Merlin Properties - One Of The Largest European REITs

by Wolf ReportSummary

- In this article, we'll take a more comprehensive look at Merlin Properties, a European REIT found in Spain.

- The company has an appealing blend of real estate investments coupled with an attractive development/investment pipeline.

- Management seems to be top-notch, and with large amounts of institutional money in the mix, things are looking good.

- Coronavirus has barely dented the company's rent collection thus far, and metrics look excellent.

- Merlin, at this time, is a BUY.

This is possibly one of the first times I've written a company-specific article on a Spanish company. In this case, we're looking at the REIT Merlin Properties (OTC:MRPRF).

One of the reasons I'm deep-diving into Merlin at this time is the company's current undervaluation, which matches some of the American REITs found on the market in terms of valuation, while at the same time, in my view, having a conservative portfolio.

I don't yet own many Spanish-listed stocks, but Merlin Properties was my second. In this article, I'll show you why I went that way, investing in this REIT, and why I believe you could do the same even if there's FX exposure and despite perhaps never considering investing in a Spanish REIT, of all things.

Merlin Properties - What does the company do?

Merlin Properties is a relatively new REIT, with an age of only 6 years, founded in 2014. The founders were, as I mentioned in my general undervaluation article focusing on Europe, former executives at Deutsche Bank and the company's history began when they received financial support from funds such as BlackRock and Invesco to acquire more than 1,000 offices from one of Spain's largest banks, Banco Bilbao (BBVA). Together with the real estate division of the construction company Sacyr as well as acquiring Metrovaceas S.A., also a Spanish property company, this formed the backbone of what is today Merlin Properties.

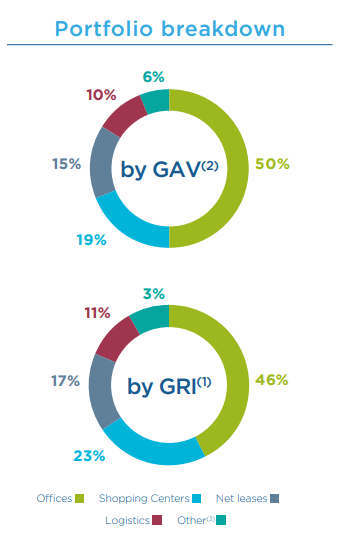

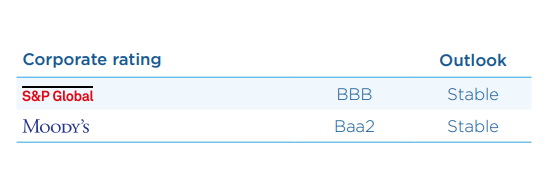

The past 6 years have been active for the company, including an investment-grade credit rating from S&P and Moody's as early as 2016, and non-stop acquisitions on an annual basis in the company's core markets. The current portfolio looks something like this.

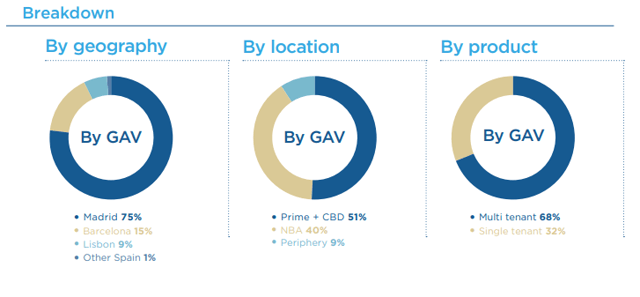

These can also be split down further, as we see below for the company's office segment, to exemplify into geographies, location, and products.

(Source: Company Presentation, 3M20)

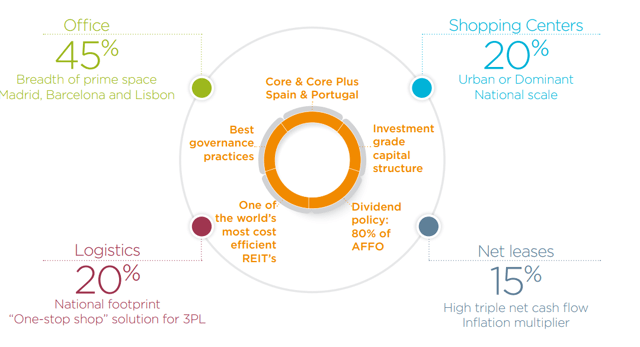

The company's portfolio is weighted towards offices specifically but contains several components typically otherwise found in singular REITs in the US. Merlin's strategy is simple and focused on servicing two particular geographies - Spain and Portugal, and within these geographies of the metropolitan areas of Madrid, Barcelona, and Lisbon.

(Source: Company Presentation, 3M20)

The company was initially primarily a net-lease REIT, with 70% net lease property found in the company portfolio in 2014. However, over the course of 4-5 years, Offices and Logistics quickly grew to eclipse its net lease exposure, to where it stands at barely 15% of GAV today.

Over the past few years, the company has focused on gaining not only Spain but also Portugal exposure, which it considers a key market, and it has certain absolute gems in its portfolio, which include The Nestlé Headquarters, Almada, Lisbon Park, Lisboa Expoa and the TFM Building. Portugal comes at an extremely attractive set of fundamentals, with an occupancy rate of 100% across the board despite the coronavirus crisis.

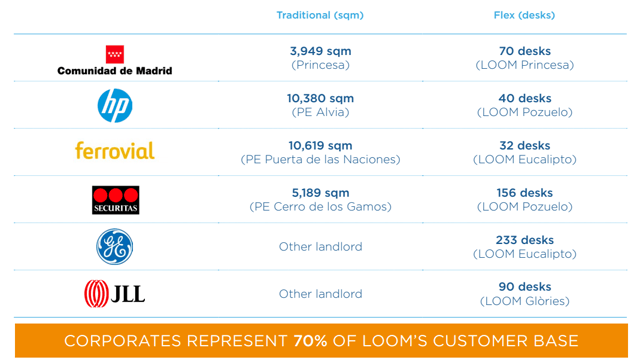

Company clients are excellent, with examples in specific buildings including mostly corporate clients.

(Source: Company Presentation, 3M20)

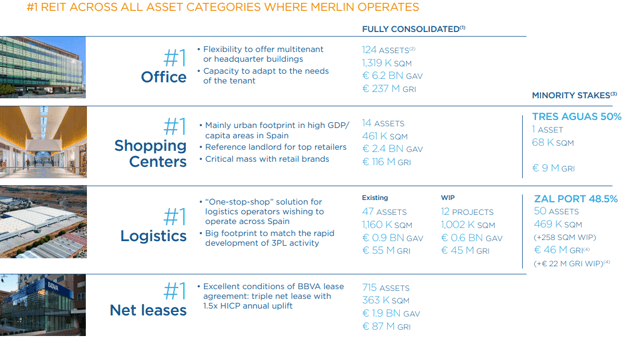

In fact, when we turn to look at exactly how the company is positioned, namely in Spain and Portugal, Merlin is on a solid #1 in all asset categories.

(Source: Company Presentation, 3M20)

Merlin's lowest occupancy metrics are found in the Office REIT category, but even here occupancy is 93%, with a weighted average contract length of 3 years. From this, things only improve. Net lease tenant occupancy is 100%, and the average contract length here is 18.4 years, with a company-wide average occupancy rate of 95% and an average contract length of 5.6 years. This is on the level with the best REITs in the US.

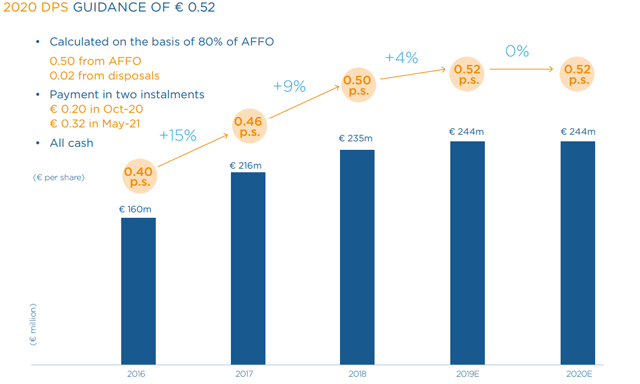

Dividend payout evolution over the year has been stellar, and the company seems to have little intention of reducing or pausing the dividend merely because of the coronavirus.

(Source: Company Presentation, 3M20)

At current share price, the guidance of €0.52 (more on that later) in DPS suggests a yield of over 7%, as of guidance and going forward.

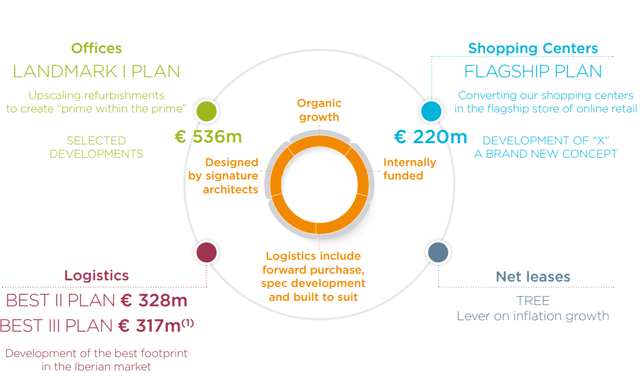

The company, as I mentioned, has an appealing pipeline of investment projects and growth ambitions.

(Source: Company Presentation, 3M20)

Furthermore, the company's debt repayment and CapEx can be considered self-funded going into 2022. The above investment projects amount for a total of €1.4B, with almost half already invested as of December 2019. €328M will flow from available cash in 2019/2020, with another €182M coming from cash flow retention, and remaining €206M coming from non-core disposals of assets. So, despite plans being significant, the above projects were, as of 3M20, already funded and planned.

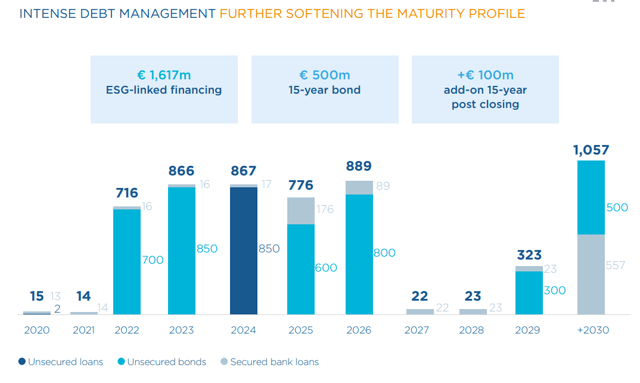

A word on capital structure and debt - It's good.

(Source: Company Presentation, 3M20)

By good I mean that the company has no significant maturities during these intense times, and no upcoming payments until 2022. The company also has no short-term debt instruments. As of FY19, the company's LTV was 40.6%, with an average maturity of 6.4 years, and a net debt of €5.182B. The key for Merlin here is the company's LTV ratio. Nearly all of the company's debt (99.5%) is, as of FY19, at fixed rates, giving forward clarity on how things will be looking in terms of debt.

So, Merlin properties is a Spanish REIT - in fact, the largest Spanish REIT of all time, which is in the business of leasing out a variety of real estate properties, mainly across the geographies of Spain and Portugal, and here mainly in specific, high-value metropolitan areas. It has high occupancy, an attractive dividend, and seems, based on initial funding and the company history since inception in 2014, to be doing well.

Let's see how the company has been doing lately and in the coronavirus crisis.

Merlin Properties - How has the company been doing?

Recent trends, despite Spain's lockdown, show favorable metrics for Merlin Properties. What do I mean by this?

- YoY revenues were down no more than 60 bps.

- Gross rents were down only 1% YoY.

- EBITDA fell only 1% YoY.

- FFO/AFFO fell only 5.6 and 10%, respectively, while company EPRA NAV increased by 5.2% YoY.

- The company experienced 3.5% like-for-like growth YoY in gross rents, and a release spread across the board.

Merlin has launched a commercial policy with 100% rent relief to retail tenants whose stores have temporarily closed. This incentive was barely noticeable in company FFO (€0.01/share), and company FFO per share was set to met the company's guidance for 2020.

The company also, despite everything, experienced no reevaluations during the period. Release spreads were excellent, particularly in the office and shopping centers, with renewals across the board and 5.1% YoY tenant sales growth despite the coronavirus. Company contracts in Logistics were also renewed, including contracts with Airbus (OTCPK:EADSF) (OTCPK:EADSY) and other larger clients.

Overall, company occupancy rates remain at extremely high rates, most exceeding 94-95% despite the coronavirus, with several geographies reporting 100% occupancy.

(Source: Financial Presentation 3M20)

A word on debt. The company fully drew down its revolver in light of COVID-19, and now has just north of €1.3B in cash and equivalents. Both Moody's and S&P confirmed the company's investment-grade credit rating, leading to further easy access to capital for Merlin. In fact, the company managed to renegotiate loan terms and lower the already-low 2.09% interest rate to 1.99%. An average interest rate which, as far as I know, doesn't exist in any REIT in the US.

The company has done a few things in order to adjust the company for COVID-19. These things are:

- The aforementioned growth plans now focus on properties with pre-lets already in place in order to improve company cash flow. CapEx, as such, has been slightly revised.

- The state policy of rent reference, which has been accepted by most customers where eligible.

- Focusing on debt, with no outstanding maturities until 2022. The company does not have any commercial paper or short-term financial instruments.

- The company dividend decision has been delegated to the board, subject to approval by the AGM on June 17th. The decision will be guided by the COVID-19 evolution of the business. As such, the dividend is not cut, but the wording now includes provisions for if things get worse.

- The company saves €11M due to the Board reducing pay by 25%, and the CEO, corporate manager, and all members of senior management have agreed to waive variable compensation and stock plans during FY20.

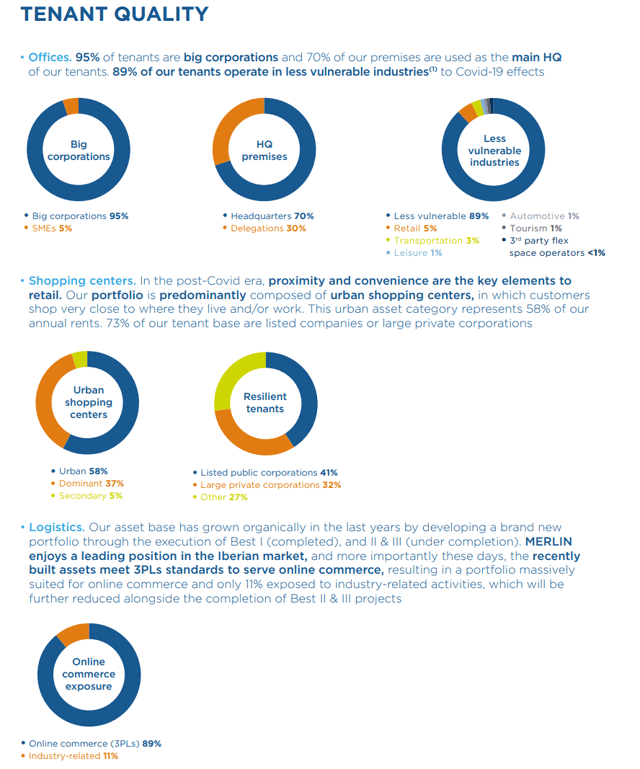

However, it's important also to note that all company properties have remained open and operating during the pandemic, and many of the company's clients are deemed as essential. In terms of sector, all of the company's net lease, logistics, and 96.5% of the company offices have been deemed essential and have remained open. Only shopping centers have been adversely affected in terms of closure, with only 11% of company clients remaining unaffected.

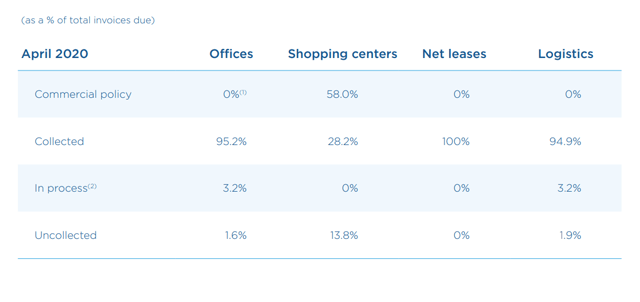

Again, when we look at rent collection, only shopping centers are truly affected to any major degree.

(Source: Financial Presentation 3M20)

The company also stated in its earnings call that (with respect to April month rent collection shaping up as above):

"I think, first, with respect to May collections, at this point of the month, they're looking very similar to April. So we're not expecting any meaningful deviation in May versus April. Obviously, in retail, because of the commercial policy, that's pretty well sorted because as people sign on to that commercial policy, it dictates the future payments as well. But then in offices and logistics, we're not seeing any deviation in May versus April." (Source: David Brush, 1Q20 Earnings Call)

This is where company tenant quality really is in Merlin's favor with, as you can see above, most of the company tenants outside of shopping centers barely being affected to any major degrees or suffering from any specific coronavirus headwinds on a long-term basis. However, part of what is making Grade-A USA mall REITs suffer is also affecting Merlin, as prime locations in Madrid and Lisbon have become problematic due to congestion and social distancing measures. We focus on resilience, however, and most company clients are indeed very resilient.

So, in short, company results during 1Q20 were quite good. The company did experience the expected disruptions in the shopping center space, but other segments and many clients continued operating without pause, confirming overall company resilience here. While the company did split the proposed dividend and leave the decision to the board, there's been no clear declaration of a cut, and the company has ample liquidity to service dividends, debt and CapEx as needed. While the coronavirus could prove more disruptive going forward, there's no signal that it's put Merlin in any sort of major jeopardy at this point.

Merlin Properties - What are the risks?

Nonetheless, and despite all of this positivity, the company does come with some major risk factors. Read with care.

- Net debt is high on a comparative basis. While LTV ratios are very good, the company's current capital structure is built upon continually high property values as opposed to manageable net debt/EBITDA ratios. EBITDA for the company in 1Q20 was ~€104M, coming to around ~€416M annualized. While there's room for improvement here, and we can give the company leeway and consider a bullish EBITDA of €400-500M per year, that still leaves the company with a current net debt/EBITDA of >10X. Any such ratio is certainly a risk, no matter how defensive the portfolio is considered to be. It also exposes the company to massive issues in case of write-downs.

- The company's low and lowering interest rate has been bought through the refinancing of debt. Unfortunately for Merlin, these refinancings have come at a cost, where just over 88% of the company's debt as of 1Q20 is now at fixed interest rates - a decrease of almost 10% in less than a quarter, to floating rates. Given Merlin's debt load, this increases exposure to interest rate fluctuations.

- The company has exposure to a low number of comparatively higher-risk geographies. By comparison, I mean by European standards. Spain hasn't exactly been known to be a bastion of financial stability for the past two decades, and Merlin's properties are found mostly in 3-4 cities in Spain and Portugal.

- It's young. Merlin Properties is a young company with barely 6 years under the belt. It was, as of the coronavirus, unproven, and while management seems to have done a good job thus far, this remains to be considered.

Aside from these, I see Merlin to be fairly clear-cut.

Merlin Properties - What is the valuation?

Here things get better. I already pointed to some of this in the more general article, so let's look at valuation more in-depth here.

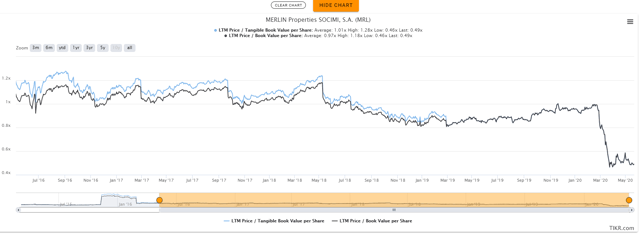

(Source: TIKR.com)

The company currently trades at 0.45X to its EPRA NAV. The company has never traded at such a level. Annualizing non-COVID encumbered FFO rates, the company currently trades at 10.58X P/FFO, where it typically goes for twice that.

Merlin is typically a very highly-valued REIT, due in no small part to the perceived value of its properties and its plans going forward. COVID-19 has broken this, but this break in valuation is not backed up by post-coronavirus effects, which has shown resilience as FFO/AFFO declined by less than 11% - at least until now - and the company continued to operate as usual.

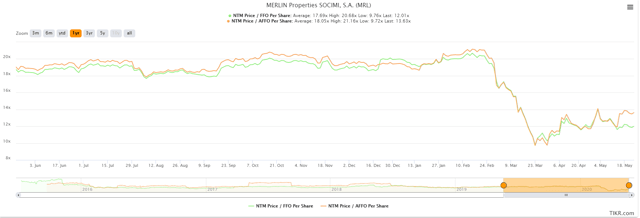

We can also consider the NTM expectations for the company AFFO/FFO, and from a historical context, this price is still appealing as well.

(Source: TIKR.com)

Analysts currently expect a full-year FFO drop of 13%, which would be above 1Q20, and logically so due to 1Q20 also containing January and February. However, following this, S&P analysts expect things to bounce back up in 2021 right back to 2019 levels. The things we're seeing out of Spain at this time suggest that full operations may come back far sooner than 3Q20, which of course would lessen FFO/AFFO impact for 2020.

So, the question becomes, is Merlin Properties worth its pre-coronavirus valuation despite coronavirus impacts - or how much should coronavirus headwinds justifiably impact the largest Spanish REIT in existence?

In my own estimate, I put faith in the analyst estimates found here, as they are backed up by current trends and company information in 1Q20. Coronavirus will have an impact on rent collection and certain key sectors, so FFO for 2020 will be lower. However, the company typically trades at the value of its properties long term. While FFO multiples have shifted, the company's stock price to EPRA NAV has rarely seen more than slight variance, and due to this, I expect it to eventually return to its fair valuation - which also includes the development of new properties with already existing pre-lets. The risk here is a complete collapse in South-European real estate, and I don't see this happening to any degree impacting Merlin fundamentally going forward.

This brings me to my thesis.

Thesis

Short-term valuation for this company is dicey at best, and given the high debt position, this is a risky investment for anyone not willing to make a long-term commitment to Merlin Properties. Knowing Spain fairly well as a market, and also knowing Portugal/Lisbon, however, I find the company a very appealing prospect indeed, as these are growing geographies with appealing real estate potentials.

This company is certainly not for everyone. By American standards and comparisons, it can be considered excessively leveraged, and many of you perhaps don't see or like what's offered here - which is understandable. European REITs are rare, however - and well-managed ones are even rarer.

While I do see Merlin Properties as a riskier proposition than one might typically entertain, the value I see here is long term. I also think management has proven itself during the past 5-year period and has handled the coronavirus crisis extremely well thus far. That is why starting a few weeks back when the stock was even cheaper, I initiated a starter position in Merlin Properties, which I may extend going forward.

Part of my focus going forward is on diversification, not just in terms of company sectors but also in terms of geographies. The fact is, my real estate allocation going into COVID-19 was rather small, at barely 11%. Given the undervaluation found here, I wanted to increase it - and I've bought more Realty Income (O), Federal Realty Investment Trust (FRT), AvalonBay Communities (AVB), as well as Merlin Properties, to increase my European real estate exposure.

While my target of a return to 1X NAV valuation may seem lofty, I do believe long term I will see such valuation returns for Merlin Properties - and this is a company I intend to own for the coming decades - as with all my real estate companies. The thesis here is European exposure to attractive geographies, with a well-mixed bag of properties and sector, good management, at a very appealing price point.

That is why Merlin Properties, in the end and despite the risks, is a "BUY".

Stance

Due to the COVID-19 induced undervaluation, which given rent collection and occupancy trends isn't justified, I consider Merlin Properties to be a "BUY".

Disclosure: I am/we are long O, AVB, FRT, MRPRF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.