Chicken Soup For The Soul Entertainment: This Streaming Company's 10.4% Preferred Yield Is Good For The Soul

by Jeremy LaKoshSummary

- Chicken Soup for the Soul Entertainment is an emerging streaming company.

- In Q1 2020, the company made a cash flow milestone, which should give preferred shareholders confidence in their dividend sustainability.

- The company's strategic plan for growth makes sense.

On the surface, investors may look at Chicken Soup for the Soul Entertainment (CSSE) and think they are dealing with a publishing company. In fact, CSSE is far more modern. The company specializes in streaming content and, after a 2019 joint venture, it is the primary investor in freemium streaming service Crackle. While the company is considered a high-risk growth play, it has a preferred share issuance (CSSEP) that is currently priced below par with a coupon yield of 10.4%

Source: Seeking Alpha

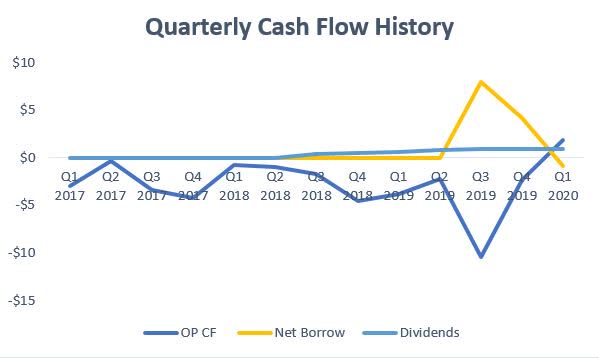

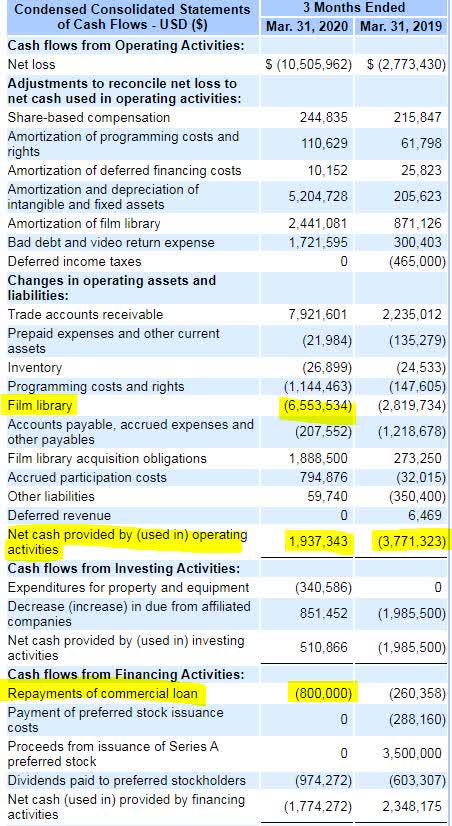

During the first quarter of 2020, COVID-19 lockdowns began to force people to stay at home more often. Many turned to streaming television as a source of entertainment to pass the time. CSSE's first quarter financial results began to show the impact of the company's expansion into streaming and COVID-19. For the first time in years, the company reported positive operating and free cash flows. For CSSE to generate positive cash flows after investments in its video library this quickly is certainly positive for the company's ability to pay preferred dividends.

Source: SEC 10-Q and 10-Q History in High Yield Digest Database

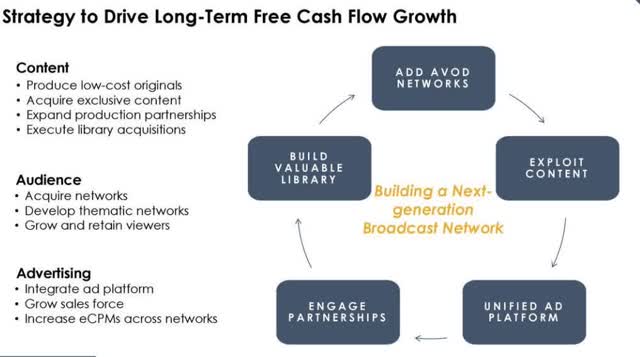

While the company did not provide any forward guidance for the full year, CSSE did provide a presentation a couple of weeks ago that shined a light on its business model. CSSE does not collect its primary revenue from its customers, rather it collects from advertisers who pay to provide commercials on the company's freemium streaming network. However, CSSE is more than just a streaming company. Its business model integrates distribution and production into its streaming operations which thus lowers its costs to bring content to market.

Source: May 2020 Investor Presentation

Looking forward, CSSE as an eye on its target market. The company is pushing to get an audience comprised of under 35 years old, who they've deemed the lost generation of media. They have identified their target audience as willing to accept advertising for free content, already active with streaming technology, and looking to actively replace traditional "cord" television bundles.

Source: May 2020 Investor Presentation

The company plans to grow through the production of low-cost originals, the expansion of its content library, and the execution of strategic partnerships (versus costlier wholly owned acquisitions). With the expansion will come increased engagement with advertisers and more ad revenue. While many may view the production of low-cost programming as more of a lottery ticket, it is important to note that CSSE has already had some hits with 'On Point' passing 12 million views and 'Going for Broke' passing 11 million views.

Source: May 2020 Investor Presentation

While CSSE's growth strategy is off to a good start, the company does face real risks. First, the company has major competition from behemoths Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), Amazon (NASDAQ:AMZN), and YouTube (NASDAQ:GOOGL) (NASDAQ:GOOG) in this space. These competitors can pivot and crush smaller players quickly. Additionally, new technology can disrupt the streaming space further, causing small players like CSSE to become outdated without the necessary capital to pivot.

Overall, I believe that Chicken Soup for the Soul Entertainment is a viable disruptor to the streaming space. The company offers free services to acquire and retain customers as well as a low-cost strategy to produce content. With original programming already generating buzz, CSSE's preferred shares are a great income investment in a growing space.

COVID-19: The pandemic black swan has deeply discounted the preferred stock and high yield debt markets. Many income opportunities are trading at all-time lows, so there's no better time than now to join us!

Want more high yield ideas? Check out High Yield Digest for access to my real-time portfolio with trade alerts, along with company dashboards and exclusive ideas!

Disclosure: I am/we are long CSSEP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.