PREIT: Earnings And Asset Value Diverge

by Adam Levine-Weinberg CFASummary

- PREIT released another weak quarterly earnings report last week.

- COVID-19 will delay a projected turnaround in NOI and FFO trends by depressing traffic in the short term and driving another wave of retail bankruptcies.

- However, PREIT's best properties are maintaining their value, as evidenced by relatively stable NOI trends. A handful of underperforming malls are driving PREIT's poor overall results.

- Even in a bankruptcy scenario, shareholders would have a good chance of recovering more than the current stock price.

- PREIT's preferred stock offers substantial upside with less risk than the common stock.

Last week, struggling mall REIT Pennsylvania Real Estate Investment Trust (PEI) (PEI.PB) (PEI.PC) (PEI.PD) reported predictably bad results for the first quarter of 2020. PREIT's FFO and NOI came under severe pressure about a year ago, due to a slew of tenant bankruptcies that took place in 2019. And while PREIT had been positioned for a return to growth in one or both metrics in the second quarter of 2020, the COVID-19 pandemic has upended its business.

PREIT's financial results will likely remain weak for at least the next year or two. For one thing, most of the REIT's malls are still closed. Even when they reopen, traffic may remain low until a safe and effective vaccine becomes widely available, either due to social-distancing rules or consumers' discomfort with crowded spaces. Relatedly, COVID-19 is set to drive another big wave of retail bankruptcies. Given the weak state of PREIT's balance sheet, it will likely need forbearance from its lenders to avoid bankruptcy.

This outlook has sent most investors running screaming in the other direction. For investors with low or medium risk tolerance, that's probably the right move. However, PREIT's asset value remains intact, and is considerably higher than the REIT's sub-$100 million market cap. That preserves substantial long-term upside potential for investors with high risk tolerance.

(Image source: Pennsylvania Real Estate Investment Trust)

The results in brief

Through the first two months of Q1, PREIT was on track to report a 5% decline in same-store NOI, according to management. While not a great result, that was to be expected. SSNOI fell 3% in Q4 2019, including the benefit from temporary holiday tenants replacing retailers that went bankrupt and closed last year. Furthermore, PREIT faced a fairly tough comparison last quarter, as SSNOI increased 2.2% in Q1 2019.

A 5% SSNOI decline in Q1 would have kept PREIT on track for a return to NOI growth in Q2, thanks to a much easier year-over-year comparison and a slew of major tenant openings scheduled for late Q1 and early Q2.

However, things fell apart in March. For the full quarter, PREIT reported a 9.6% plunge in SSNOI, while adjusted FFO per share fell by nearly half, from $0.26 to $0.14. PREIT attributed the miss to additional tenant bankruptcies, credit losses from tenants that were already struggling prior to COVID-19, and a decrease in percentage rent.

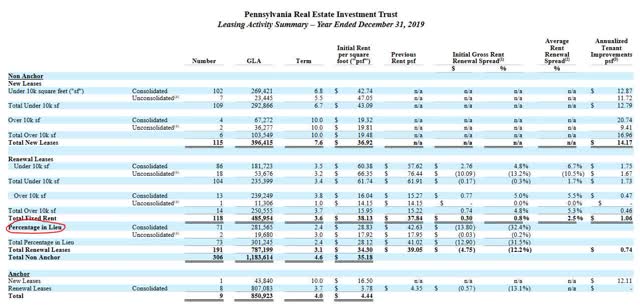

Notably, PREIT signed short-term percentage-rent leases for over 300,000 square feet of space during 2019, compared to just 130,000 square feet of percentage-in-lieu leases signed in 2018. (Typically, these leases are offered to troubled (often bankrupt) tenants to give them a chance to turn their businesses around while keeping space occupied. After a couple years, either the tenant renews at market rate or the mall would bring in a new tenant.) This has increased the short-term loss of rent from malls being closed or having depressed traffic.

(Source: PREIT Q4 2019 Supplemental Disclosure, p. 22)

PREIT has withdrawn its guidance for the rest of the year. However, it's a good bet that NOI will continue to decline in the short term. Percentage rent declines will be even greater in Q2, as most of PREIT's malls have been closed for most of the quarter. (Management does hope to reopen all of its properties over the next several weeks.) Additionally, retail bankruptcies continue to pile up.

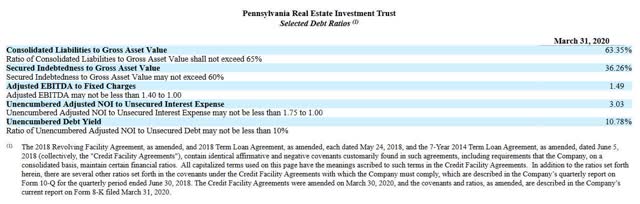

Furthermore, PREIT is close to violating its debt covenants, despite receiving temporary relief from its lender group just two months ago. With tenant openings delayed due to COVID-19 and several properties' sales per square foot likely to temporarily fall below $500 (which triggers the use of a higher cap rate for the purpose of calculating asset values under the covenants), PREIT will likely need to request further loosening of its covenants, at least in the short term. That puts it at the mercy of its lenders, to some extent.

(Source: PREIT Q1 2020 Supplemental Disclosure, p. 32)

Tracing the sources of PREIT's NOI declines

Despite the poor Q1 results and weak near-term outlook, there's no sign that PREIT's best properties are deteriorating. Most of the pressure on FFO is coming from a handful of weaker malls (B- and below) in its portfolio. Such properties carry high cap rates because they are expected to experience long-term declines in cash flow. In other words, their declining NOI is just par for the course.

In fact, over the past 12 months, 71.8% of PREIT's mall NOI came from properties with sales per square foot exceeding $450, up from 57.9% for the 12 months ending in March 2019. This reflects two properties surpassing the $450 mark due to strong comp sales growth and a mix shift as NOI declines accelerated at weaker properties.

PREIT's seven weakest malls (as measured by sales per square foot) accounted for 19% of mall NOI over the past 12 months. Those same seven properties accounted for 22.7% of mall NOI in the prior-year period. (The biggest declines by far came at Exton Square Mall and Plymouth Meeting Mall.) Meanwhile, the REIT's top eight malls now account for 58.5% of mall NOI, up from 55% for those same properties a year earlier.

Essentially, this means that PREIT's best properties are holding their own with respect to NOI, despite the big uptick in retail bankruptcies last year. Meanwhile, its worst properties appear to be driving a disproportionate amount of the recent NOI declines.

Asset value remains intact

The relative stability of PREIT's best assets highlights their continuing value. Over the past 12 months, its top eight malls generated about $120 million of NOI. At a fairly conservative 7.5% cap rate, their combined value would be $1.6 billion.

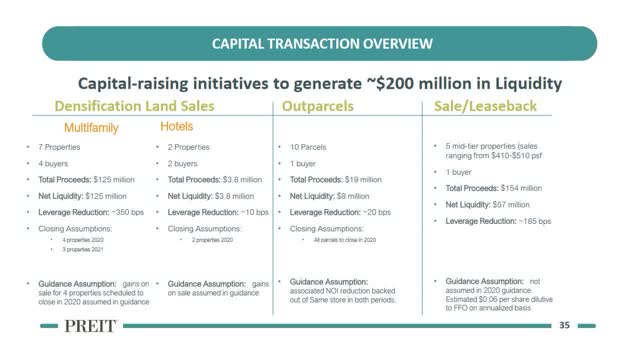

PREIT also has over $300 million of asset sales on track to close over the next two years or so (including a sale/ground-lease deal for five of its mid-tier malls). Future land sale opportunities could be worth another $100 million or so. Finally, PREIT's stake in the recently-opened Fashion District Philadelphia project is likely worth at least $250 million. Thus, between the value of land that PREIT plans to sell and its top nine assets (including Fashion District Philadelphia), there is more than enough value to cover the REIT's $2.1 billion of debt.

(Source: PREIT March 2020 Investor Presentation, slide 35)

Meanwhile, many of PREIT's lower-quality assets are mortgaged. Six of its 10 worst malls and virtually all of its non-mall assets fall into this category. Collectively, these properties carry $421 million of non-recourse debt. That represents a floor value for those properties. We can think of that as offsetting the $384 million face value of PREIT's preferred stock.

That still leaves six unencumbered low- and mid-tier malls generating tens of millions of dollars of NOI annually. Together, these properties are probably worth $300 million or more (even after accounting for rent under the pending ground lease deal, which will reduce NOI for four of the six malls). With future land sale proceeds, non-recourse mortgages, and top-performing properties more than covering PREIT's roughly $2.5 billion of debt and preferred shares, the common stock's intrinsic value is several times its recent price.

Yet while the common stock appears to be significantly undervalued, PREIT's preferred stock may offer an even better risk-reward tradeoff. All three series of preferred stock have recently traded at a more than 70% discount to face value. (Incidentally, they also offer higher yields, as PREIT slashed its common dividend by 90% earlier this year.) The entire intrinsic value of the common stock serves as a margin of safety for preferred stock owners.

Of course, the common stock theoretically has unlimited upside, whereas the preferred's value is capped. However, given that the preferred shares could triple while still trading at a discount to face value, there is still plenty of capital appreciation potential and far less risk.

What about bankruptcy risk?

While PREIT's assets are worth more than its obligations, that does not eliminate bankruptcy risk. Between the existing pressure on its balance sheet from its extensive redevelopment work of the past few years and the impact of COVID-19 (both short-term rent deferrals and the long-term impact of additional retail bankruptcies), PREIT needs forbearance from its lenders to avoid bankruptcy.

That's not as dire as it sounds, though. PREIT has longstanding relationships with its banks, which increases the odds that they will work constructively with management. In any case, a liquidation at fire-sale prices in the current environment would be bad for everybody (including the lenders).

Moreover, even bankruptcy would not make the stock a zero. (The preferred stock is even less likely to go to zero.) In many ways, PREIT's current situation resembles that of General Growth Properties over a decade ago. General Growth was overleveraged entering the global financial crisis and was forced to file for bankruptcy. However, the stock eventually recovered, as lenders allowed the REIT to gradually pay down debt rather than forcing a liquidation.

PREIT is far smaller than General Growth Properties 12 years ago, so there is less money at stake and less complexity. That makes it far more likely that management and the lender group will reach a negotiated agreement to allow the REIT to gradually repair its balance sheet using internally-generated cash flow and future asset sales. Yet even in a bankruptcy scenario, there should still be plenty of value for shareholders (and especially preferred shareholders) to capture.

If you enjoyed this article, please scroll up and click the follow button to receive updates on my latest research covering the retail, real estate, airline, and auto industries.

Disclosure: I am/we are long PEI, PEI.PC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.