Rocket Pharmaceuticals: Updating Our Bullish View For Recent Events - Still A BUY

by The Twilight InvestorSummary

- We remain bullish on RCKT - a gene therapy biotechnology company with a considerable amount of news flow anticipated during the next 12 months.

- We first highlighted the stock in our report last September. The company has 5 shots on goal. If successful, the upside from here is multiples of the current share price.

- News flow during the past 6 months has been extremely positive (and the stock is up c. 50%). We continue to anticipate good news flow during the next 6-12 months.

- World class management team, solid shareholder register, good science, and well capitalized.

We first wrote about Rocket Pharmaceuticals (RCKT) in September 2019 (see report here) so we figured it was time for an update. Additionally, this year is a big year for RP-A501, an AAV9 gene therapy for Danon Disease that has billion dollar plus revenue potential. So we figured it is worth including a primer on Danon Disease and just how this drug candidate may play out over the next few years.

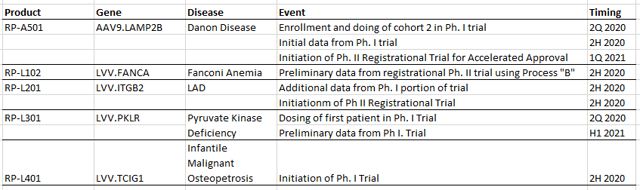

While like most things in the stock market during the past six months it has been an up and down ride but the stock is up c. 50% since we wrote our first report. In that report we highlighted that there are numerous important catalysts during 2020. These are still to play out and are listed below:

A reminder of the investment thesis

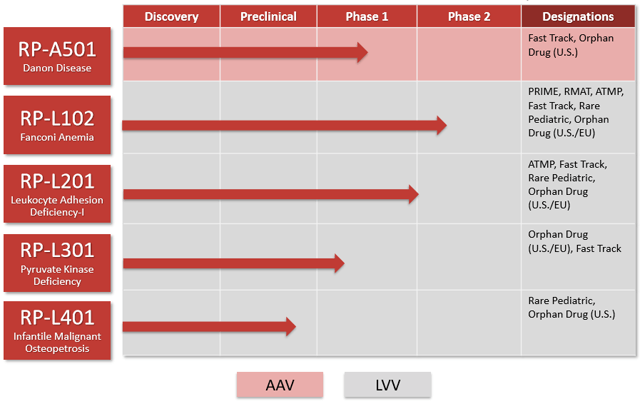

Rocket Pharmaceuticals (RCKT) is a best in class gene therapy company with five shots on goal and strong data to support its current valuation. The two largest assets, RP-L102, a lentiviral gene therapy for Fanconi Anemia and RP-A501, an AAV gene therapy for Danon Disease are each worth multiples of the current share price, if successfully commercialized. The management team is highly experienced and have successfully commercialized many products at predecessor companies. The board of directors are both experienced and proven money makers on wall street in the world of biotech. The shareholder base is strong with top quality investors and the company has sufficient cash on the balance sheet for at least two years, during which multiple value drivers will report out. Commercialization of the most advanced products could occur in the 2021 timeframe.

Source: Company Data

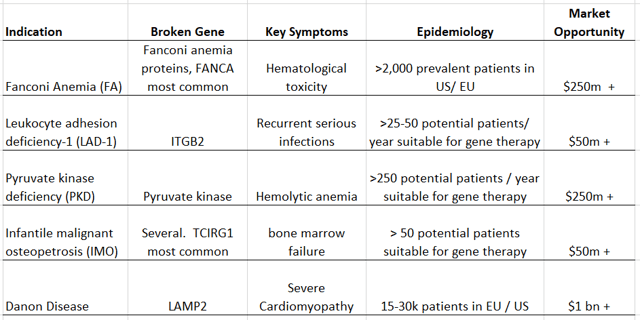

Pipeline has > $1bn in Revenue Potential

Source: Company data, my estimates

Recent Updates

The company has provided numerous updates in recent months and these are detailed below. Broadly speaking, all support our investment thesis which was detailed in our original report. These updates were published or presented at ASH (American Society of Hematology) in Dec 2019, at the company’s FY and 1Q results or at ASGCT (American Society of Gene and Cell Therapy), which took place virtually in May this year.

Update on RP-L102 highly encouraging

At ASH, in December 2019, the company announced promising early 6-month data from 2 Fanconi anemia (FA) patients treated with commercial-grade RP-L102 under the optimized Process B methodology. As a reminder, Rocket is currently evaluating two processes (A and B; similar to the different processes that BLUE used for lentiglobin in its sickle cell program) for RPL102 in Fanconi Anemia. Process B differs from Process A in that it administers higher doses of virus, utilizes transduction enhancers, and employs a commercial-grade vector.

Process B is clearly resulting in a higher quality product as VCNs for the first two patients were 2-3x higher. Further, at 4-6 months post-infusion, both FA patients showed early signs of engraftment and stabilized or increased blood cell counts in the absence of cytotoxic conditioning. We believe this data corroborates the long-term data from the patients treated under Process A that showed durability of engraftment for more than 2 years.

Patients 1001 and 1002 had mean CFC vector copy numbers (VCNs) of 1.1 and 0.93, respectively (~5E4 CFUs/kg for both patients). For comparison, the Process A patients that achieved the best results out to 2+ years were '2 and '6, who had vector copy numbers (VCNs) of 0.45 (1.7E4 CFUs/kg) and 0.53 (16E4 CFUs/ kg), respectively

Engraftment kinetics are largely independent of drug dose at the 6-month time point, but we believe these higher vector copy numbers (VCNs) should translate to improved long-term outcomes. Additionally, blood cell counts stabilized in both Process B patients and patient 1001 achieved neutrophil and platelet counts slightly higher than baseline at 6 months, which is an encouraging early signal. Recall that Process A patients '2 and '6 similarly demonstrated stability in blood cell counts at 6 months that continued out to 24-36 months and we believe patients 1001 and 1002 should follow a similar trajectory. Finally, patients '2 and '6 had ~10% and ~4% MMC resistance at the 6-month follow-up, respectively, and both patients went on to achieve >10% during 24-36 months. While the bone marrow specimen for patient 1002 was insufficient to enable the MMC assay (and could not be practically repeated), resistance to MMC was demonstrated in 4% of bone marrow progenitors from patient 1001 at 6 months post-infusion, which is promising considering FA patients start at zero and should continue to increase. Recall that the FDA and EMA agreed on a 10% threshold of MMC resistance at 12 months as an endpoint for registration in the ongoing pivotal, but the company notes that not all patients need to show 10% MMC resistance. Indeed, only about half need to convert to meet the primary endpoint.

At ASGCT, in May 2020, the company presented data from seven process A patients. The initial four Process A FA patients continue to show robust and durable engraftment following treatment with RP-L102 with follow-up out to 2+ years. Two of the patients (product consistent with registrational Process B criteria) even demonstrated hemoglobin normalization, with one of them ('6) making a significant improvement since the last update. Additionally, the three new patients have 6-12+ of data and are showing early signs of engraftment via peripheral blood VCN.

RP-L201 also progressing in line with our Bullish view on the stock

As a reminder, the company is also developing RP-L201, an LVV-based gene therapy for the treatment of leukocyte adhesion deficiency-1 (LAD-1). LAD-1 is an immune disorder that can range in severity with a majority of the most-severe patients facing mortality before the age of 2. The disease is caused by mutations in the ITGB2 gene that encodes for CD18, a component of the Beta-2 integrin that is critical for the adherence of leukocytes to blood vessels and surrounding tissues. This defect results in the patient’s leukocytes being unable to exhibit cytotoxic activities, which significantly increases susceptibility to life-threatening bacterial and fungal infections. RP-L201 delivers ITGB2 to express CD18 in diseased patients and restore this defective immune response.

There is significant potential for a CD18-expressing gene therapy such as RP-L201 to make an impact in this indication, as a natural history study recently detailed the correlation between increasing expression of CD18 and increased survival of patients with LAD-1. This finding is supported by well-validated preclinical studies in a mouse model of LAD-1, where RP-L201 displayed high levels of engraftment of CD18+ cells and increased overall survival in CD18 knockout (KO) mice. Interestingly, chimerism as low as 5% was associated with long term survival. Moreover, canine data demonstrated that 5-10% CD18 expression can restore normalcy. Put simply, restoring 5-10% of CD18 expression may induce meaningful immune responses in LAD-1, which may be life-saving for patients.

At ASH, December 2019, the company presented some initial data on its LAD-1 program and they updated this data at the ASGCT conference in May 2020.

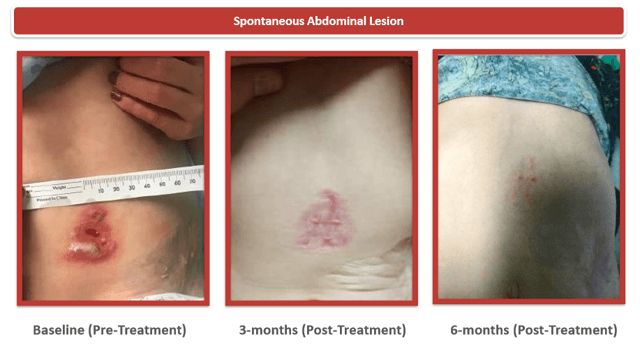

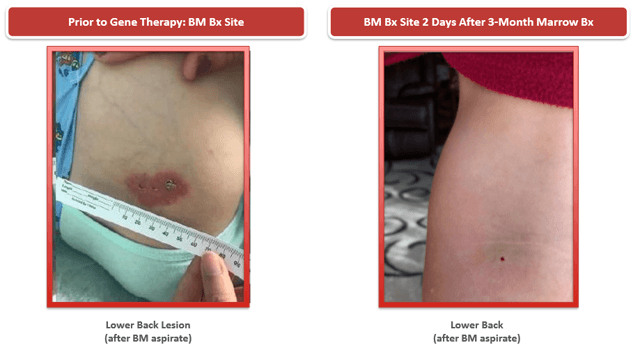

At ASH we also received 3-month data from 1 LAD-1 patient treated with RP-L201 who achieved 45% CD18 expression, which should dramatically alter the course of their disease. At 3 months with RP-L201, this patient (who had <1% CD18 expression) demonstrated complete healing of skin lesions that previously would have lasted months or years. Additionally, the patient's CD18 expression was 45% of normal levels, which should translate to uniform survival if sustained.

Additionally, at ASGCT, the patient's CD18 expression was 47% of normal levels, which is slightly higher than the 45% expression seen at 3 months at ASH

Management have stated that every single patient treated with RP-L201 will be counted towards registration as all patients have or will receive commercial-grade product, and that data from only 9 patients are required for filing (2 from Phase I, 7 from Phase II).

RP-L201 – Pictures are worth 1,000 words, sometimes.

Source: Company presentation

Source: Company presentation

The first cohort in the Phase I for RP-A501 is now complete and initial data are expected in Q4.

The company has dosed all three patients in the first cohort (6E13 vg/kg) of the Phase I study for RP-A501 in Danon disease, and so far no dose-limiting safety signals have been observed. Overall, the safety profile appears favorable and the company has been cleared to move to the undiclosed higher dose cohort in Q3. Phase I data from this program is expected in Q4, which should include a more detailed analysis of safety and tolerability. Preliminary efficacy measurements should include enzymatic biomarkers (troponin, CK), tissue histology, cardiac imaging/echo parameters, and functional parameters including exercise tests (such as walking distance) or peak VO2 The most meaningful endpoints will be extracted for use in the pivotal Phase II trial, which could begin later this year.

Recent publications also support strong science.

In February, the peer-reviewed journal Annals of Hematology published Rocket’s comprehensive review of somatic mosaicism in Fanconi Anemia (FA), written in collaboration with Centro de Investigaciones Energéticas, Medioambientales y Tecnológicas (CIEMAT) and other international research partners. The article, entitled, “Mosaicism in Fanconi Anemia: Concise review and evaluation of published cases with focus on clinical course of blood count normalization,” highlights research describing mosaicism in FA and supports Rocket’s approach of treating patients with RP-L102 without any pre-treatment conditioning measures. In March, Science Translational Medicine published positive preclinical data on Rocket’s Danon program, demonstrating that vector-mediated transfer of LAMP2B to deficient mice improved heart function and survival. The article, “AAV9.LAMP2B Reverses Metabolic and Physiologic Multiorgan Dysfunction in a Murine Model of Danon Disease,” underscores the promise of Rocket’s AAV-based gene therapy candidate for Danon, RP-A501.

RP-L301 also progressing on track

Rocket is also developing RP-L301, which is a preclinical stage drug candidate for the treatment of pyruvate kinase deficiency (PKD) that should be entering the clinic by year-end. Patients with PKD have a mutation in the pyruvate kinase L/R (PKLR) gene which is critical for ATP production and the survival of red blood cells. As a result, these patients experience severe hemolytic anemia, or breakdown of red blood cells. Rocket’s RP-L301 is an LVV-based therapy in which expression of PKLR cDNA is driven by the constitutive human PGK promoter and strong preclinical evidence of safety and efficacy has been observed. Specifically, RP-L301 was shown to correct multiple pathologies in a PKD mouse model (PKLR KO), including reticulocytosis, splenomegaly, and toxic iron buildup in tissues, which are all hallmarks of PKD. The prevalence of PKD is roughly 3,0008,000 patients in the US and EU which makes this product a potential $250 million - $750 million commercial opportunity, dependent upon clinical trial data and pricing.

Update on Balance sheet and Cash Flow

The company finished the first quarter with US$ 275.9 million in cash and stated that they remain capitalized into 2022. We view this as encouraging. We prefer to invest in companies with strong balance sheets and lots of news flow.

Company specific Investment risks

As with all biotechnology stocks, there are significant risks associated with this investment and under a worst case outcome, there is 100% downside. The most obvious risk is that the pipeline products fail in clinical development. While Rocket has five assets in its pipeline, and success in any one of these is likely enough to justify the current valuation, negative clinical trial data would clearly have a negative impact on the company's share price. Under the outcome that all five pipeline assets fail in development, the stock is likely worth zero.

We are also in an uncertain political environment with an election looming in 2020. It is unlikely that either party will be arguing for higher drug prices and biotech stocks often underperform during these periods. Investors can mitigate this risk by being short a number of lower quality biotech companies and long a number of higher quality biotech companies. In my opinion, investors need to be long biotech stocks that are financed through 2021 and have multiple catalysts during the next 12 months. Being short companies in the opposite camp likely generates a good return as well.

Currently this company is not really exposed to foreign exchange rate or interest rate risks but these factors may become relevant in years to come.

Disclosure: I am/we are long RCKT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.