Dunkin' Brands: Strong Brand At A Decent Price

by Stefan OngSummary

- Dunkin' has a strong brand that has allowed the company to grow steadily in the past.

- There will be uncertainty regarding customer consumption behaviour due to the crisis.

- The company's stock price appears to be undervalued relative to its peers based on consensus estimates.

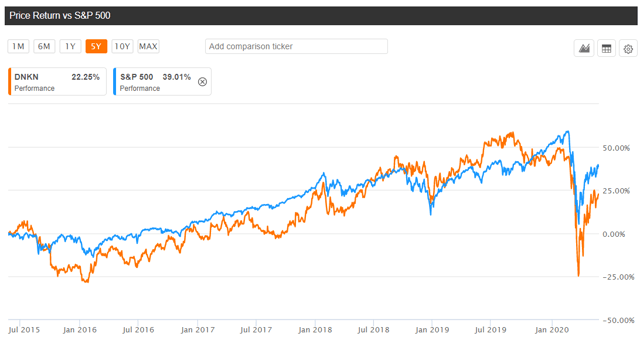

Dunkin' Brands Group's (NASDAQ:DNKN) stock price has underperformed the S&P 500 over the past 5 years, returning 22.2% compared to the S&P 39%. This is mainly driven by fears of structural declines in sales due to the recent restaurant closures in some areas of the company's business. But Dunkin' has a strong brand and long-term cash flows should remain strong in the future. The company share price also appears to be undervalued relative to peers based on consensus estimates.

(Source: Seeking Alpha)

Dunkin' sales would likely recover in the long run

In the short term, the quick-service food industry is likely to face a downturn due to the restrictions imposed on dine-in services to reduce the outbreak. This is mitigated slightly in some areas where drive-thru orders are still allowed. But concerns for safety would likely lead to large declines in orders for at least next few months. In the long term, however, Dunkin' appears likely to survive this crisis.

Before the virus hit, Dunkin' has grown revenues from $553M in 2010 to $1317M in 2019 at an annual rate of 9%. The most recent annual growth rate was a steady 3.64%. Menu innovation was one key driver of growth. The company has been capitalizing on food trends to attract customers to increase their purchase frequency. For instance, their focus on Expresso has led to sales in that category to grow nearly 40% year-over-year in the United States. They also launched Dunkin Bowls and Power Breakfast Sandwich in 2019, which attracted the health-conscious customers. Furthermore, they partnered with Beyond Meat (NASDAQ:BYND) to develop a plant-based breakfast sandwich the become the first U.S. restaurant chain to offer 100% plant-based Beyond Sausage.

With its 100% franchise mode, it is likely Dunkin' can grow its presence beyond its current markets due to low capital requirements in opening new stores. Without the need to own stores, the company can focus on other initiatives like menu innovation, franchisee support, and marketing to drive the overall success of the brand. However, the future model will depend on emerging consumer behaviour after the crisis settles.

Dunkin' is innovating in online and delivery channels

The company has continued to innovate for a more convenient experience. Previously, Dunkin' only allowed loyalty members onto their digital ecosystem, After opening-up their platform to all customers, the company experienced a 40% increase in loyalty members.

Dunkin has also improved its delivery infrastructure. The company now allows third-party options in international markets. In 2019, Dunkin's franchisees and licensees opened 385 net new restaurants globally, including 211 net new Dunkin’ U.S. locations. Their investment in delivery has paid off during this period, where most of the company's restaurants would likely be shut. The improved online and delivery experiences would contribute to some revenue resilience for Dunkin' in 2020 compared to companies who avoided investments in these areas.

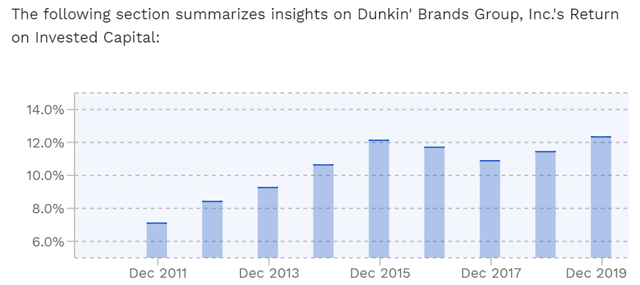

These initiatives have created some intangible asset advantages against smaller independent brands to scale due to Dunkin' strong branding and franchisee infrastructure. The company is also likely able to raise prices steadily without much negative impact on the overall demand of its products. As such, Dunkin has maintained high operating margins (mostly above 30%) throughout the past decade. Return on invested capital for the company has also been steadily improving over the years to roughly 12%. With its cost of capital at roughly 7.5%, the company's steady growth has been creating value for its shareholders.

(Source: Finbox)

Balance Sheet

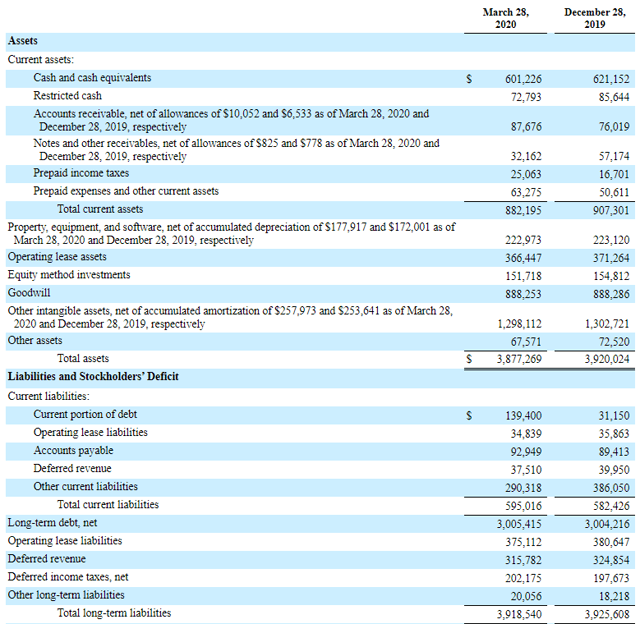

Dunkin' has roughly $600M of cash and cash equivalents with $139M of short term debt. Despite the company having $3B in long term debt, there are no debt maturities until 2024. Dunkin' has been producing roughly $300M of free cash flow over the past few years. Despite the cash flow likely taking a hit this year, the long-term free cash flow generation ability of the company is likely intact due to the strong brand and franchisee infrastructure in place. The company has also suspended its dividend program to conserve cash. As such, Dunkin' should have no issues raising funds to fund future growth.

(Source: 10Q)

Investment Risks

Due to its 100% franchisee model, the company's results are heavily reliant on its franchisees. The franchisee has sole control over the restaurant operations. If the franchisees do not operate the restaurant up to the required standards, it may result in a decline in franchise fees. Any undesirable behaviour that becomes widely publicised could also lead to a loss of reputation for the Dunkin' brand.

Despite the company's strong brand and infrastructure, Covid-19 may have a lasting impact on the industry. This could potentially change the layout and location structure of quick-service restaurants in the future with a higher focus on deliveries and take-outs.

There are also no switching costs for Dunkin' so changing consumer tastes could cause customers to switch brands. Competition in this industry is also fierce with other strong players like Starbucks (NASDAQ:SBUX). Poorer than expected performance against competition could cause revenues and margins to decline in the future.

Valuation

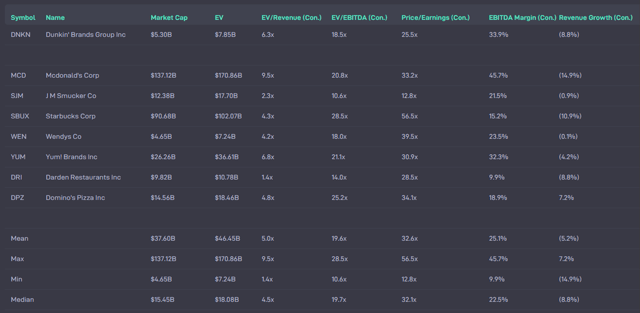

The relative valuation analysis shows that Dunkin' ranks more expensive than the median-peer group based on consensus EV/Revenue. The company is cheaper based on other ratios such as consensus EV/EBITDA and P/E. But Dunkin' has better EBITDA Margin than the comparison group. Its consensus EBITDA margin of 33.9% is much higher than the peer group median's 22.5% due to its 100% franchise model. Revenue growth is also in-line with the consensus median of -8.8% due to the negative outlook from the coronavirus. Hence, Dunkin' seems to be relatively undervalued based on these ratios and its consensus estimates.

(Source: Atom Finance)

Takeaways

For Dunkin' to outperform in the future, the company has to continue to invest in its online and delivery channels in case there is a long-term change in how customers purchase its products. The company might even have to change some of the layouts of its restaurants to compete against peers who may have a lower cost structure to cater to the online ordering customer group. Ultimately, strong execution by the management is required to navigate the company and fast response is necessary when long-term customer trends emerge after the crisis.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.