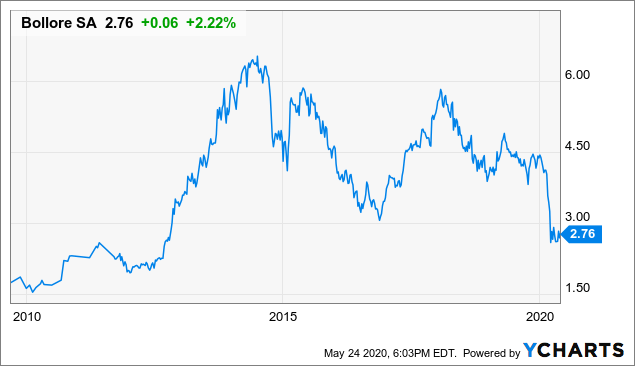

Bollore's Shares Are Cheap, But Value Still Mostly Rests On Unwinding Complex Structure

by Capital IdeasSummary

- Bollore is a French conglomerate with a history dating back to the early 19th century that today owns investments concentrated in logistics and media.

- A complicated ownership structure means that of the 2.9 billion shares outstanding, only 1.4 billion net shares are effectively outstanding, causing many to understate Bollore's underlying net asset value.

- Even assuming a substantial discount to net asset value of 20%-40%, shares are trading for no more than half of intrinsic value.

- Despite a thesis shared by many smart investors so far not playing out, Bollore's risk/reward currently appears to be skewed in investors' favor.

Bollore (OTCPK:BOIVF) is a French holding company founded in 1822 and headquartered in Paris. Its predecessor company, Papeteries d'Odet, owned a paper mill along the Odet River in Brittany that supplied specialty papers used in bibles and as rolling paper for tobacco. The business was lost by the Bollore family in the 1970s to investment bank Edmund de Rothschild but it was sold back to Vincent Bollore in 1981, who restructured the business and then started making acquisitions and transforming the business into a conglomerate.

Source: Company website.

The opportunity in Bollore's shares today is two-fold. First, the group is actually well managed and has compounded net-asset-value at a double digit rate since it came public in 1985. Second, the corporate structure is incredibly complex and opaque. A cascade of holding companies can make it challenging to understand even how many shares are effectively outstanding and to add just a little more complexity to that equation, Vivendi (OTCPK:VIVHY) is among Bollore's key assets, itself a media conglomerate which trades at a discount to its net assets.

Bollore is still not extremely well known to investors in the United States. Although, to be clear, the Bollore thesis has been out there for quite a few years now, with Muddy Waters clearly laying it out in 2015. Since that time, the stock has been owned and discussed by other intelligent investors such as Bireme Capital, Greenwood Investors, Woodlock House, and Yacktman Asset Management.

Back in 2017 I wrote an article about the out-performance of companies which are owner-led rather than manager-led. While I mentioned Bollore in the article, its complicated structure has kept me away from the stock until very recently.

Shares are actually lower today than they were in 2015 when Muddy Waters declared the stock to have 95% upside and investors will need a lot of patience on this one. But, while if the corporate structure is never dramatically simplified investors may only receive a return equal to the underlying net asset value performance, the upside remains absolutely enormous. If Bollore traded at the standard discount to its net asset value that European peers tend towards of 20%-40% it would mean that the shares traded over the counter in the United States would be worth between $5.50 and $7.00 versus their last trade of $2.76, representing upside of between approximately 100% and 150%.

The Underlying Assets

Bollore's wrapper is quite complicated, but its underlying assets are not at all difficult to understand. The company can be divided into four sources of value: a collection of mature, cash producing logistics and energy companies operating in Europe and Africa, a large stake in media conglomerate Vivendi, loss making early-stage battery businesses, and investments in agriculture and public companies.

The first piece, the logistics and energy companies, includes Bollore Logistics, African Ports and Railroads, and Bollore Energy.

Bollore Logistics is a freight forwarder and third party logistics provider. Its closest publicly traded peers include Kuehne + Nagel (OTCPK:KHNGF) and Expeditors International (EXPD). Rather than own assets directly, these companies buy capacity in bulk on airplanes, ships, and trucks. In reselling that capacity to customers, they also provide technology to assist with document transfers and shipment tracking and coordinate movement through customs. Basically, if a manufacturer needed to move goods from point A to point B, doing so might involve multiple hand-offs and coordination, so companies like Bollore Logistics make this process seamless to customers. They can additionally provide inventory and other supply chain solutions.

The European logistics business had revenues of €3.5 billion in 2019 and has grown consistently, if not rapidly, with growth of about 3% per year over the last decade.

The African Ports and Logistics business operates a network of ports primarily along the west African coastline in addition to owning three rail concessions and substantial warehouse space. The ports concessions stretch along the northwestern part of Africa from Mauritania to the Congo. The African ports and logistics business has been built systematically over decades through local relationships and the continual reinvestment of capital, making it quite difficult to replicate. Bollore's African business was a fast grower for many years. Between 2007 and 2012 it grew revenues at annual rate of 12%, but since 2012 revenues have been flat at €2.4 billion.

Bollore Energy is a midstream energy company owning storage facilities, operating an oil pipeline, and distributing fuel and oil products. Revenues can fluctuate with fuel prices, but operating income has been more consistent and currently is ~€50 million per year.

The second major piece of the Bollore puzzle, Vivendi, is where things get even more interesting. That's because Vivendi is itself a holding company. Vivendi was a water utility for a century until it started buying companies in other industries after 1976 when Guy Dejouany became Chairman, including construction, waste management, and media. The water and waste management companies are now Veolia Environmental (OTCPK:VEOEY), while construction and other assets became a part of Vinci (OTCPK:VCISY), leaving behind the media assets at today's Vivendi.

Bollore first became invested in Vivendi in 2012 when interests in television stations were sold in exchange for shares. Bollore kept buying shares after that deal and owns 27% of the company today.

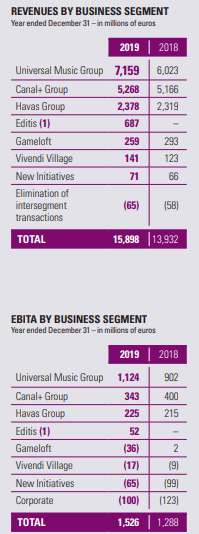

Results over the past two years demonstrate the sizable part of Vivendi's value today that comes from Universal Music Group. The remainder comes from French television and film group Canal+, advertising company Havas, publisher Editis, video game publisher Gameloft, ticketing company Vivendi Village, video distributor Dailymotion, and sizable stakes in Telecom Italia (TI), Mediasset (OTCPK:MDIUY), and Banijay Group.

Vivendi revenue and adjusted operating income by division, 2018-2019. Source: Vivendi Annual Report.

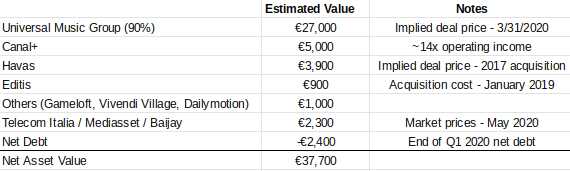

Vivendi's market cap is currently a little less than €23 billion and has net debt equal to €2.4 billion. In other words, its enterprise value is €25.4 billion. Yet, just recently (at the end of March), 10% of Universal Music Group was sold to an investor group led by Tencent at an enterprise value of €30 billion. One can easily get to an additional €10 billion of value outside of Universal Music Group at Vivendi. In fact, in the below analysis, these other divisions are valued at €13 billion, implying Vivendi's share price currently reflects a 40% discount to net asset value.

Vivendi estimated net asset value. Source: Author.

To be fair, most of Vivendi's divisions are affected by the COVID-19 pandemic, but its most important source of value, Universal Music Group, should not be in the aggregate. Some of the music label's revenue will likely be hurt, but other sources are actually likely to be aided. First quarter revenues were higher by 13% at constant currency and did not appear to be affected dramatically in March. If one wanted to haircut the other businesses' valuation by 20%, Vivendi's discount to net asset value is still ~35%.

The point is not to be overprecise, but to demonstrate that Vivendi's stock trades much like other European family conglomerates with large discounts to net asset values and the implications for Bollore is that you now have to contend with underlying asset values which are discounted and which are then discounted again at the level of the holding company.

Bollore also owns some loss-making entities related to the development of batteries, Blue Solutions and Blue Applications. The losses have been consistently in the range of €150 million per year. Obviously, like many venture type investments there is a chance Bollore could win big from the further commercialization of their battery technology or by selling it to another company and at the same time there is a very real risk of the parent company just racking up continual losses.

Some remaining investments are comprised of publicly traded investments as well as some agricultural investments. The publicly traded investments are in Italian investment bank Mediobanca (OTCPK:MDIBY), of which Bollore owns ~6%, and Vallourec (OTCPK:VLOWY), a steel company. The agricultural investments are comprised of a large stake in Socfin Group, French vineyards, and farmland used for olive groves in Georgia and Florida.

How Many Shares Are Outstanding?

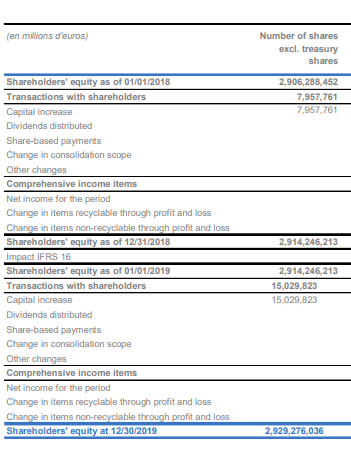

Bollore's year-end shares outstanding according to its investor presentation is 2.929 billion.

Bollore shares outstanding. Source: 2019 Results Presentation.

For most companies the discussion ends here. Bollore is not most companies. At least, it's not like American or British companies.

Shareholders in the United States and some other countries can control a company without greater than 50% ownership of the economic value through multiple voting shares and dual classes of stock. A share of Facebook (FB) Class B stock has 10x the voting rights of Class A stock, which allows Mark Zuckerberg to control close to 60% of Facebook while owning only 20%. Similarly, Alphabet (GOOG) (GOOGL), Berkshire Hathaway (BRK.A) (BRK.B), Ford (F), UPS (UPS), and Comcast (CMCSA) all have dual classes of stock, among many other companies.

Dual-class structures have not been so readily available in France. French law does allow for double voting rights to shareholders who have held the stock for at least two years, but Facebook's corporate governance would be pas bien under French law.

An investment banker from Lazard (LAZ) named Antoine Bernheim helped devise a pyramidal ownership structure for many French and Italian firms called a Breton Pulley system to get around these corporate governance restrictions. A pyramidal structure conceptually works the following way. Suppose an operating company is valued at $1 billion. By holding just 51% of that company, an individual or another entity can control that $1 billion in value with only $510 million. Now suppose that another entity owns that 51%, which is then owned by another entity. That means that now someone could control that $1 billion in capital with an investment of only $260 million. A third entity inserted as another intermediary reduces that number to $133 million, and another to $68 million.

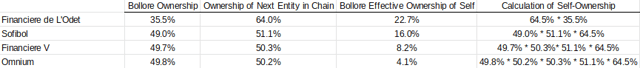

In the case of Bollore, the family owns slightly more than half an entity named Omnium, which owns slightly more than half of an entity named Financiere V, which owns 51% of an entity named Sofibol, which owns 55% of an entity named Financiere de L'Odet (OTCPK:FCODF) (another publicly traded entity), which owns 64% of the publicly traded Bollore. Following those percentages through, it would appear that the Bollore family ultimately owns ~4.5% of the underlying equity of Bollore. But, the story does not stop here.

The ownership structure is not only pyramidal in nature, but also circular, arising from the fact that Bollore itself owns pieces of the companies along this chain. This fact is what makes the true net shares outstanding of Bollore somewhat confusing.

Moving backwards along the chain, Bollore itself owns 35.5% of Financiere de L'Odet, 49% of Sofibol, and slightly less than half each of Financiere V and Omnium.

Calculating precisely what this ownership chain ultimately means would literally require an infinite regression. When Muddy Waters researched the company in 2015, they hired consultants to help determine the number of shares outstanding. A simplified approach can still determine with reasonable precision the net shares outstanding and economic ownership of Bollore.

Calculation of Bollore's effective self-ownership through ownership of intermediaries. Source: Author.

Bollore's ownership of 35.5% of Financiere de L'Odet multiplied by Financiere de L'Odet's ownership of Bollore means that through this one intermediary, Bollore owns 22.7% of itself. Summing up its self-ownership through all its intermediaries results in Bollore owning 51% of itself. Put another way, rather than having 2.9 billion shares outstanding, Bollore actually has 1.4 billion.

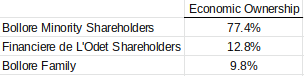

The 4.5% ownership that the Bollore family appeared to have before considering the ownership of intermediary entities by Bollore, actually becomes 9.8% once this ownership is included. This can be calculated by taking that 4.5% and dividing it by the sum of Bollore's ownership of Financiere de L'Odet, Financiere de L'Odet's shareholders direct ownership of Bollore (9.2% multiplied by 64.0%), and the same 4.5%. A similar calculation implies that Financiere de L'Odet's shareholders own an underlying 12.8% of Bollore. Bollore's shareholders, other than the Bollore family itself, own the remaining value, or 77%.

Economic ownership of Bollore. Source: Author.

Valuation

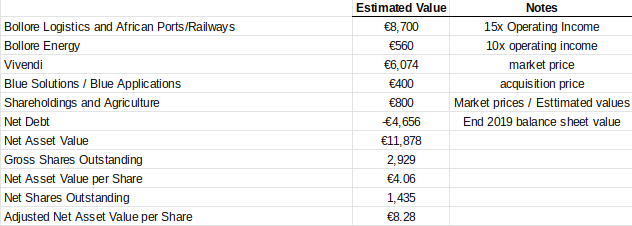

With an accurate number of effective shares outstanding, it is now possible to derive the true net asset value per share. Below is an estimation of the non-listed pieces as well as market prices of the listed pieces of Bollore.

Bollore estimated net asset value. Source: Author.

Using the reported shares outstanding discounted by 51% yields a net asset value of €8.28 per share. Using the reported shares outstanding yields a net asset value of €4.06 per share. Compared to Bollore's recent price in Paris of €2.51, the stock trades at discounts to net asset values of 70% and 38% respectively.

Given that European, family controlled conglomerates do typically trade at 20%-40% of a discount to net asset value, Bollore's discount to net asset value based upon the gross number of shares outstanding makes a certain degree of sense. Italian conglomerate Exor (OTCPK:EXXRF) controlled by the Agnelli family currently trades for a discount of about 35%. But, that also implies that the market is clearly valuing Bollore on its gross shares, and not its net shares, outstanding.

Were Bollore to trade at a discount of 20%-40% to its net asset value based upon its net shares outstanding, shares would need to trade between roughly €5.00 and €6.60 per share. Converting to U.S. dollars, the range becomes close to $5.50 and $7.00, implying upside of between 100% and 150%.

It should be remembered that this valuation does value Vivendi at market and not at the value of its underlying assets. Any additional value assumed in Vivendi shares would make Bollore's discount to net asset value even higher.

Simplification?

Bollore could grow its net asset value while the shares maintain its current discount and shareholders could get a satisfactory result. But, it's obvious that in order for shareholders to hit a home run, the corporate structure needs to be simplified. It is not guaranteed that will happen.

The Bollore family is not going to relinquish control of Bollore, so completely untangling the web of intermediaries in the Bollore structure cannot happen. That does not mean that incremental steps towards simplification cannot take place.

For starters, the other public entity in the Bollore web, Financiere de L'Odet, could be taken over. Currently, 55% is owned by Sofibol, 36% by Bollore, and 9% by public shareholders. The market value of the public shareholders stake is currently ~€350 million. Sofibol and Bollore could structure a deal in which Financiere de L'Odet is absorbed and its 64% ownership interest is transformed into a direct stake of more than 50% by Sofibol of Bollore, while at the same time Bollore retires a portion of its gross shares outstanding for a relatively minor amount of money. In fact, some investors with access to shares of Financiere de L'Odet may prefer betting on those shares instead of directly on Bollore.

So long as Bollore's share price is this cheap, though, share repurchases along the Breton Pulley chain will be value accretive and ever so slowly continue simplifying the overall system.

Conclusion

Investing is a process of seeking the maximum returns with minimal risk.

In the case of Bollore, it is possible that the thesis laid out by several respected investors may not ultimately play out in the near future. Five years after Muddy Waters published its research, Bollore's corporate structure is not much more simplified and the share price has not started to reflect the net share outstanding rather than the gross amount.

The biggest risk of a Bollore investment is that precisely that continues to happen much longer into the future and investors capture nothing but the fluctuation in net asset value. As far as downside risks go, this one is not that large.

Of course, Bollore is impacted by the COVID-19 pandemic in some respects, including in its logistics businesses and in parts of Vivendi, but to a lesser extent than one might think. Vivendi overwhelmingly derives its value from Universal Music Group, which should hold up well thanks to music streaming's continued growth. And the logistics businesses' transportation of health care supplies has partially offset weakness elsewhere. Bollore made this statement in announcing Q1 revenue:

At this stage, the impact of the Covid-19 crisis on Bolloré Group activities remains limited. In the context of air and sea freight markets, which have been difficult since the 2nd half of 2019, the transportation and logistics activities are currently benefiting from exceptional transport of freight related to the health crisis, which partly offsets the slowdown in the usual flows. Revenue in the communications activity (Vivendi) has not been significantly affected by the consequences of Covid-19, for which the impact varies across the different activities of the Group and the geographic areas in which it operates.

In contrast to these risks, the upside in Bollore is huge. It trades for an extremely meaningful discount to the value of its underlying assets, so much so that even including a discount to its net asset value of as much as 40% still implies the shares could double from here. With the logistics and media businesses fairly attractive economically, underlying value should compound as well.

The last decade has not been kind to international and value investments, and Bollore falls into both of those categories. It cannot be said when the tide may turn and Bollore may fall back into favor with investors. But the upside in the stock seems to suggest that the required large amount of patience required in owning shares will likely be rewarded at some point in the future.

Disclosure: I am/we are long BOIVF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.