional job boards, is a feature that allows direct chat engagement between job seekers and recruiters. In this way, the intermediate function of the traditional job search platforms is circumvented. This appears to be extremely interesting for inexperienced and young talent on the one hand, and employers who are looking for an inconvenient and swift match on the other. Although Boss Zhipin has clearly gained traction, the company still has some way to go.

From my point of view, Boss Zhipin is not the ultimate disruptive threat for 51job and Zhaopin. I would argue that the latter (i) own long-term relationships with employers/recruiters, (ii) are able to develop a similar product on their own to amplify their portfolio (51job employs 900+ website designers and software developers) and (iii) the (current) focus of Boss Zhipin on freshmen is very/too narrow.

At the same time, within its Online Recruitment Services segment, 51job covers a wide range of niches and sub-verticals:

| Portal | Focus |

|---|---|

| 51job.com | Primarily white-collar workers aged 20-35 |

| Yingjiesheng.com | College graduates and students |

| 51jingying.com | Passive job seekers who are usually currently employed, older, more experienced and highly skilled |

| Lagou.com | Focus on the technology and engineering sector |

| 51mdd.com | Front line workers in the service sector (mainly sales, customer service, logistics) |

Little headroom left for 51job and Zhaopin in Chinese white-collar market

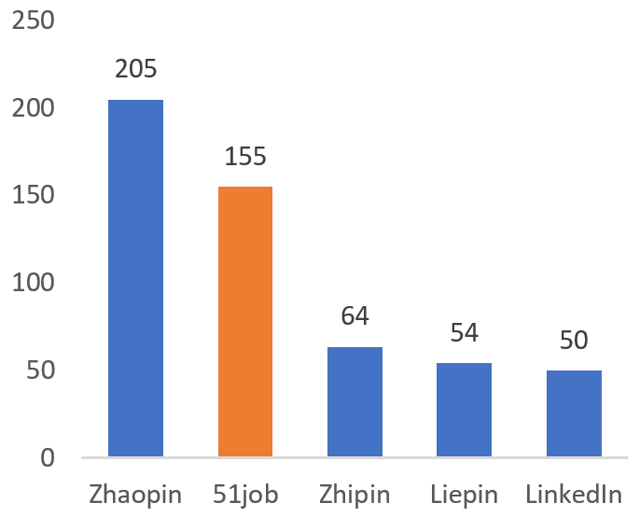

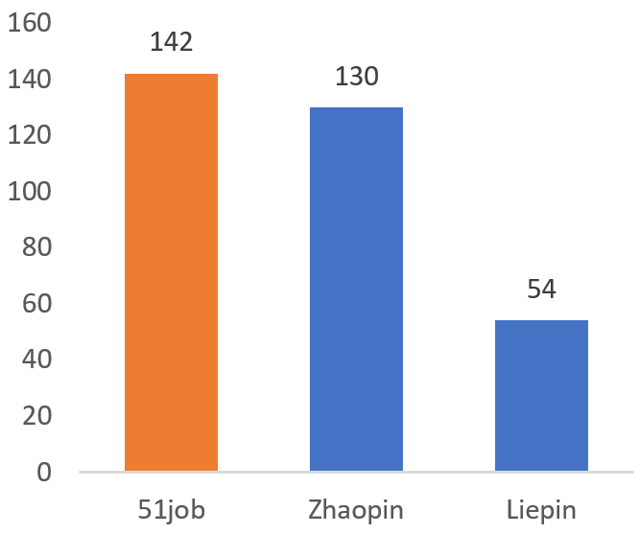

The examination of operational KPIs underpins the front-running positions of 51job and Zhaopin. In terms of registered users, 51job accounts for 155 million as of year-end 2019, while Zhaopin stands at 205 million. In early 2019, a data breach at 51job allowed Zhaopin to increase the gap which was "only" at roughly 30 million registered users in 2018. However, regarding the depth of the CV database 51job is slightly ahead of Zhaopin (142 million over 130 million).

Considering that both 51job and Zhaopin address primarily white-collar workers, they must be close to some kind of market saturation. According to Boss Zhipin, there are roughly 200 million white-collar and about 400 million blue-collar workers in China. I am saying "close" because I assume that neither the amount of registered users nor the number of resumes is 100% white-collar.

| Registered users in millions | Depth of CV database in millions |

| Source: own illustration based on data of the respective companies. | Source: own illustration based on data of the respective companies. |

51job is ahead of the curve in terms of traffic

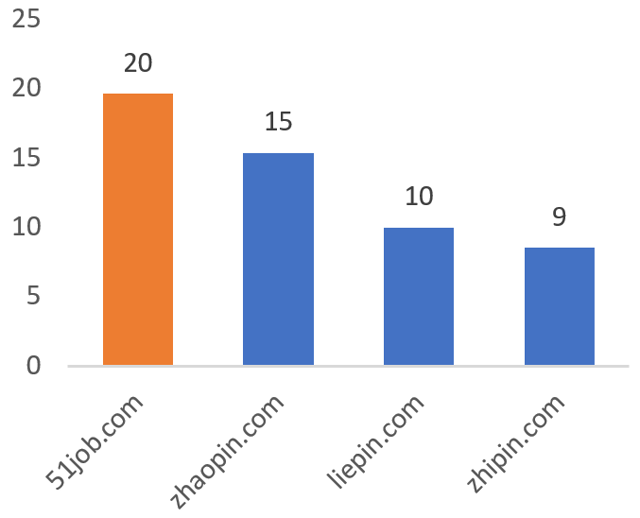

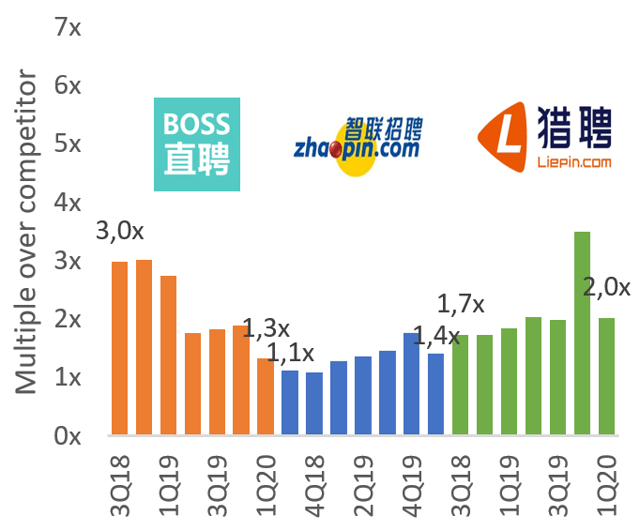

Over the period from May 2018 to April 2020 (24 months), 51job.com registered roughly 20 million monthly visits on average, while Zhaopin averaged 15 million. On a quarterly basis, 51job was able to expand its advantage over its two main competitors Zhaopin and Liepin slightly, while Boss Zhipin has gained momentum.

| Visits in millions over last 24 months per April 2020 | Quarterly visits: 51job’s multiple over competitors |

| Source: own illustration based on data of SimilarWeb. | Source: own illustration based on data of SimilarWeb. |

Strategic focus on customer profitability since 2018

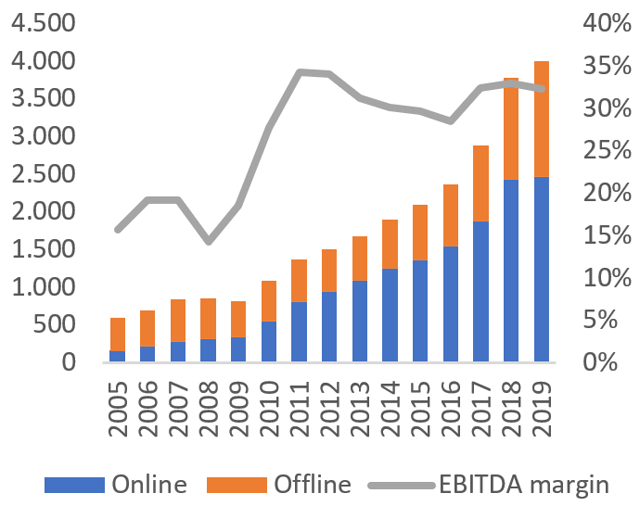

On the back of the print-to-online shift mentioned above, 51job was able to drive its topline by 15% annually since 2005. Simultaneously, the share of online revenues in total sales increased from 27% (2005) to 62% (2019). Nevertheless, offline revenue will remain an essential part of the group's business model. Within its Other HR Related Services segment, 51job offers business process outsourcing, campus recruitment, training, assessment and placement services. According to the management, these concepts and services are still "relatively new in China". The company cross-sells services among its two segments.

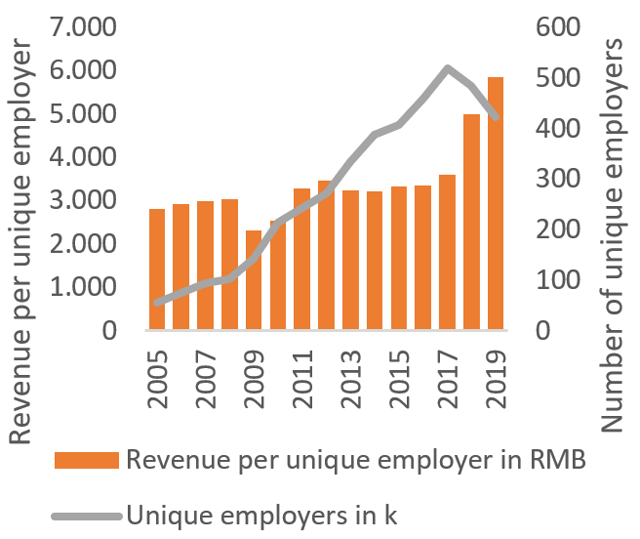

In 2019 financial year online revenues increased by 2% yoy only. The long-term CAGR of the online business was at 22% (2005-19). Zhaopin's online business stagnated, too (+3% yoy in 2019). Both blame weak macroeconomic conditions. In addition, 51job referred to a strategic review of its customer base to increase the average revenue per user (ARPU). After years of stagnation, the ARPU accelerated significantly in 2018 and 2019. Simultaneously, the number of unique employers declined, i.e., 51job terminated business relations with customers of lower-priced services who could not be up-sold to higher-priced/multiple online products.

| 51job: online and offline revenue (mRMB), EBITDA margin (%) | 51job: ARPU and number of unique employers (both refer to online business only) |

| Source: own illustration based on company data. | Source: own illustration based on company data. |

Current economic crisis as a chance for market consolidation

To learn about the potential impact of the current economic crisis, we can look back into the past. During the last bigger crisis in 2008/09, 51job's revenue decelerated significantly in 2008 (+2% yoy after +21%) and even dipped in 2009 (-5% yoy). In 2010, the group returned, on the back of its online division, to its growth path, recording 33% topline growth yoy.

Sure, the current crisis is unprecedented. However, crisis situations often have helped market leading companies to consolidate or even extend their position. This is due to smaller players filing for bankruptcy or active market consolidation via M&A bailing out financially distressed competitors. Additionally, customers are more likely to rely on leading companies associating stability with a well-established brand. Generally speaking, in the classifieds business the prevailing view is that in the long-run there is only room for a maximum of two (big) players in a given market.

In any case, 51job brings a strong balance sheet to the table to sit out this crisis. The equity ratio (adjusted for minorities) stands at 77% as of December 2019. Additionally, the company sits on a cash reserve of more than USD 300 million which translates into a strong net cash position.

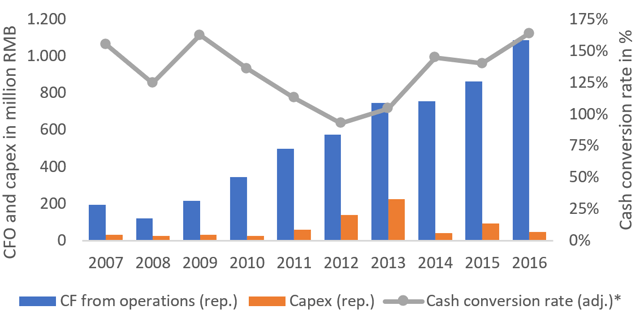

The group's ability to generate convincing cash flows even in macroeconomic downturns is noteworthy. In 2008 and 2009 the cash conversion rate (free cash flow to net income) stood at 125% and 163%, respectively. In general, the company finances all its capital expenditures by means of its cash flows from operations. Fluctuations in capex originate from one-time effects, primarily linked to purchases of office space (normalized capex stands at 2-3% of revenues).

| 51job: strong cash conversion driven by solid cash flows from operations |

| *Adjusted for changes in fair value of convertible senior notes issued in 2014 and due in 2019 which were affected by FX volatility (RMB-USD). Source: own illustration based on company data. |

Case study: Seek basically became a monopolist in its core market after 2008/09

The case of Australia-based job board Seek helps to get a better idea on the consolidation argument in favor of the market's front running company. The group is active in various geographies, but in none of these its market position is that strong as in its home markets Australia and New Zealand.

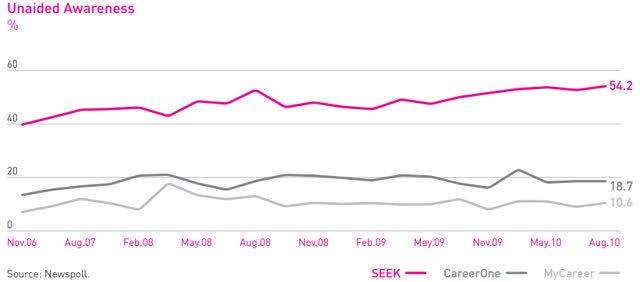

Already before the crisis in 2008/09 Seek enjoyed a market leading position in terms of relevant operational metrics and brand recognition. However, after the crisis Seek basically created a monopoly in its core market leveraging its strong position and structural market dynamics (primarily, print-to-online shift in job advertising). What stands out is Seek's significant upswing in unaided brand awareness rallying from roughly 40% (2006) to 54% (2010), while the main competitors in the Australian market stagnated.

| Seek: unaided awareness |

| Source: Seek Limited AR 2010. |

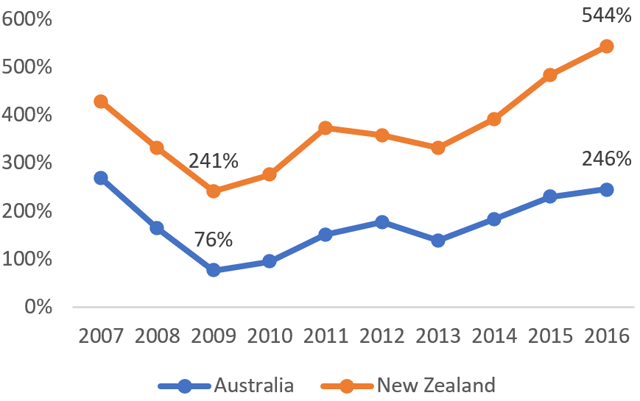

Based on the group's geographical disclosure, I use the asset turnover ratio (non-current assets are disclosed on a segmental basis) as a proxy for the return on investment (RoI) in both of its home markets Australia and New Zealand. Arguing that a high profitability (reflected in RoI which I proxy via the asset turnover) is the direct result of an outstanding underlying market position, we may conclude that Seek cornered the market in the aftermath of the financial crisis after a trough in 2009 financial year.

| Seek: (non-current) asset turnover ratio for operations in Australia and New Zealand |

| Source: own illustration based on data of Seek Limited. |

Valuation offers interesting entry opportunity

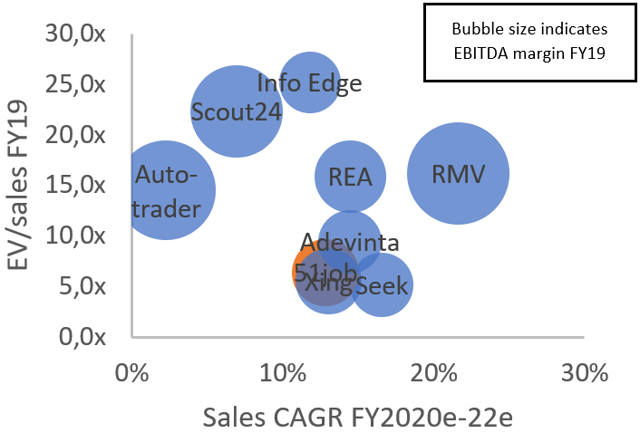

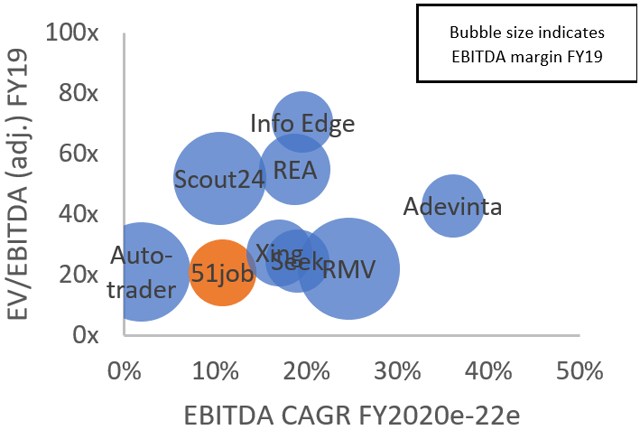

In the context of an international peer group consisting of classifieds players of different verticals, 51job's valuation looks currently to be on a fair level. Against its job vertical core comps (Seek and Xing) valuation in terms of EV/sales seems to be slightly stretched.

For the EV/EBITDA ratio I adjusted the reported EBITDA figure of all companies for share-based payments, capitalized R&D and, if applicable, for effects of the adoption of IFRS 16. As for the sales figure, I did not adjust for minority shares, although they are pretty material at least in the case of Seek. Additionally, the EBITDA consensus for 51job consists of one estimate only and is therefore less representative. Against this background, valuation seems to be rather fair compared to the job vertical peers.

| Valuation based on EV/sales and sales forecast | Valuation based on EV/EBITDA (adj.) and EBITDA forecast |

| Source: own illustration based on own calculations and Bloomberg consensus data (as of May 21, 2020). | Source: own illustration based on own calculations and Bloomberg consensus data (as of May 21, 2020). |

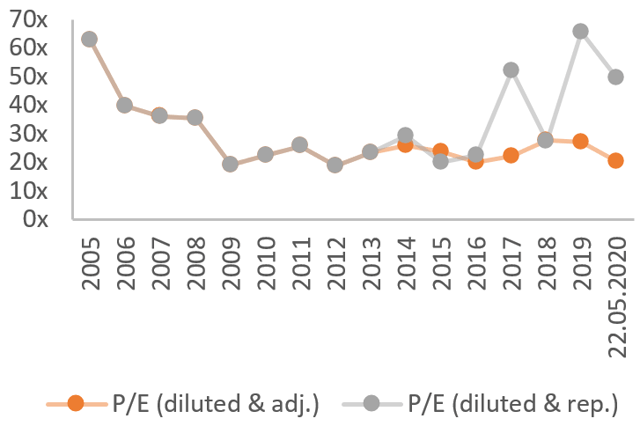

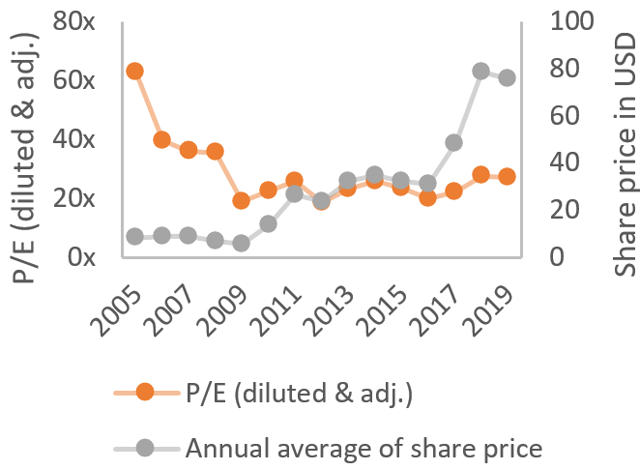

After the significant share price decline on May 22, 2020 (-12%), the stock currently trades at 20.5x its FY19 adjusted earnings. I adjusted for changes in fair value of convertible senior notes issued in 2014 and due in 2019 which were affected by FX volatility (RMB-USD) and materially impacted the group's earnings position while being a non-cash item.

The current P/E (adj.) ratio is in line with its historical average of 23.3x (since 2009). This valuation appears to be justified against the background of long-term growth prospects (after the 2020 dip).

| Historical valuation based on P/E ratio | P/E (adj.) and share price performance |

| Source: own illustration based on company data. | Source: own illustration based on company data. |

Conclusion

Despite the current severe contraction, the long-term levers for HR related services in China remain intact. As the past has proven quite often, it will be the market leaders who weather the crisis in good shape. In anticipation of economic expansion, which is accompanied by an increased demand for talent, 51job, the leading company in one of the largest and still growing HR markets in the world, has one of the best starting positions (both in terms of operational and financial KPIs) for a further growth hike. Against this background, the stock's current valuation at its historical P/E levels appears to be an attractive entry point.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in JOBS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.