Athersys: Fare Well

by Out of IgnoranceSummary

- Athersys' take on cell therapy has significant advantages but is unproven to this point.

- Athersys' longstanding and vitally important lead program focusing on the treatment of ischemic stroke faces unfortunate delays.

- Athersys' second key indication in the treatment of ARDS is better suited for advancement today and will quite possibly leapfrog its ischemic stroke application.

- Athersys' Healios collaboration adds substantially to its investment attraction and may provide its first to market product.

- Athersys has adequate financial resources but will undoubtedly be diluting its shareholders along the way.

Athersys' (ATHX) two lead programs in the treatment of ischemic stroke and acute respiratory distress syndrome [ARDS] have to endear it to those who have encountered these miserable afflictions. Each can rise up without notice and punish unwary victims severely.

This article reviews Athersys' progress in its lead programs and how they impact its investment merits and demerits.

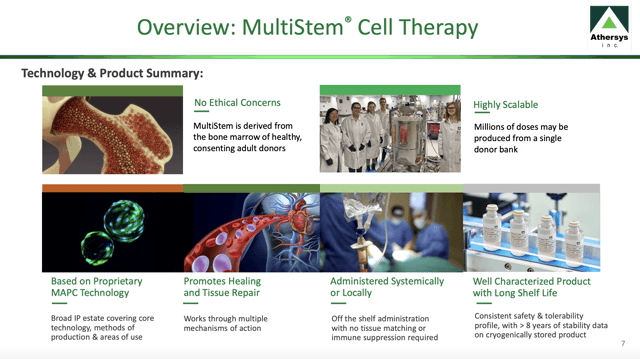

Athersys is a cell therapy company investigating its MultiStem regenerative cell therapy to attack a variety of diseases and conditions

Stem cell therapeutics can take on a wide variety of forms. It has failed to live up to its initial hype. Athersys has worked to learn from such experiences and has adopted a powerful, highly scalable and user-friendly approach to the genre.

Athersys' MultiStem cell therapy has significant attractions; derived from Multipotent Adult Progenitor cells [MAPC] harvested from bone marrow of healthy adult volunteers, they undergo no genetic modification. Once isolated they are used to produce banks of cells yielding as much as millions of doses from a single donor.

Athersys characterizes its MultiStem product as an off the shelf therapy. This is an important characteristic. It means:

... the cell suspension may be conveniently stored frozen in a vial. The vial can be quickly thawed and administered to a patient, typically through a simple intravenous infusion. MultiStem can be administered like Type-O blood, as tissue matching is not required due to the nature of this special class of human stem cells, nor is administration of immune suppressive agents.

Intravenous infusion is a convenient method of application in the case of Athersys' lead indications for ischemic stroke and ARDS, insofar as the patients receiving treatment are likely already in a medical setting.

In its latest company overview slide presentation, Athersys includes the following slide 7 in which it sets out its summary of its Multistem therapy:

Ischemic stroke is the lead indication for Athersys' MultiStem therapy

Ischemic strokes are a common and potentially devastating, even deadly, type of stroke that occurs when a blood clot blocks an artery to the brain. Damage following an ischemic stroke begins to accrue almost immediately as brain cells begin to die.

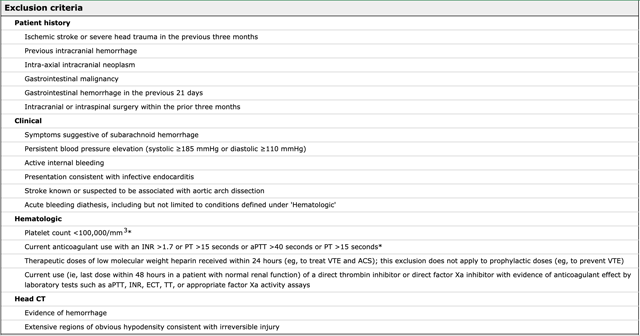

Standard treatment for such strokes, tissue plasminogen activator (tPA), works to break up the clot. The scary thing about tPA is the time clock that it inserts into a devastating and bewildering situation. According to guidelines from the American Heart and American Stroke Associations, tPA is most effective when administered within 4.5 hours.

For those among us who recognize ourselves as candidates for the type of cholesterol buildup that can cause a sudden and unexpected ischemic stroke, this 4.5 hours may seem entirely inadequate. Should one of us become victim to such an attack, will the circumstances favor recognition of the problem and transport to a facility that can follow the protocol and administer the tPA within this 4.5 hours?

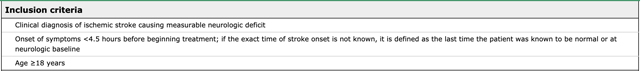

If 4.5 hours seems daunting consider not so much the inclusion criteria for this treatment which are straightforward:

The exclusion criteria on the other hand are convoluted and multifarious:

How long would it take for such a work up? Might it not take several hours? The slide below explains my title to this article; I want Athersys to "fare well" in its lead indication so that MultiStem cell therapy becomes widely accepted in treatment of ischemic stroke and by so doing relaxes its awful time deadlines:

On the subject of time, Athersys' ischemic stroke trial has hardly been a greyhound. On clinical trials.gov its Phase 2 shows a study start date of 2011. Its Phase 3, NCT03545607, lists its first posting as 6/4/2018 with a primary completion date of 12/20 and a study completion date of 9/21.

Unfortunately, this trial has no current target wrap-up date. Indeed I am concerned that it is destined for a slow journey. During Athersys' Q1, 2020 earnings call, after addressing COVID-19-related delays in clinical trial progress, CEO Van Bokkelen volunteered the following in response to a written question:

We remain committed to completing enrollment of our trials as quickly as possible, and we expect a complete enrollment of the MASTERS-2 study sometime next year. But at this point, it's too early to give a precise timeline or estimate. Strokes are still happening and sites in our study continue to enroll patient. That people should recognize that many clinical sites are limiting clinical trial participation or activity in light of the current restrictions and operational environment and that's understandable. We can't say when things will return to normal in the hospital environment or elsewhere, and accordingly, we're all taking it one step at a time.

Athersys' MultiStem ARDS therapy being trialed for COVID-19-induced ARDS could become Athersys' lead indication

ARDS is a condition that has long tormented patients, well before the current pandemic. Mayo Clinic has an informative pre-COVID-19 discussion of ARDS. In times past, ARDS was not widely recognized beyond patients impacted, their families and clinicians. Now with so many horrible stories of patients whose lungs have been damaged by SARS-CoV-2, it is common fare in the popular press.

ARDS may arise when any condition (i.e. pneumonia or COVID-19) advances to the point of significant lung injury. In such cases, the body's immune system floods the lungs with immune cells causing an inflammatory reaction.

From that point on the situation begins teetering out of control. The lungs begin to fill with fluid interfering with oxygen circulation in the blood supply. Patients then are often intubated and connected to a ventilator. At this point, the prognosis is not good. Many don't survive the ventilator; even those who are weaned off the ventilator often die within 30 days.

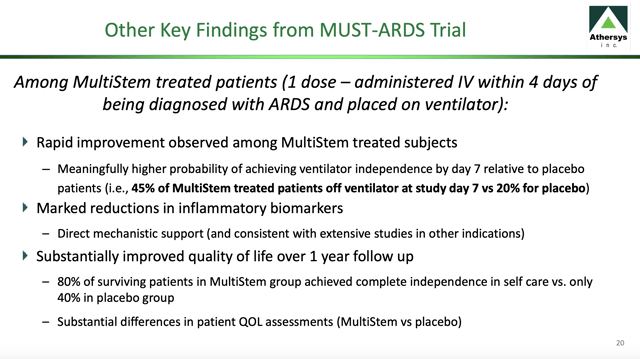

Even those who survive and return home are scarcely home-free. Instead, they often suffer from debilitating physical and cognitive impairments. Athersys' completed Phase 2 MUST-ARDS (NCT02611609) trial provided significant relief from this dismal prognosis as reflected on its "key findings" slide from its company overview below:

Should this data hold up on Phase 3 analysis, MultiStem would provide a significant advancement in the treatment of ARDS. Athersys' current Phase 3 ARDS trial (NCT04367077) focuses on a limited subset of ARDS as reflected by its title "MultiStem Administration for COVID-19 Induced ARDS."

Insofar as the trial will be responding to COVID-19-induced ARDS, it should not face the pandemic disruption potential inherent in clinical trials for other indications.

Athersys' Healios corroboration adds significantly to its prospects

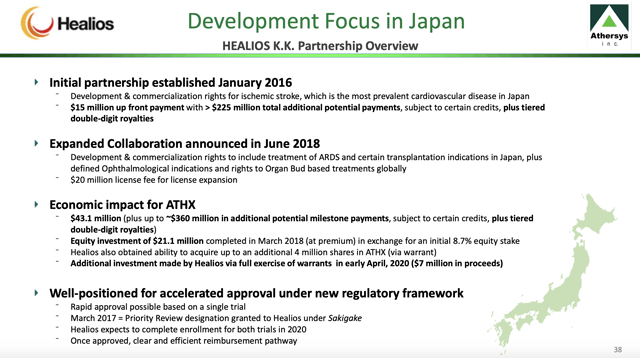

In January 2016, Healios, a Japanese cell-based regenerative medicine venture, took up MultiStem for ischemic stroke and possibly other indications. Under the deal, Healios agreed to develop MultiStem for ischemic stroke in Japan with Athersys providing the product and support.

The deal also gave Healios an option for MultiStem in treatment of ARDS and one other indication. It called for a $15 million out-front fee, a full suite of milestone payments and a tiered double-digit royalty along with a manufacturing supply agreement.

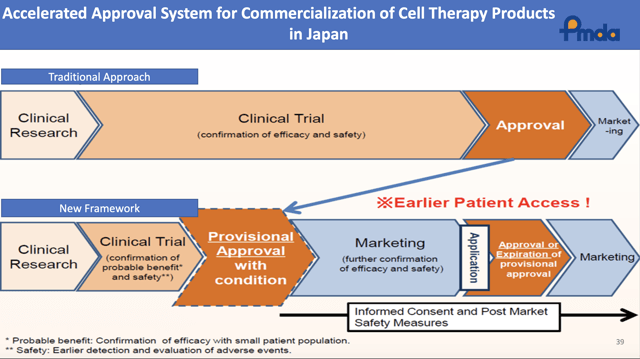

Now, four years down the line, Japan is shaping up as a possible inaugural market for Athersys. Its slides from its May 2020 company overview set out an exciting vista for MultiStem in Japan.

Slide 38 summarizes the growing scope of the collaboration as follows:

Slide 39 illustrates Japan's new accelerated review program as follows:

A Q1, 2020 question and answer session between CEO Van Bokkelen and Dawson, James analyst Kolbert addresses the status of Healios' TREASURE (NCT02961504) and ONE-BRIDGE (NCT03807804) clinical trials respectively for stroke and pneumonia-induced ARDS. Noting that Japan has been hit harder by COVID-19 than portrayed in the media, they still look for enrollment to fill by year-end.

The stroke, TREASURE trial, is a fairly large trial with 220 patients. Its targeted completion dates are in 2020. The ARDS, ONE-BRIDGE trial is far more modest in size, planned for 30 patients; its estimated primary completion date is December 2020 with an estimated study completion date of May 31, 2021.

Unfortunately, there is no way to know how a rampaging pandemic is impacting these dates. The Cell and Gene sector's annual industry gathering Meeting On the Mesa for 2019 was held in October 2019 before the pandemic riled clinical trial schedules. Healios' CFO Richard Kincaid gave a fascinating overview of Healios' various projects with extensive discussion of its Athersys collaboration projects.

Anyone interested in an investment in Athersys would do well to listen to the ~13.5-minute webcast. His discussion includes:

- Japan's regulatory framework around conditional approval as a derisking of the clinical trial process (3:31-3:55 / 13:32)

- Healios' characterization of its Athersys ischemic stroke asset and its 220 patient clinical trial in Japan with 41 trial sites actively enrolling (4:15-4:53 / 13:32)

- The ischemic stroke market opportunity in Japan (4:53-5:07 / 13:32) including competitive landscape (5:33-6:00 / 13:32)

- Healios' 30 patient ARDS trial for pneumonia induced ARDS including its application for orphan designation (since granted slide 5) and including potential for full approval based on the one study (6:50-7:40 / 13:32) and Japan's ARDS market opportunity (7:50-8:10 / 13:32)

- Pricing landscape in Japan for similar therapies (8:10-8:24 / 13:32)

One thing I took away from this presentation was the potential that royalties to Athersys from Ischemic stroke and ARDS could provide Athersys with significant financial support beginning as early as 2021.

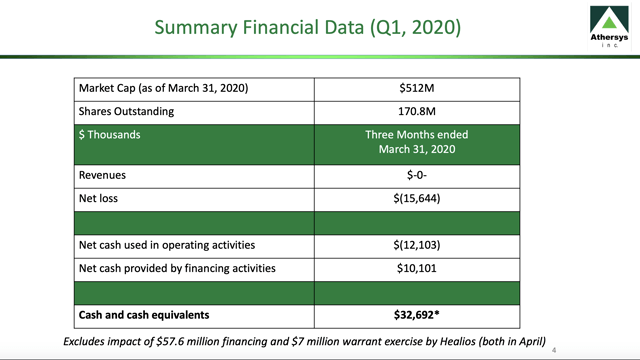

Athersys' finances are typical, meaning that they bear watching but raise no immediate alarms

Athersys finds itself in a reasonable financial condition in this difficult pandemic-infused market. Its Q1 2020 overview financial data slide is set out below:

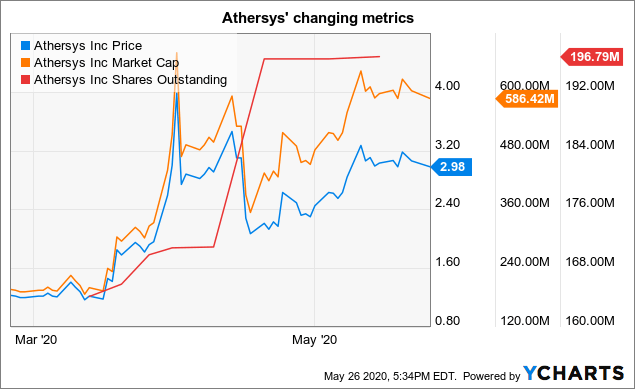

At the time its market cap was $512 million. This has since grown to >$600 million; its shares outstanding have also grown reflecting the April $57.6 million financing and $7 million warrant exercise by Healios as referenced on the slide above.

Data by YCharts

Conclusion

This article has focused exclusively on Athersys' two lead indications for its MultiStem cell therapy. These two indications each present solid opportunities with significant potential market reach. They show tremendous midterm growth potential subject to the normal risks attendant upon clinical trials of a new therapy.

In today's environment, the risk is significantly heightened by the uncertainty surrounding the pandemic. This includes risks to clinical trial development as I described recently to include:

The pandemic subjects routine activities essential for clinical trials to vagaries of shifting policies and regulations with attendant delays. Examples include such areas as site initiation, distribution of clinical trial materials, monitoring and data analysis, and participant recruitment, enrollment and dosing.

A further concern in uncertain times relates to potential difficulties in capital markets that could hamstring Athersys if it needed to access cash. Luckily, this does not appear to be an issue for Athersys in the near term. Further, Athersys' efforts to provide a therapy for ARDS induced by COVID-19 raises a potential that it benefits from government grants as for example BARDA funding as discussed in its Q1 2020 earnings call.

When I consider Athersys' potential, absent its Healios deal, I pass. However, when I add Healios to the mix, potentially derisking its MultiCell, accelerating timelines and generating significant milestones and significant royalties, I become much more sanguine.

When I evaluate a development stage biotech such as Athersys, I do not normally expect it to generate significant alpha from Japan. The fact that Athersys has made such a prospect likely makes me think there must be other potential deals that would support a bull case.

I take great heed of the following from CEO Van Bokkelen during Athersys' Q1, 2020 call:

We also advanced our ongoing discussions with other potential partners regarding working jointly to further advance the development and commercialization of MultiStem in key indications in geographies of interest.

Athersys is a speculative play with an unproven technology. Nonetheless, it has serious potential and deserves consideration in portfolios looking for a high risk-high reward biotech candidate.

Disclosure: I am/we are long ATHX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may buy or sell shares in ATHX over the next 72 hours