Stabilus: A New Wave In Auto Components Business Concentration

by Enrique GarciaSummary

- Stabilus is not only a German industrial provider for the automotive industry - 60% revenue -, but also for other industries - 40% revenue.

- It produces gas springs and motion control systems, components which are increasingly in demand in the new mix of modern automobiles.

- Its diversification outside the auto industry provides some balance and stability to the business, as well as a greater scale to its technologies and know-how.

- In recent years, Stabilus has acquired smaller companies and has increased its productivity. This points out to a consolidation in the industry and a higher return on invested capital.

- It does not have a huge earnings yield compared to its peers, but it is well-positioned to grow in revenue and profits after the recent crisis.

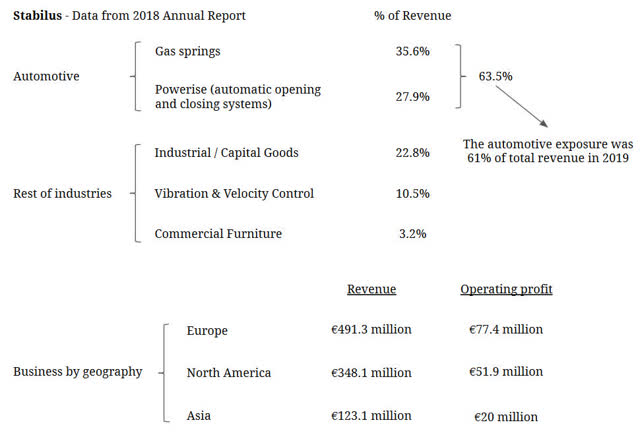

Stabilus (OTC: SIUAF) is a German industrial company specialized in gas springs, dampers and automatic opening and closing systems. Its expertise in these technologies is applied to a wide range of industries, especially the automotive industry which represents 60% revenue. The following diagram shows data from the 2018 fiscal year, where the details for commercial furniture were reported - not in the case of 2019 data -, but the weight of each segment in 2019 was similar:

*Data from 2018 Annual Report

Powerise is the new relevant segment in the automotive section and includes automatic opening and closing systems, which are mainly applied to the new tailgates/trunks. Another interesting segment is gas springs for commercial furniture, as there are just a few global providers.

In general, all the products are based on related technologies, although for multiple applications and different sectors. This is important as the company is increasing the scale of its know-how and technology, a strong advantage to expect an improvement in return on invested capital. Stabilus is not trying to grow outside its expertise area, a requirement we demand when looking for long-term investment ideas.

Its diversification provides some balance to its business, as the auto industry has been underperforming in recent years - although auto spare parts are more stable, which is positive for Tier-1 providers. As we noted in the Schaeffler (OTC:SCFLF) story, this wide range of similar products but different applications reduces the impact of some specific risks of a single industry. However, we are not pessimistic about the auto industry in the long-term, at least for auto parts providers.

Consolidation through integration of smaller companies

In recent decades, we have witnessed an important growth and concentration in Tier-1 auto providers, reaching a point in which those providers are more powerful and profitable than final manufacturers. Some articles - such as this one - have reasonably summarized this phenomenon, but we can find a more extended explanation in the book written by Wilson Kia Onn Wong in 2016: Automotive Global Value Chain: The Rise of Mega Suppliers:

These suppliers subsequently pass on this intense pressure to their own supplier networks (Nolan, 2008). Buffeted by the powerful forces of the cascade effect, even traditionally small third-tier suppliers (e.g., rubber suppliers in chapter 3) are compelled to merge to not only augment their ability to meet the increasingly stringent quality and service demands of their first-tier supplier customers but also to bolster their position in price negotiations. In short, the cascade effect has not only led to rising industrial concentration (i.e., forming oligopolistic and even duopolistic market structures) among the first-tier suppliers but has also spilled over to the second and third-tier suppliers (Nolan, Zhang and Liu, 2008). 'Automotive Global Value Chain: The Rise of Mega Suppliers' by Wilson Kia Onn Wong

The author offers a great deal of data and observations on how these mega providers are increasing their power in the auto value chain, as there are fewer Tier-1 global providers than final manufacturers. As these mega providers cannot grow much more in market share after a big concentration in their industry, perhaps the next wave of concentration and productivity increases are in Tier-2 winners.

Stabilus defines itself as a Tier-1 provider in automotive and industrial segments, but it also recognizes that some products are previously sold to other Tier-1 providers. Thus, we can consider Stabilus as a mix of a Tier-1 and Tier-2 provider, which is interesting, taking into account that some opportunities will arise in the second stage of the value chain. Another important fact is that the gas spring industry is very fragmented, and Stabilus is the leader from the point of view of market share. A fragmented industry, which requires more scale and standardization, means that there is pressure to increase concentration in that sector. Compared to other mega Tier-1 providers, such as Continental (OTC: CTTAF) or Valeo (OTC: VLEEF), Stabilus' size is small and there is room to grow further.

There are hints that suggest a trend of concentration. Stabilus has been acquiring smaller companies to integrate them in a larger organization. In 2016, it bought Hahn Gasfedern, ACE, Fabreeka and Tech Products; and Aerospace, Piston and Clevers in 2019. These are recent acquisitions, whose goal seems to be to include more component-related businesses or broaden the geographical reach of its production capacity.

In this regard, the company recognizes its need for more infrastructure in Asia, which is one of the opportunities to become a fully global auto provider. This was already accomplished by the most important Tier-1 providers some time ago, as they expanded their footprint to the whole world to supply auto manufacturers in a global scale. It then makes sense that we also observe this trend in some Tier-2 providers, simplifying the whole value chain. This means that a Tier-1 provider will work with fewer Tier-2 providers, reducing transaction costs and scaling R&D.

Management gave us some hints of opportunities to improve productivity, specifically integrating the sales teams of acquired brands. The first objective of acquisitions was to join technologies and physical infrastructure; now, the focus is to improve sales efficiency in the industrial segment:

On the industrial side, we have plenty of brands with all the acquisitions we did in the past years. We have ACE, we have Hahn, we've Fabreeka/Tech Products, General Aerospace, Piston, Clevers and then for sure, also future industrial acquisitions that'll be in this industrial segment. What we experienced in the past, and also during the time when we acquired the different brands, is that we are kind of -- need to work in terms of one voice to the customer offering all products out of one hand in all markets. And this is what we want to do with this change. We when we acquired these companies, for sure, grasped the whole low-hanging fruits, we did streamline our product portfolio, went out to the market and got great benefit from acquiring these companies. However, now it's time to cluster them under one umbrella to make sure, for example, that one salesperson out of our business walks to the customers with all the products in hand. Because, for example, in the past, it was that the ACE person would sell mainly ACE products, the Hahn person would sell mainly Hahn products. And there will be great benefit for our business, combining all these businesses under the industrial business umbrella of Stabilus to take one step ahead in terms of streamlining the touch point to our customers. And we'll have fruits not only in terms of efficiency in our business, but also in terms of further increasing our sales. Having all these brands under one umbrella is logical and good next step in our business and will foster the Industrial business. And you know that we, at this point in time, have 40% Industrial business versus 60% Automotive. We further want to grow on the Industrial side. And this is the right way to do so. Stabilus Earnings Call Transcript 2020 Q1 - Michael Büchsner (NYSE:CEO)

Trends and management perception

Stabilus has benefitted from the increasing adoption of electronic motion control technology in automobiles. As manufacturers include more accessory comfort systems to please consumers, Stabilus is able to sell more components for each car. This is remarked in every report and presentation of the company:

Stabilus' strategic aim is to further extend its leadership positions in this product range. The key focus areas of its strategy process are to: (NYSE:I) drive profitable and cash-generating growth, (II) benefit from megatrends, such as increased standard of living, increasing comfort requirements and aging population, (NASDAQ:III) focus on innovative gas spring solutions, especially in the industrial business through new applications and selected add-on acquisitions and (iv) maintain and strengthen the Company's cost and quality leadership. 2019 Stabilus Annual Report

Although the automotive industry is still underperforming - it was slightly weak at the end of 2019, and the Covid-19 crisis has significantly impacted in recent months -, Stabilus' management points out that the mix of vehicles sold is benefitting the company. According to the CEO, SUVs and crossovers require more components sold by Stabilus. This explains why the company has been overperforming the auto industry in the last two years.

Vehicle outlook quite clearly -- production vehicle outlook is a number that per definition will change a bit up and down. Now overall, whether it is now 88 million to 89 million or 86 million units, does not currently have an impact. What you need to remember, within the cars being produced, there are certain body styles that are more relevant for us than others. The underlying trend and body styles that are helpful for us, what I refer to as boxy cars or also called SUVs, crossovers, et cetera are more helpful to us. Those body styles globally are still moving forward. Other body styles are coming down. So in our detailed analysis, we, of course, take a look at relevant body styles and not on everything being produced. Stabilus Earnings Call Transcript 2020 Q1 - Michael Büchsner (CEO)

Financial summary: growing returns on invested capital

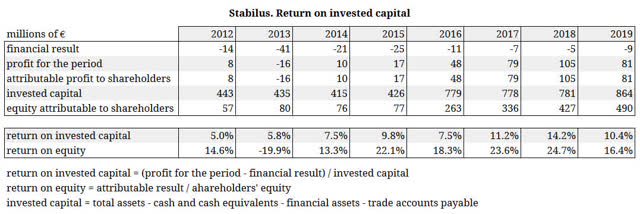

Stabilus was listed on the German market in 2016, raising capital to complete some acquisitions and avoid a large financial leverage. After those acquisitions, it is reasonable to expect more revenue and profits, but the question is whether those investments were productive. The relationship between net invested assets - including goodwill - and profit, excluding the financial result, will give us a measure of how the company is carrying out its strategy.

*Data from Stabilus Annual Reports

Those acquisitions have increased the invested return on capital since 2016, highlighting that the integration is achieving good results. We can consider that the increase in returns was supported by the expansive cycle, instead of by a direct result from the integration of smaller companies. However, after the recent decline in the auto sector, its profit is stabilizing around €70-80 million per year - before the Covid-19 crisis -, which still represents a good return compared to the invested capital - around 10% based on conservative estimations.

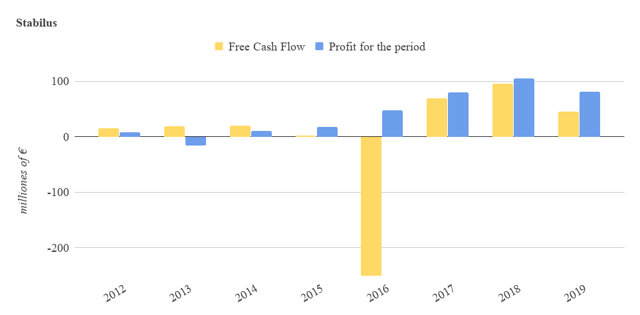

*free cash flow = net cash provided by operating activities - purchase of property, plant and equipment - purchase of intangible assets - acquisitions, net of cash + proceeds from disposal of property, plant and equipment - payment for interest - payment for finance leases

*Data from Stabilus annual reports

After those high investments in 2016, the company increased its free cash flow. In fact, nowadays, its debt position is reasonable. Its net financial debt - including pension liabilities and subtracting cash - was €298 million at the end of March 2020, which is less than double the 2019 EBITDA - €183 million. The diversification of the business by sectors provides more stability in comparison to other auto providers, therefore, in our opinion, its current debt position is not quite a serious risk.

Regarding shareholder remuneration, Stabilus does not repurchase its own shares, which is the usual policy followed by many European industrial companies. It distributes annual dividends considering annual profits and cash generation. The last dividend was paid in February and represents a dividend yield of 2.5% at current share price.

Assessment and valuation

The last 6 months of financial data - October 2019 to March 2020 - indicate that profits and revenue are stabilizing after the drop since the 2018 peak. Covid-19 impact is mitigated by the fact that the European industry outside autos is holding reasonably well. Being an exceptional situation, we consider that 2019 is a more representative year to calculate earnings yield and other valuation metrics.

In the previous fiscal year, the attributable profit was €80.8 million - less than the €120 million profit in 2018 - and the current market capitalization is at present around €1.08 billion - as of May 22. This means a 7.4% earnings yield. It is very interesting for a company well-positioned for long-term growth, after adjusting for the cyclical setbacks. It is not a huge bargain in terms of earnings yield, but its qualities are very attractive, as the company is suited for good operating performance in the future. At least, it is an important candidate to consider if the share price goes down again below €40; the recent €30-35 minimum was a clearer entry. German factories did not completely shut down during the pandemic, smoothing the impact of the crisis.

Specifically, we consider a 2% annual organic growth in normal circumstances, but we cannot forget the possibilities of integrating other smaller companies and scaling still more its know-how. In the last 5 years, revenues grew an annual 13.4% due to the integration of other companies and the economic global expansion. Therefore, the total growth will be determined by how many acquisitions are successfully executed in the future.

Compared to other auto parts providers, the earnings yield is not very high. For instance, Schaeffler's current earnings yield - a company with some similarities which also operates for other non-auto industries - is almost double. However, Stabilus has other qualities and context - lower debt and more potential growth -, as we have previously discussed regarding long-term trends in the industrial sector. Stabilus seems attractive for a diversified stock portfolio, which would try to benefit from long-term trends but without paying too much for current profits.

Disclosure: I am/we are long SIUAF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. As we have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.