10 REITs One Year Later - Part 1

by Dividend SleuthSummary

- It's been a year since I wrote a series of articles about the ten REITs with A or A- S&P credit ratings.

- Earlier in 2020, I added two REITs from this group of ten: Federal Realty and Realty Income.

- Last week I sold Simon Property Group, which one year ago was my only holding from this group of ten REITs.

- Several price points reveal the year's swings in valuation, the annualized dividend and the price and dividend yield as of May 26, 2020.

- Two REITs from this group are on my watch list: Camden Property Trust and Prologis.

A look back at a fun project

Last summer, between June 29 and July 25, I wrote an article about each of the ten REITs with Standard & Poor's credit ratings of A or A-, plus a summary article, "9 REIT Takeaways."

It was a fun project and I learned a great deal about these REITs, some of which often are overlooked by dividend investors seeking higher yields.

It's been less than a year, but it seems long ago. This article is part 1 of a 2-part retrospective:

- The long-term success of Simon Property Group (SPG) will depend on its transition to more mixed-use properties and more open-air properties.

- PS Business Parks (PSB) is an impressive, conservative REIT that lives in the shadow of Public Storage (PSA), from which it came.

- Equity Residential (EQR) and AvalonBay (AVB) appeal to younger professionals in "gateway" cities, with AVB venturing into "family" suburbs.

- Boston Properties (NYSE:BXP) had strong rent growth in their iconic office buildings. Now, WFH is growing and BXP has a negative outlook from S&P.

- The entire Federal Realty Investment Trust (FRT) portfolio benefits from what they've learned from big mixed-use properties like Santana Row.

- Realty Income (O) expanded into the U.K., enjoys a strong balance sheet, a durable portfolio and a relatively new CEO, Sumit Roy.

- Prologis (PLD) was made wiser by tough times in 2008-2009, and is a juggernaut whose distribution centers are critical to online retailing.

- My biggest positive takeaway was the management and business model of Camden Property Trust (CPT). I told Kirk Spano, "They're kicking it!"

I added two REITs to the portfolio in 2020

Last summer, just one A or A- rated REIT was in my portfolio: Simon Property Group. In January 2020, I added Federal Realty Investment Trust and in February 2020, I added Realty Income.

Federal Realty has raised its dividend for 52 consecutive years. Don Wood is one of the best REIT CEOs and FRT has outstanding leadership throughout. Like small towns within major metropolitan regions, FRT's major mixed-use developments are transforming their approach to smaller shopping centers.

The Q1 2020 earnings call on May 7 was very encouraging. Here's one example:

"...landlord organized and integrated curbside delivery programs at shopping centers and mixed-use communities in densely populated first-tier suburbs need to be, in our view, a permanent component of a property's toolkit for attracting customers... "We'll be a leader in landlord-integrated curbside delivery on the other side of this. ... Federal formats, tenant mix and locations are pretty darn well-positioned."

Realty Income has raised its dividend for 27 consecutive years. In the Q1 2020 earnings call on May 5, CEO Sumit Roy described the company's strengths in the face of the coronavirus pandemic and noted:

"For April, we have collected approximately 83% of contractual rent, and we received essentially all of expected rent from investment grade rated tenants. ... "Our top four industries; convenience stores, drug stores, dollar stores and grocery stores, each sell essential goods and represent approximately 37% of our rental revenue. And we have received almost all of the contractual rent due to us from tenants in these industries."

Sold Simon Property Group

The title of my first article in last summer's series was "Simon Property Group: Sticking With Quality." At that time, SPG was the only A or A- rated REIT in my portfolio. I stuck with Simon during several years of debate about our changing retail environment. The article's title is ironic. It took a global pandemic to shake me loose from my shares, and even then it was with reluctance that I closed the position last week.

Simon's size and financial strength put it in a class of its own among retail REITs. SPG and Public Storage are the only two REITs with A credit ratings. The other eight on the list of ten are rated A-. SPG has raised the dividend for ten consecutive years. David Simon has been recognized globally as an outstanding CEO.

When I finish this article, Seeking Alpha will ask me whether I'm bullish, bearish or neutral on Simon. I'll say "neutral," because I believe SPG has the potential to weather this storm and continue its transformation to more mixed-use and more open-air properties. While I believe a dividend cut is imminent, SPG was able to resume dividend growth after the 2008-2009 recession. Simon may be an appropriate speculative holding for the adventurous.

When I closed my SPG position, I added Nestlé (OTCPK:NSRGY) and three regulated utilities: Dominion Energy (D), Duke Energy (DUK) and Southern Company (SO).

As I approach age 70, I want companies that provide truly essential services and products. The coronavirus pandemic has been a sobering personal experience. We're experiencing a coronavirus surge in our region as the vast majority of people do not mask or distance themselves.

I have little confidence in our federal government or in many state governments to implement science-based policies to prevent future coronavirus waves. I doubt society's will and discipline to maintain safe practices for an extended period. Lax policy and poor discipline make me think retail sales will be lower for longer - unless we speedily find effective, safe treatments and vaccines. Even then, progress against this pandemic may be slowed by "vaccine doubters."

The current bear market rally expresses the market's hope for speedy medical science breakthroughs against the virus. Last week, I weighed this hope against our difficulty with mitigation and the unknowns that have been expressed by some economic/market voices I respect:

- Lyn Alden Schwartzer: "The next several years are likely to be challenging for many companies with weak balance sheets..."

- Kirk Spano: "Economic data is brutal and the likelihood of a 'V' shaped recovery seems remote..."

- Jeff Miller: "We have missed the chance for a 'U-shaped' recovery. Expect a rebound followed by another decline – a 'W.'"

- Rob Arnott: "We will see more bankruptcies than we’ve seen since the Great Depression... We’re not in a recession. We’re in a depression and the only question is what shape will the recovery look like... I think it’s going to be three to four years before we’re back to the per capita GDP levels that we had just a few weeks ago."

On April 28, Standard and Poor's placed a negative outlook on Simon's A credit rating, saying it "reflects our view that its business and operational vibrancy is under immediate stress as the longer-term credit implications of the pandemic pressure retail fundamentals."

I hope David Simon and his team succeed and thrive on the other side of this recession. I would like to be a shareholder once again.

I remain neutral on Simon Property Group.

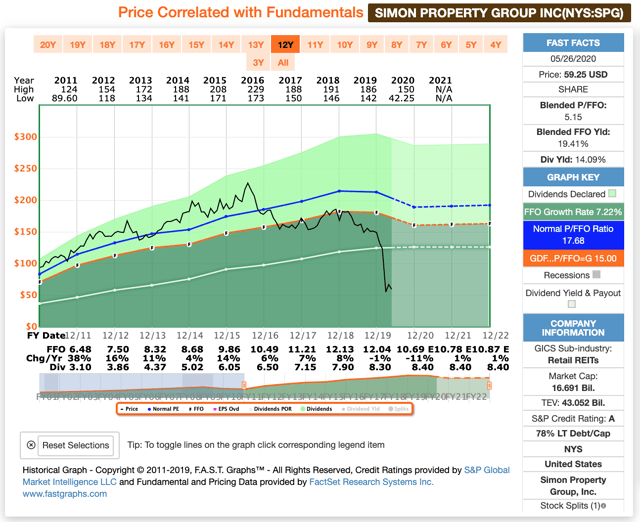

From F.A.S.T. Graphs

Then and now

The table below indicates the closing price on July 26, 2019, the current 52-week high and low, and the closing price on Tuesday, May 26, 2020. The annualized dividend is shown and the dividend yield as of the closing price on May 26. This table depicts our recent roller-coaster ride. Six of the 52-week lows were made on March 23. O made its low on March 19. SPG's low came on April 2. BXP and FRT reached their lows on May 14.

| REIT | 7/26/19 | 52-Wk High | 52-Wk Low | 5/26/20 | Div | Yield |

| SPG | 158.33 | 172.44 | 42.25 | 59.25 | 8.40 | 14.2% |

| PSA | 239.43 | 266.76 | 155.37 | 192.48 | 8.00 | 4.2% |

| EQR | 78.56 | 89.55 | 49.62 | 60.27 | 2.41 | 4.0% |

| AVB | 208.38 | 229.40 | 118.17 | 160.41 | 6.36 | 4.0% |

| CPT | 105.91 | 120.73 | 62.48 | 92.15 | 3.32 | 3.6% |

| FRT | 130.78 | 141.35 | 64.11 | 83.48 | 4.20 | 2.4% |

| O | 69.54 | 84.92 | 38.00 | 55.49 | 2.80 | 5.0% |

| PLD | 82.11 | 99.79 | 59.82 | 90.02 | 2.32 | 2.6% |

| PSB | 177.85 | 192.13 | 102.48 | 126.97 | 4.20 | 3.3% |

| BXP | 131.30 | 147.83 | 71.57 | 84.52 | 3.92 | 4.6% |

Two REITs on my watch list

During the past year, two REITs from the list consistently have been on my watch list: Camden Property Trust and Prologis. I'll say more about those in my Part 2 of this retrospective, with a focus on Camden.

The 2020s will see the transformation of the economy during the 4th Industrial Revolution. We are also running head-first into a wave of demographic and debt-driven problems that will need solving. A cautious, but forward-looking approach, will be required to thrive in what could be a lost investing decade for many, much like 2000-2009.

Benefit from the insights of Kirk Spano, Dividend Sleuth and David Zanoni. Get exclusive investment ideas based upon in-depth and up close research that few others do.

Sign-up now for a free trial and 20% first year discount.

Disclosure: I am/we are long JNJ, MSFT, AAPL, WMT, ADP, RHHBY, PG, CL, NSRGY, NVS, NKE, V, BLK, CSCO, PFE, RY, TD, PEP, UL, TXN, USB, GPC, ADM, FRT, CDUAF, ED, O, SO, PPL, DUK, D, VZ, BCE, T, WPC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The article is for informational purposes only (not a solicitation to buy or sell stocks). Ted Leach (Dividend Sleuth) is not a registered investment adviser. Kirk Spano is an RIA. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.