Enterprise Products Partners - A +9% Yield From A Best In Breed Midstream

by Rida MorwaSummary

- Enterprise Products Partners has a massive amount of liquidity, enough to cover 2 years of the company’s distributions.

- The company is focused on reducing capital spending so that its DCF is enough to cover both its capital spending, along with its dividends.

- The company managed to keep DCF constant from 1Q 2019 to 1Q 2020. With 91% investment-grade ratings among its largest 10 customers, its financial strength will continue.

- The company repurchased 0.4% of its market capitalization in 1Q 2020, and it's continuing to invest in growth.

- This company issues a K-1 at tax time.

Co-produced with The Value Portfolio

Here at High Dividend Opportunities, we like to invest in extremely high-quality dividend-paying securities whenever possible. COVID-19 has created opportunities that were not present prior to its onset. Enterprise Products Partners L.P. (EPD) is one such opportunity. We can't pass up this near 10% yielding firm that has every right to be viewed as the model for reliability and strength in the MLP space.

EPD is an almost $40 billion publicly traded MLP. The company, as a result of COVID-19 price fluctuations, is the single largest publicly traded midstream company by market capitalization. The company's relative strength is supported by its secure business and relatively low debt. As we'll see throughout this article, the company's distribution is supported by the potential for long-term secure cash flow.

Balance Sheet Check-Up

EPD's share price has been punished significantly by the decline in oil prices. Investors, either concerned that the drop in oil prices will cause long-term demand to decline, or through simple irrationality, have continuously sold off the company's stock.

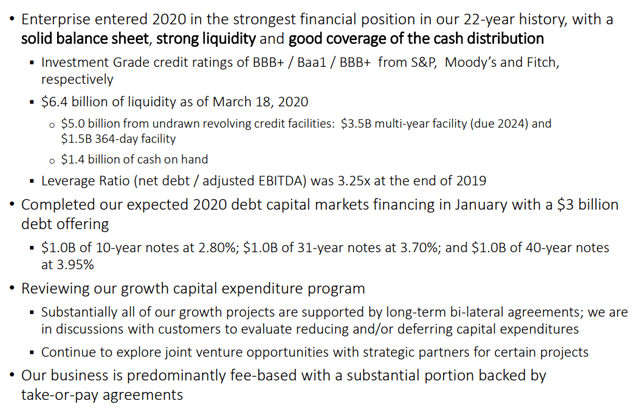

Source: EPD March 2020 Investor Update

EPD has entered 2020 with the strongest financial position in its 22-year history bolstered by its investment-grade credit ratings across the board. The company has a massive $8 billion of liquidity worth more than 15% of the company's market capitalization. The company's liquidity consists of specifically $1.4 billion of cash on hand. That's enough to cover a quarter of the company's distribution obligations by itself.

Additionally, the company has an incredibly manageable leverage ratio (net debt / adjusted EBITDA) at 3.25x at the end of 2019. With Energy Transfer (ET) and Kinder Morgan (KMI) both in the 4.x range, that's a significantly lower amount of debt. That's supported by the company's $3 billion debt offering in Jan. 2020 including 31-year notes at 3.70% and $1 billion of 40-year notes at 3.95%. It is always a good idea to listen to the bond markets. With such a low interest rate on their borrowing, the credit markets are rewarding these companies with very low debt rates.

EPD's move to take advantage of low-interest rates to issue 40-year debt is significant. Personally, I'd like to see the company issue significantly more debt at its current financial position. That would be easily manageable under its current debt load and will help it handle the downturn. Lastly, the company is drastically cutting its capital expenditures to support its portfolio. We'll discuss this more in later sections.

A Brief 2020 Financial Outlook

Enterprise Products Partners 2020 financial outlook is incredibly impressive despite the difficult market position we're in.

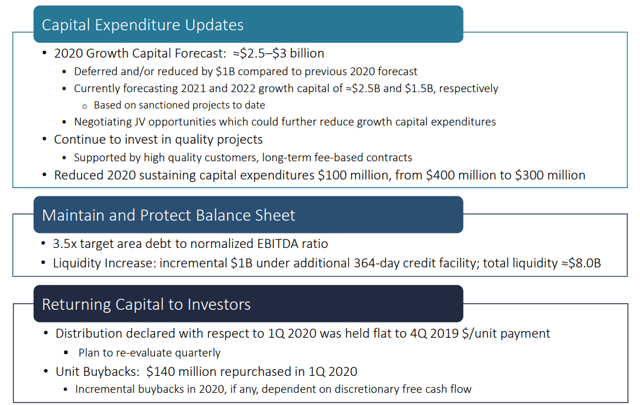

Source: EPD 1Q 2020 Earnings Presentation

EPD has changed its 2020 growth capital forecast to roughly $2.7 billion, a $1 billion reduction to its prior growth capital. The company is forecasting 2021 growth capital of $2.5 billion, on the lower end of this range, with $1.5 billion of forecast growth capital in 2022. From 2020-2022 the company will be spending more than 15% of its market capitalization on growth, which will support shareholder returns.

At the same time, the company has reduced sustaining capital expenditures significantly to a mere $300 million. That means if the market remains low, the company can cut spending significantly further. The company maintained DCF at $1.6 billion in both 1Q 2019 and 2Q 2020 and retained $574 million of DCF in 1Q 2020. That means, if the company keeps DCF at $2.2 billion annually, it is covering both its growth and dividends without additional debt.

It's worth highlighting the company's focus on returning capital to investors. The company chose to keep its distribution flat at a double-digit yield. It has stated that it'll re-evaluate the yield quarterly. One other thing worth noting is that the company repurchased $140 million in shares in 1Q 2020 and has stated it'll increase buybacks depending on DCF. I'd personally love to see the company increase repurchases at its current yield.

Inspecting The Business Risks

One of the aspects of EPD worth discussing is the company's risk to a continued decline in oil prices.

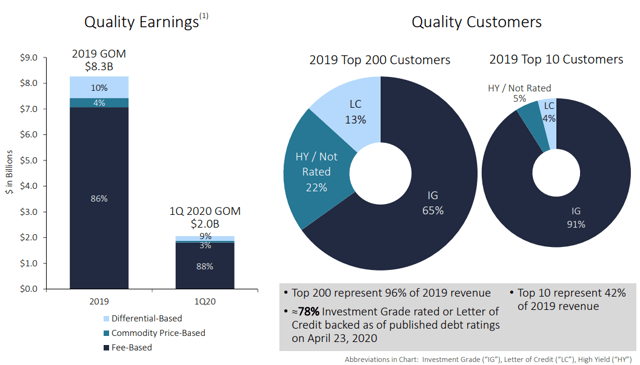

Source: EPD 1Q 2020 Earnings Presentation

Enterprise Products Partners has incredibly high-quality earnings. The company has managed to improve fee-based earnings YoY from 86% in 2019 to 88% in 1Q 2020. At the same time, the company's top 10 customers are 91% investment grade with 65% of the top 200 customers as investment grade. The company has also decreased commodity price-based earnings from 4% in 2019 to 3% in 1Q 2020.

Overall, the company could in a worst-case scenario see a 10% decline in its earnings / DCF. However, the company's $6.4 billion in annualized DCF, of which only $4 billion in required for dividends, should be able to more than handle a $640 million decline in DCF. At the same time, the company's continued investments should help maintain DCF, and the company maintained its DCF as constant from 2019 into 1Q 2020.

The company does have the business risk that prices will remain lower for longer along with potential bankruptcy of some of its customers. However, it's worth noting that even in a bankruptcy scenario, the oil and gas will continue to be produced. The contracts, outside of spare capacity, will continue to be utilized. More so, the company's investment-grade customers have a low chance of bankruptcy.

Looking At Their Capital Investments

Among that factors that support EPD's cash flow in the immediate term is the company's capital investments in its business.

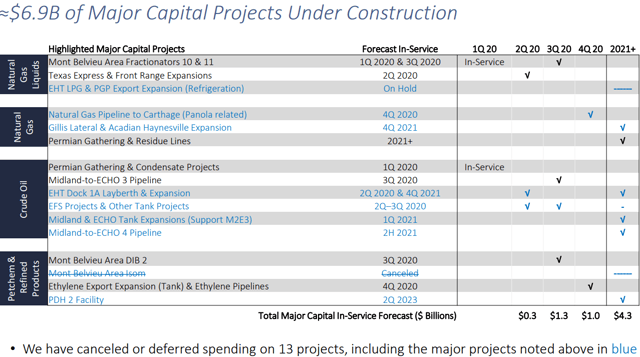

Source: EPD 1Q 2020 Earnings Presentation

EPD has $6.9 billion of major capital projects due, however, the company has canceled or deferred 13 projects (shown in blue). Only one project has been canceled, while the remainder has been delayed. As a result, the company only has 5 more projects coming in service for the remainder of 2020. These projects will support immediate cash flow for investors in addition to the company's DCF.

Additionally, the company has several major projects coming out in 2021. It's worth noting here, that significantly, several of the company's projects involve various storage projects. The current demand for storage is at an all-time high. As a result, if the company brings these assets on earlier, that could support additional immediate term cash flow. The company could leave these assets on the spot market before going after fixed volume contracts.

High-Quality Shareholder Returns

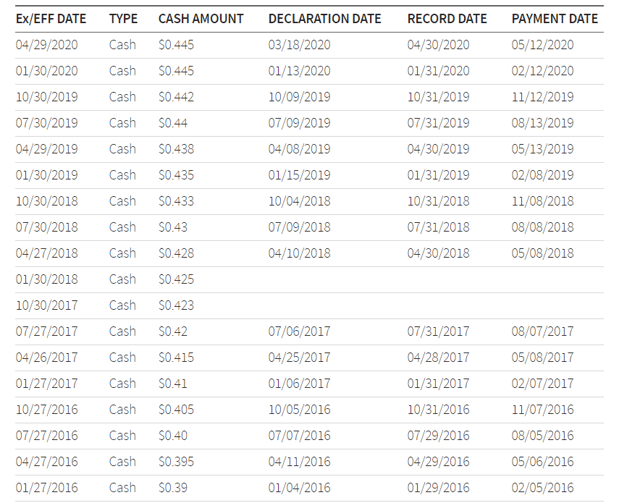

EPD has a strong history of distribution increases supporting shareholder returns at its current share prices.

Source: EPD Dividend History - NASDAQ

EPD's significant strength is evident through the company's past 5 years of distributions since the bottom of the current oil collapse. The company, throughout this time, has increased distributions by the double-digits, with an increase in most quarters. Those are incredibly strong distributions supported by the company's history of cash flow. We expect that the company will be able to at least maintain if not increasing distributions going forward.

At a near 10% dividend yield, even without capital expenditures, investors are able to achieve very strong long-term returns.

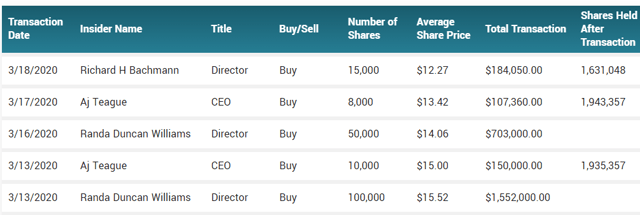

Insiders Are Buying

Additionally, EPD has seen significant net shareholder investment in the company.

Source: EPD Insider Buys - Market Beat

EPD saw almost $3 million worth of insider purchases in March 2020. That's equivalent to 0.01% of the company's market capitalization. It might not sound like much, but as a percentage of the company from insider buys on an average month, it's respectable. For those who don't find that number exciting, in February 2020, the company saw insider purchases total more than $20 million, which is more like 0.05% of the company.

That annualizes at almost 1% of the company purchased on an annualized basis by insiders. The company's long history of insider purchases, that have continued by the downturn, shows the support insiders have for the business. Additionally, the significant insider ownership supports minimum interest in cutting distributions, these owners would be impacting their own distribution checks.

Risks

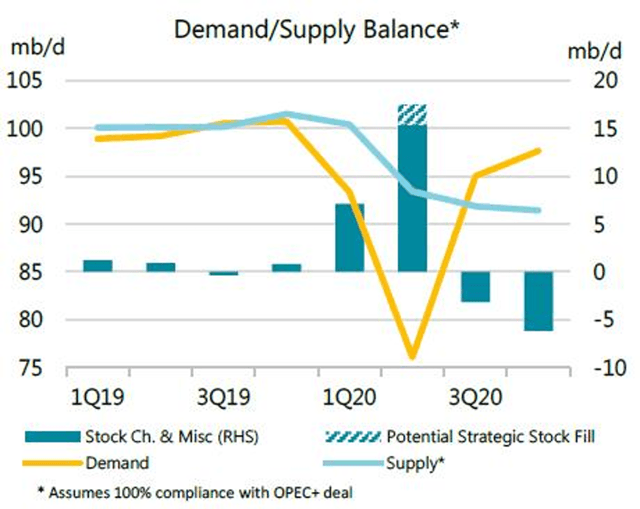

EPD has a single significant risk worth paying attention to, which is that oil prices could remain lower for longer.

Source: Demand / Supply Balance - Oil & Gas Journal

EPD operates in the oil industry, which has seen an unprecedented decline in oil demand from COVID-19. That massive decline caused a collapse in oil prices, something that will be partially made up by declining supply. However, the net demand deficit is still significant. That's expected to result in a rapid increase in storage, which could fill up all remaining storage. That resulted in oil prices going negative for the first time ever.

However, as can be seen above, that oversupply is expected to turn into a deficit going into the second half of the year. That deficit, combined with capital spending declines, should remain going into the next year. That should allow prices to recover from 2020 going into 2021. That recovery in prices and timeline is more than manageable by EPD. It means that distributions should continue without being reduced.

Conclusion

EPD has an impressive portfolio of assets that support strong DCF from the company's business. The company will be able to more than maintain its distribution yield as it has the ability to support throughout this past oil crash. The company's DCF stayed constant in 1Q 2020 from 1Q 2019. At the same time, the company made sure to prudently repurchase shares, which we'd like to see it continue doing.

Going forward, the company has significant flexibility in its capital budget to avoid accessing the debt markets. However, the rates the company achieved on its last debt issuance means it should continue to opportunistically borrow. EPD's ability to continue to invest in its business, support it, and pay distributions as oil recovers, is significant. EPD is a strong buy at the current price. The +9% dividend yield is unlikely to last for long.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +4300 members. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long ET. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.