Tech View: Nifty close above 20-DMA may be signalling new leg of upswing

Nifty may face resistance at 9,500 level and have support near 9,250, said analysts.

by Amit Mudgill

NEW DELHI: Nifty50 rallied over 3 per cent on Wednesday to top the 9,300 level on a closing basis. The index formed a long bullish candle on the daily charts. During the session, the index took support at its 50-day moving average, whose value stood at 9,006 at close.

The NSE barometer also closed above its 20-day moving average, which analysts said is a positive signal. Going ahead, the index may face resistance at 9,500 level and have support near 9,250, said analysts.

Mazhar Mohammad of Chartviewindia.in said the correction from the recent high of 9,889, registered on April 30, had unfolded a downsloping channel for 17 sessions. With Wednesday’s breakout, the bulls seem to have unleashed a fresh leg of upswing. The analyst said the index can even hit the swing high of 9,889 in coming sessions, but before that, the bulls may face some hiccups near the 9,500 level, he said.

For the day, the index closed at 9,314, up 285 points or 3.17 per cent.

“Buying support around the 9,000 level pulled Nifty higher,” said Rajesh Palviya of Axis Securities, who noted that the index has retracted the losses of past eight sessions, indicating strength.

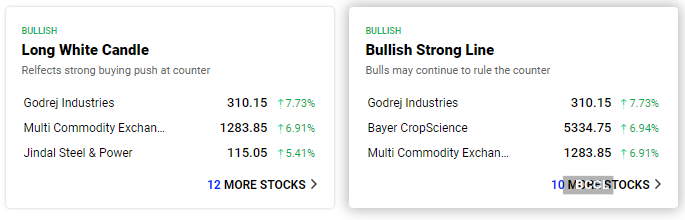

Check out the candlestick formations in the latest trading sessions

If Nifty50 trades above 9,350, said Palviya, this buying momentum may excel towards 9,400-9,500 zone. On downside, support is seen at 9,250-9,200 levels.

"If we can stay above 9,350 level in the next few sessions, we could achieve levels closer to 9,700," said Manish Hathiramani, Technical Analyst at Deen Dayal Investments.

Both daily strength indicator RSI and momentum indicator Stochastic are in a bullish mode, which support an upside momentum, analysts said.