It's A Bird, It's A Plane, It's Brookfield Property REIT

by Brad ThomasSummary

- Although BPY/BPR is considered a mall REIT, the company technically is considered a diversified REIT because it invests in core office, retail and multifamily properties.

- It's important to clarify the difference between BPY (which is an LP that uses a K-1 tax form) and BPR, which is a REIT.

- I’m UPGRADING BPY/BPR to a Strong Spec Buy (was Spec Buy) recognizing that this REIT deserves to be upgraded to first class.

As my readers and followers know, I have been covering the mall REIT sector in granular detail.

For example, my latest article broke down Pennsylvania REIT (PEI), the smallest mall REIT that has been a party to a series of unfortunate events. As I explained,

“PEI's situation is the result of avoidable and unavoidable circumstances. The REIT finds itself in violation of at least three debt covenants putting it at the mercy of lenders.”

I also covered Simon Property Group (SPG) recently as I explained,

“This "speculative" buy rating is a signal of our cautious outlook in the mall sector due to movement restrictions, mall closures, and job losses (i.e. the loss of discretionary income). The road to recovery lacks clarity as we recognize that there will be a prolonged department store closures that will put added pressure on all mall REITs.”

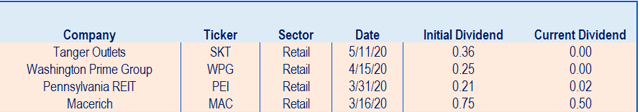

Other notable research reports we touched on recently include Washington Prime (WPG), Seritage Growth (SRG), and Tanger Outlets (SKT). Given the impacts related to Covid-19, most all mall REITs have either cut or suspended their dividend (prior to that, CBL and SRG suspended).

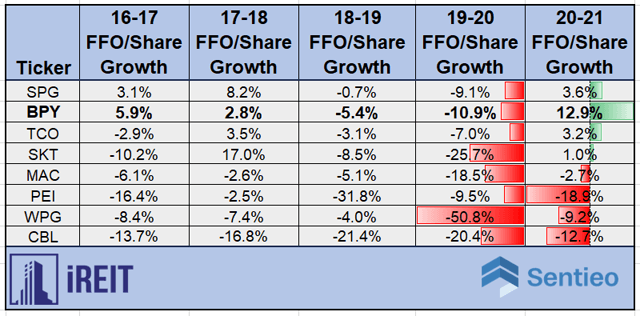

Source: iREIT on Alpha

Our only other Buy rating in the mall REIT sector is Brookfield Property REIT (BPYU) and Brookfield Property Partners (BPY), two economically identical ways to profit from Brookfield Asset Management's (BAM) global real estate empire. (We also covered BAM recently at iREIT on Alpha)

*** Throughout this article I will refer to BPYU as BPR (remember that this is the REIT) and BPY is the LP (with the K-1) ***

Although BPY/BPR is considered a mall REIT, the company technically is considered a diversified REIT because it invests in core office, retail and multifamily properties.

BPY/BPR is part of Brookfield's empire of private equity funds and publicly-traded LPs and REITs that traces its roots back to 1902 and has spent nearly 120 years enriching investors and amassing more than $385 billion in assets under management. BPR/BPY pays BAM a hedge fund-like fee structure.

- 0.5% (of market cap) management fee, with a $50 million minimum

- 25% incentive distribution rights (it's structured similar to an MLP), meaning 25% of marginal distributions also go to BAM

- 1.25% performance incentive fee, for market cap growth over a hurdle rate of $11.5 billion

Now, it's true that the hedge fund-like structure of BPY/BPR is one of the reasons the stocks trade at such a low valuation (investors tend to dislike complexity).

It's important to clarify the difference between BPY (which is an LP that uses a K-1 tax form) and BPR, which is a REIT. Here's Brookfield explaining the bottom line between these two stocks.

Brookfield Property REIT is a subsidiary of BPY, intended to offer investors economic equivalence to BPY units but in the form of a U.S. REIT security. Dividends on BPR shares are identical in amount and timing to distributions paid out for BPY units, and BPR shares are exchangeable on a 1:1 basis for BPY units or their cash equivalence." - Brookfield Property (emphasis added)

BPR is technically just a subsidiary of BPY created during BPY's 2018 $15 billion acquisition of GGP, one of America's largest Class A mall REITs. That was so that GGP owners, who prefer a traditional REIT structure (1099 tax form rather than more complex K-1) could continue owning a REIT.

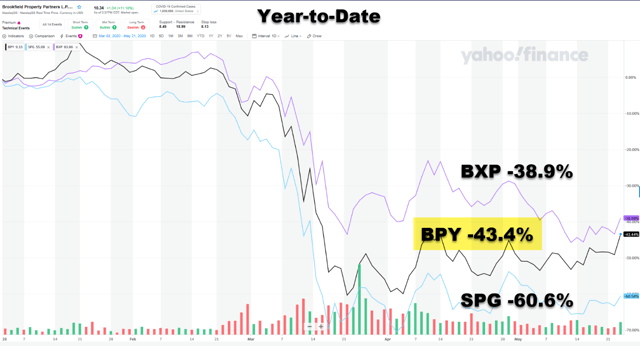

Now let’s take a closer look at BPY/BPR and the components that make up the value of this beaten down company (shares have declined by -43% YTD).

Source: Yahoo Finance

The Business Model

Starting with the retail portfolio, BPY/BPR owns 122 best-in-class retail properties totaling ~120 million square feet in the U.S. including 730 Fifth Avenue in NYC, Ala Moana Center in Honolulu, Fashion Show Mall in Las Vegas, Oakbrook Mall in Chicago, Stonestown Galleria in San Francisco, Willowbrook Mall in New Jersey and Staten Island Mall in New York.

In recent years, Brookfield acquired the remaining interest in General Growth Properties in August of 2018 for $9.25 billion and also it acquired City Forest REIT in an $11.4 billion deal that significantly increased its exposure to a wide variety of real estate. (Forest City managed a portfolio comprised mainly of office buildings, shopping centers, and apartment buildings at the time.)

During 2019, BPY/BPR continued to be aggressive in the retail segment. Bloomberg reported that it paid $3.2 billion, including debt, for JPMorgan's (JPM) stake in four shopping centers.

Representatives from Brookfield, JPMorgan, and the New York State Retirement System - which also reported to have a stake in the malls - declined to comment on the deal. But the Bloomberg reporter revealed one of her sources as saying:

The deal fits with Brookfield's strategy of acquiring top-tier malls where the surrounding land can be redeveloped with hotels, residences, and offices."

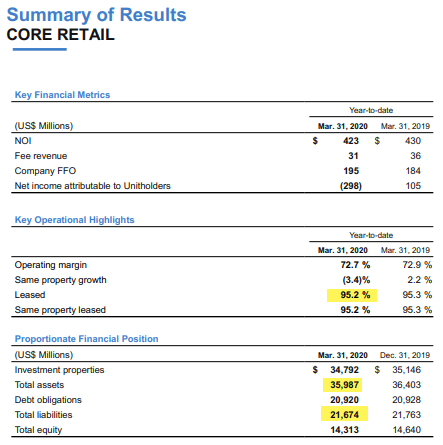

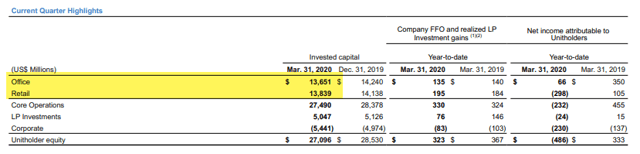

As of Q1-20 BPY/BPR’s same-property portfolio 95.2% leased and 8.4M square feet of leases commenced over the prior twelve months. The core retail business generated FFO (funds from operations) of $195 million, compared to $184 million in the same period in the prior year.

In April BPY/BPR’s rent collection was around 20% and Kingston said “with only eight days into May, so it’s a little early, but I would say it’s tracking pretty closely to what we experienced in April. So I would anticipate this month is likely the same.”

He added,

“We’re in active dialogue with every single one of our tenants and the conversations range from those tenants who were saying, look, it’s a short –-term liquidity issue and I just need time, short-term deferrals. To some tenants whose businesses are struggling, and they are looking for more of an abatement. So it’s really going to be literally 2,400 individual negotiations with all of these tenants.”

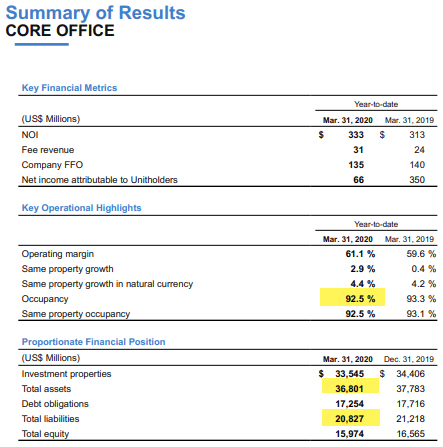

BPY/BPR’s office portfolio consists of 143 premium global properties (96 million square feet of space). In Q1-20 this segment generated FFO of $135 million with same-store NOI growth of 3% over the last year.

On the recent earnings call the company said that “collections for the month of April were very good with no material decline from prior periods”. The portfolio was 93% leased with a remaining average lease term of almost nine years. As Brian Kingston, CEO, explained,

“These office properties provide our tenants with critical infrastructure from which to operate their businesses, even if their employees are working remotely for the time being.”

He added,

“And while we expect some short-term impact on the office leasing markets, we are well protected against the downturn due to the long-term nature of the leases we have in place. We also believe that one of the results of the current crisis may be an increased demand for high-quality office space as tenants seek to reduce density within their existing premises.”

BPY/BPR has over 8 million square feet of office and multifamily projects underway, primarily concentrated in New York City and London, and as Kingston pointed out,

“These projects require very little equity from us to complete as we have construction facilities in place on all of them that will fund the remaining construction costs.”

Kingston explained that “while construction on several of the office developments were temporarily halted, as they did not qualify as essential civic projects, we have been able to put mitigation measures in place to ensure that we will deliver these buildings to their pre-committed tenants on time.”

In Q1-20 BPY/BPR generated FFO of $135 million, compared to $140 million in the same period in 2019.

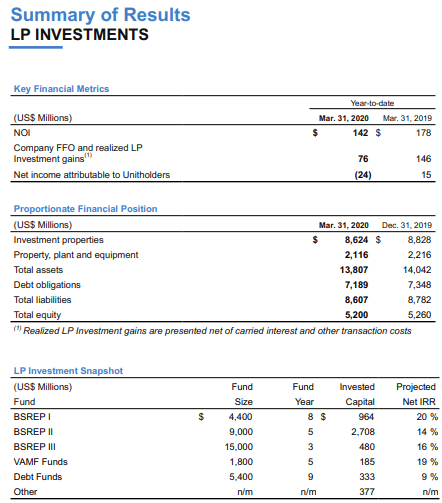

BPY/BPR’s LP investments represent approximately 15% of the balance sheet and consists of investments in various funds targeting a specific return profile including:

- BSREP I: A 31% interest in a $4.4 billion real estate fund targeting opportunistic returns; the fund is in its 8th year, is fully invested and is executing realizations

- BSREP II: A 26% interest in a $9.0B real estate fund targeting opportunistic returns; the fund is in its 5th year and is fully invested

- BSREP III: A 7% interest in a $15.0B real estate fund targeting opportunistic returns; the fund is in its 3rd year

- A blended 36% interest in two multifamily funds totaling $1.8B targeting value-add returns

- A blended 13% interest in a series of real estate debt funds totaling $5.4B

The LP investment strategy is to acquire high quality assets at a discount to replacement cost or intrinsic value, and to execute defined strategies for operational improvement in order to achieve opportunistic returns through NOI (net operating income) growth and realized gains on exit.

The Sum of the Parts

So clearly, BPY/BPR is more than a mall REIT, as the company owns $13.7 billion invested in Office properties, $13.8 billion in Retail properties and another $5 billion in LP investment. These businesses are capitalized with a low amount of corporate debt ($2 billion), around $2 billion of longer-term preferred equity and $27 billion of equity.

On the recent earnings call Kingston points out that “the lower rate of collections within the retail business isn’t having a huge impact on the debt that’s securing the office business. And so, this is exactly why we designed the structure the way we did.”

He added that “there may potentially be the opportunity to either restructure or in some cases buyback some of the debt on those individual assets where we maybe have a different longer-term view on the prospects than the current holders of that debt.

About half of our debt in the retail business is in CMBS and the other half is with banks, insurance companies, Lifecos, et cetera. And so, I think there’s – for the CMBS, there’s sort of screen prices every day. And for the others it’s more on balance sheet and it is a bit more on a direct negotiation basis. But you could see us do some of that, absolutely.”

In terms of liquidity, in Q1-20 the company had approximately $7.2 billion of capacity in undrawn credit lines and cash on hand. Kingston said,

“We expect this will be more than sufficient to withstand this protracted downturn. In addition, our sponsorship by Brookfield Asset Management fortifies our financial position should we ever require additional assistants.”

In terms of dividend safety, the company said,

“While a prolonged economic contraction would impact cash flow in the longer term, we continue to have more than sufficient resources to pay our stated quarterly dividend. As such, our Board of Directors today has approved the declaration of our regular $0.3325 per unit distribution.”

In a remark to an analyst Kingston said,

“…we do expect that as our shopping centers start to reopen, those collections and numbers will normalize again. So, assuming that, that occurs that the way we think it will, then we have no liquidity concerns. …a recurrence where every one of our shopping centers get closed down for a longer period of time could have some impact on that, as an example. A second wave later on in the year, those sorts of things might change our view on that. …But based on our current projections around timing of reopening, our discussions with the tenants around how long post that reopening it will take before they start to become current on their rent again, as I say, we’re not anticipating that, that will have any meaningful impact on the distribution.”

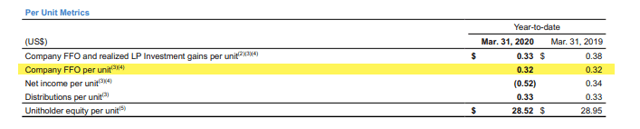

In Q1-20 BPY/BPR earned company FFO and realized gains of $323 million or $0.33 per unit, this compares with $367 million or $0.38 per unit for the same period in 2019.

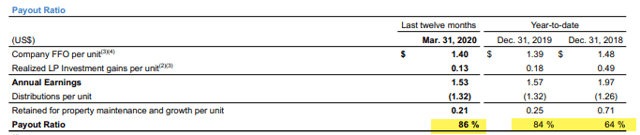

As see above, BPY/BPR’s payout ratio in Q1-20 was 86% (based on FFO), but of course this does not include the April rent collection (20% for retail).

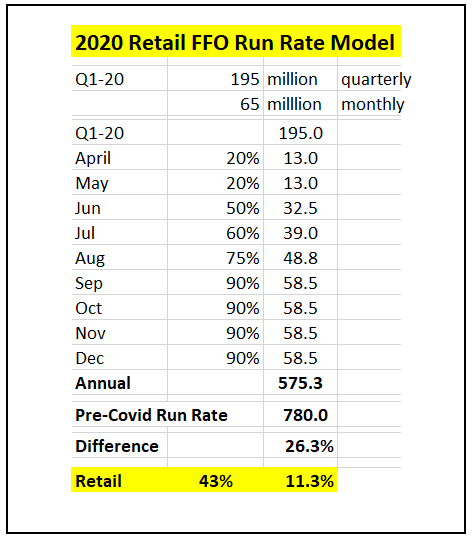

I decided to put together a quick back of the napkin model for BPY/BPR’s Retail portfolio to determine the impact to FFO on an annual run-rate basis. As you can see below, this model suggests that BPY/BPR could see FFO per share decline by ~11% in 2020:

Source: iREIT

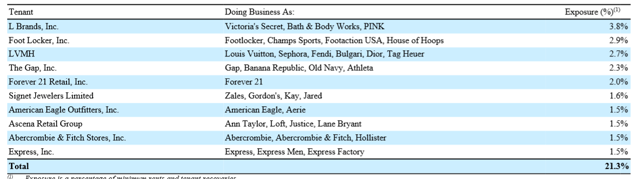

Now in case you’re wondering why I used 90% rent collection in September – December, take a look at the top tenant list (based on ABR):

I could not find the list of anchor stores in company filings, but it’s evident that the company has a number of JC Penney and Neiman Marcus stores in the portfolio. Many of the in-line stores -like L Brands and Signet – have announced store closures and we believe that 90% occupancy may be the new norm in the months and quarters ahead.

So it’s clear that in Q2-20 BPY/BPR’s payout ratio will be well above 100% (closer to 130%), but as rent collection improves and rent abatements kick-in, the payout ratio should like normalize to a range closer to 90%.

Source: Investor Presentation

It’s a Bird, It’s a Plane, It’s Brookfield

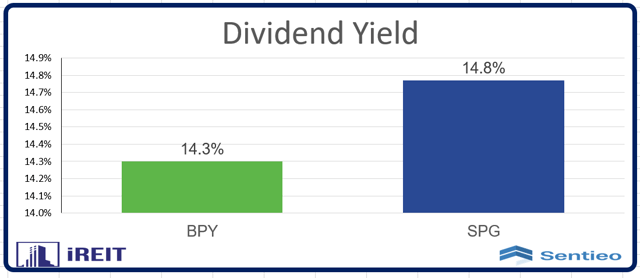

As viewed below, there aren’t too many mall REIT peers paying dividends these days (so we have SPG and BPY):

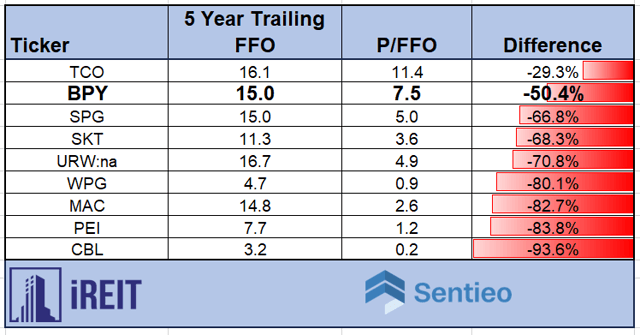

Also, recognizing once again that BPY/BPR is not a “pure play” mall REIT, consider the current P/FFO multiple:

One last scoop on BPY/BPR, analysts are forecasting earnings of -10.9% in 2020 and +12.9% in 2021. This is promising news and a reason to be bullish on this global powerhouse. Assuming analysts are correct, BPY/BPR could become one of the best comeback stories in 2021.

In closing, I am reminded of Frank Sinatra singing Come Fly With Me:

Come fly with me, let's fly, let's fly away / If you can use some exotic booze / There's a bar in far Bombay / Come fly with me, let's fly, let's fly away Come fly with me, let's float down to Peru / In llama-land there's a one-man band / And he'll toot his flute for you

Source

I’m UPGRADING BPY/BPR to a Strong Spec Buy (was Spec Buy) recognizing that this REIT deserves to be upgraded to first class. Although the payout ratio will be tight for a quarter or two, it appears that there is adequate liquidity to maintain the dividend. I can now buy some of the top trophy assets in the world at a deep discount….

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Markets will eventually recover, and may reward patient investors...

Investors need to remain disciplined with their investment process throughout the volatility. At iREIT on Alpha we offer unparalleled research that now includes a "daily" vodcast and mortgage REIT coverage. "There is great opportunity" to take advantage of the selloff.. subscribe to iREIT on Alpha (2-week free trial).

Don't miss our latest CEO interviews including Iron Mountain (IRM), Gladstone Land (LAND), and Power REIT (PW).

Disclosure: I am/we are long BPYU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.