XLE: Energy Stock Comeback Has Begun

by Stuart AllsoppSummary

- Energy stocks are dirt cheap relative to the overall market based on current oil prices, suggesting XLE outperformance versus SP500 even in the absence of an oil-price recovery.

- Despite the strong cyclical nature of oil price trends, the ratio of XLE to SP500 is trading as though investors expect a continuation of the bear market in oil prices.

- The extreme valuation divergence suggests that if the economy fails to rebound strongly the SP500 is highly at risk of a crash, while if it does, energy stocks could soar.

- Even if energy equities do not recover, the XLE's dividend yield should remain far higher than the overall market resulting in steady total return outperformance.

Energy stocks are dirt cheap relative to the overall market based on current oil prices, suggesting that even if we do not see an oil-price recovery we should still see energy equity outperformance. If we do, the outperformance could be significant. We are therefore long the Energy Select Sector SPDR ETF (XLE) and short the S&P500 Index (SP500).

The extreme valuation divergence between XLE and SP500 means that if the economy fails to rebound strongly the SP500 is highly at risk of a crash, while if it does, energy stocks could soar. Meanwhile, a rise in inflation would likely benefit energy stocks relative to the overall market. Even if energy equities do not recover, dividend yields should remain far higher than the overall market resulting in steady total return outperformance.

Bearish Perfect Storm Has Passed

The first few months of the year marked a bearish perfect storm for energy prices and energy stocks, with the combination of the COVID-19 lockdowns and Saudi-Russia production increases causing front month WTI prices to fall to an unthinkable -USD40/bbl. However, energy price declines tend to sow the seeds of subsequent higher prices. Just as the cure for high oil prices is high oil prices, the cure for low oil prices is low oil prices.

On the one hand the collapse in oil prices will support demand, particularly in emerging markets, and particularly if we see renewable subsidies decline as governments marginally shift their priorities away from climate change and towards fiscal concerns. On the other hand, low prices encourage capex cuts, causing supply to be taken offline. We have already seen this take place and with most countries now easing lockdowns, it is no surprise that oil prices have rebounded strongly. Front month WTI has already recovered the gap left on March 9 caused by the double whammy of the Saudi-Russia price war and Italy's announcement of nationwide lockdowns.

Valuations Imply An Intensification Of The Oil Bear Market

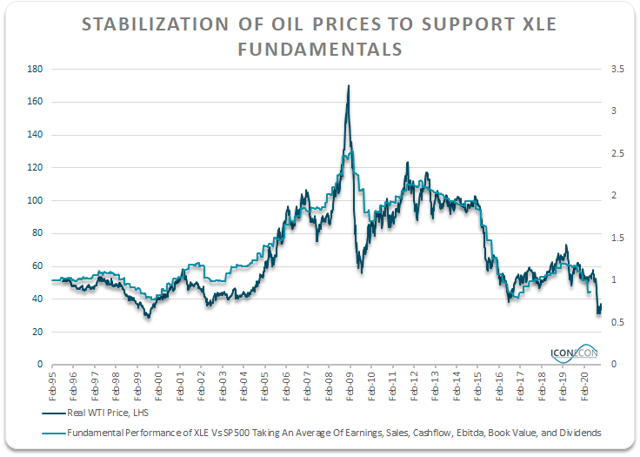

The decline in oil prices has caused severe underperformance in the fundamentals of energy stocks as one would expect. The following chart shows the relative performance in the fundamentals of the XLE versus SP500 taking an average of earnings, sales, cashflows, EBITDA, book values, and dividends. The relative performance of the energy sector's fundamentals tracks the real oil price with a lag of 6 months. The recent oil price rebound suggests we should see a stabilization in the XLE's relative fundamentals towards the end of the year.

Source: Bloomberg

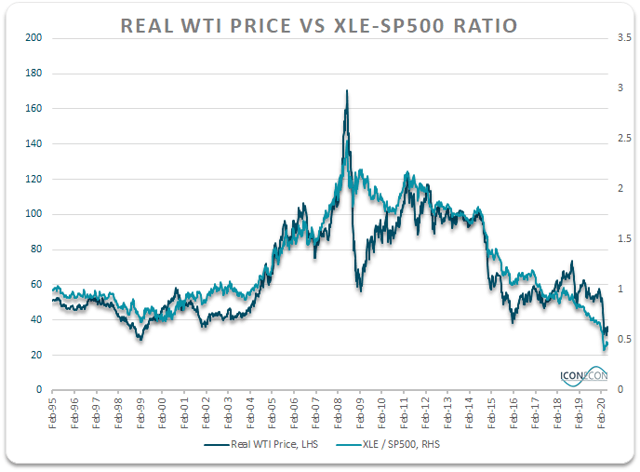

However, investors have shunned energy stocks to such an extent that they have underperformed even relative to their deteriorating fundamentals. Based on the historical correlation between the XLE/SP500 ratio and WTI, investors appear to be pricing in another 20-30% decline in oil prices. In other words, while the natural cyclicality of oil prices looks likely to remain in place, energy equities look priced for an extrapolation of the oil price decline.

Source: Bloomberg

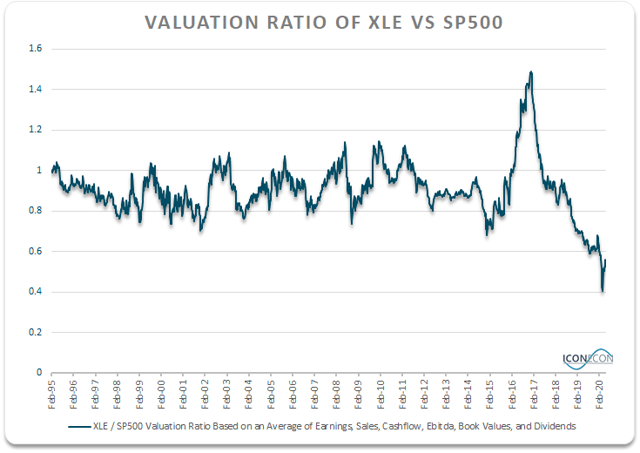

As a result, the XLE is at its cheapest level relative to the SP500 on record based on an average of valuation metrics used above. As the chart below shows the energy sector is roughly 40% below average valuations.

Source: Bloomberg

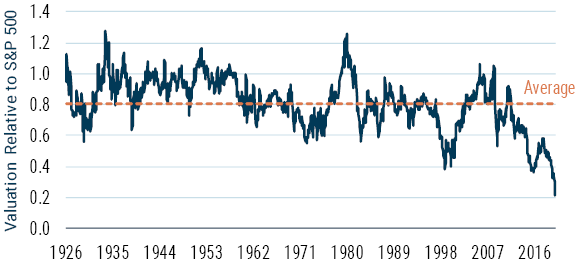

This chimes with the findings of a GMO research note from last month, which showed that energy and metals stocks were by far the cheapest relative to the overall market going back to the 1920s. The growth of sustainability mandates and the impact of ETF inflows driving up large cap stocks are often seen as reasons to justify the extreme valuation gap between the XLE and SP500. While this may be true, even if valuations extremes are justified, they still imply positive relative future returns for investors who are able and willing to invest in the energy sector.

Valuation of Energy and Metals Companies Relative to the S&P 500

Source: GMO, S&P, MSCI, Moodys,

Dividend Yield Advantage Large And Here To Stay

Even if oil prices remain low or even head lower and negative sentiment towards the energy sector prevails keeping valuations depressed, we would still expect to see the higher dividend yield on energy stocks relative to the SP500 to remain in place. The XLE has a current dividend yield of 5.7%, roughly 3x and almost 4 percentage points higher than the SP500, meaning that if dividend yields remain unchanged, the SP500 would have to see dividends grow 4pp faster than the energy sector in order in order to outperform.

While the energy sector is almost certain to see dividend cuts over the coming quarters, the same is true of the SP500 in our view. Dividend payouts relative to other corporate fundamentals remain similarly elevated across both the energy sector and the SP500, with dividends as a share of cash flow coming in at 30% and 26% respectively.

FAANGs Need The Real Economy, Which Needs Oil

The valuation gap between the SP500 and the XLE suggests that the former is priced for an economic boom and the latter for a long-term recession. As we have argued previously, the tech sector, and particularly the FAANG stocks are valued have driven up the overall market as though they are immune from economic weakness (see 'Tech Turmoil Ahead').

We sympathize with the potential for declining long-term oil demand due to electric vehicle substitution among other factors, and see the potential for travel-related oil demand to remain deeply subdued over the medium term due to the COVID-19 threat. However, it is difficult to see a continued disconnect between the booming digital economy represented by the FAANGs and the depressed real economy represented by the energy sector, at least while energy remains the key global energy source. The success of the digital economy relies on the output of the goods producing industries to generate sufficient output to enable consumers' surplus time and resources to spend on consumer services. Without a recovery in real goods production it is unclear how the FAANG stocks are going to continue to grow revenues.

A Mirror Image Of 2008

The current oil price and energy equity environment is a mirror image of the situation which occurred in 2008. Back then, peak oil supply was a key theme driving prices with investors believing emerging market demand would cause prices to continue rising indefinitely. Meanwhile, the macroeconomic backdrop was shifting from inflationary growth to deflationary recession.

Today, even though the idea of peak oil supply is no less true today than it was back then as easy-to-access crude continues to deplete, it seems irrelevant in the current climate of abundant near-term production. The focus has instead shifted to peak oil demand. Meanwhile, while the economy was turning from inflationary boom to deflationary bust in 2008, we believe the economy is now on the verge of moving from deflationary bust to inflationary boom. If real GDP growth does not recover strongly from the current crisis, central banks and government will likely ramp up money printing and fiscal deficits which would further raise the prospect of high inflation (see 'The Inflation/Deflation Debate: Taking The Over'). In other words, nominal GDP looks set to rise one way or another, providing a supportive backdrop for the energy sector.

Disclosure: I am/we are long XLE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.