Weak Apparel Makers To Avoid

by Paul FrankeSummary

- Recessions are typically hard on apparel makers, with inventory adjustments and falling sales.

- The COVID-19 economic shutdown and physical retail disruption in operations are problematic for the clothing industry.

- The apparel manufacturers have become one of the weakest stock market groups to own during 2020.

The coronavirus economic shutdown in the U.S. has closed most physical clothing retail locations for 6-8 weeks, and many are still waiting to reopen. One side effect on the supply chain shock is inventories have ballooned at retailers. They are cancelling orders and piling up goods that may not be moved to consumers for months, if not longer in 2020. A second negative effect of the pandemic is a disruption of the overseas manufacture of items being delivered on time to warehouses, wholesalers and consumers in the U.S. Without doubt, a ripple of issues are being felt by the major clothing manufacturers. This industry group has been one of the weakest performers to date on Wall Street.

Of course, consumers will buy clothes online and visit local brick-and-mortar locations over time. The biggest questions are what are the immediate and direct costs of doing business in a disrupted world, including the changing channels of distribution. Apparel makers have a variety of unexpected expenses to absorb. Then what trends in buying will resume later in the year? Regular recessions are typically hard on clothing companies from lower sales and inflated inventories. If the coronavirus recession leads to a depression in clothing demand for several years, stock quotes will likely remain weak throughout 2020. The worst-case scenario is a second wave of infection, even larger than the first, hits America by November, incredibly ill-timed as the important Christmas sales season begins.

Under Armour (UA), Hanesbrands (HBI) and Ralph Lauren (RL) have remained relatively weak against the rocket move higher in the typical stock since March. For traders/investors, the respective 15-25% up-moves in price on the three names the last several weeks may have opened another smart area to liquidate shares, before increased selling pressure appears later in 2020.

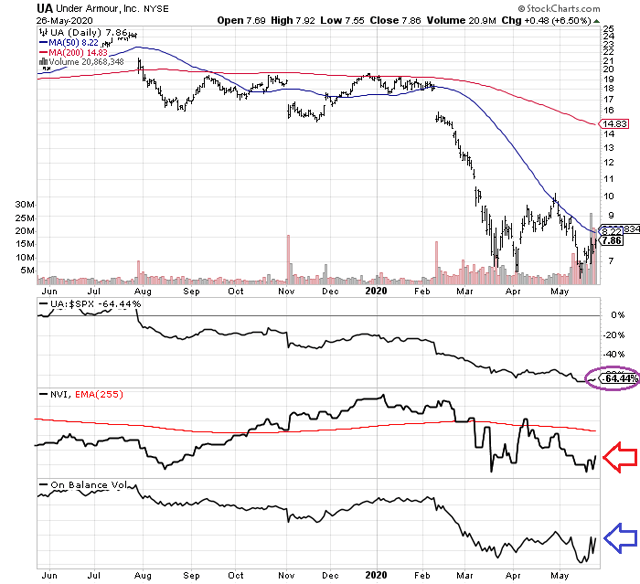

Under Armour

Under Armour issued stock to the public as its consumer popularity peaked, and investor enthusiasm couldn't be any higher for this widely touted next 'Nike' brand of sportswear and shoes. Well, investors have figured out consumer apparel trends are quite fickle and can change on a dime. UA's stock peaked at $104 in 2015, and today's $8 quote may still be too expensive versus backpedaling sales and rising operating losses. The stock is trading at 2.5x tangible book value (using the latest March quarter data) and is projected by Wall Street analysts to lose -$0.65 per share this year, while potentially earning a profit of $0.20 per share next year.

Image Source: Company Website

On the chart below circled in purple, I have highlighted the ultra-rotten relative price change in the stock against the S&P 500 average company. Dropping 64% more than the market the last 12 months, and unable to recapture its simple 50-day moving average, Under Armour has been thrown to the curb by investors. The red arrow points to a weakening Negative Volume Index (NVI). Buyers have been absent on falling volume, quieter trading sessions. On top of the lack of accumulation on low volume days, aggressive selling on high activity days is the message from the On Balance Volume (OBV) line. If you are purchasing shares today, you are sticking your head (and money) out of a window and praying a reversal will happen, lacking any real evidence a bottom has been reached.

Hanesbrands

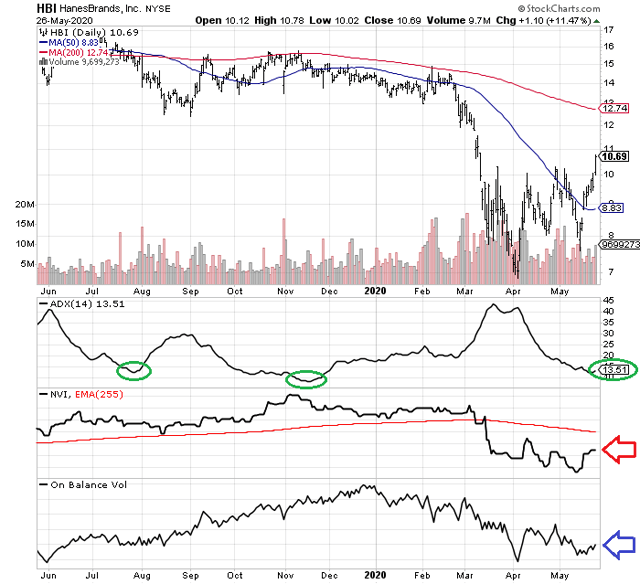

Hanes has been around for decades, known mainly for its underwear, bra, t-shirt and sock items. While analysts are projecting $0.70 for EPS in 2020 and $1.30 for 2021, I am expecting far worse as consumers put off purchases like past recessions, especially as unemployment approaches 25% in May. The company is highly leveraged with $7 billion in total liabilities and a negative tangible book value of -$2 billion, using March financial data.

Image Source: Great Lakes Crossing Mall Storefront

I have drawn some green circles around the low 14-day Average Directional Index (ADX) scores under 15 the past year of trading. They have proven a great area to sell shares. The red arrow points to the punk performance in the NVI and a blue arrow highlights the weak 2020 trend of the OBV line. The whole technical picture is bearish. Remember, this does not guarantee a major drop is on deck, but it shouldn't be a surprise if Hanes declines again given a faltering economy.

Polo Ralph Lauren

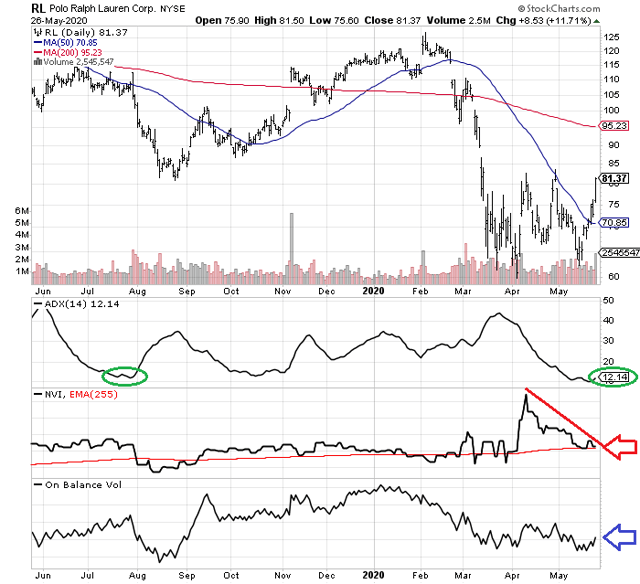

The Ralph Lauren story is not any brighter than the other two apparel stocks. The maker of mid-range to luxury priced clothing, notably for men, Ralph Lauren's equity quote today is similar to its August low. So far it has held up better than UA or Hanes, but the same technical warning signs may be forecasting another large move lower is approaching.

In December, the company held $2 billion in tangible book value vs. the current $5.4 billion stock market capitalization at $81 a share. Earnings estimates for the next fiscal year, ending March 2021, are around $4.70 per share.

Image Source: Company Website

On the 52-week chart below, I am circling in green the super low ADX reading of 12, similar to the July number that preceded a 30% sell-off. Unlike the July occurrence, the NVI and OBV indicators have been in steep decline the last six weeks. The NVI has been particularly bearish, highlighted with a red line. If the stock quote cannot get above $85 this week or next, the odds of a retest of the $65 low area looks reasonable.

Final Thoughts

Investments in the apparel manufacturing industry are essentially a function of your view of the economic recovery, or lack of one, from the coronavirus pandemic. If we get a second wave of infection in the fall/winter or its current spread does not abate below today's ongoing rate of 600,000 new cases and 30,000 deaths per month in America, a sustainable rebound in apparel sales and profits may not occur for a year or two. Like past recessions, a number of years of restructuring operations to meet the new level of slack demand could also weigh on potential upside in these names.

With the uncertain future of retail sales for America, outside of the grocery market, why not invest your hard-earned capital into companies with better predictability? I rank Under Armour, Hanesbrands and Ralph Lauren as Avoids or Sells for my money.

If you decide to short the major apparel makers, please understand that borrowing shares to sell involves greater risk than a long-only approach to investing. You can lose more than you invest initially if good news propels a stock higher unexpectedly. I suggest shorting a number of individual stocks from different industries with your capital mainly as a hedge against your investments on the long side. Smaller short positions and a net-neutral to long portfolio design overall will keep your bearish picks from ruining performance when one or more invariably outperform the market.

Thanks for reading. Please consider this article a first step in your research process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Want to read more? Click the "Follow" button at the top of this article to receive future author posts.

Disclosure: I am/we are short HBI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.