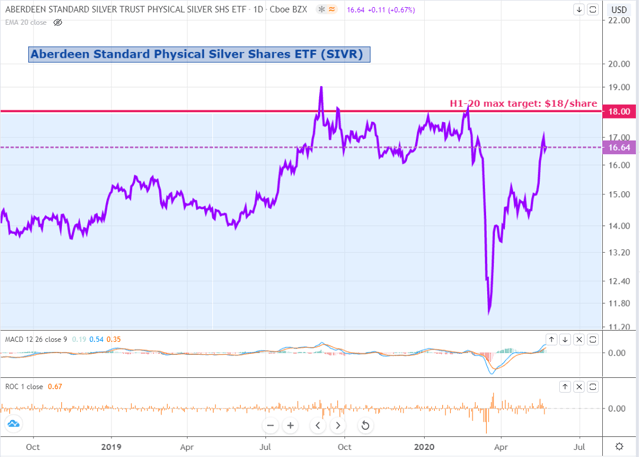

SIVR Weekly: Up 50% From Its March Low And More Upside To Expect

by Orchid ResearchSummary

- SIVR has jumped by roughly 50% since its March low, in line with our expectations.

- Silver’s spec sentiment is shifting positively. But given that spec positioning remains very light, there is plenty of room for additional spec buying in the months ahead.

- There is still an important divergence between the price performance of gold and silver in the year to date. As such, we think that silver could play more catch-up.

- Although collectors have slowed their coin buying due to the rapid appreciation in silver prices since Q2-start, ETF investors have boosted their silver buying at an accelerating pace.

- We forecast a max upside of $18 per share for SIVR in the second quarter.

Investment thesis

Welcome to Orchid’s Silver weekly report, in which we wish to deliver our regular thoughts on the silver market through the Aberdeen Standard Physical Silver Shares ETF (SIVR).

SIVR has jumped by nearly 50% since its March low, in line with our expectations.

Silver’s spec sentiment is shifting positively. But given that spec positioning remains very light, there is plenty of room for additional spec buying in the months ahead.

There is still an important divergence between the price performance of gold and silver in the year to date (+14% for the former, -4.5% for the latter). As such, we think that silver could play more catch-up.

Although collectors have slowed their coin buying due to the rapid appreciation in silver prices since the start of Q2, ETF investors have boosted their silver buying at an accelerating pace over the same period.

We forecast a max upside of $18 per share for SIVR in the second quarter.

Source: Trading View, Orchid Research

About SIVR

SIVR is an ETF product using a physically backed methodology. This means that SIVR holds physical silver bars in HSBC vaults.

The physically-backed methodology prevents investors from getting punished by the contango structure of the Comex silver forward curve (forward>spot), contrary to a futures contract-based methodology.

For long-term investors, SIVR seems better than its competitor SLV, principally because its expense ratio is lower (0.30% for SIVR vs. 0.50% for SLV), which is key to make profit over the long term.

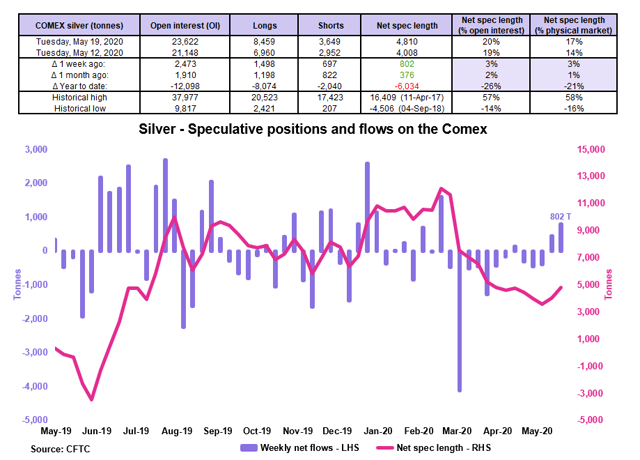

Speculative positioning

Source: CFTC, Orchid Research

The speculative community raised significantly by the equivalent of 802 tonnes its net long position in COMEX silver in the week to May 19, according to the CFTC. This represents around 3% of the annual supply of silver.

This was the second consecutive weekly increase in the net spec length and the largest increase since mid-February. The COMEX silver price registered a hefty gain of 12% over the corresponding period.

This could signal a shift in speculative sentiment toward silver considering that the latest increase in net long positions in COMEX silver was exclusively due to fresh buying and not short-covering.

Since silver’s spec positioning remains materially light, there is plenty of room for additional speculative buying in the months ahead.

Implications for SIVR: We expect speculative buying for silver to continue in the months ahead, which could push the COMEX silver price strongly higher. This will, in turn, push SIVR higher.

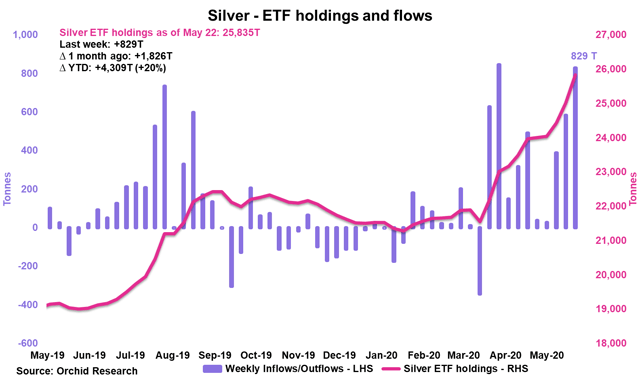

Investment positioning

Source: Orchid Research

ETF investors bought silver at a significant pace of 829 tonnes in the week to May 22, according to our estimates. This was the 10th straight week of ETF buying and the largest increase in ETF holdings since mid-March.

The COMEX silver price registered a gain of 3.5% over the same period.

Silver ETF holdings have surged at an accelerating pace since the start of Q2, highlighting a marked improvement in sentiment among investors.

We think that investors have taken advantage of the too elevated gold:silver ratio to raise their allocations to silver. In addition, the increase in investment demand for silver could reflect an improvement in the forward fundamentals of the silver market due to the re-reopening of some economies and the resulting rebound in silver industrial demand.

Implications for SIVR: Strong investment demand for silver should support the COMEX silver price, which is, therefore, positive for SIVR.

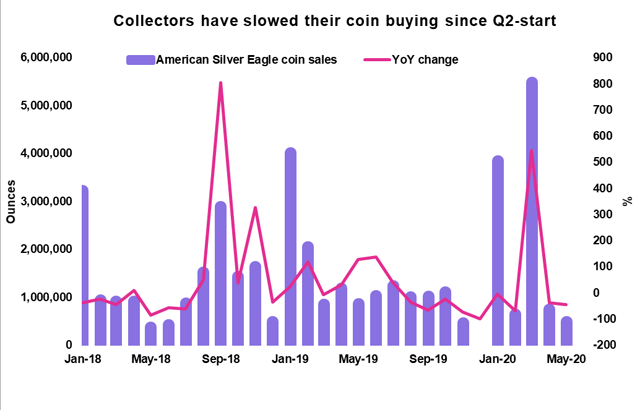

Coin demand slows materially

It seems that the marked rebound in silver price since the start of Q2 has deterred coin buying among collectors. While American Silver Eagle coin sales amounted to a massive 5.483 million ounces in March (+545% year on year), they slowed to 750 koz in April (-37% year on year) and 490 k oz in May (-43% year on year).

Source: Bloomberg, Orchid Research

Implications for SIVR: It is not a surprise to find a negative co-movement between silver prices and coin demand. Coin sales tend to respond to silver prices rather than to alter silver prices. The impact of slowing coin sales should be marginal on SIVR, in our view.

Our closing thoughts

SIVR has performed very well since the start of May (+14%), in line with our expectations.

We see further upside since our Q2-20 target is at $18 per share.

We think that SIVR will continue to perform well in the months ahead because 1)the divergence between the price performance of gold and silver in the year to date remains too large and should continue to narrow; 2)silver’s speculative sentiment is shifting positively; 3)ETF demand for silver is significant; 4)industrial demand for silver is likely to rebound as economies re-open for business.

We expect silver to outperform gold in the months ahead, making us more bullish on SIVR than GLD.

Did you like this?

Click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.