S&P 500 Price Analysis: US stocks battling with the 3000 mark

by Flavio Tosti- The bullish recovery sends the S&P 500 in 2.5-month highs.

- The S&P 500 is starting the New York session battling with the 3000 level.

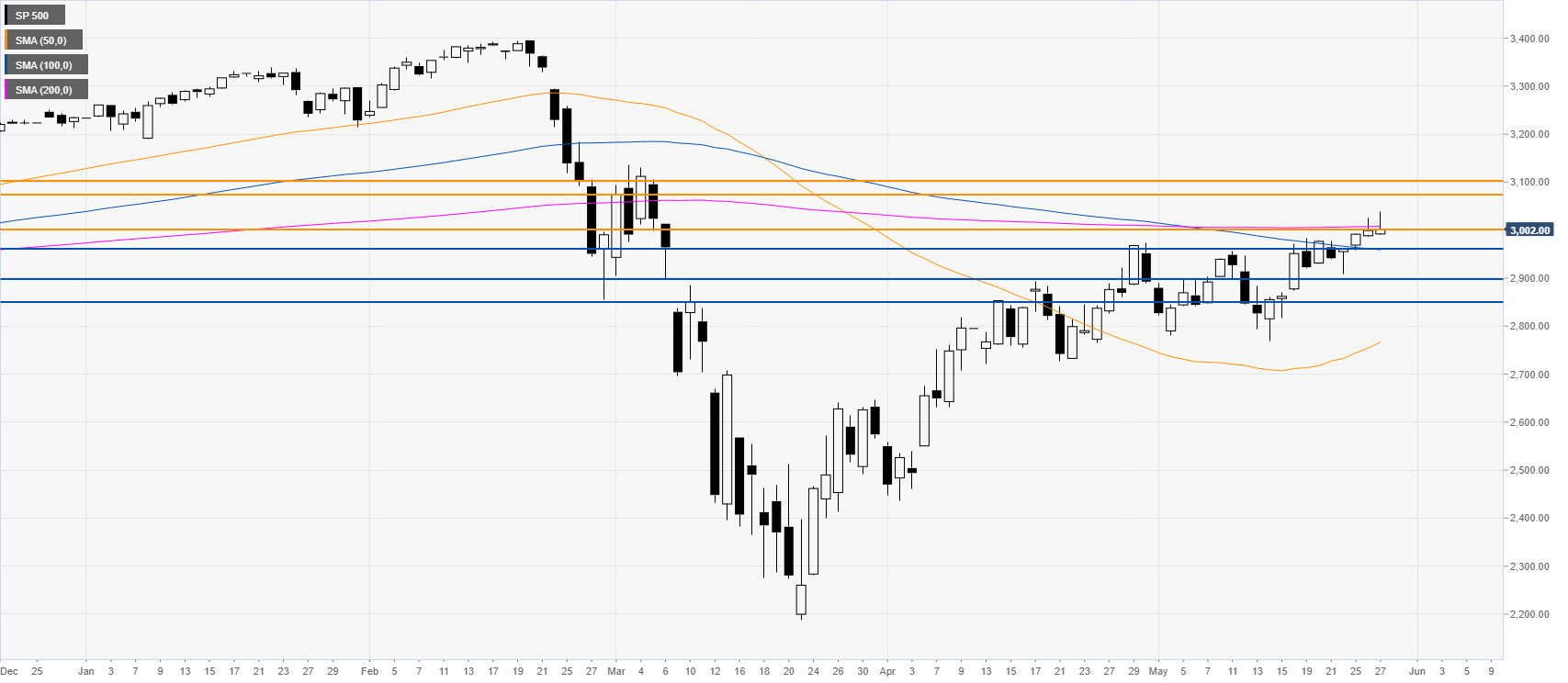

S&P 500 daily chart

After the February-March collapse, the S&P 500 is recovering a great part of the lost ground. The market is trading in 2.5-month highs above its main SMA on the daily chart. The index is battling with the critical 3000 mark. A daily close above the mentioned level could see an advance to the 3075/3100 price zone in the medium-term. On the flip side, support can be seen near the 2960 and 2900 levels initially.

Additional key levels

SP 500

| Overview | |

|---|---|

| Today last price | 3015.25 |

| Today Daily Change | 16.00 |

| Today Daily Change % | 0.53 |

| Today daily open | 2999.25 |

| Trends | |

|---|---|

| Daily SMA20 | 2906.56 |

| Daily SMA50 | 2754.44 |

| Daily SMA100 | 2961.51 |

| Daily SMA200 | 3007.45 |

| Levels | |

|---|---|

| Previous Daily High | 3024.25 |

| Previous Daily Low | 2986.75 |

| Previous Weekly High | 2982.5 |

| Previous Weekly Low | 2874.5 |

| Previous Monthly High | 2974 |

| Previous Monthly Low | 2436.25 |

| Daily Fibonacci 38.2% | 3009.92 |

| Daily Fibonacci 61.8% | 3001.08 |

| Daily Pivot Point S1 | 2982.58 |

| Daily Pivot Point S2 | 2965.92 |

| Daily Pivot Point S3 | 2945.08 |

| Daily Pivot Point R1 | 3020.08 |

| Daily Pivot Point R2 | 3040.92 |

| Daily Pivot Point R3 | 3057.58 |