Ferrari Isn't What It Was

by Josh ArnoldSummary

- RACE is facing unprecedented issues in its engines and F1 revenue streams.

- Margins have plateaued with downside catalysts aplenty, but no meaningful upside catalysts to offset.

- With margins on negative watch and a very expensive valuation, this stock isn't what it used to be.

Ferrari (RACE) is a name known the world over for its long-lived relationship with Formula 1, its extensive line of licensed merchandise, and of course, it’s world-class sports cars. That reputation and brand power has served the company extremely well in the years since it went public, and early shareholders have been rewarded quite handsomely. However, I think there is sufficient evidence that Ferrari’s outstanding performance so far this year will need to be unwound at some point, and I see the stock as very expensive as a result.

Before we get to the fundamentals, I think there is a very interesting element to the stock chart that is worth noting. The Accumulation/Distribution line attempts to catch divergences between price action and money flows, providing an early warning of sorts to investors if a rally or a selloff is losing strength.

Ferrari’s A/D line has been in near-constant decline since last summer while the stock has traded largely flat. To my eye, this is fairly compelling evidence that buyers are drying up, perhaps waiting for a better valuation. While this doesn’t mean Ferrari will crash at the open tomorrow, it does signal that the buyers that have kept shares afloat are gradually drying up, and in fairly large numbers.

Reason for caution

Apart from what looks like the makings of a pullback from a technical perspective, Ferrari has some fundamental issues to work through as well. The global economic crash that occurred earlier this year – and is still largely going on – should be insulated away from Ferrari’s customers. These are people that generally own many cars and have already accumulated great wealth. This sort of customer doesn’t get bogged down in the news of the day impacting their paycheck, and with job losses so concentrated in lower-income jobs in the US, for example, there really shouldn’t be much of an impact on the company’s sales of its own cars.

Ferrari doesn’t sell any vehicles normal people can afford, so I actually see it as being fine during this downturn, apart from the ~2-month period where its factories were shut.

However, there is a lot more to Ferrari than just selling its own cars, as I shall now demonstrate.

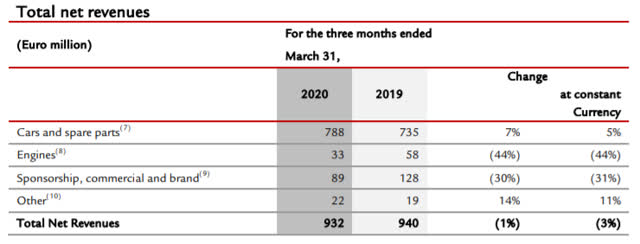

Source: Earnings release

Ferrari sells a lot of parts to customer companies, it leases its engines for other Formula 1 teams, and it derives a huge amount of revenue from Formula 1’s revenue sharing agreement, of which it is a large beneficiary due to its longstanding relationship with the sport.

In the first quarter of this year, which ended in March and therefore, didn’t capture most of the shutdown, sales of engines to Maserati, which uses Ferrari engines exclusively in its road cars, as well as rentals of engines to Formula 1 customer teams, plummeted by nearly half. I’m fairly certain Q2 will look worse because Formula 1 hasn’t run a race yet this year, and Maserati has the same problems every other automaker has in terms of supply and demand. In Maserati's case, however, it wasn't in very good shape with demand anyway before the crisis, so this is just accelerating declines that were already in place.

This is a relatively minor issue, but an issue nonetheless. Where I think investors may want to be concerned is with Ferrari’s share of Formula 1 revenue, which Forbes reckons was $426 million in 2019. This year, with two-thirds of the scheduled races set to be run, and likely all of them with no fans in attendance, that number promises to be a lot lower.

Ferrari can cut a bit from its F1 spending this year, but the sport promises to create a sizable deficit that must be filled by other parts of the business. This should be temporary, but it’s a huge loss and will impact earnings; we just don’t know by how much yet.

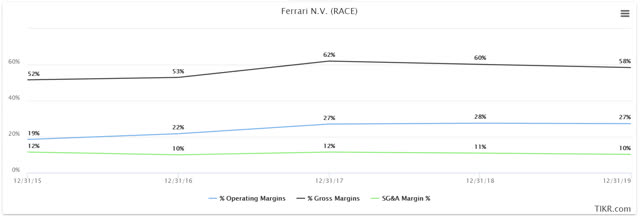

In addition, Ferrari had been boosting its margin profile gradually in the years since it came public, but huge R&D spending – which is necessary to keep Ferrari at the front of a crowded supercar field – means that margin growth has halted of late.

Source: TIKR.com

Gross margins topped out just above 60% of revenue and while SG&A costs have been kept under control, the company spends nearly one in five dollars of revenue on R&D, which is extraordinary. That has kept a lid on operating margins, which are very strong, but have plateaued.

I’m not here to bash Ferrari’s world-beating margins, but I am suggesting that it appears they’ve topped out with no catalysts for meaningful improvement. In fact, with Formula 1’s future quite uncertain at this point, I’d suggest that margins have a much better chance of ticking down than up.

The bottom line

All of this means that the stock seems to be levitating at a time when uncertainty has multiplied and its fundamentals may have trouble keeping up with investor expectations.

Ferrari will continue to make world-class cars and it will make lots of money on them. However, investors have bid shares up to the point where I don’t see how the company could possibly live up to expectations. On what should be normalized earnings next year, the stock is at 39x EPS estimates of $4.15.

For a company that may have a nine-digit hole to fill from missed Formula 1 revenue this year, as well as uncertain futures from its engine customers, along with margins that look like they’ve topped, I just don’t get it. I know the company is viewed as a luxury brand and not a carmaker, but facts are facts, and Ferrari needs everything to be firing on all cylinders to meet expectations. I just don’t see how it can, and I think shares will trade significantly lower than they are today.

Given low-double-digit normalized EPS growth, I could see 30 times earnings as a max, but we’re significantly over that today, so I see downside potential to something like $130. That’s $30 lower than the share price is today, and at that price, I’d find the stock fairly valued, not cheap. I’d be very interested in owning Ferrari at $115 or lower, but not until then.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.